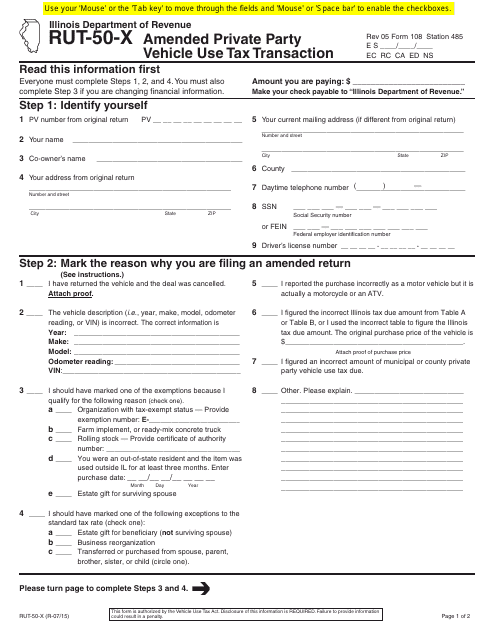

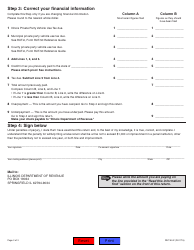

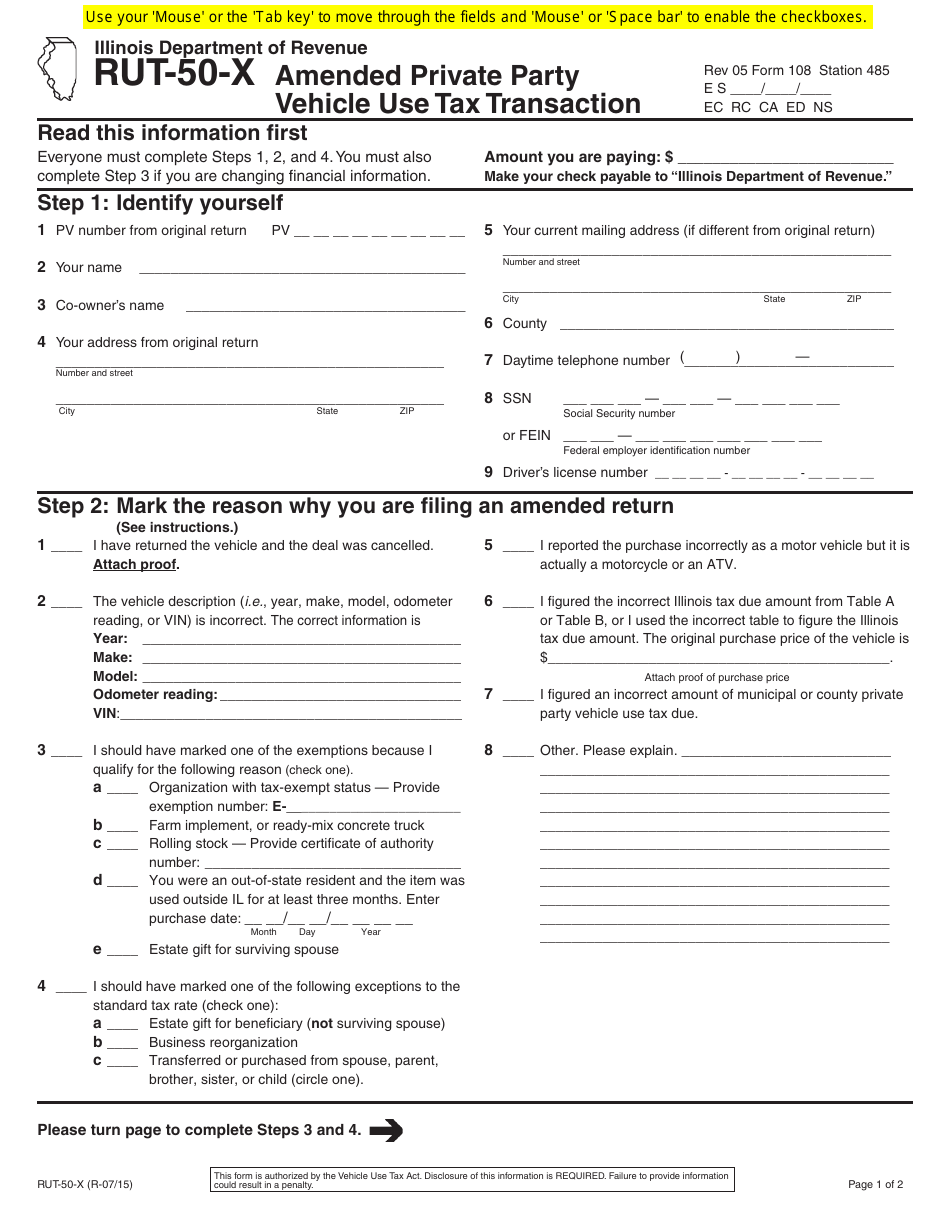

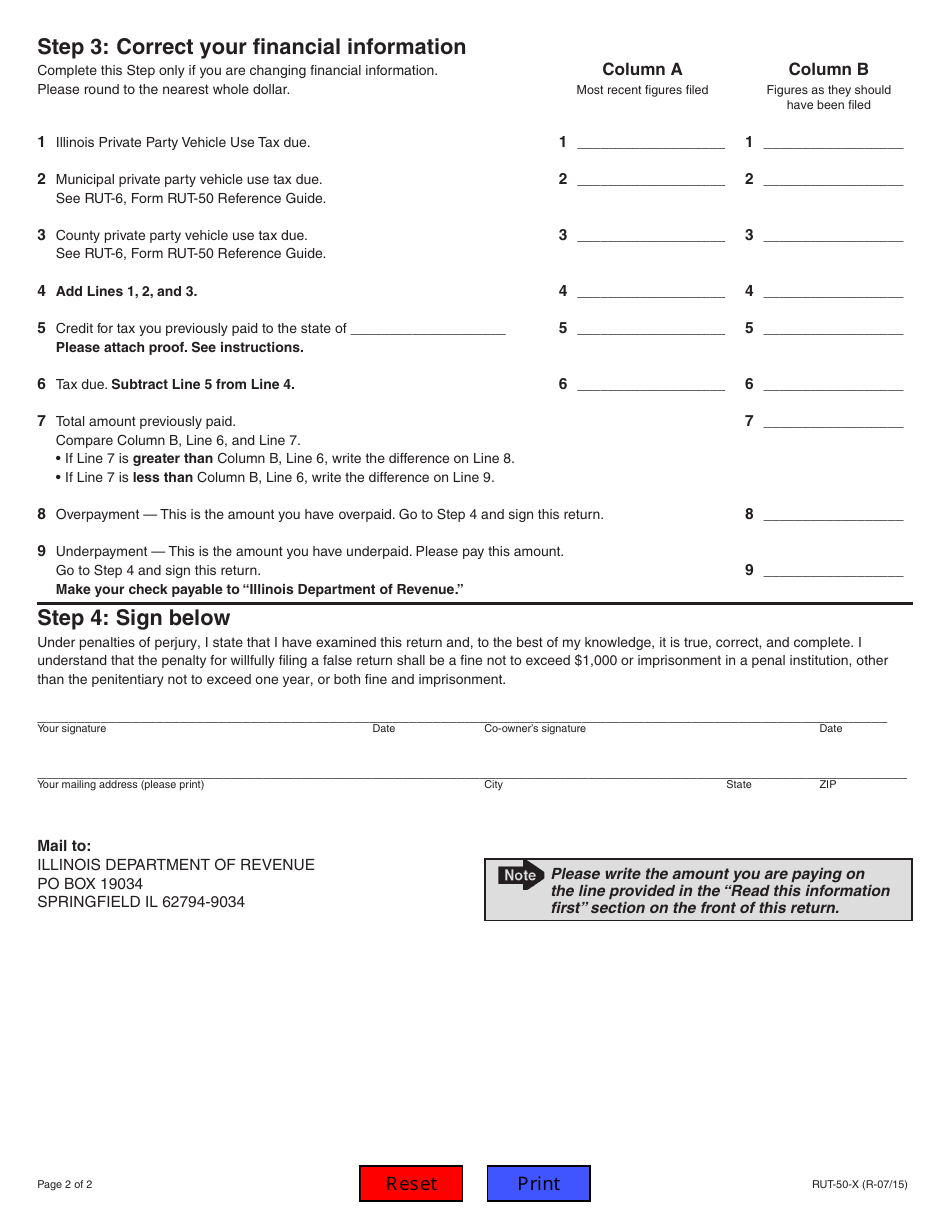

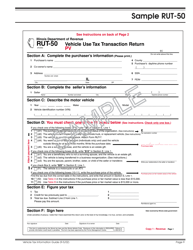

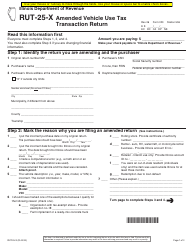

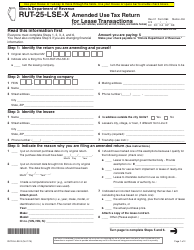

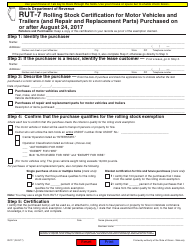

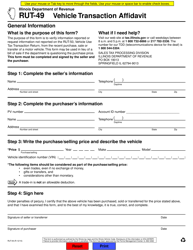

Form RUT-50-X Amended Private Party Vehicle Use Tax Transaction - Illinois

What Is Form RUT-50-X?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form RUT-50-X?

A: Form RUT-50-X is a form for reporting an amended private partyvehicle use tax transaction in Illinois.

Q: What is the purpose of Form RUT-50-X?

A: The purpose of Form RUT-50-X is to correct or update information related to a private party vehicle use tax transaction in Illinois.

Q: Who should use Form RUT-50-X?

A: Form RUT-50-X should be used by individuals or businesses who need to amend their previously filed private party vehicle usetax transaction in Illinois.

Q: When should Form RUT-50-X be filed?

A: Form RUT-50-X should be filed within 20 days of discovering an error or change in the information provided in the original private party vehicle use tax transaction in Illinois.

Q: Is there a fee for filing Form RUT-50-X?

A: No, there is no fee for filing Form RUT-50-X in Illinois.

Form Details:

- Released on July 1, 2015;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RUT-50-X by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.