Missouri Group Self-insurance Workers' Compensation Tax for Groups Authorized to Self-insure Pursuant to 287.280, Rsmo - Missouri

Missouri Group Self-insurance Workers' Compensation Tax for Groups Authorized to Self-insure Pursuant to 287.280, Rsmo is a legal document that was released by the Missouri Department of Commerce and Insurance - a government authority operating within Missouri.

FAQ

Q: What is the Missouri Group Self-insurance Workers' Compensation Tax?

A: The Missouri Group Self-insurance Workers' Compensation Tax is a tax levied on groups that are authorized to self-insure their workers' compensation obligations under section 287.280 of the Missouri Revised Statutes.

Q: Who is required to pay this tax?

A: Groups that are authorized to self-insure their workers' compensation obligations in Missouri are required to pay this tax.

Q: What is the purpose of this tax?

A: The purpose of this tax is to fund the oversight and administration of self-insured workers' compensation programs in Missouri.

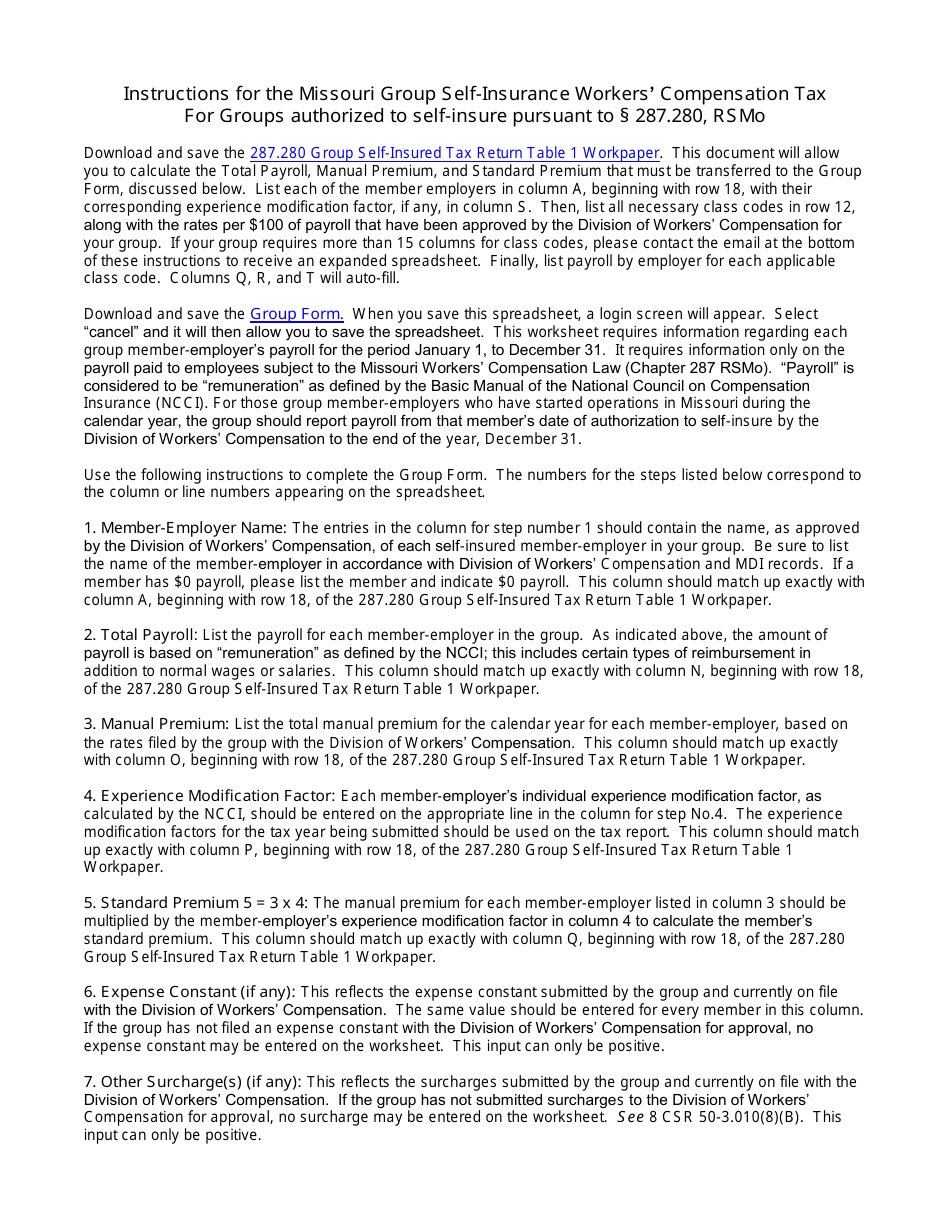

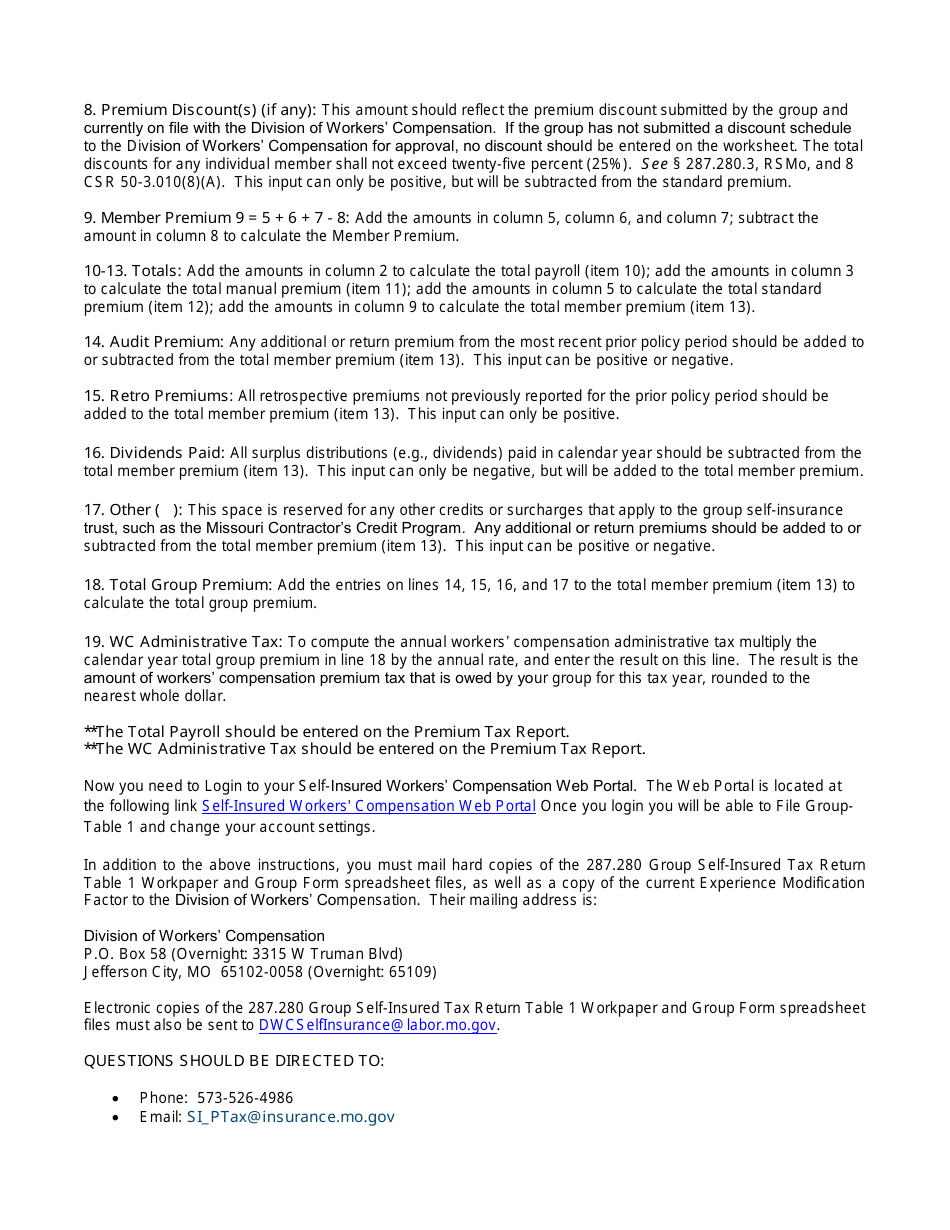

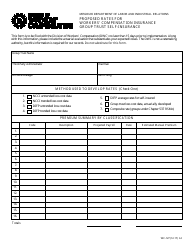

Q: How is the tax calculated?

A: The tax is calculated based on the total workers' compensation liabilities assumed by the self-insured group.

Q: Are there any exemptions or deductions available for this tax?

A: There are no specific exemptions or deductions available for this tax. All authorized self-insured groups are required to pay the tax based on their workers' compensation liabilities.

Q: Are there any penalties for non-payment of the tax?

A: Yes, there are penalties for non-payment of the tax, including interest charges and potential legal action by the Missouri Department of Labor and Industrial Relations.

Q: Is there a deadline for payment of the tax?

A: Yes, the tax should be paid by the designated due date specified by the Missouri Department of Labor and Industrial Relations.

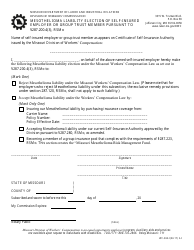

Q: Are there any additional requirements for groups authorized to self-insure?

A: Yes, authorized self-insured groups in Missouri are also required to submit annual reports and maintain certain financial security requirements.

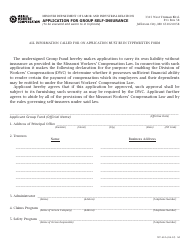

Form Details:

- The latest edition currently provided by the Missouri Department of Commerce and Insurance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Missouri Department of Commerce and Insurance.