This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form IL-1041-X

for the current year.

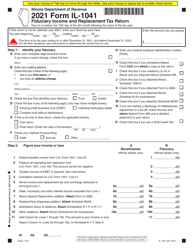

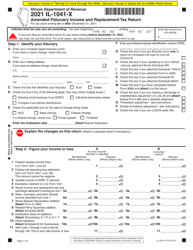

Instructions for Form IL-1041-X Amended Fiduciary Income and Replacement Tax Return - Illinois

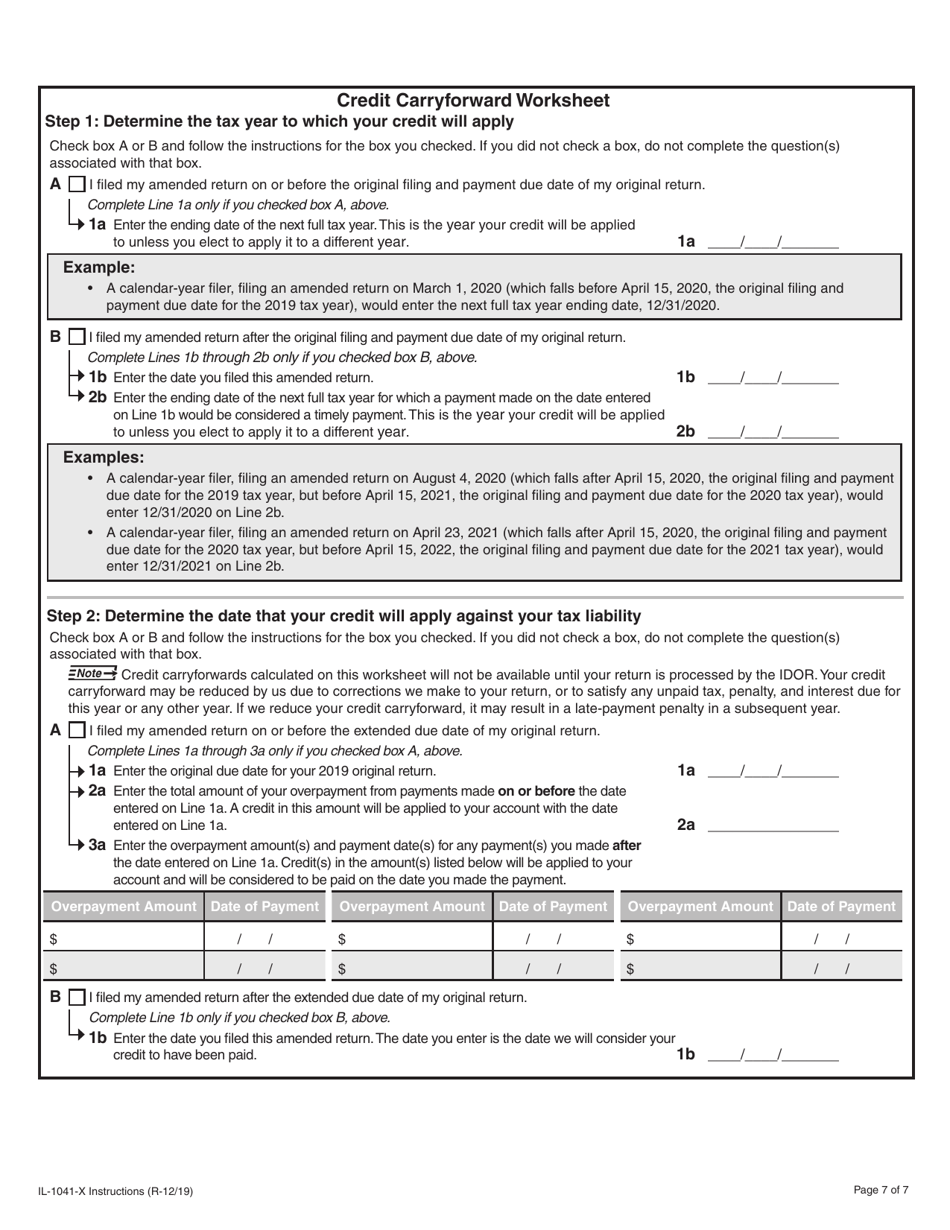

This document contains official instructions for Form IL-1041-X , Amended Fiduciary Income and Replacement Tax Return - a form released and collected by the Illinois Department of Revenue.

FAQ

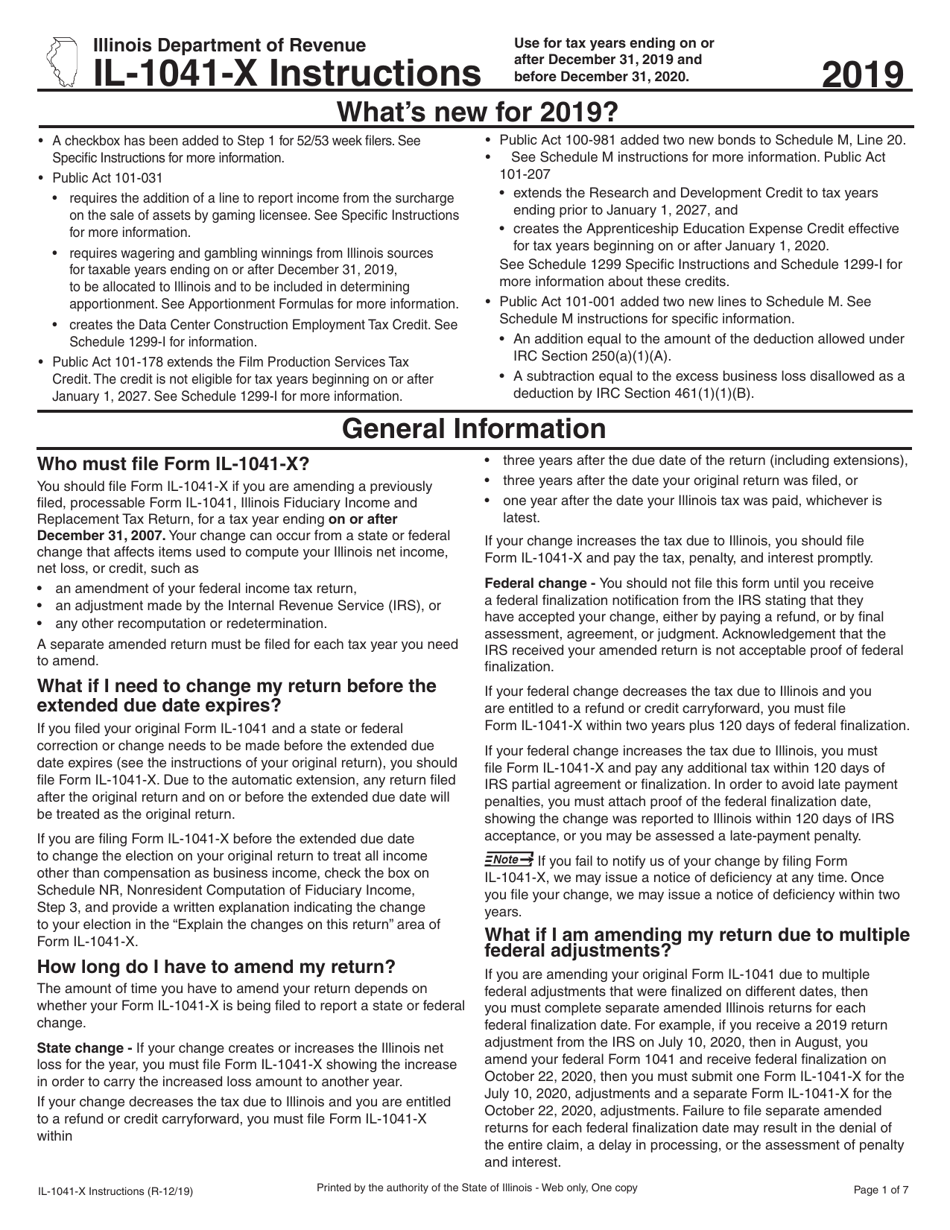

Q: What is Form IL-1041-X?

A: Form IL-1041-X is the Amended Fiduciary Income and Replacement Tax Return for Illinois.

Q: Who needs to file Form IL-1041-X?

A: Any fiduciary who needs to correct errors or make changes to their previously filed Form IL-1041 for Illinois.

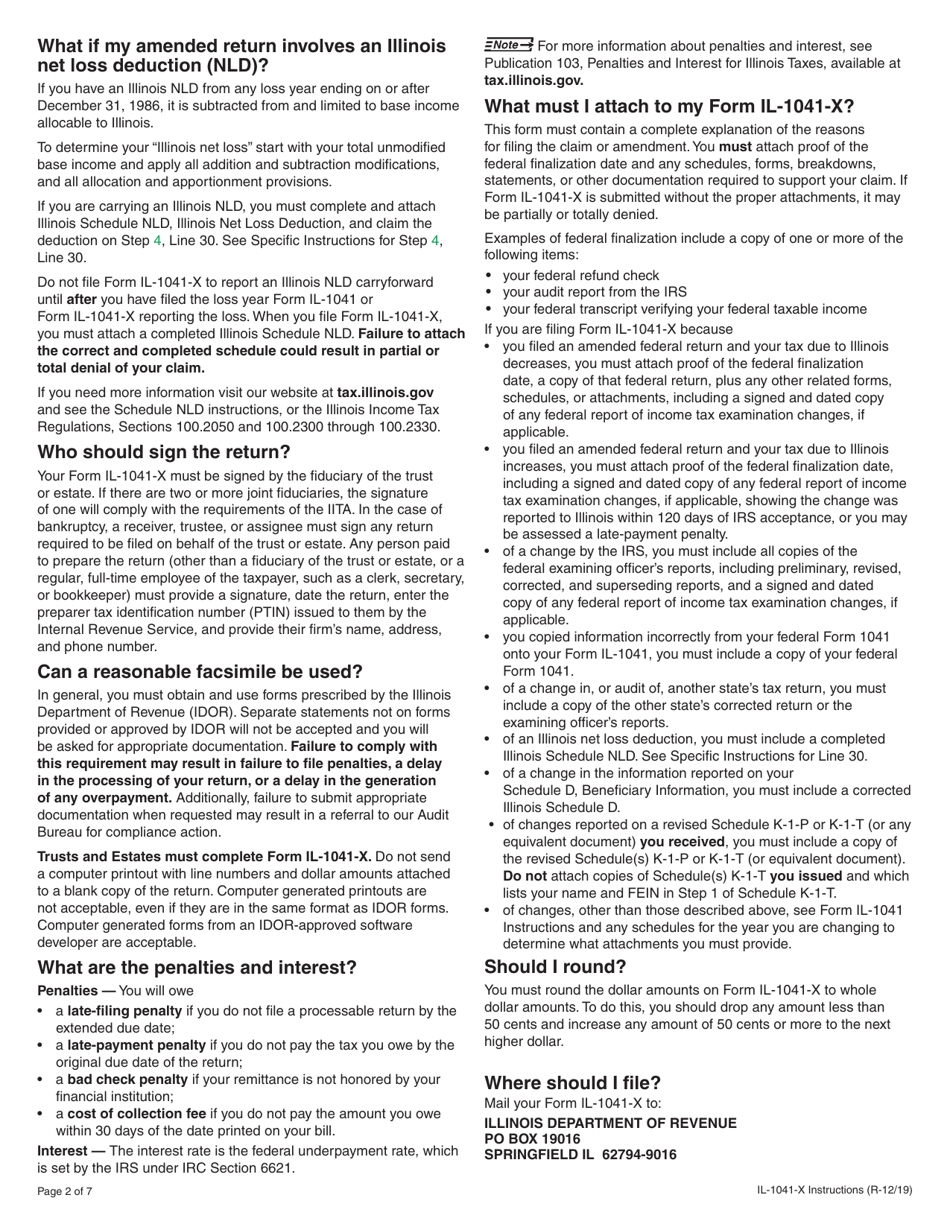

Q: What information is required on Form IL-1041-X?

A: Form IL-1041-X requires you to provide information about the original return, the changes being made, and the reasons for the changes.

Q: When should Form IL-1041-X be filed?

A: Form IL-1041-X should be filed as soon as you discover errors or changes that need to be made on your original Form IL-1041.

Q: Are there any fees associated with filing Form IL-1041-X?

A: No, there are no fees associated with filing Form IL-1041-X.

Q: What should I do if I made a mistake on Form IL-1041-X?

A: If you made a mistake on Form IL-1041-X, you should file an amended Form IL-1041-X to correct the error.

Q: Can I e-file Form IL-1041-X?

A: No, Form IL-1041-X cannot be e-filed. It must be filed by mail.

Q: Is there a deadline for filing Form IL-1041-X?

A: Yes, Form IL-1041-X must be filed within three years from the original due date of the return or within one year from the date you filed the original return, whichever is later.

Instruction Details:

- This 7-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.