This version of the form is not currently in use and is provided for reference only. Download this version of

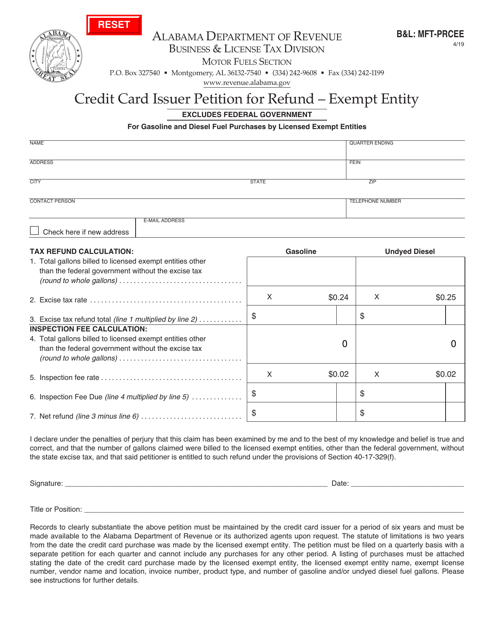

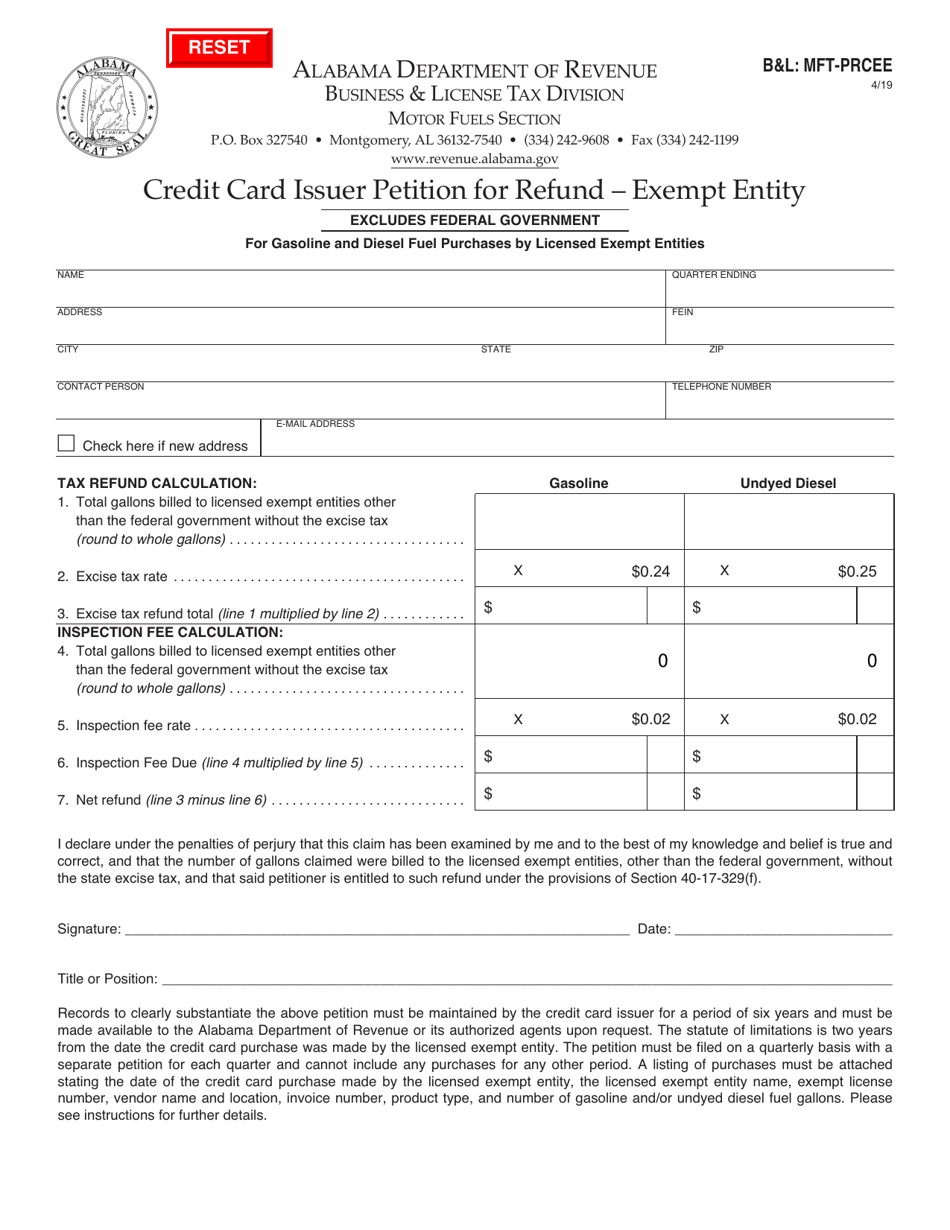

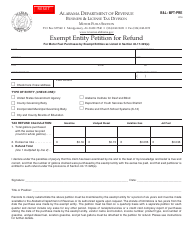

Form B&L: MFT-PRCEE

for the current year.

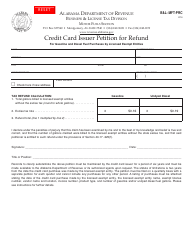

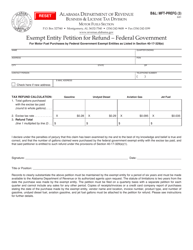

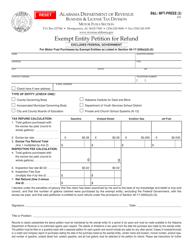

Form B&L: MFT-PRCEE Credit Card Issuer Petition for Refund - Exempt Entity - Alabama

What Is Form B&L: MFT-PRCEE?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form B&L: MFT-PRCEE?

A: Form B&L: MFT-PRCEE is a Credit Card Issuer Petition for Refund - Exempt Entity form.

Q: Who can use Form B&L: MFT-PRCEE?

A: Form B&L: MFT-PRCEE is used by Credit Card Issuers who are Exempt Entities.

Q: What is an Exempt Entity?

A: An Exempt Entity is a credit card issuer that is exempt from certain taxes.

Q: Is Form B&L: MFT-PRCEE specific to Alabama?

A: Yes, Form B&L: MFT-PRCEE is specific to Alabama.

Q: What is the purpose of Form B&L: MFT-PRCEE?

A: The purpose of Form B&L: MFT-PRCEE is to petition for a refund of certain taxes for Credit Card Issuers who are Exempt Entities in Alabama.

Form Details:

- Released on April 1, 2019;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form B&L: MFT-PRCEE by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.