This version of the form is not currently in use and is provided for reference only. Download this version of

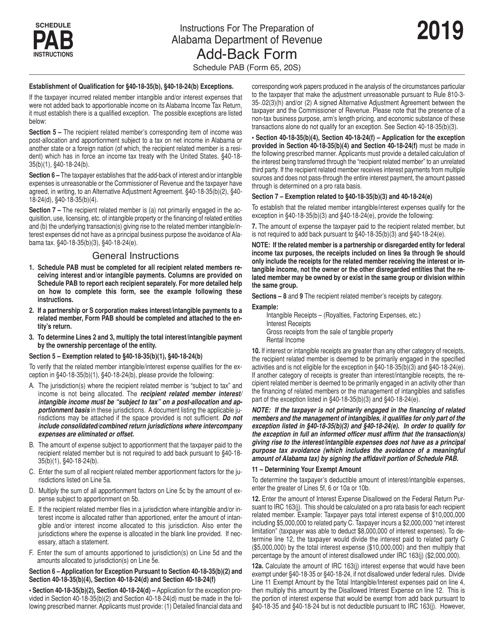

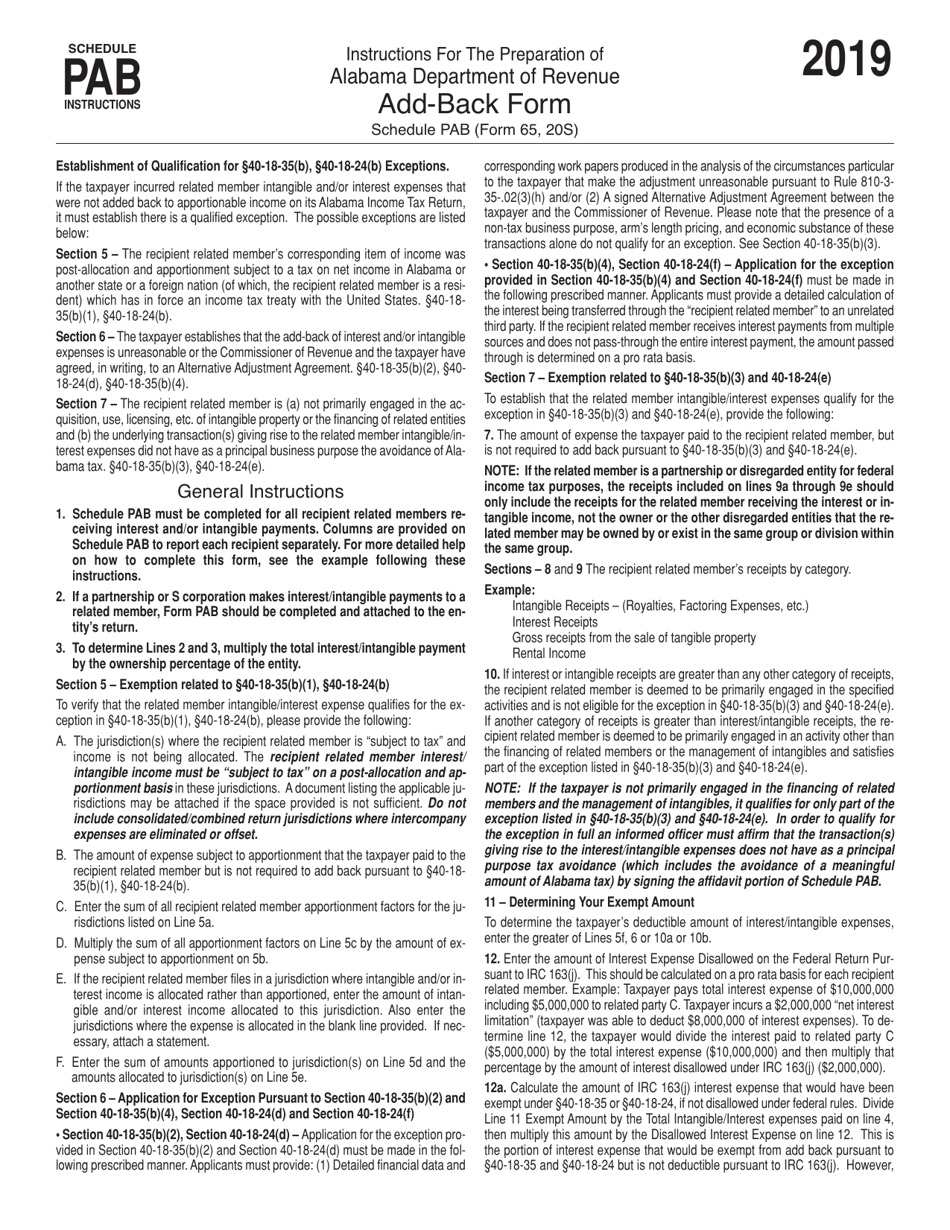

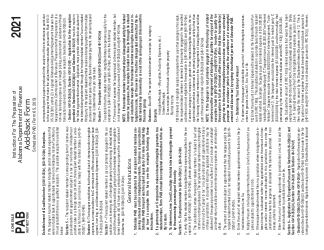

Instructions for Schedule PAB

for the current year.

Instructions for Schedule PAB Add-Back Form - Alabama

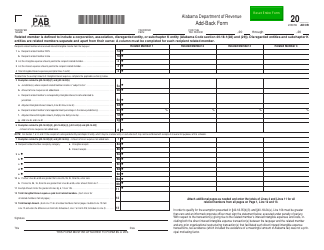

This document contains official instructions for Schedule PAB , Add-Back Form - a form released and collected by the Alabama Department of Revenue.

FAQ

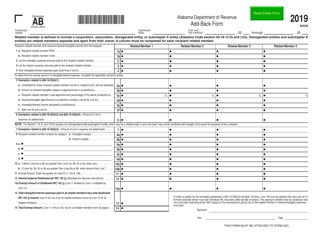

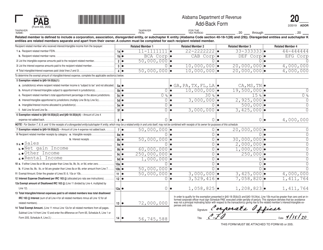

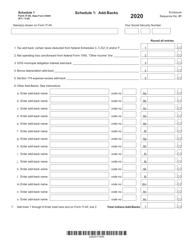

Q: What is Schedule PAB Add-Back Form?

A: Schedule PAB Add-Back Form is a form used in Alabama to add back certain deductions to your state taxable income.

Q: Why do I need to use Schedule PAB Add-Back Form?

A: You need to use Schedule PAB Add-Back Form to accurately calculate your state taxable income.

Q: Which deductions do I need to add back using Schedule PAB Add-Back Form?

A: You need to add back deductions related to interest and intangible expenses, dividends, income from partnership, and more.

Q: Do I need to include Schedule PAB Add-Back Form with my state tax return?

A: Yes, you need to include Schedule PAB Add-Back Form with your state tax return if you have any applicable deductions to add back.

Instruction Details:

- This 2-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Alabama Department of Revenue.