This version of the form is not currently in use and is provided for reference only. Download this version of

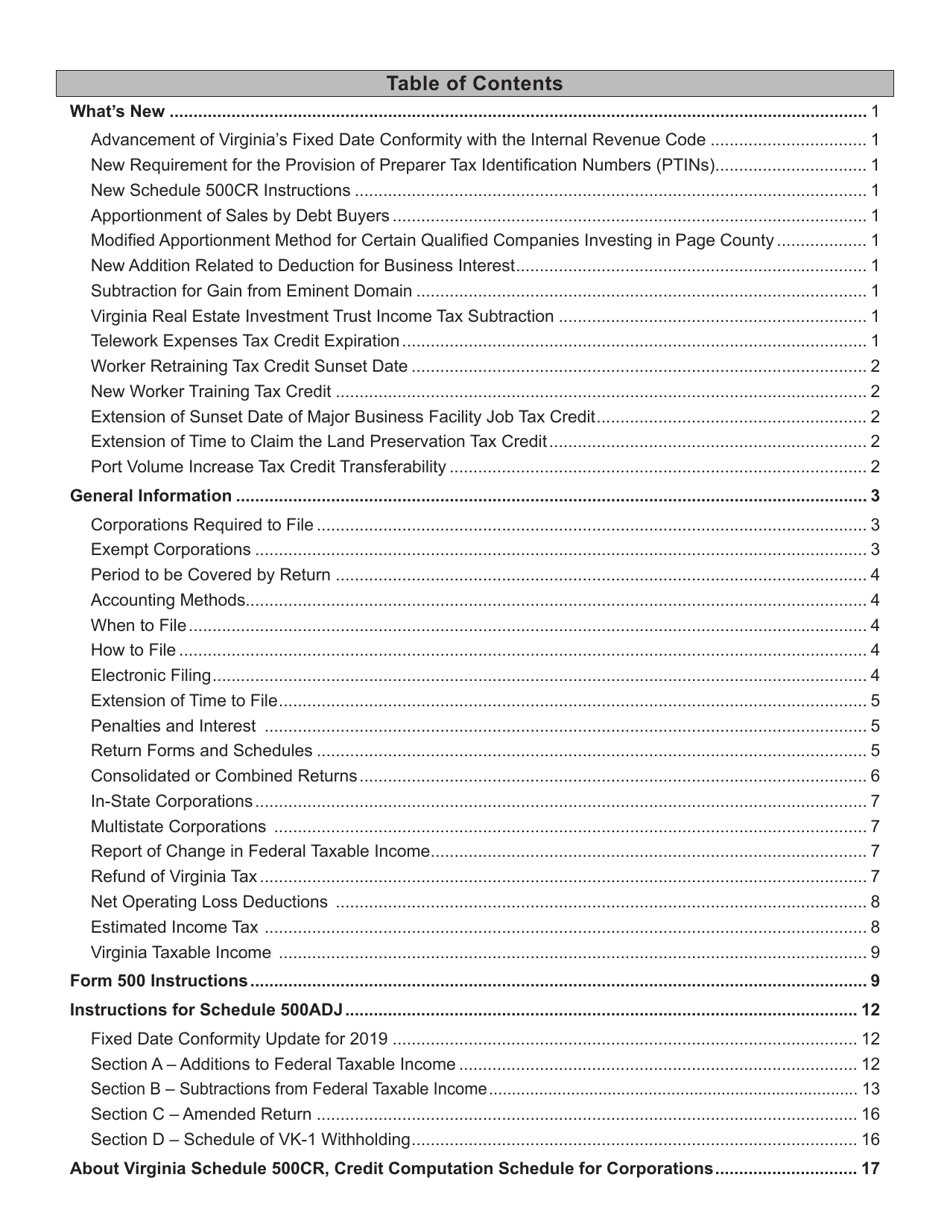

Instructions for Form 500

for the current year.

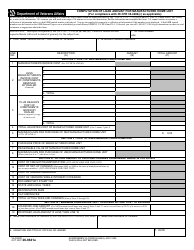

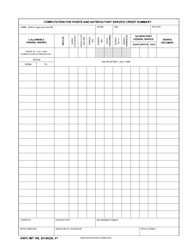

Instructions for Form 500 Virginia Corporation Income Tax Return - Virginia

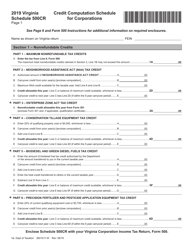

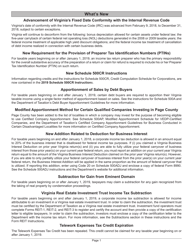

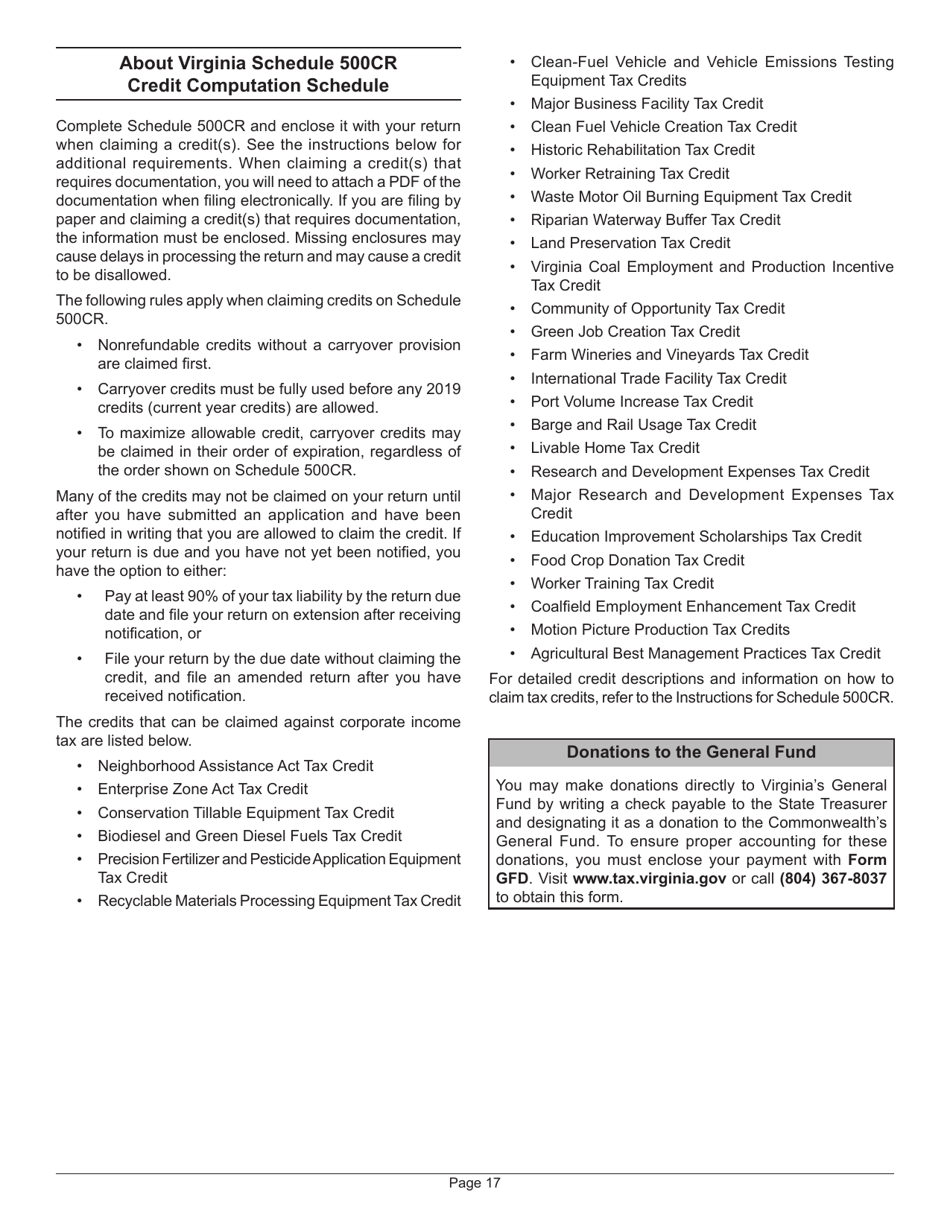

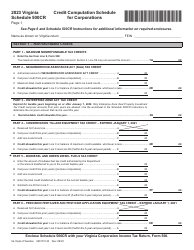

This document contains official instructions for Form 500 , Virginia Corporation Income Tax Return - a form released and collected by the Virginia Department of Taxation. An up-to-date fillable Form 500 Schedule 500CR is available for download through this link.

FAQ

Q: What is Form 500?

A: Form 500 is the Virginia Corporation Income Tax Return.

Q: Who is required to file Form 500?

A: All Virginia corporations, including foreign corporationsdoing business in Virginia, must file Form 500.

Q: Do I need to attach any additional documents with Form 500?

A: Yes, you may need to attach additional schedules or forms depending on your specific tax situation. Please refer to the instructions for Form 500 for more information.

Q: When is the deadline to file Form 500?

A: The deadline to file Form 500 is generally the 15th day of the fourth month following the close of your corporation's taxable year.

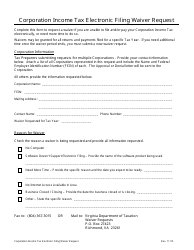

Q: Can I file Form 500 electronically?

A: Yes, Virginia offers electronic filing options for Form 500. Please refer to the instructions for more information on electronic filing.

Q: What if I need an extension to file Form 500?

A: If you need additional time to file Form 500, you can request an extension. However, it's important to note that an extension to file does not grant an extension to pay any taxes owed.

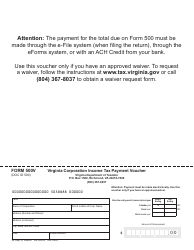

Q: How do I pay any taxes owed with Form 500?

A: You can pay any taxes owed with Form 500 using electronic funds transfer (EFT), credit card, or by mailing a check or money order with your return.

Q: What should I do if I have more questions about filing Form 500?

A: If you have more questions about filing Form 500, you can contact the Virginia Department of Taxation for assistance.

Instruction Details:

- This 21-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Virginia Department of Taxation.