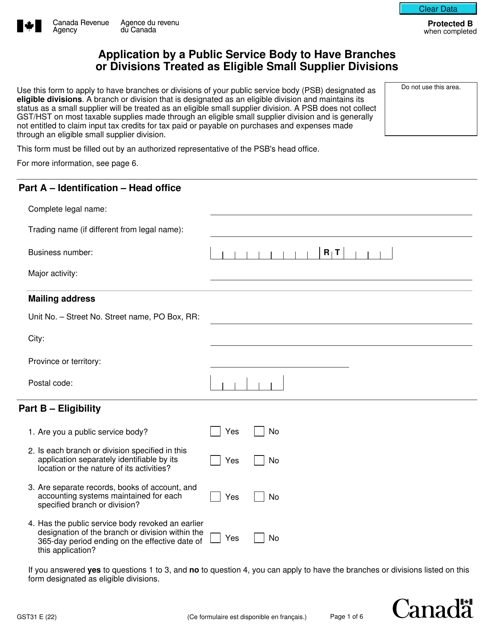

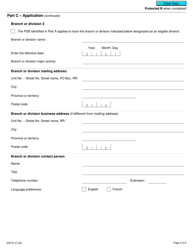

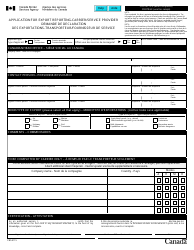

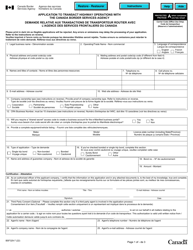

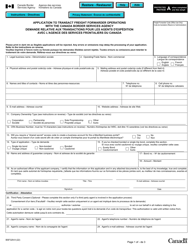

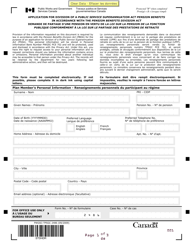

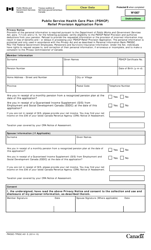

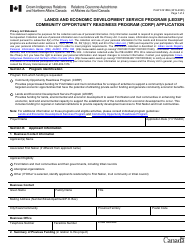

Form GST31 Application by a Public Service Body to Have Branches or Divisions Treated as Eligible Small Supplier Divisions - Canada

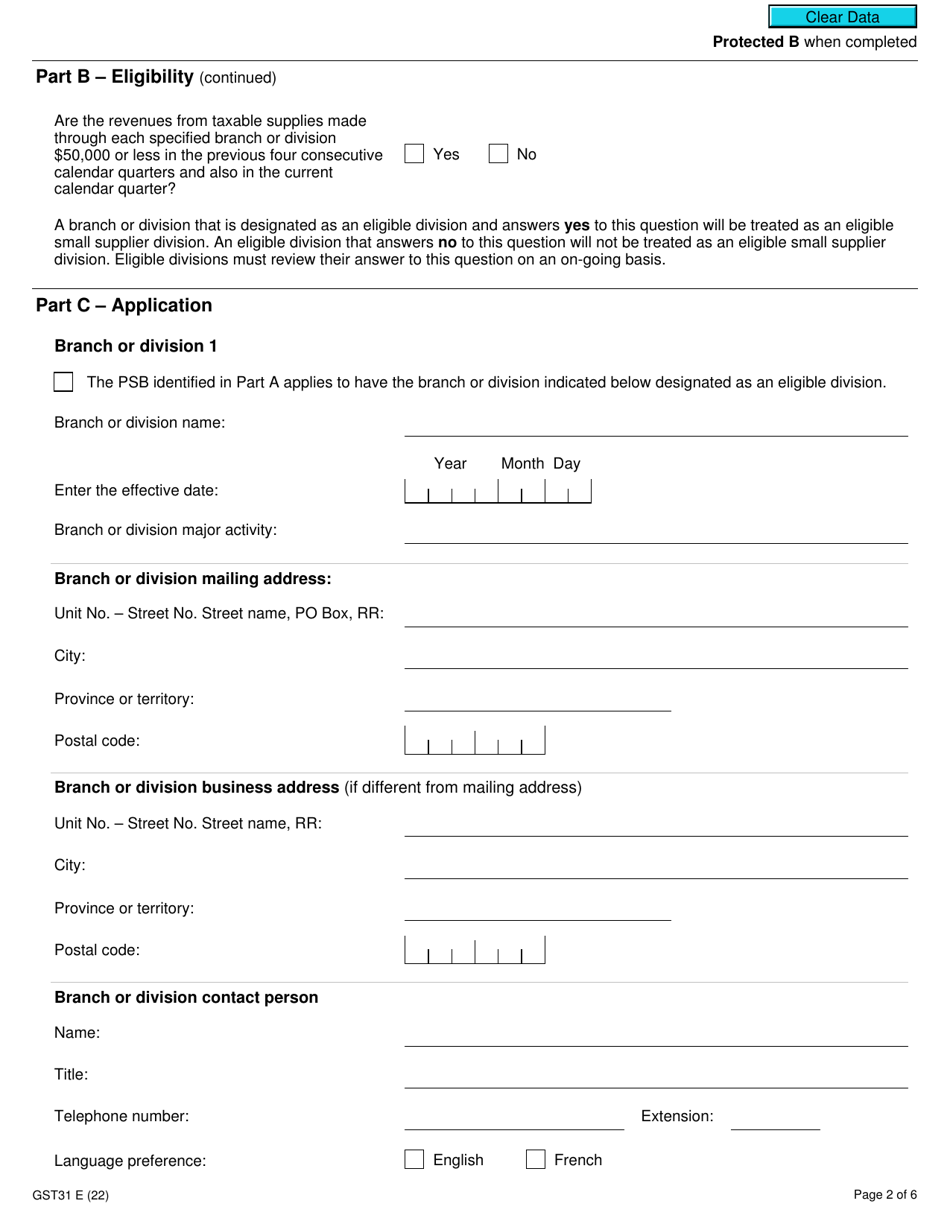

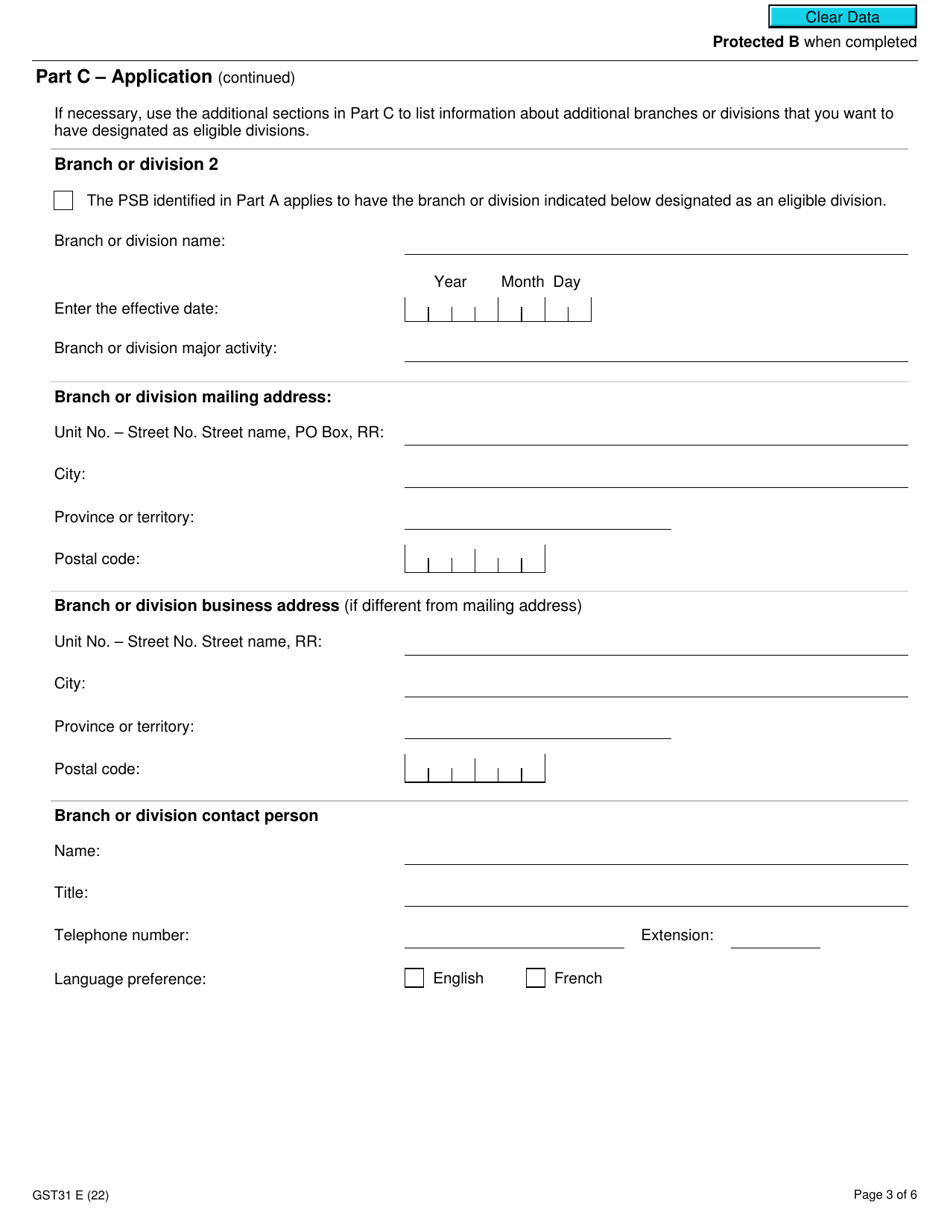

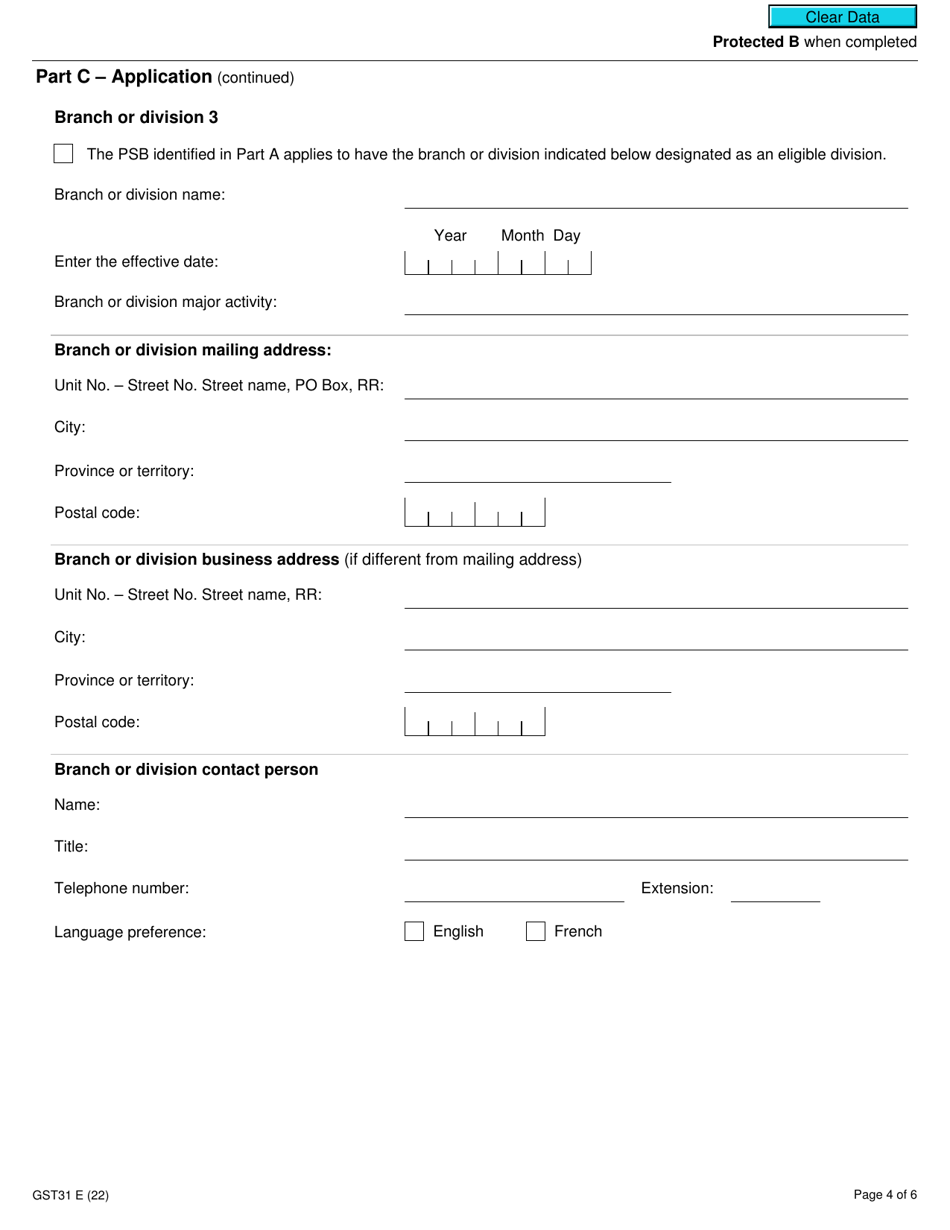

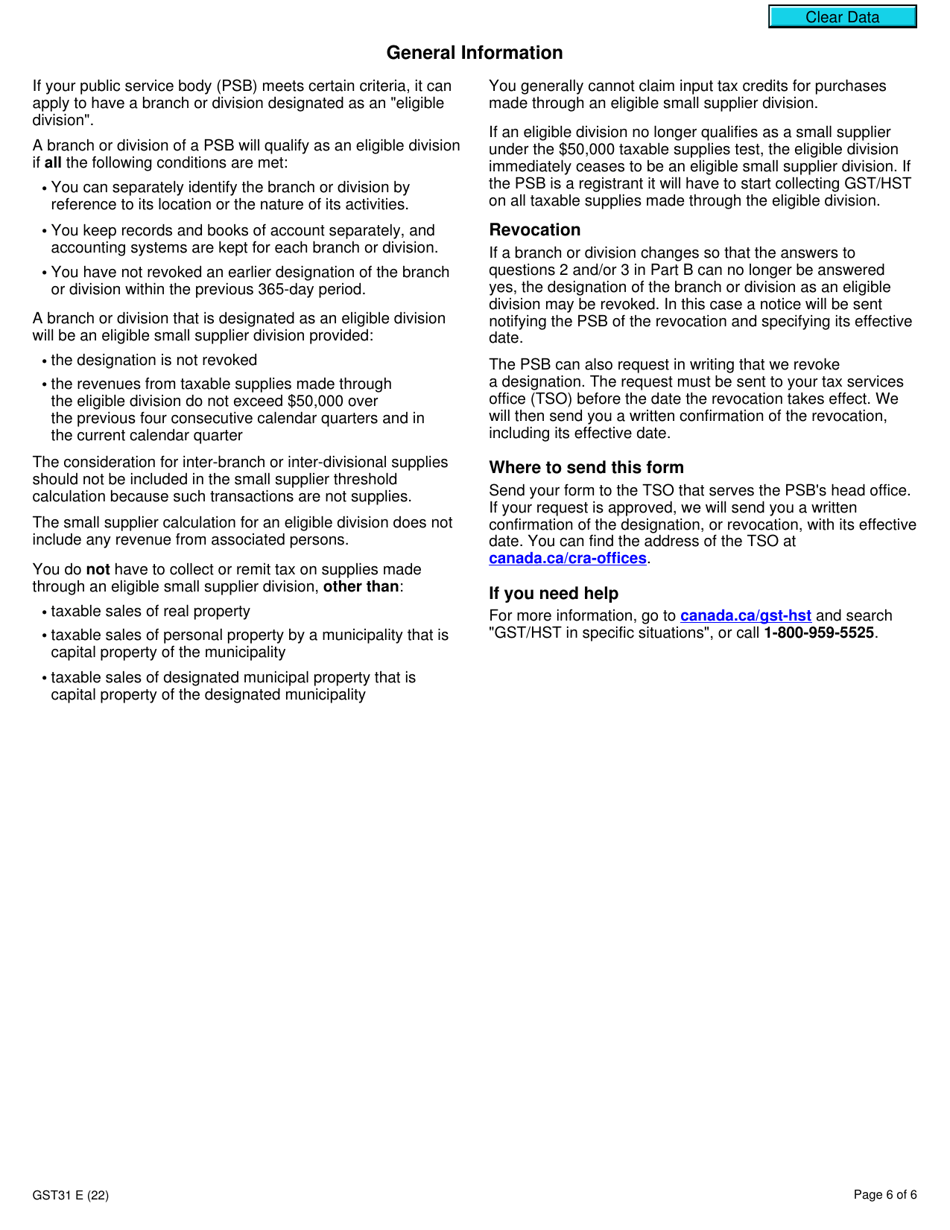

Form GST31 is an application form used by Public Service Bodies (PSBs) in Canada to request that their branches or divisions be treated as eligible small supplier divisions for Goods and Services Tax (GST) purposes. This allows these branches or divisions to be exempt from certain GST requirements.

The Form GST31 Application is filed by a public service body in Canada

Form GST31 Application by a Public Service Body to Have Branches or Divisions Treated as Eligible Small Supplier Divisions - Canada - Frequently Asked Questions (FAQ)

Q: What is Form GST31?

A: Form GST31 is an application by a Public Service Body (PSB) in Canada to have its branches or divisions treated as Eligible Small Supplier Divisions.

Q: Who can use Form GST31?

A: Public Service Bodies (PSBs) in Canada can use Form GST31 to apply for eligible small supplier divisions.

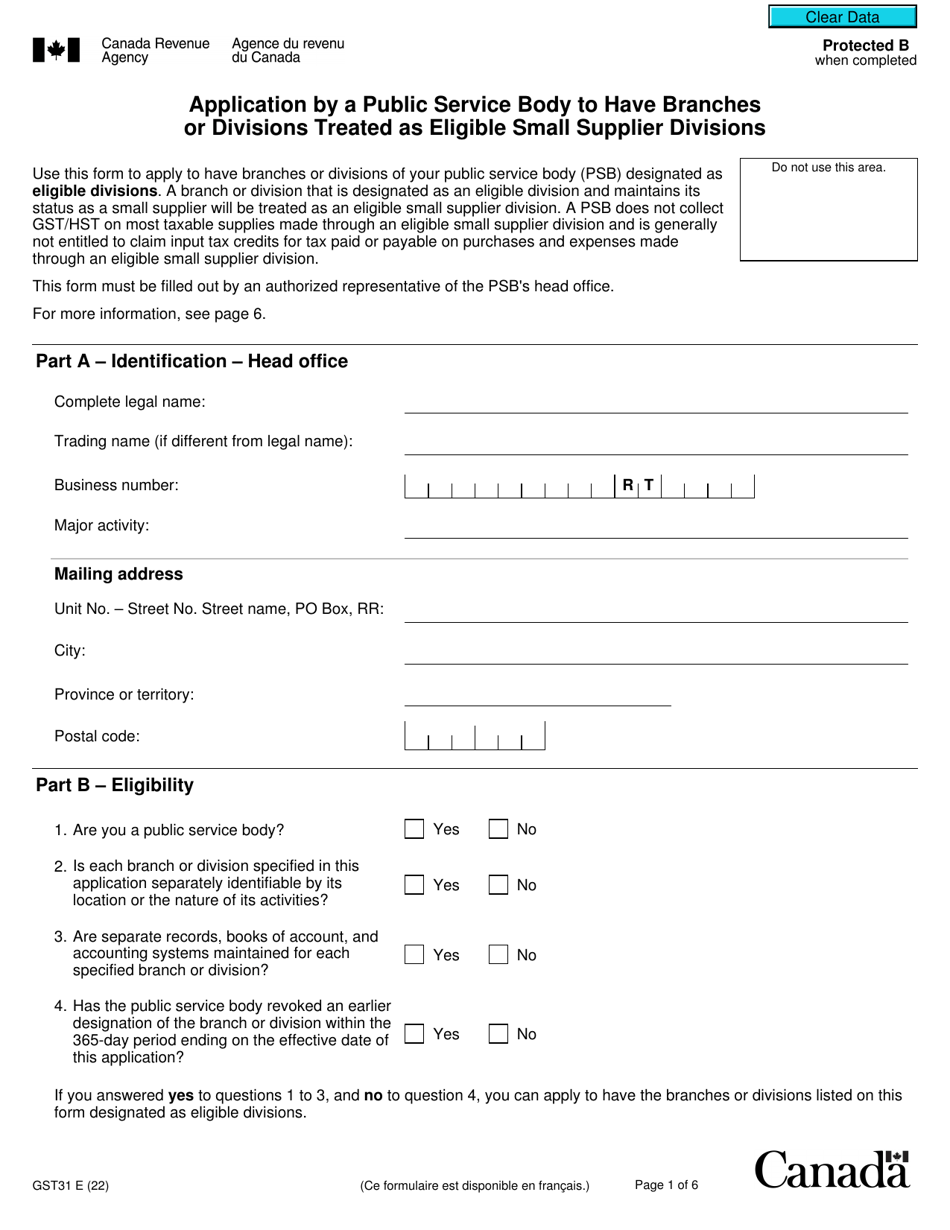

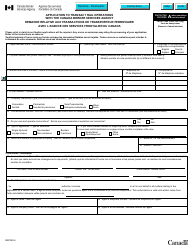

Q: What does it mean to be treated as an Eligible Small Supplier Division?

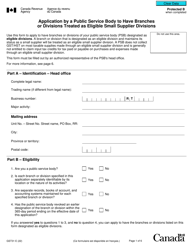

A: Being treated as an Eligible Small Supplier Division means that the branch or division of a Public Service Body (PSB) will be considered a separate entity for Goods and Services Tax (GST) purposes, and will not be required to register for GST if its taxable supplies are below the threshold.

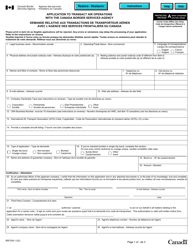

Q: What are the requirements for using Form GST31?

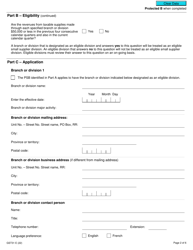

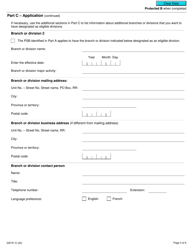

A: To use Form GST31, the Public Service Body (PSB) must meet certain criteria, such as having branches or divisions that are separate and distinct, and keeping separate records for each branch or division.

Q: Is there a fee for submitting Form GST31?

A: No, there is no fee for submitting Form GST31.

Q: How long does it take to process Form GST31?

A: The processing time for Form GST31 can vary, but most applications are processed within 30 days.

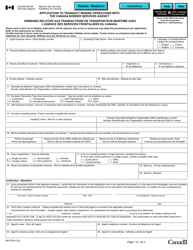

Q: What should I do if my application is approved?

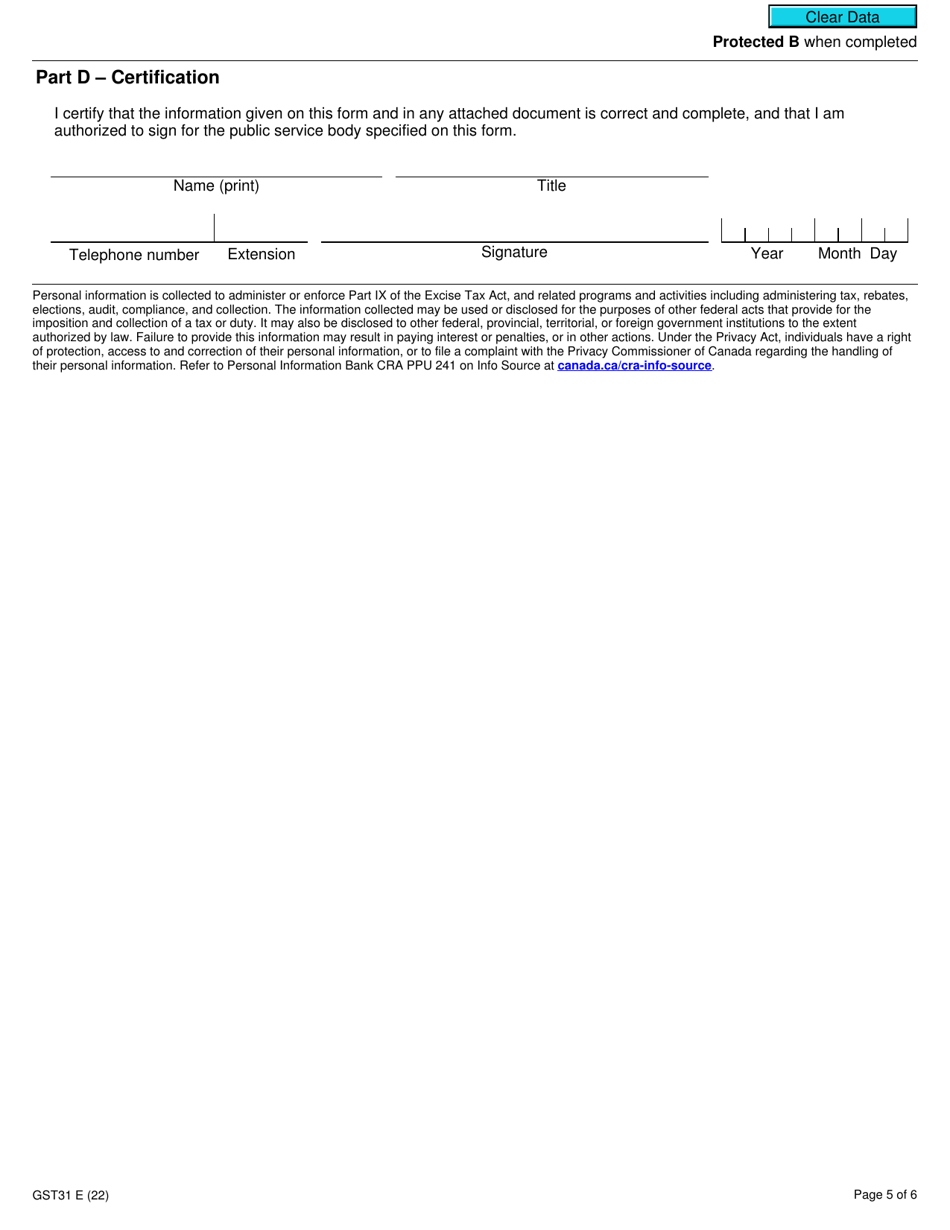

A: If your application is approved, you will receive a confirmation letter from the Canada Revenue Agency (CRA) stating that your branches or divisions are treated as Eligible Small Supplier Divisions.

Q: What should I do if my application is denied?

A: If your application is denied, you will receive a denial letter from the Canada Revenue Agency (CRA) explaining the reason for the denial. You may have the option to appeal the decision.

Q: Can I make changes to my application after it has been submitted?

A: Yes, you can make changes to your application by contacting the Canada Revenue Agency (CRA) and providing them with the necessary information and documentation.