This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Schedule 80/20

for the current year.

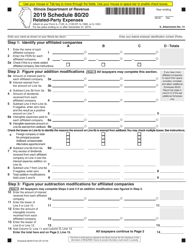

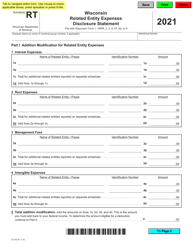

Instructions for Schedule 80 / 20 Related-Party Expenses - Illinois

This document contains official instructions for Schedule 80/20 , Related-Party Expenses - a form released and collected by the Illinois Department of Revenue.

FAQ

Q: What is Schedule 80/20?

A: Schedule 80/20 is a form that reports related-party expenses in Illinois.

Q: What are related-party expenses?

A: Related-party expenses are costs incurred from transactions between two parties that have a significant relationship.

Q: Who needs to file Schedule 80/20?

A: Taxpayers in Illinois who have related-party expenses exceeding $5,000 need to file Schedule 80/20.

Q: How do I complete Schedule 80/20?

A: You need to provide detailed information about the related-party transactions, including the nature of the expense, the amount, and the relationship between the parties.

Q: When is the deadline for filing Schedule 80/20?

A: Schedule 80/20 must be filed along with your Illinois income tax return.

Q: Are there any penalties for not filing Schedule 80/20?

A: Yes, failing to file Schedule 80/20 or providing inaccurate information can result in penalties and interest.

Q: Can I file Schedule 80/20 electronically?

A: Yes, you can file Schedule 80/20 electronically if you are e-filing your Illinois income tax return.

Instruction Details:

- This 3-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.