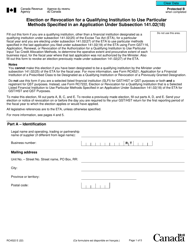

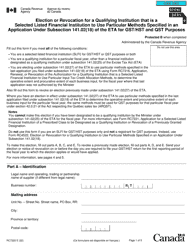

This version of the form is not currently in use and is provided for reference only. Download this version of

Form GST116

for the current year.

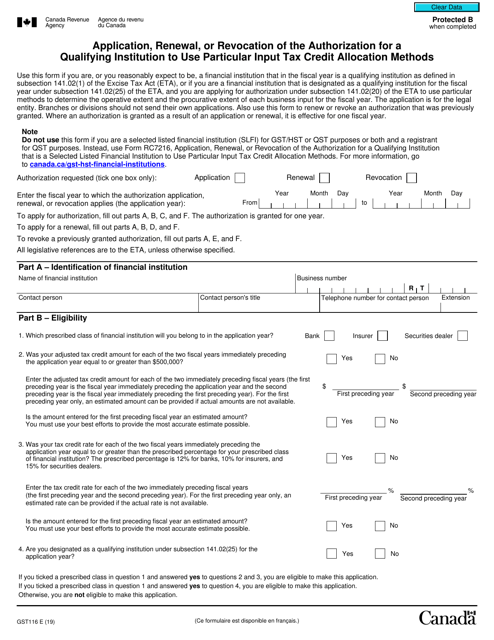

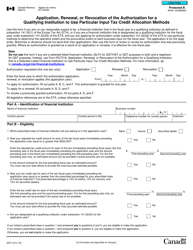

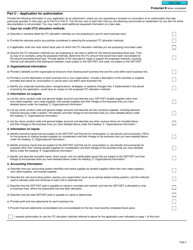

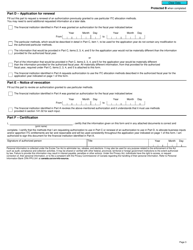

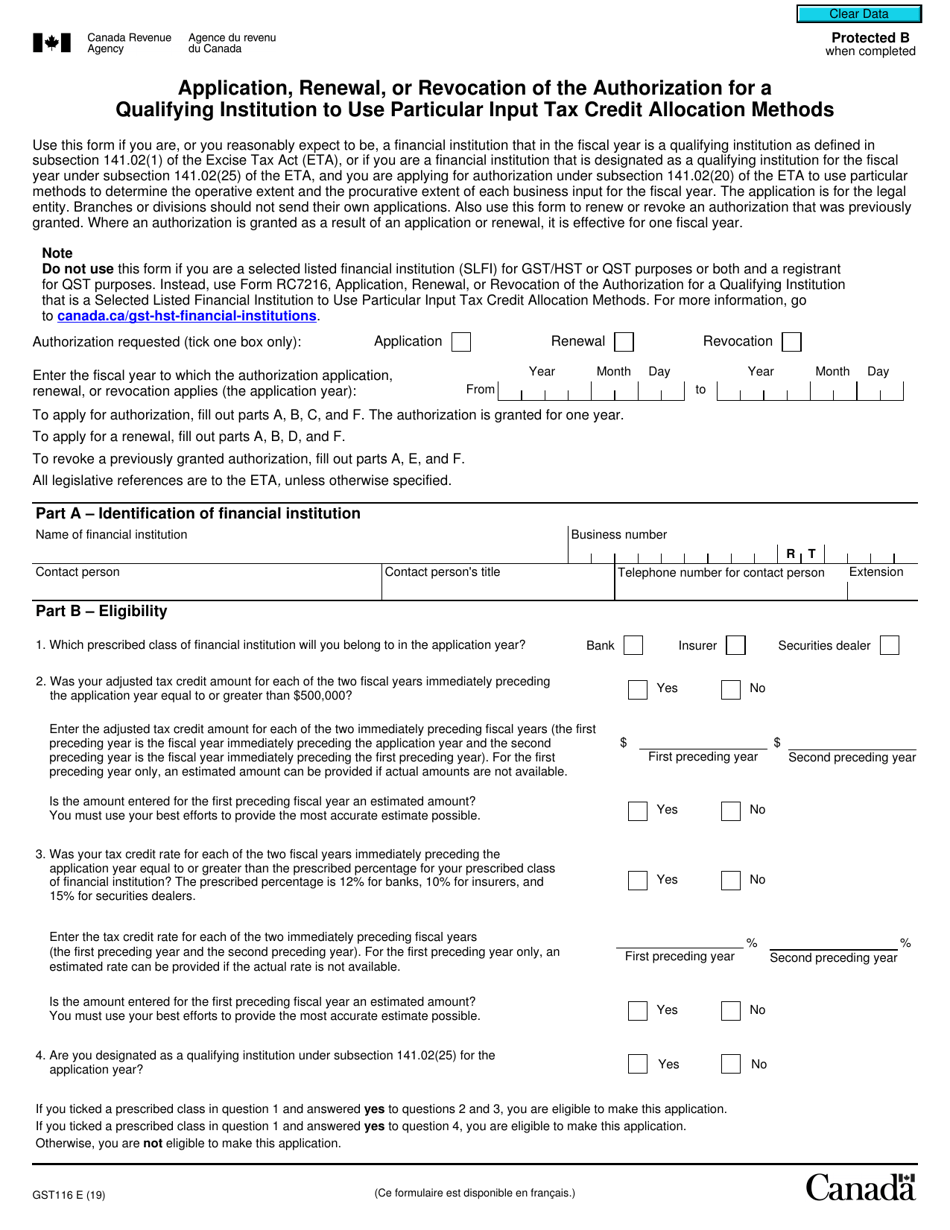

Form GST116 Application, Renewal, or Revocation of the Authorization for a Qualifying Institution to Use Particular Input Tax Credit Allocation Methods - Canada

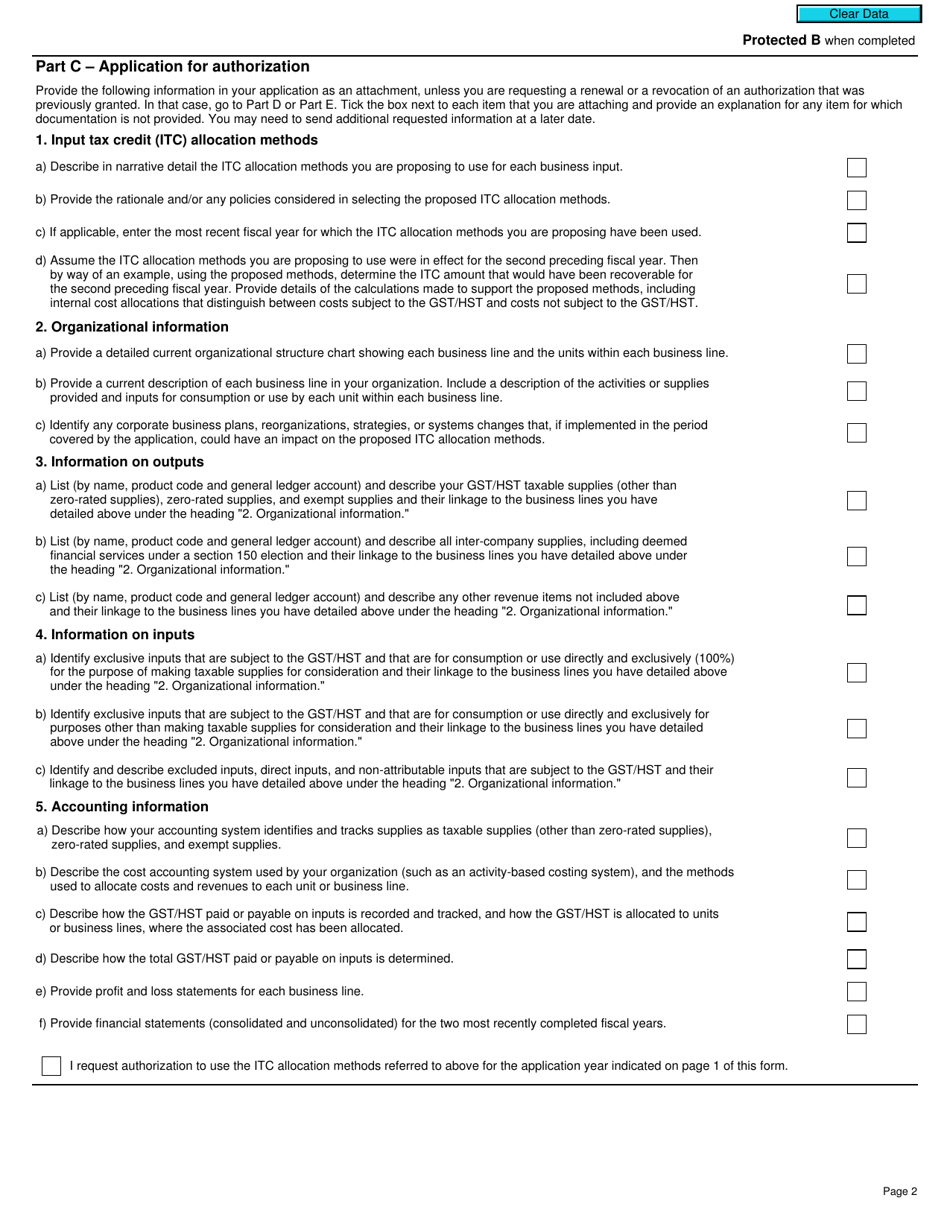

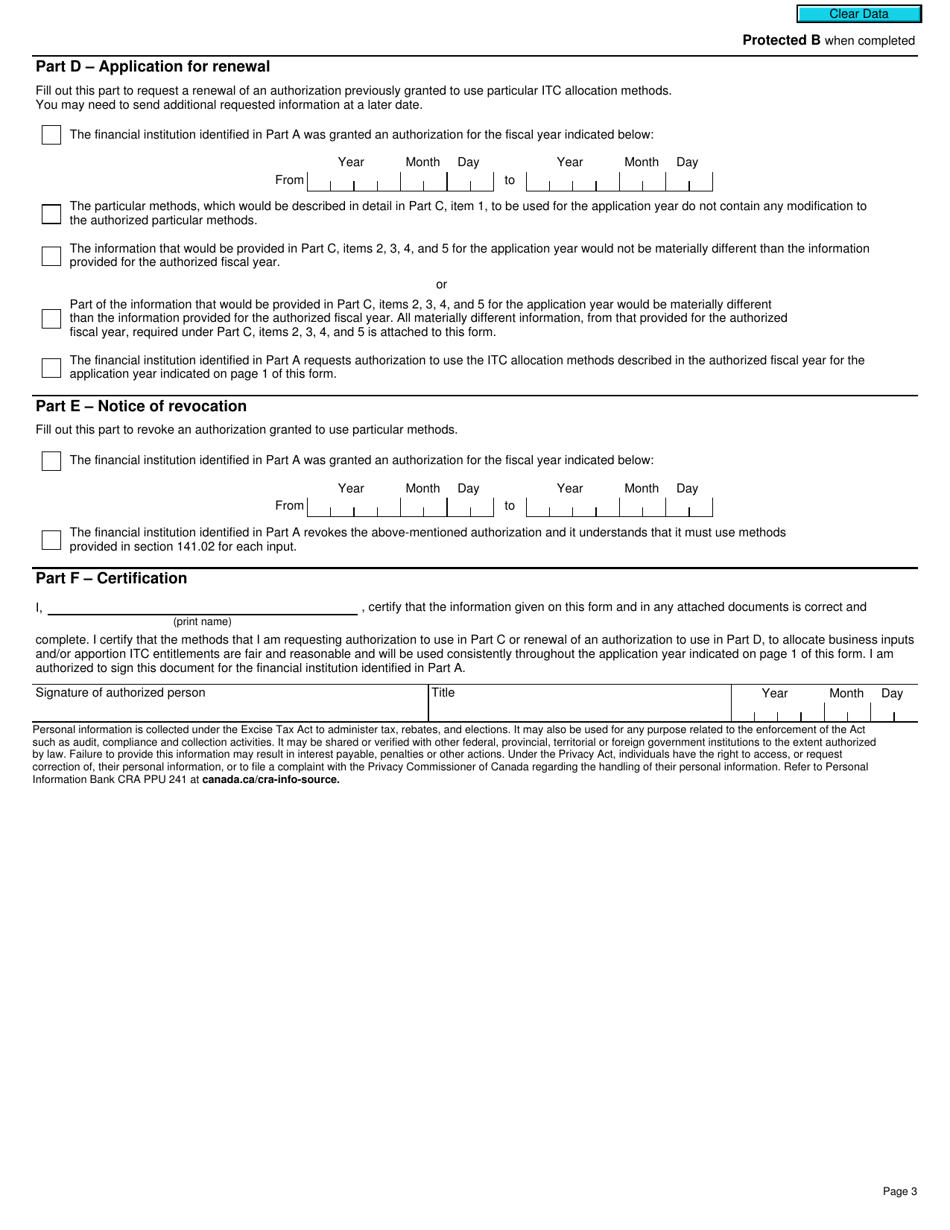

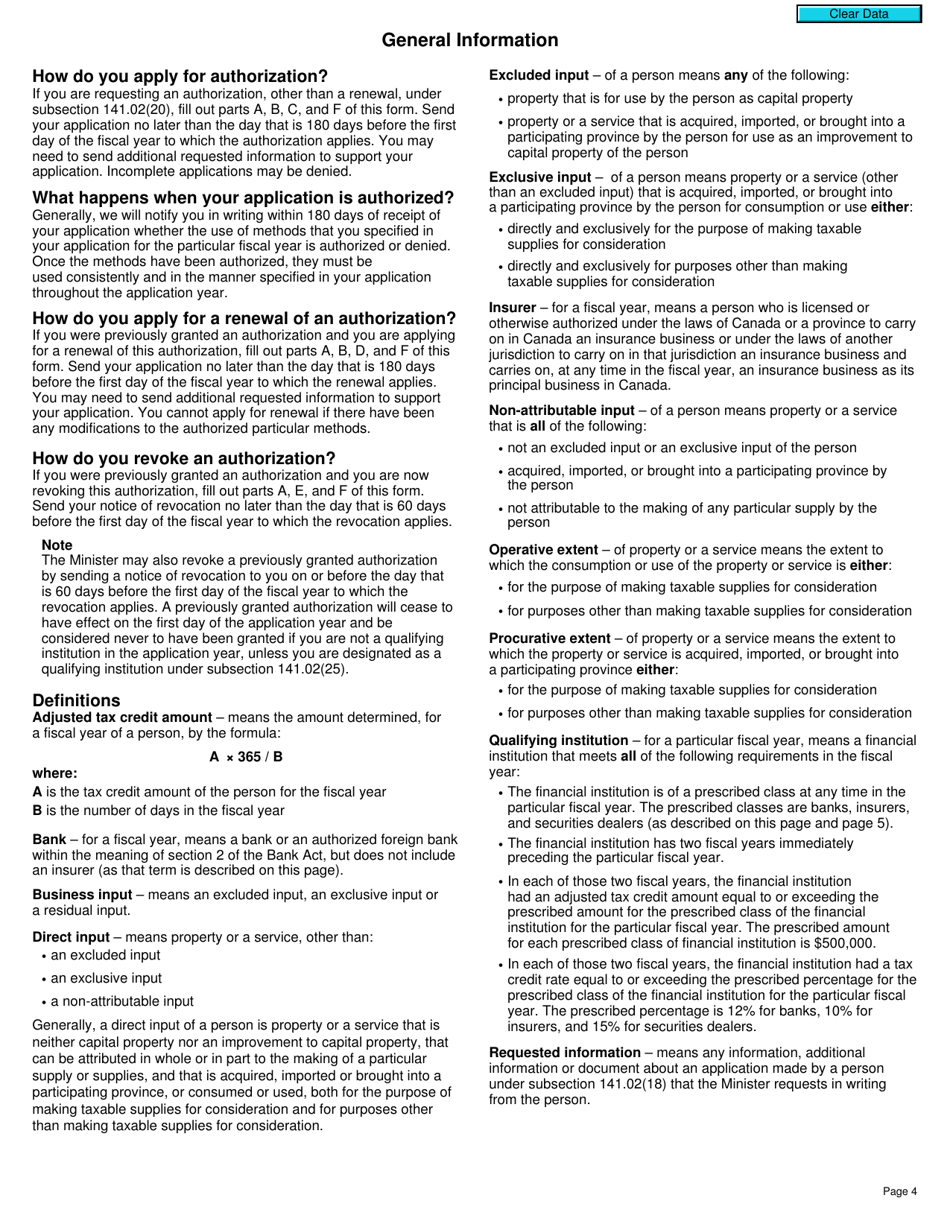

Form GST116 Application, Renewal, or Revocation of the Authorization for a Qualifying Institution to Use Particular Input Tax Credit Allocation Methods in Canada is used by qualifying institutions to apply, renew, or revoke authorization for using specific input tax credit allocation methods. It allows institutions to manage and optimize their tax credits related to the Goods and Services Tax (GST) in Canada.

The qualifying institution files the Form GST116 Application, Renewal, or Revocation of the Authorization for a Qualifying Institution to Use Particular Input Tax Credit Allocation Methods in Canada.

FAQ

Q: What is the Form GST116?

A: Form GST116 is a form used in Canada for Application, Renewal, or Revocation of the Authorization for a Qualifying Institution to Use Particular Input Tax Credit Allocation Methods.

Q: Who can use Form GST116?

A: Form GST116 can be used by qualifying institutions in Canada.

Q: What is the purpose of Form GST116?

A: The purpose of Form GST116 is to apply for, renew, or revoke the authorization for a qualifying institution to use particular input tax credit allocation methods.

Q: What are input tax credit allocation methods?

A: Input tax credit allocation methods refer to the methods used by qualifying institutions to allocate and claim input tax credits.

Q: How do I fill out Form GST116?

A: To fill out Form GST116, you need to provide relevant information about your qualifying institution and the preferred input tax credit allocation methods.

Q: Is there a fee for submitting Form GST116?

A: No, there is no fee for submitting Form GST116.

Q: How long does it take to process Form GST116?

A: The processing time for Form GST116 can vary, but it typically takes several weeks.

Q: Can I track the status of my Form GST116 application?

A: Yes, you can track the status of your Form GST116 application through the CRA's MyBusiness portal.