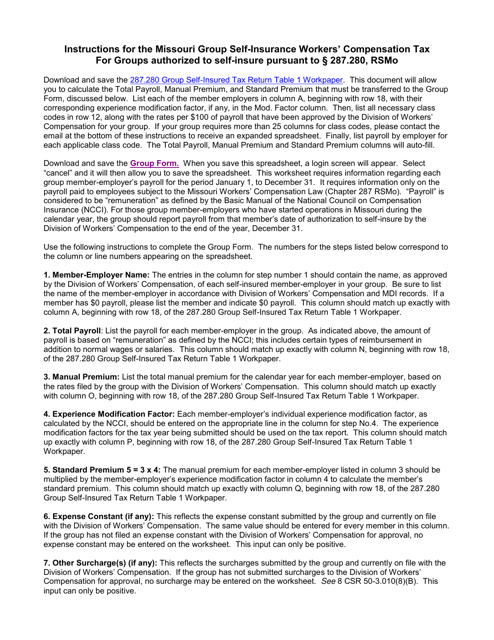

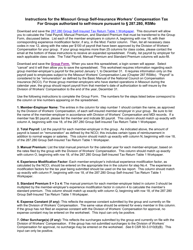

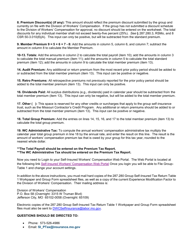

Instructions for Missouri Group Self-insurance Workers' Compensation Tax and Assessment Reporting Form - Missouri

This document was released by Missouri Department of Commerce and Insurance and contains the most recent official instructions for Missouri Group Self-insurance Workers' Compensation Tax and Assessment Reporting Form .

FAQ

Q: What is Missouri Group Self-insurance Workers' Compensation Tax and Assessment Reporting Form?

A: It is a form used for reporting taxes and assessments related to group self-insurance workers' compensation in Missouri.

Q: Who needs to file this form?

A: Employers who have opted for group self-insurance for workers' compensation in Missouri.

Q: What is the purpose of this form?

A: The form is used to report and pay taxes and assessments associated with group self-insurance workers' compensation.

Q: What taxes and assessments are reported on this form?

A: Taxes and assessments related to group self-insurance for workers' compensation in Missouri.

Q: When is the deadline for filing this form?

A: The deadline for filing this form is determined by the Missouri Department of Revenue and can vary from year to year.

Q: Are there any penalties for not filing this form?

A: Yes, there may be penalties for failure to file or late filing of this form.

Q: Can I file this form electronically?

A: Yes, electronic filing is available for the Missouri Group Self-insurance Workers' Compensation Tax and Assessment Reporting Form.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library legal documents released by the Missouri Department of Commerce and Insurance.