This version of the form is not currently in use and is provided for reference only. Download this version of

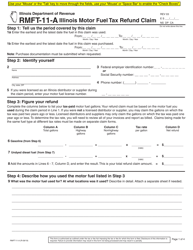

Form RMFT-11-A

for the current year.

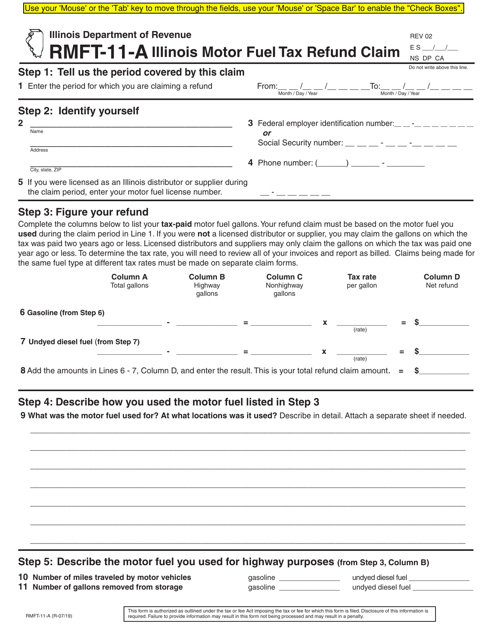

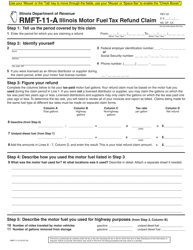

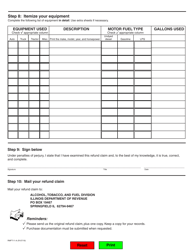

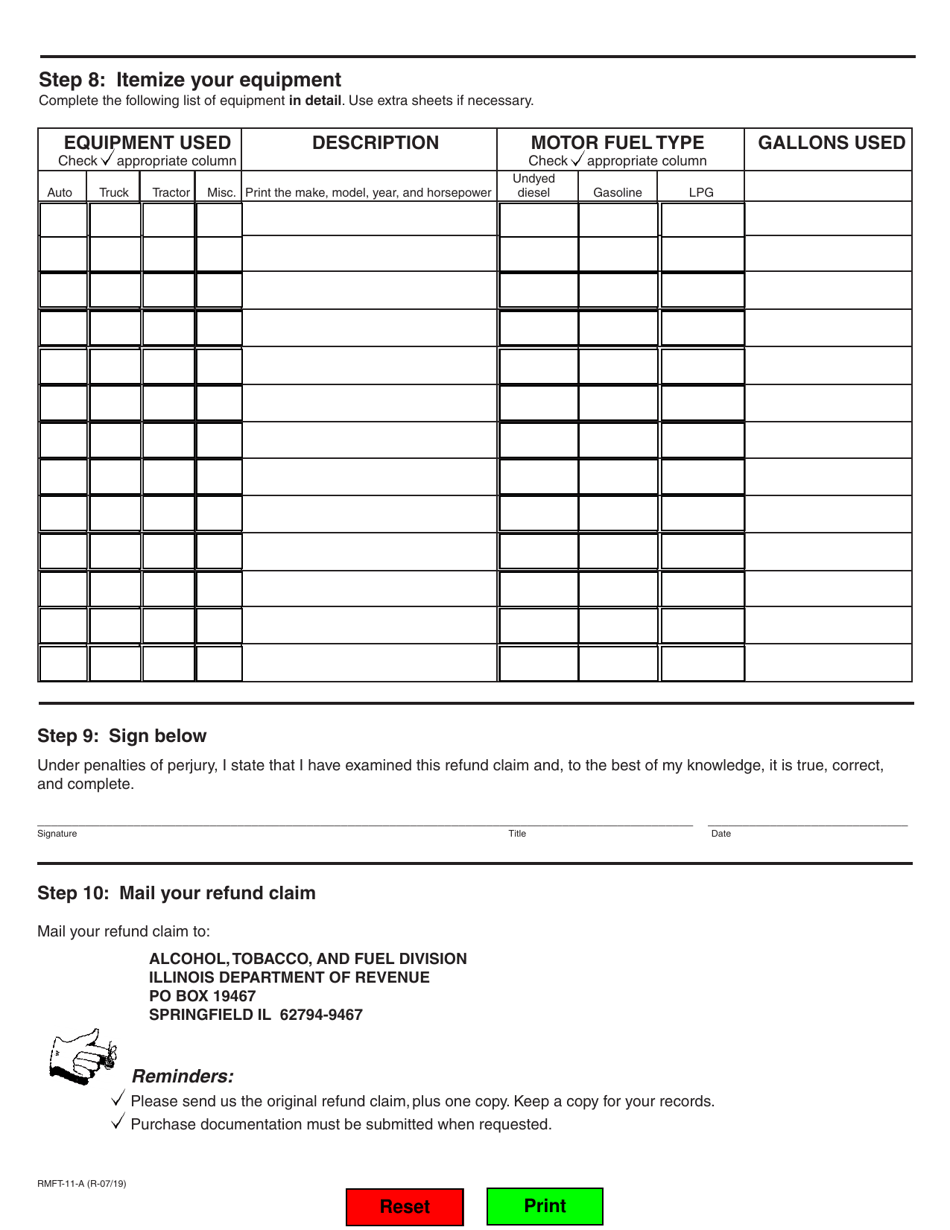

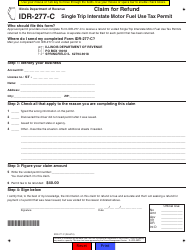

Form RMFT-11-A Illinois Motor Fuel Tax Refund Claim - Illinois

What Is Form RMFT-11-A?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is RMFT-11-A?

A: RMFT-11-A is a form used to file a Motor Fuel Tax Refund Claim in Illinois.

Q: Who can file the RMFT-11-A form?

A: Any individual or entity that believes they are eligible for a motor fuel tax refund in Illinois can file the RMFT-11-A form.

Q: What is the purpose of the Motor Fuel Tax Refund Claim?

A: The Motor Fuel Tax Refund Claim allows individuals or entities to request a refund of the taxes paid on motor fuel in Illinois.

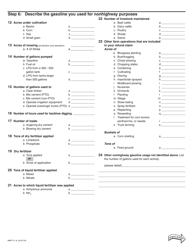

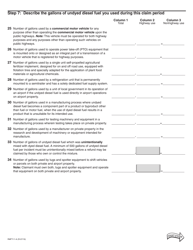

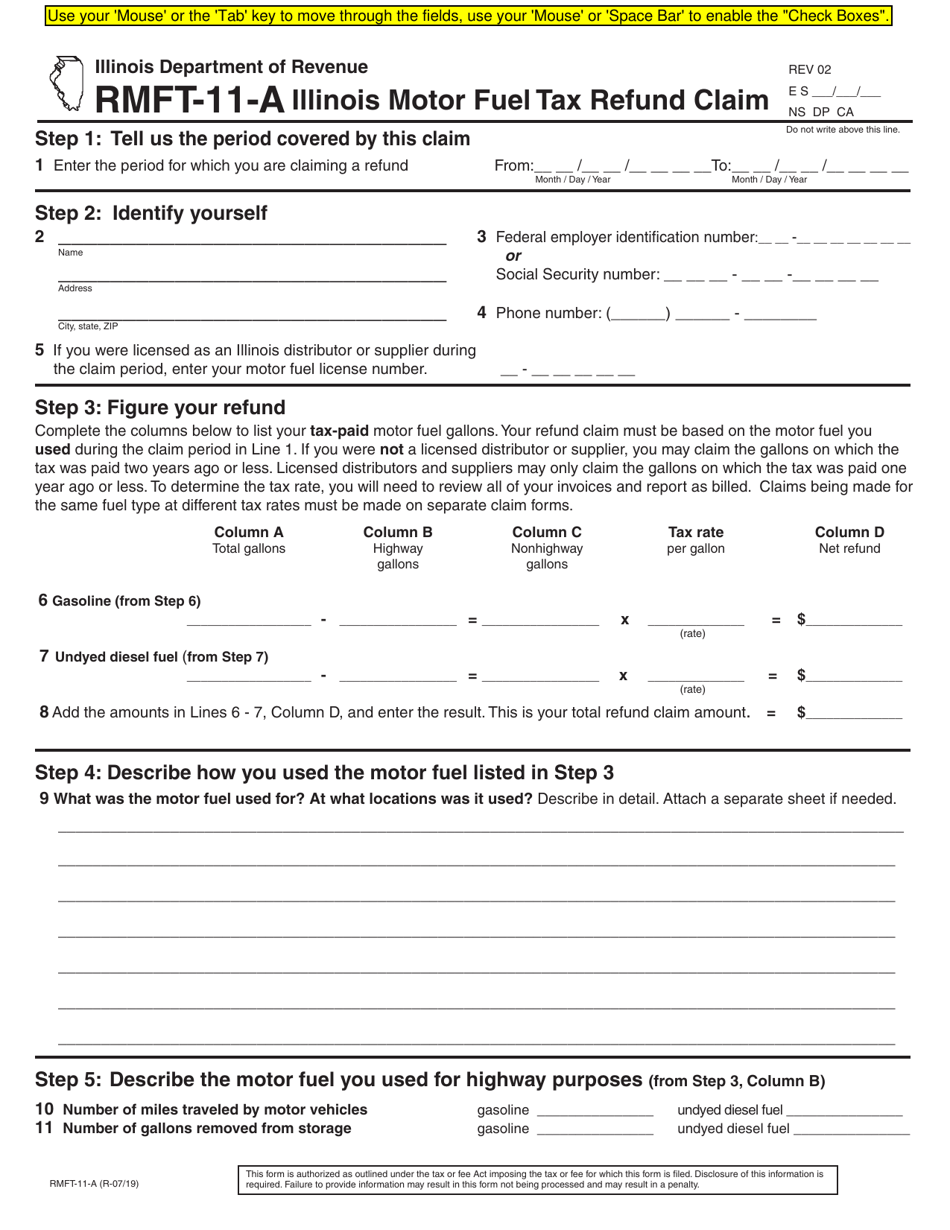

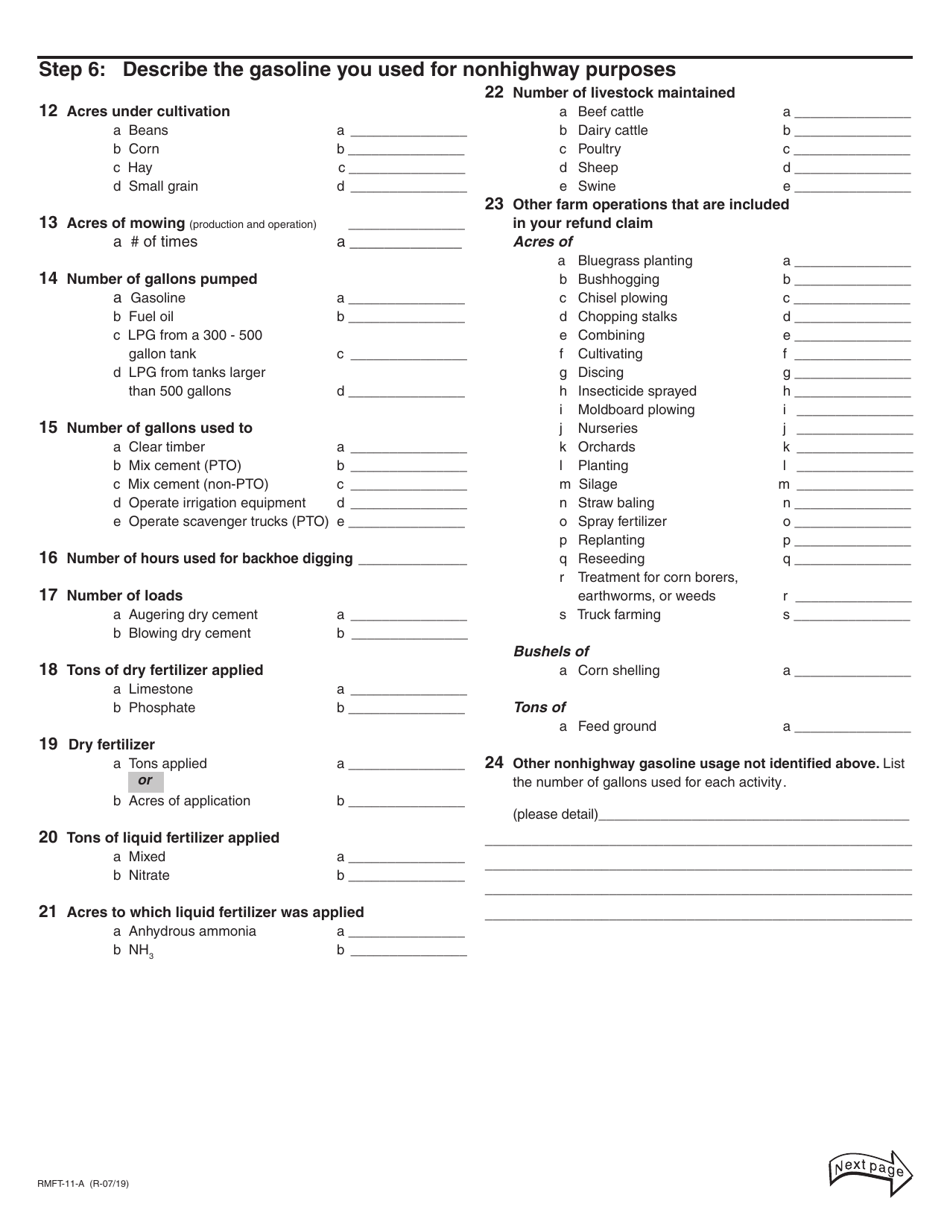

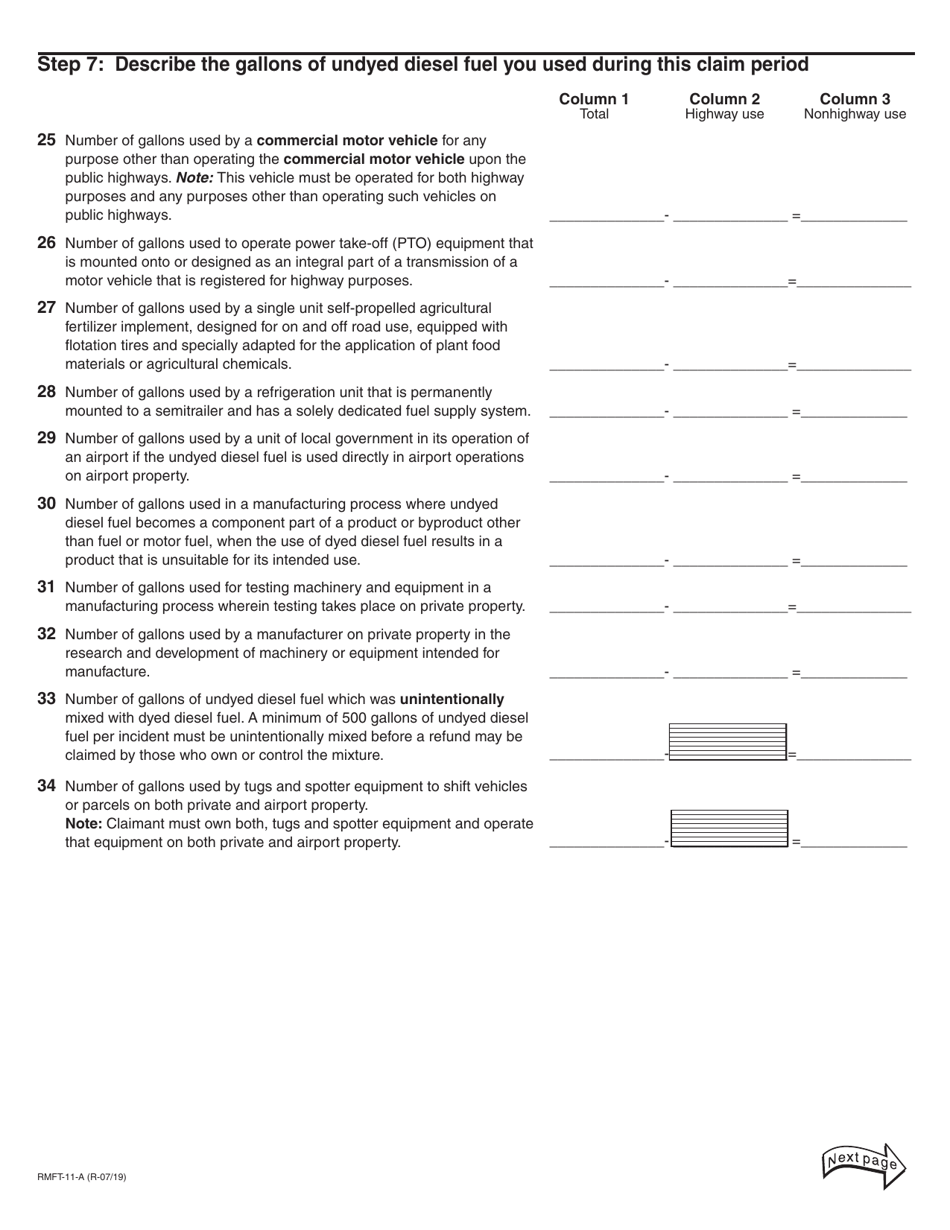

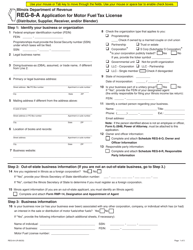

Q: What information is required to complete the RMFT-11-A form?

A: The RMFT-11-A form requires information such as the claimant's name, address, business information (if applicable), fuel purchase details, and supporting documentation.

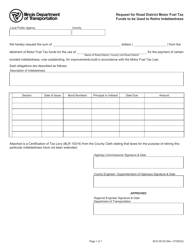

Q: What are the deadlines for filing the Motor Fuel Tax Refund Claim?

A: The Motor Fuel Tax Refund Claim must be filed within three years from the date of the fuel purchase or six months after the due date of the return.

Q: Can I file a Motor Fuel Tax Refund Claim for multiple periods on one RMFT-11-A form?

A: Yes, you can file a Motor Fuel Tax Refund Claim for multiple periods on one RMFT-11-A form.

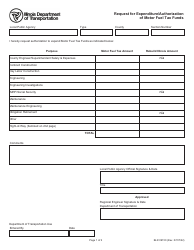

Q: How long does it take to process the Motor Fuel Tax Refund Claim?

A: The processing time for the Motor Fuel Tax Refund Claim can vary, but generally, it takes about 8-12 weeks for the claim to be processed and a refund to be issued.

Q: What should I do if my Motor Fuel Tax Refund Claim is denied?

A: If your Motor Fuel Tax Refund Claim is denied, you have the option to appeal the decision or request a reconsideration.

Q: Are there any penalties for filing an incorrect or fraudulent Motor Fuel Tax Refund Claim?

A: Yes, there can be penalties for filing an incorrect or fraudulent Motor Fuel Tax Refund Claim, including fines and potential criminal charges.

Form Details:

- Released on July 1, 2019;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RMFT-11-A by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.