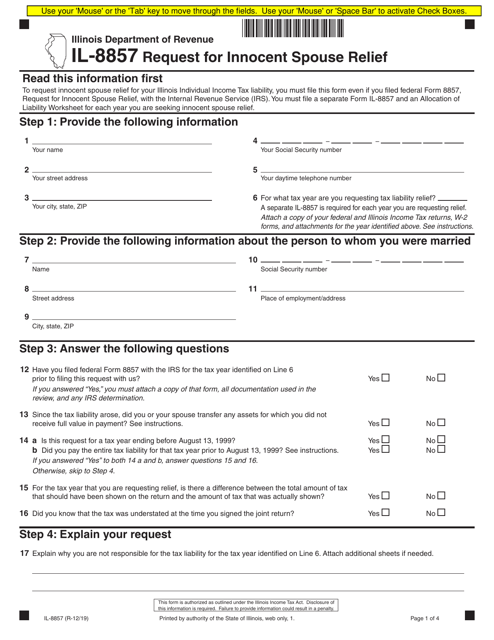

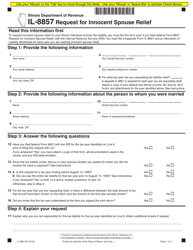

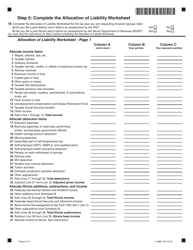

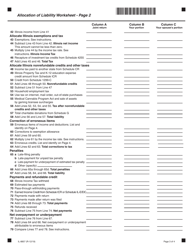

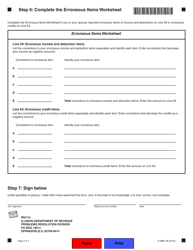

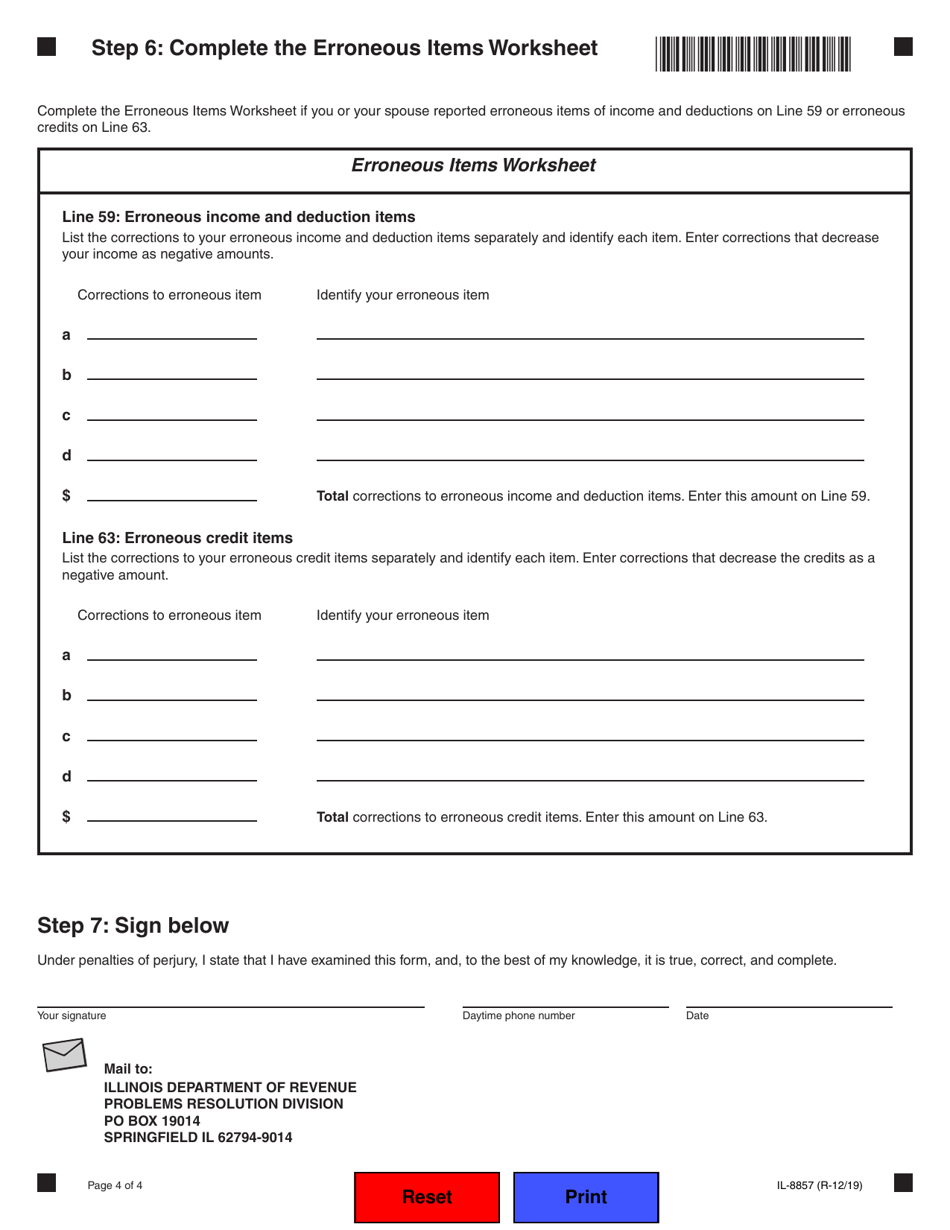

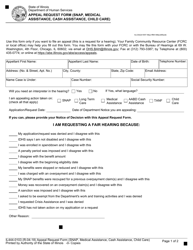

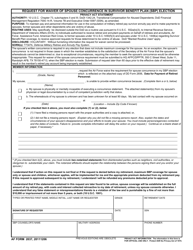

Form IL-8857 Request for Innocent Spouse Relief - Illinois

What Is Form IL-8857?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IL-8857?

A: Form IL-8857 is the Request forInnocent Spouse Relief specific to the state of Illinois.

Q: What is Innocent Spouse Relief?

A: Innocent Spouse Relief is a provision that allows a taxpayer to be relieved of joint liability for tax, penalties, and interest on a joint tax return.

Q: Who can file Form IL-8857?

A: Any individual who filed a joint tax return with their spouse or former spouse and believes they qualify for innocent spouse relief in the state of Illinois can file Form IL-8857.

Q: What is the purpose of Form IL-8857?

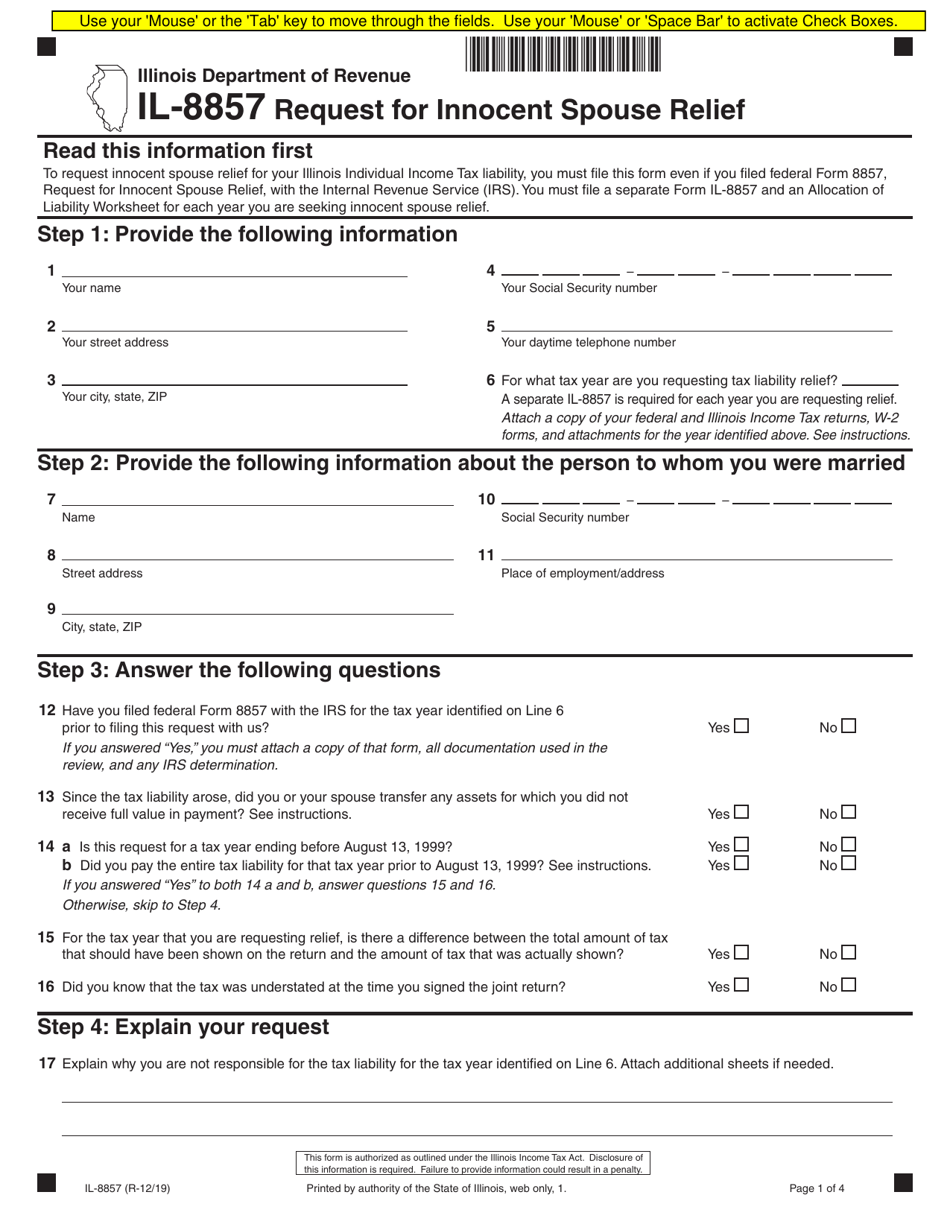

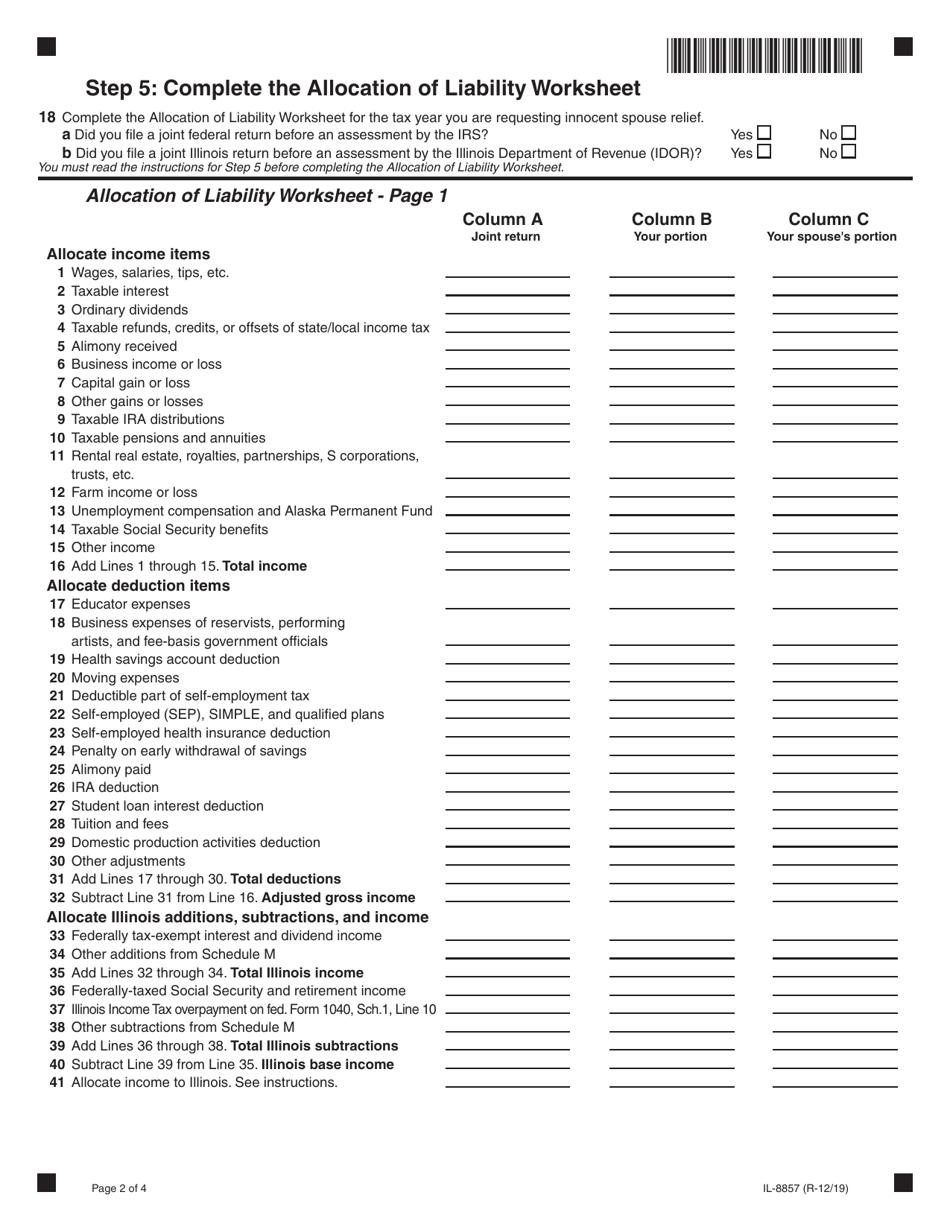

A: The purpose of Form IL-8857 is to request relief from liability for taxes, penalties, and interest resulting from a joint tax return filed with a spouse or former spouse in Illinois.

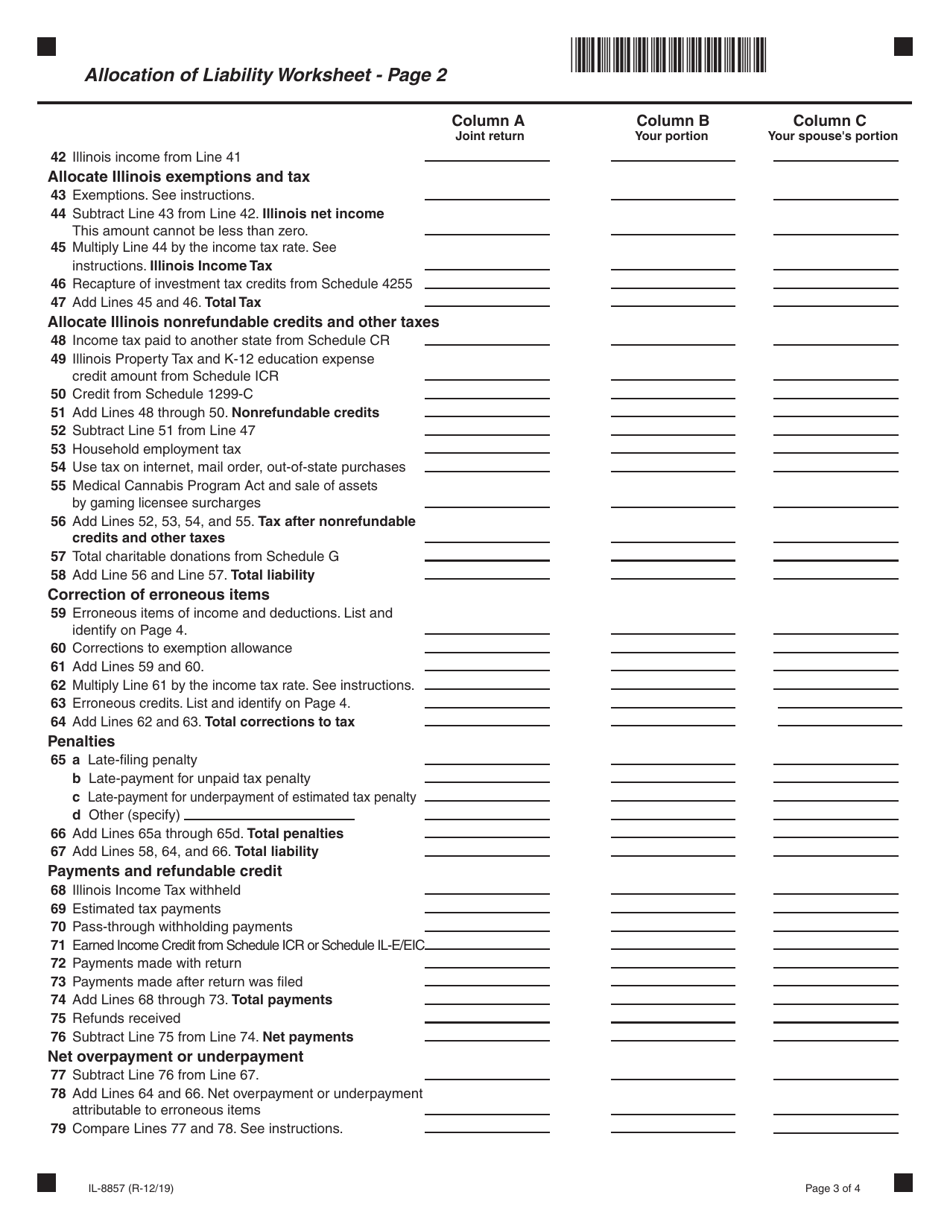

Q: What is required to be included when filing Form IL-8857?

A: When filing Form IL-8857, you will need to provide information about your joint tax return, the specific items you are seeking relief from, and any supporting documentation to support your claim for innocent spouse relief.

Q: Is there a fee to file Form IL-8857?

A: No, there is no fee to file Form IL-8857.

Q: What happens after I file Form IL-8857?

A: After you file Form IL-8857, the Illinois Department of Revenue will review your request and may ask for additional information or documentation to support your claim. They will then make a decision on whether to grant or deny your request for innocent spouse relief.

Q: Are there any time limits to file Form IL-8857?

A: Yes, you generally have two years from the date the Illinois Department of Revenue first attempts to collect the tax to file Form IL-8857.

Q: Can I appeal if my request for innocent spouse relief is denied?

A: Yes, if your request for innocent spouse relief is denied, you have the right to appeal the decision by filing a written protest with the Illinois Department of Revenue within 60 days of receiving the denial.

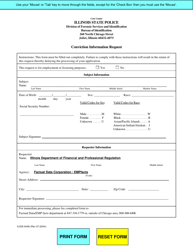

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL-8857 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.