This version of the form is not currently in use and is provided for reference only. Download this version of

Form GST191

for the current year.

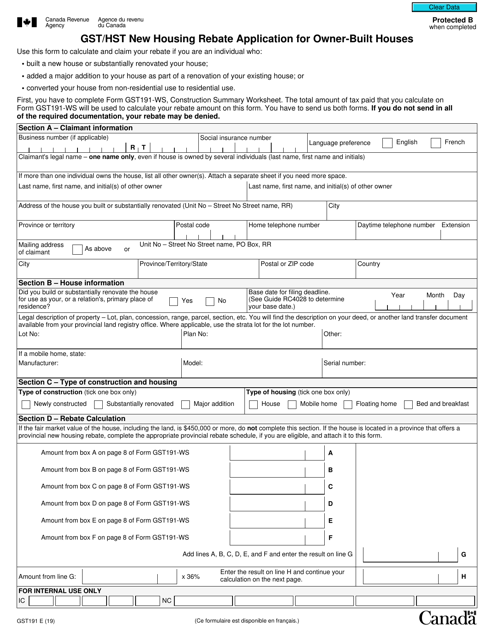

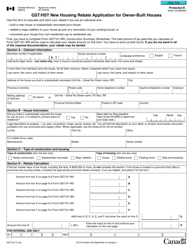

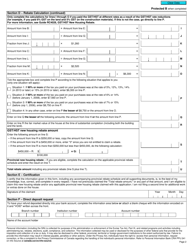

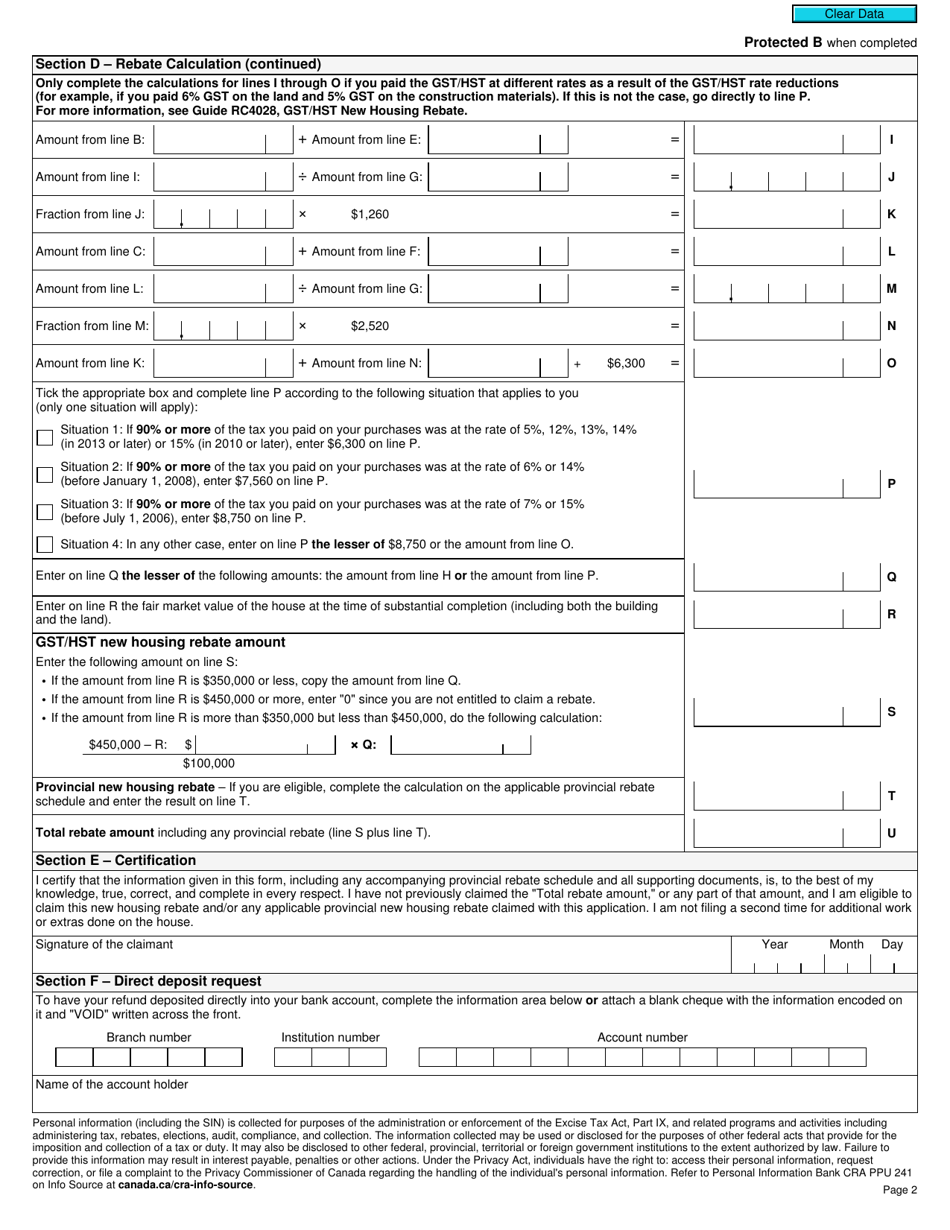

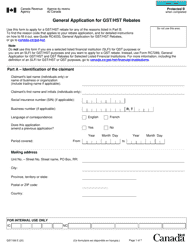

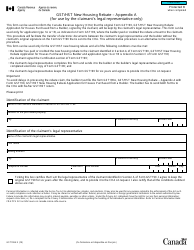

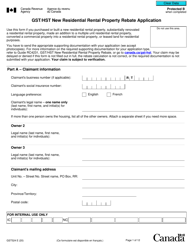

Form GST191 Gst / Hst New Housing Rebate Application for Owner-Built Houses - Canada

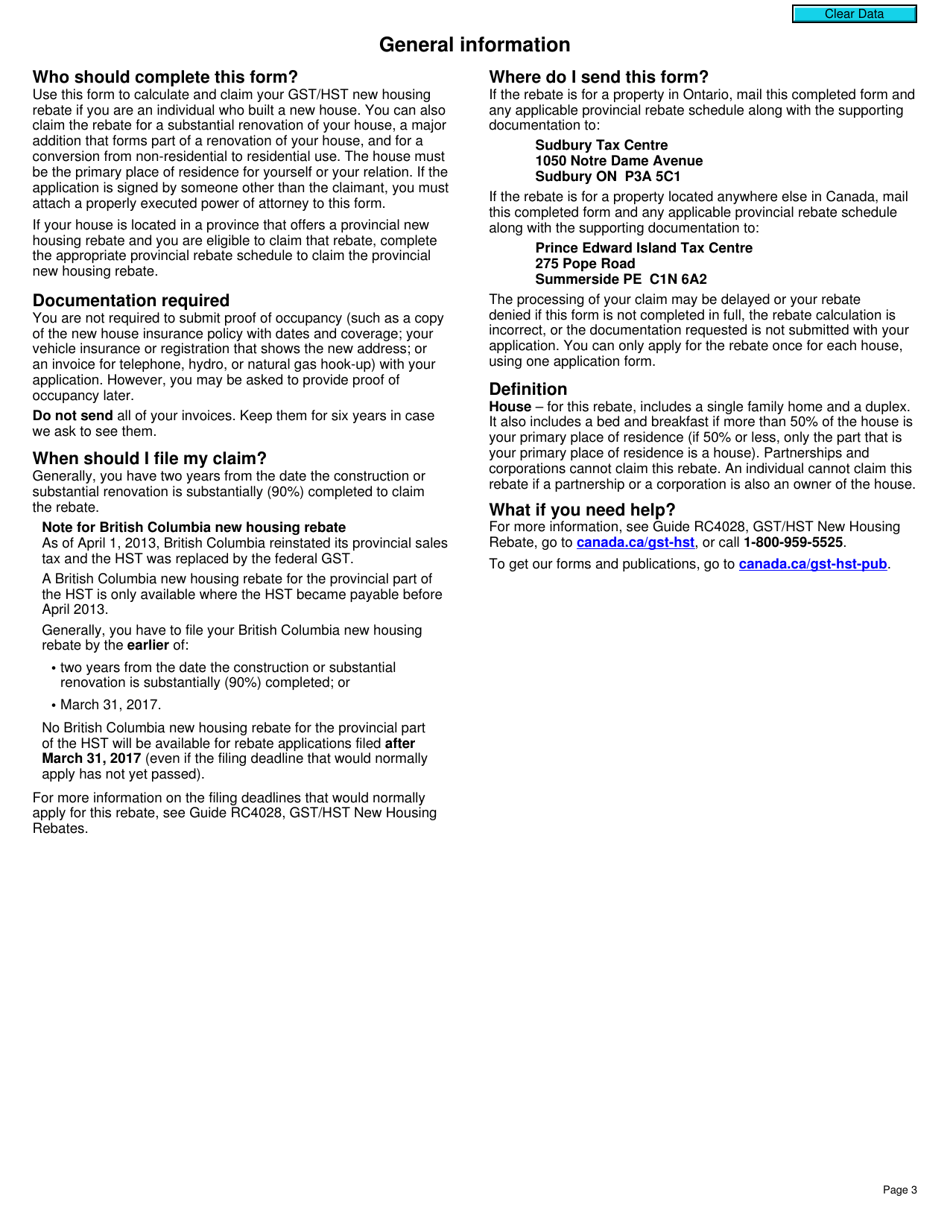

Form GST191 is the application form for claiming the Goods and Services Tax/Harmonized Sales Tax (GST/HST) New Housing Rebate in Canada. This rebate is available for individuals who have built their own houses and meet certain eligibility criteria.

The owner of the newly built house in Canada files the Form GST191 GST/HST New Housing Rebate Application for Owner-Built Houses.

FAQ

Q: What is the Form GST191 for?

A: The Form GST191 is for applying for the GST/HST New Housing Rebate for owner-built houses in Canada.

Q: Who can use Form GST191?

A: Form GST191 can be used by individuals who have built their own houses in Canada.

Q: What is the GST/HST New Housing Rebate?

A: The GST/HST New Housing Rebate is a rebate provided by the government to offset the GST/HST paid on the purchase or construction of a new home.

Q: How can I apply for the GST/HST New Housing Rebate?

A: You can apply for the GST/HST New Housing Rebate by filling out Form GST191 and submitting it to the Canada Revenue Agency.

Q: Are there any eligibility requirements for the GST/HST New Housing Rebate?

A: Yes, there are eligibility requirements for the GST/HST New Housing Rebate. You must meet certain criteria, such as being the builder and occupant of the house.

Q: What supporting documents do I need to include with Form GST191?

A: You may need to include documents such as building permits, invoices, and proof of occupancy with your GST/HST New Housing Rebate application.

Q: Is there a deadline for submitting Form GST191?

A: Yes, there is a deadline for submitting Form GST191. You must submit the application within two years from the date the house was substantially completed.

Q: What happens after I submit Form GST191?

A: After you submit Form GST191, the Canada Revenue Agency will review your application and determine if you are eligible for the GST/HST New Housing Rebate.

Q: Can I appeal if my GST/HST New Housing Rebate application is denied?

A: Yes, if your GST/HST New Housing Rebate application is denied, you have the right to appeal the decision.