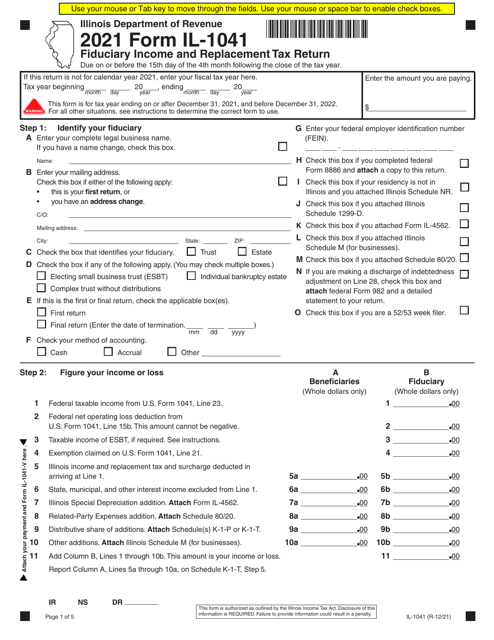

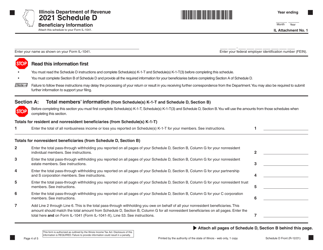

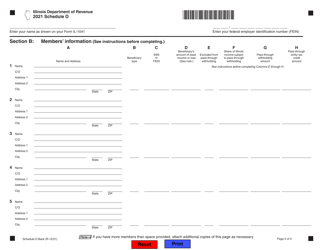

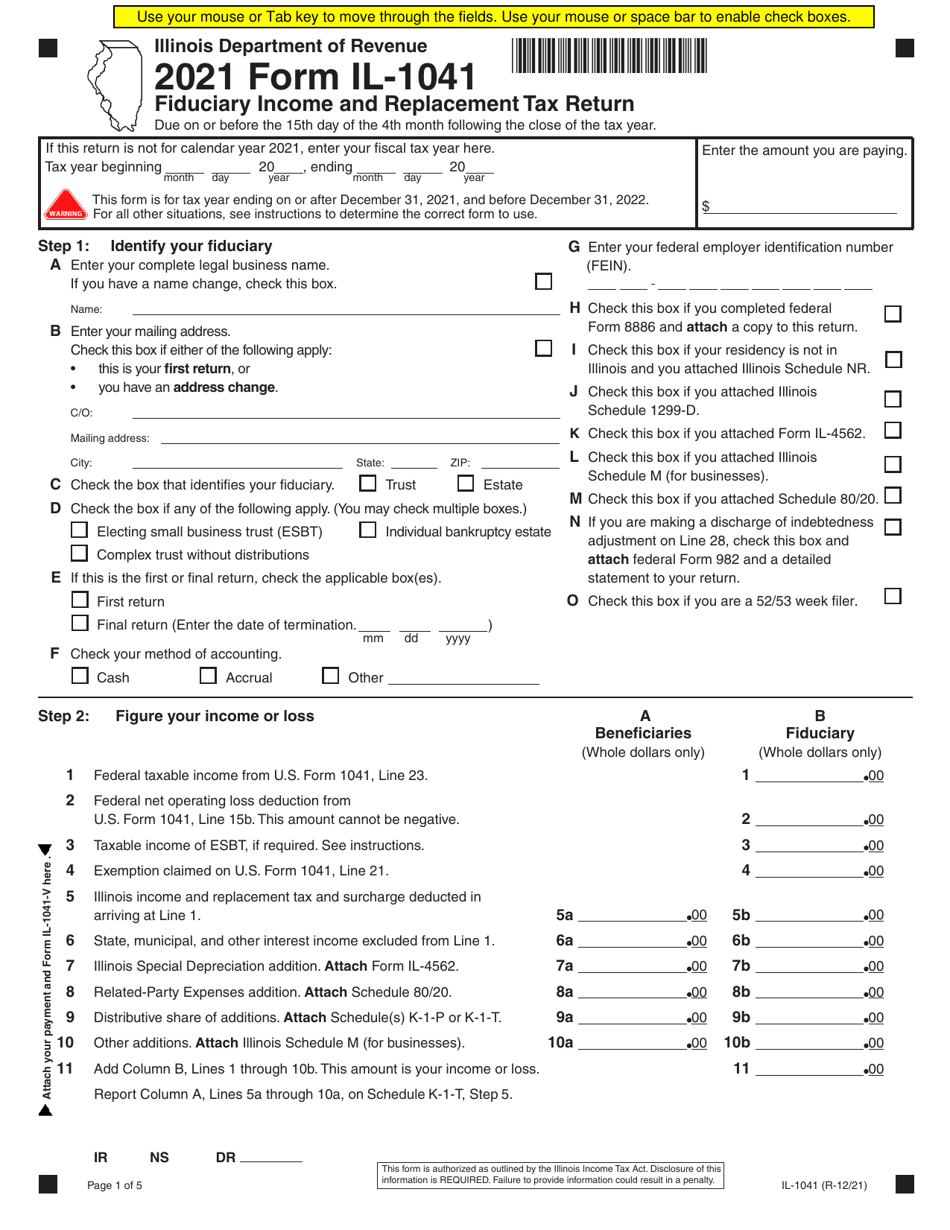

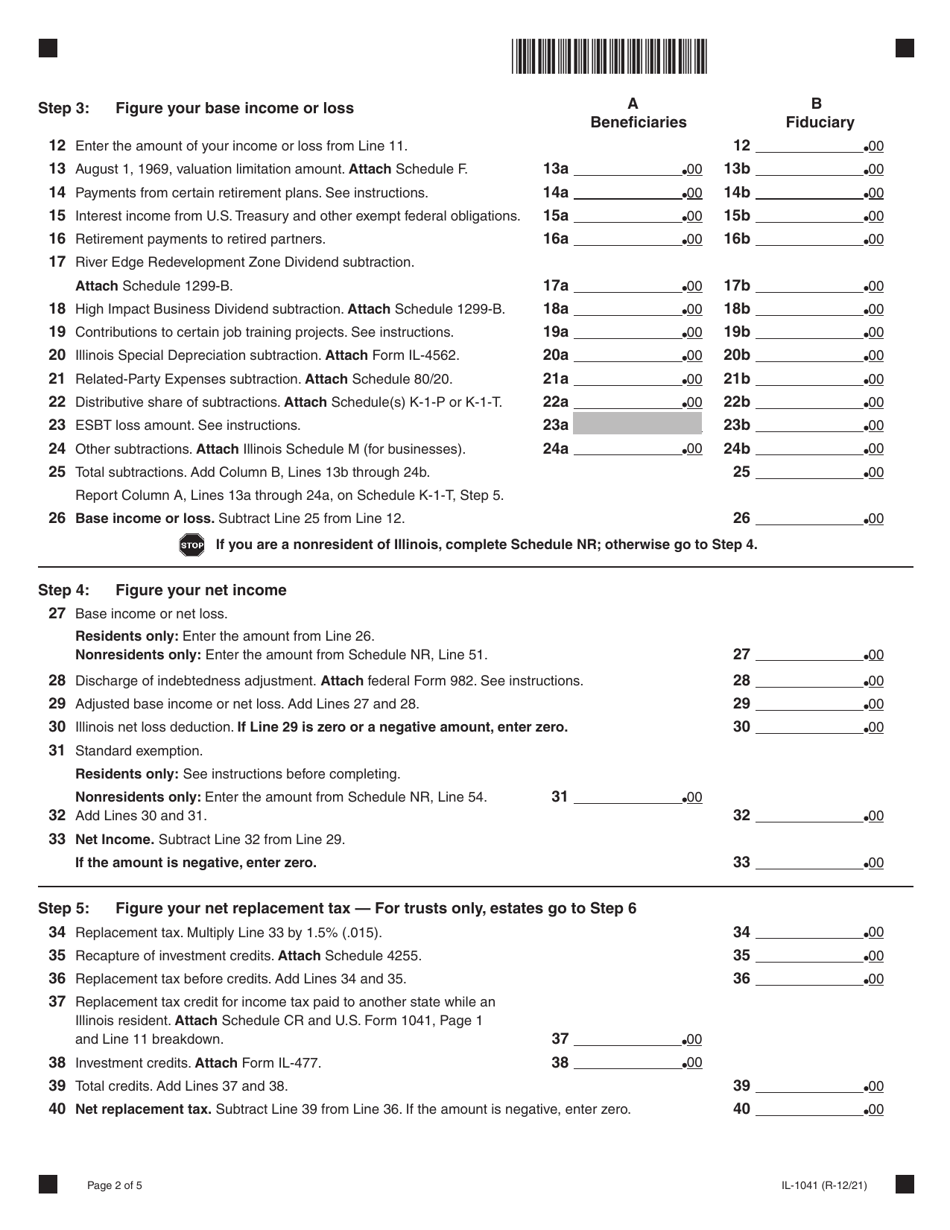

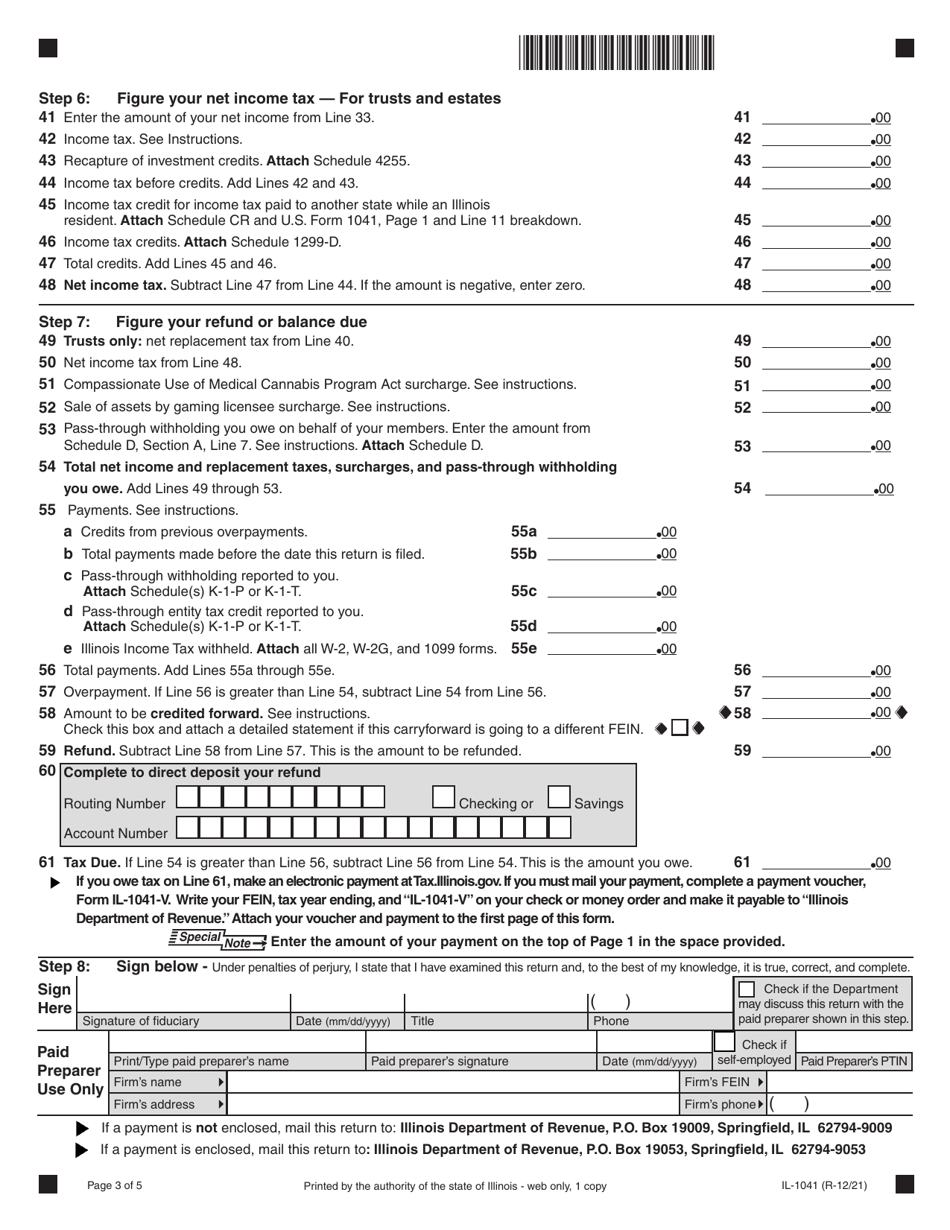

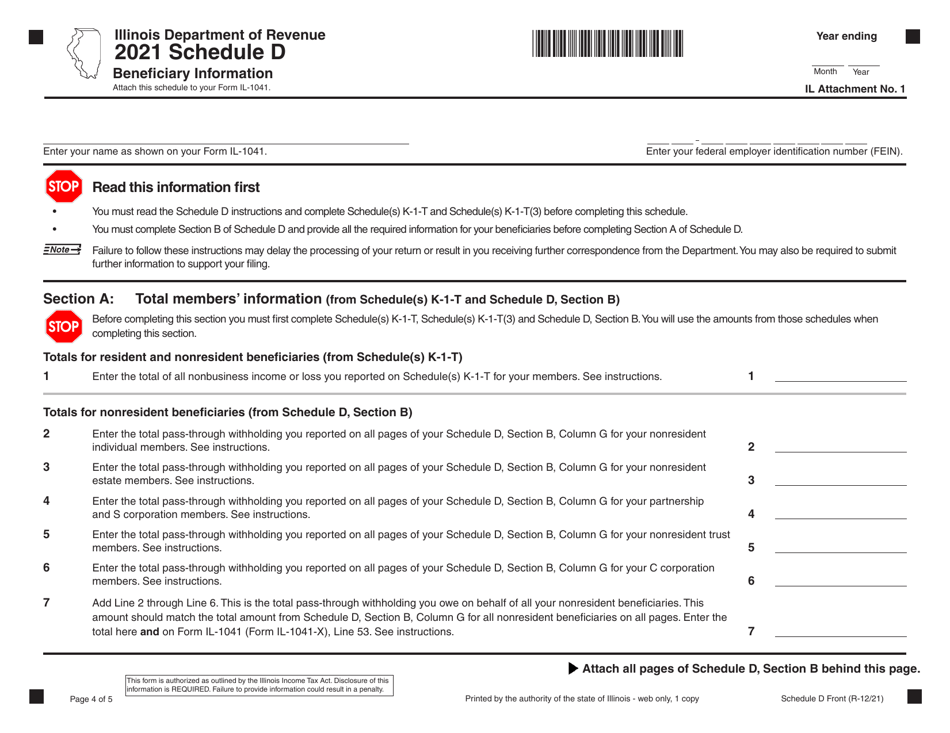

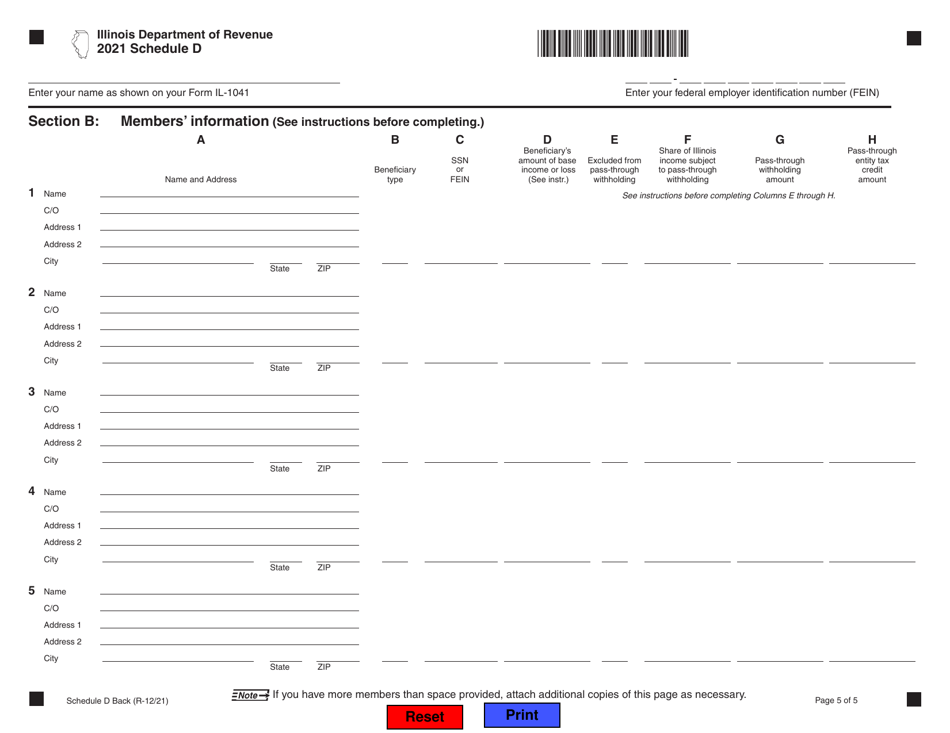

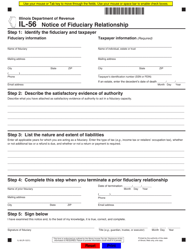

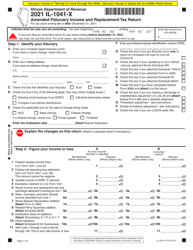

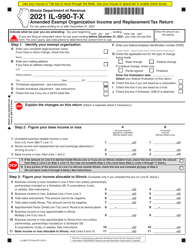

Form IL-1041 Fiduciary Income and Replacement Tax Return - Illinois

What Is Form IL-1041?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IL-1041?

A: Form IL-1041 is the Fiduciary Income and Replacement Tax Return for the state of Illinois.

Q: Who needs to file Form IL-1041?

A: Form IL-1041 must be filed by fiduciaries, such as trustees or executors, who are in charge of a trust or estate in Illinois.

Q: What is the purpose of Form IL-1041?

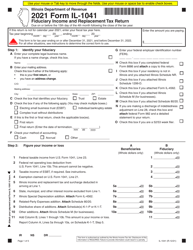

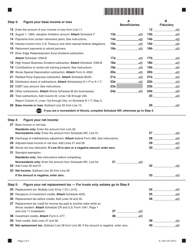

A: The purpose of Form IL-1041 is to report income, deductions, and credits for trusts and estates and calculate the appropriate tax liability.

Q: When is Form IL-1041 due?

A: Form IL-1041 is due on the 15th day of the 4th month following the close of the tax year, which is usually April 15th.

Q: Are there any extensions available for filing Form IL-1041?

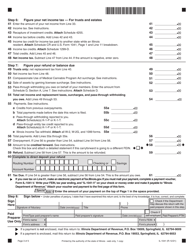

A: Yes, you can request an extension of time to file Form IL-1041. The extension must be requested before the original due date and will give you an additional 5 months to file.

Q: What tax rates apply to Form IL-1041?

A: For tax years beginning on or after January 1, 2021, the tax rates range from 4.95% to 7.99% depending on the amount of income.

Q: Is electronic filing available for Form IL-1041?

A: Yes, you can file Form IL-1041 electronically through the Illinois Department of Revenue's e-file system or using approved tax software.

Q: Are there any penalties for late filing of Form IL-1041?

A: Yes, if you fail to file Form IL-1041 by the due date, you may be subject to penalties and interest on the unpaid tax amount.

Q: What should I do if I made a mistake on Form IL-1041?

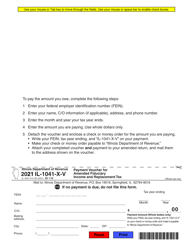

A: If you made a mistake on Form IL-1041 after filing, you can file an amended return using Form IL-1041-X to correct the error.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL-1041 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.