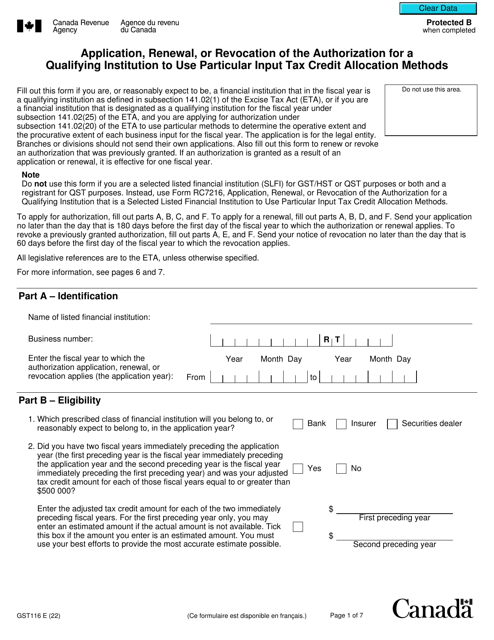

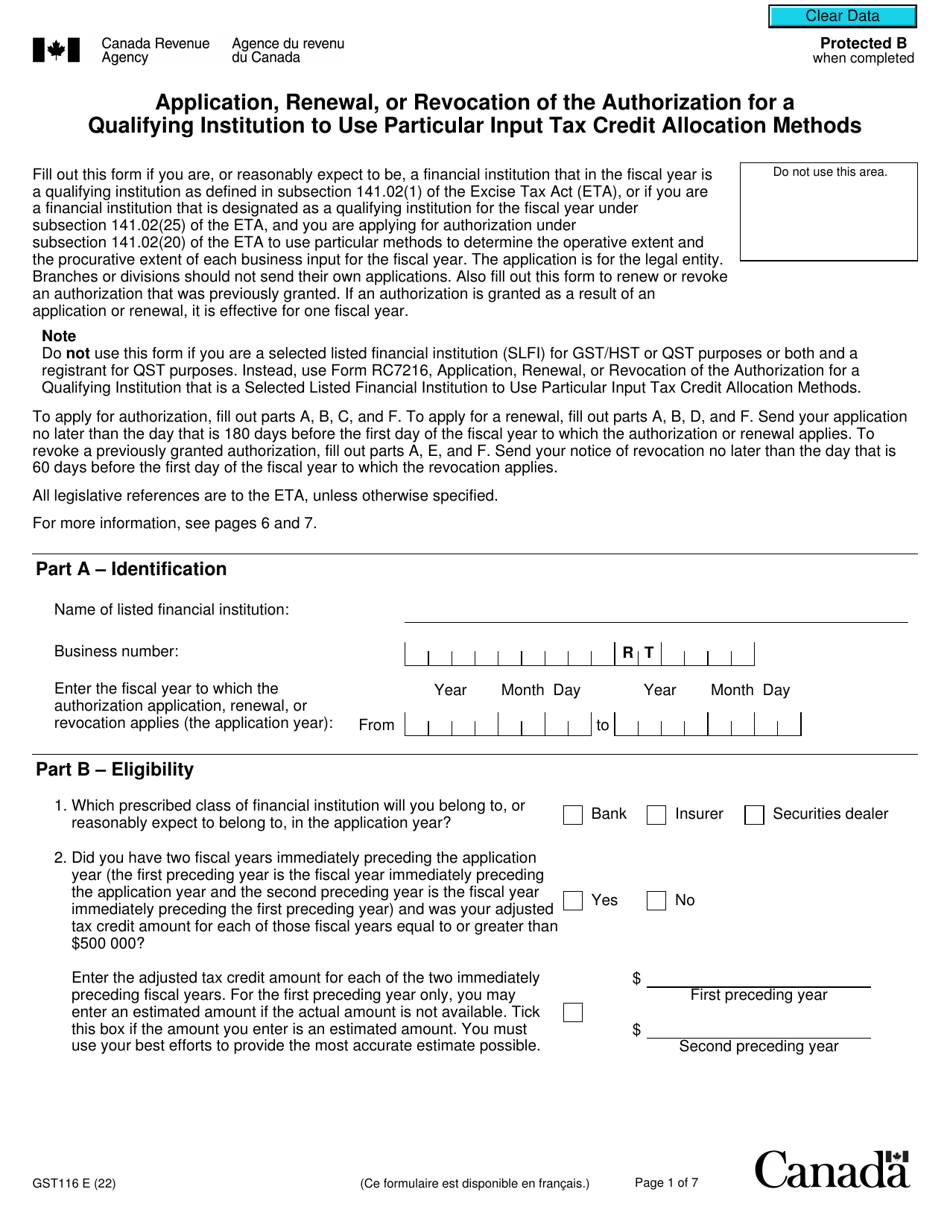

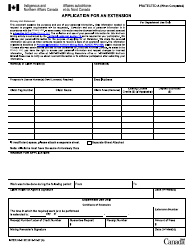

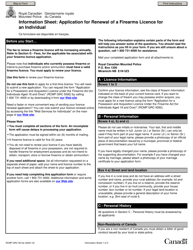

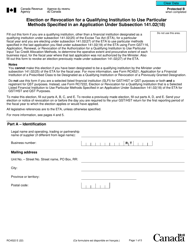

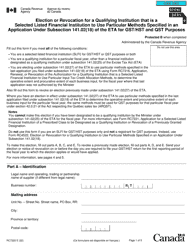

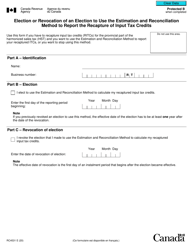

Form GST116 Application, Renewal, or Revocation of the Authorization for a Qualifying Institution to Use Particular Input Tax Credit Allocation Methods - Canada

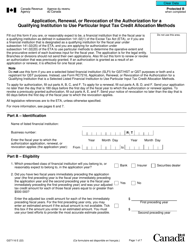

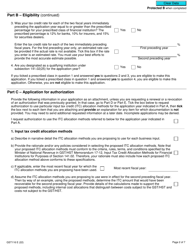

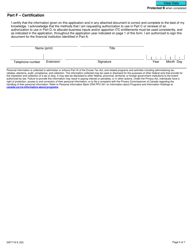

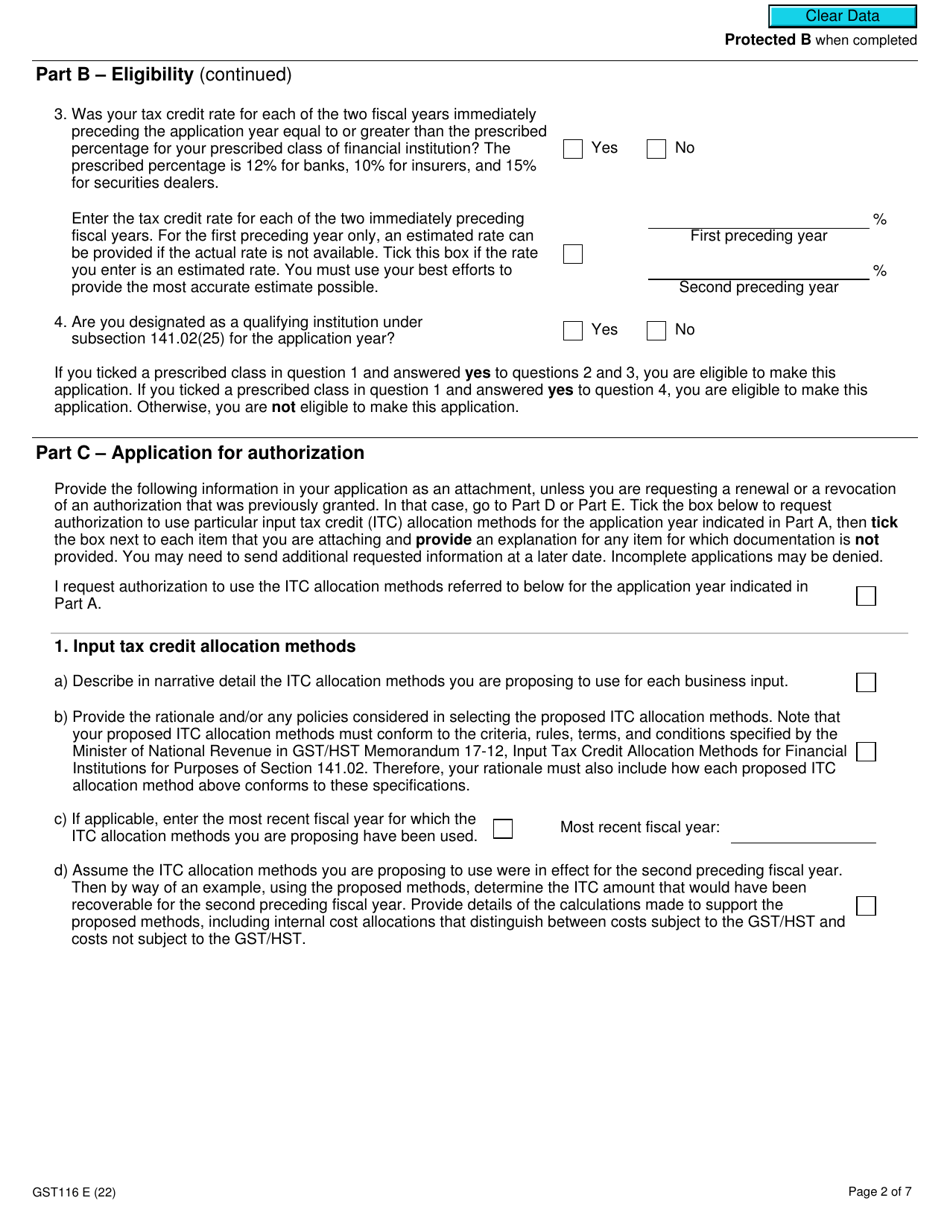

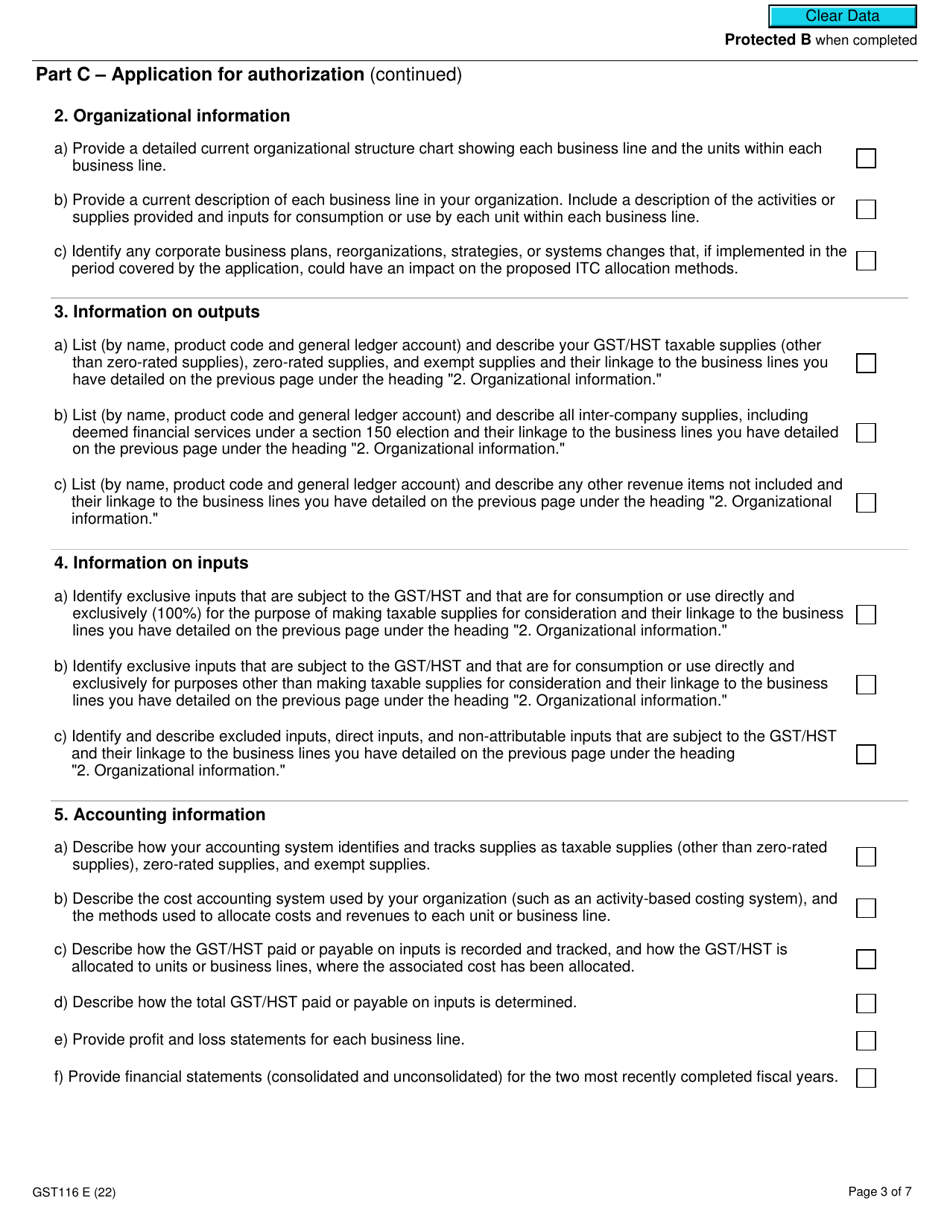

Form GST116 Application, Renewal, or Revocation of the Authorization for a Qualifying Institution to Use Particular Input Tax Credit Allocation Methods is a form used in Canada for qualifying institutions to apply, renew, or revoke their authorization to use specific methods for allocating input tax credits. This form is related to the Goods and Services Tax (GST) and helps in managing the allocation of tax credits for eligible institutions.

The form GST116 is filed by a qualifying institution in Canada who wishes to apply, renew, or revoke the authorization for using particular input tax credit allocation methods.

Form GST116 Application, Renewal, or Revocation of the Authorization for a Qualifying Institution to Use Particular Input Tax Credit Allocation Methods - Canada - Frequently Asked Questions (FAQ)

Q: What is GST116?

A: GST116 is a form used in Canada for the application, renewal, or revocation of the authorization for a qualifying institution to use particular input tax credit allocation methods.

Q: Who can use Form GST116?

A: Qualifying institutions in Canada can use Form GST116.

Q: What is the purpose of Form GST116?

A: The purpose of Form GST116 is to apply, renew, or revoke the authorization for a qualifying institution to use specific input tax credit allocation methods.

Q: What are input tax credit allocation methods?

A: Input tax credit allocation methods are ways for qualifying institutions to allocate their input tax credits.

Q: Can I use Form GST116 to claim input tax credits?

A: No, Form GST116 is used to apply for or manage the authorization to use specific input tax credit allocation methods, not to claim the credits themselves.