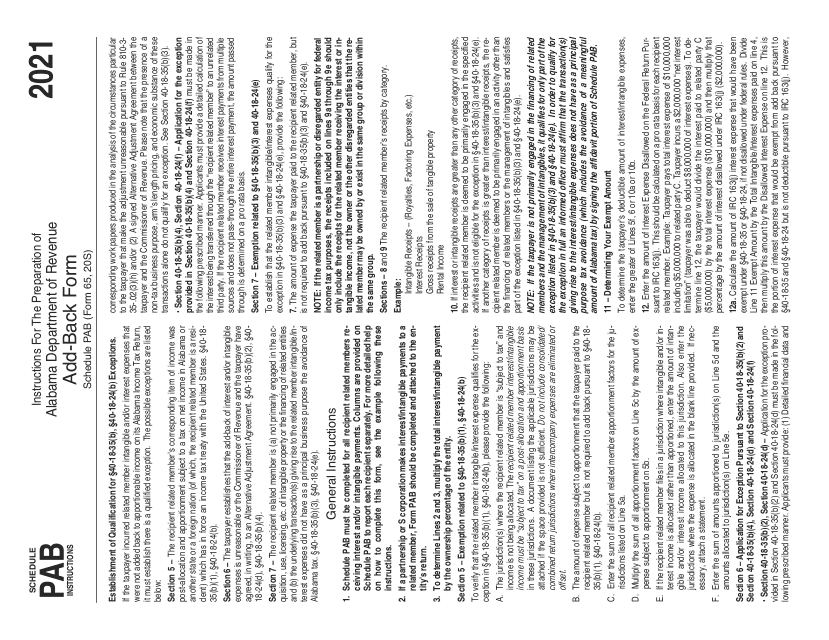

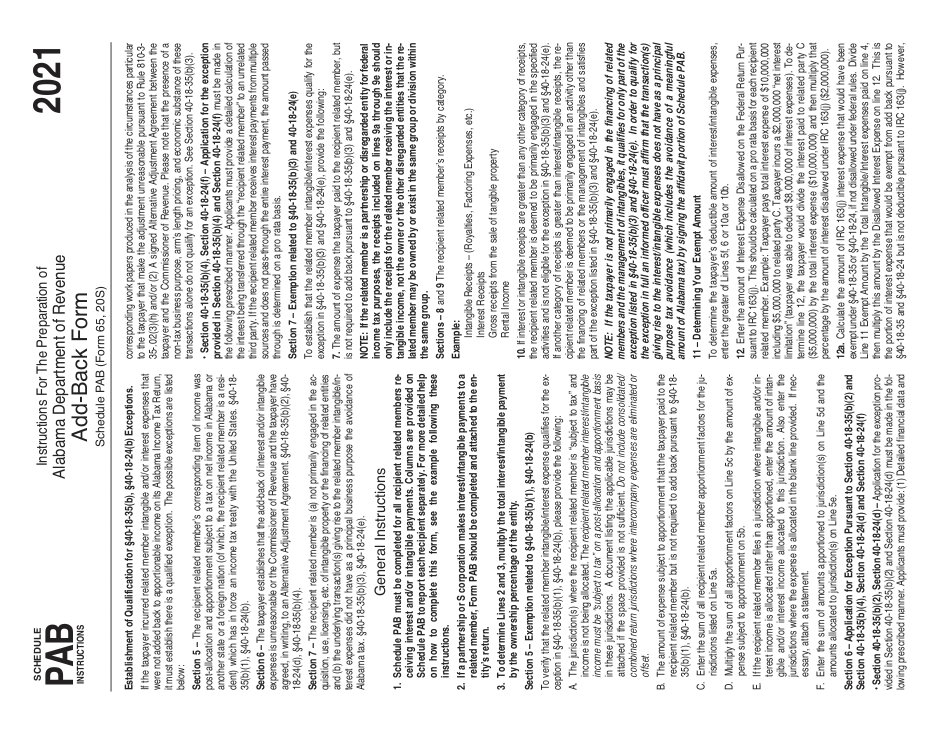

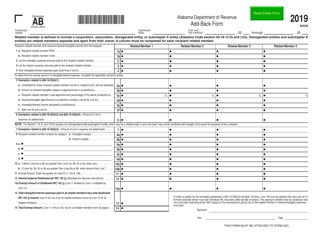

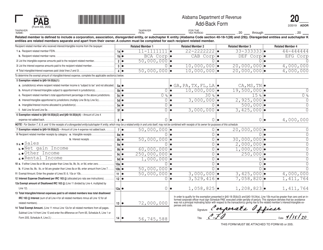

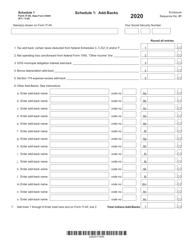

Instructions for Form 65, 20S Schedule PAB Add-Back Form - Alabama

This document contains official instructions for Form 65 Schedule PAB and Form 20S Schedule PAB . Both forms are released and collected by the Alabama Department of Revenue.

FAQ

Q: What is Form 65?

A: Form 65 is a tax form used in Alabama for partnership incometax purposes.

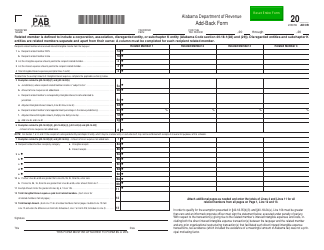

Q: What is 20S Schedule PAB Add-Back Form?

A: 20S Schedule PAB Add-Back Form is a specific form used within Form 65 to report add-backs for Alabama income tax purposes.

Q: What is an add-back?

A: An add-back is an adjustment made to a partnership's income to account for certain deductions that are not allowed for Alabama income tax purposes.

Q: Who needs to file Form 65?

A: Partnerships operating in Alabama and subject to Alabama income tax laws must file Form 65.

Q: What information is required on Form 65?

A: Form 65 requires information about the partnership's income, deductions, credits, and other relevant details.

Q: Do I need to file 20S Schedule PAB Add-Back Form separately?

A: No, 20S Schedule PAB Add-Back Form is filed as a part of Form 65.

Q: What if I have questions or need assistance with Form 65?

A: If you have questions or need assistance with Form 65, you can contact the Alabama Department of Revenue or consult with a tax professional.

Q: Are there any filing deadlines for Form 65?

A: Yes, Form 65 must be filed by the 15th day of the 4th month following the close of the partnership's tax year.

Q: What are the penalties for failing to file Form 65?

A: Failure to file Form 65 may result in penalties and interest charges imposed by the Alabama Department of Revenue.

Instruction Details:

- This 1-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Alabama Department of Revenue.