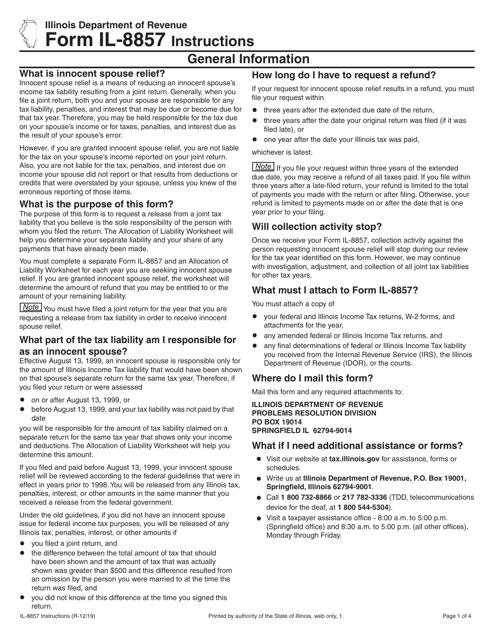

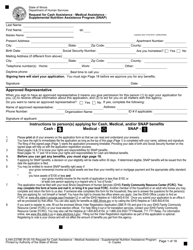

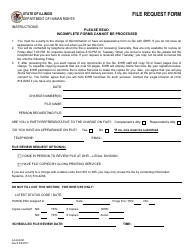

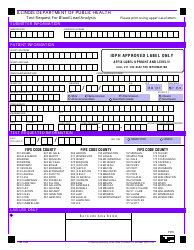

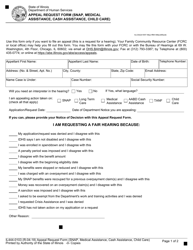

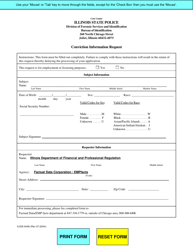

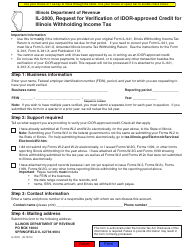

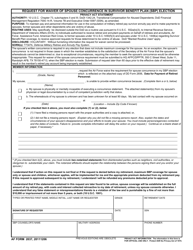

Instructions for Form IL-8857 Request for Innocent Spouse Relief - Illinois

This document contains official instructions for Form IL-8857 , Request for Innocent Spouse Relief - a form released and collected by the Illinois Department of Revenue. An up-to-date fillable Form IL-8857 is available for download through this link.

FAQ

Q: What is Form IL-8857?

A: Form IL-8857 is a request forinnocent spouse relief specifically for Illinois residents.

Q: Who can use Form IL-8857?

A: This form can be used by individuals who believe they are eligible for innocent spouse relief.

Q: What is innocent spouse relief?

A: Innocent spouse relief is a provision that allows a taxpayer to be relieved of joint and several liability for tax, interest, and penalties.

Q: What are the eligibility requirements for innocent spouse relief?

A: To be eligible for innocent spouse relief, the taxpayer must meet certain criteria such as not having knowledge or reason to know of the understatement or understatement of tax.

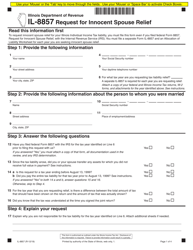

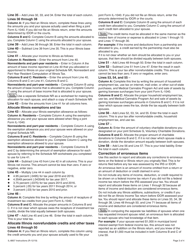

Q: What should I include with my Form IL-8857?

A: You should include any supporting documentation or evidence that proves your eligibility for innocent spouse relief.

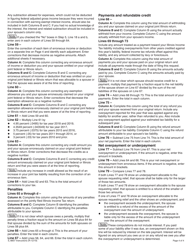

Q: Is there a deadline for filing Form IL-8857?

A: Yes, there is a deadline for filing Form IL-8857. The form must be filed within 2 years from the date the department first notifies the taxpayer spouse of the liability.

Q: What happens after I submit Form IL-8857?

A: After you submit Form IL-8857, the Illinois Department of Revenue will review your request and determine if you qualify for innocent spouse relief.

Q: Can I appeal the decision if my request for innocent spouse relief is denied?

A: Yes, if your request for innocent spouse relief is denied, you have the right to appeal the decision.

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.