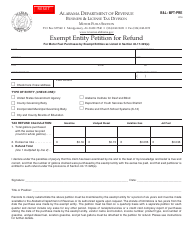

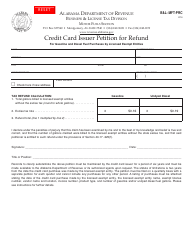

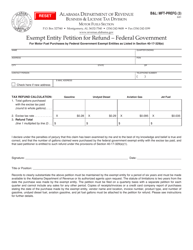

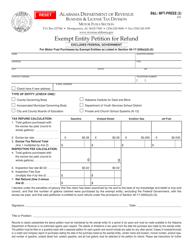

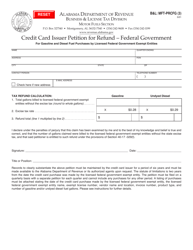

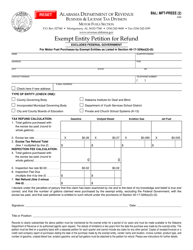

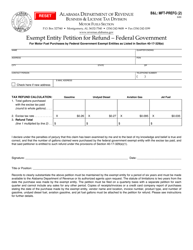

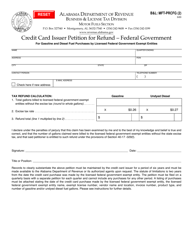

Instructions for Form B&L: MFT-PRCEE Credit Card Issuer Petition for Refund - Exempt Entity - Alabama

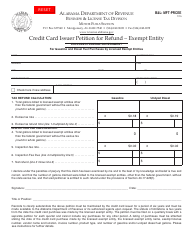

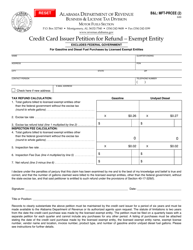

This document contains official instructions for Form B&L: MFT-PRCEE , Credit Card Issuer Petition for Refund - Exempt Entity - a form released and collected by the Alabama Department of Revenue. An up-to-date fillable Form B&L: MFT-PRCEE is available for download through this link.

FAQ

Q: What is Form B&L?

A: Form B&L is the MFT-PRCEE Credit Card Issuer Petition for Refund - Exempt Entity form.

Q: Who can use Form B&L?

A: This form is for credit card issuers who are exempt entities.

Q: What is the purpose of Form B&L?

A: The purpose of this form is to petition for a refund.

Q: What type of refund is this form for?

A: This form is for obtaining a refund for credit card issuer taxes.

Q: Which entity is this form specific to?

A: This form is specific to credit card issuers in Alabama.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Alabama Department of Revenue.