This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Schedule 500AP

for the current year.

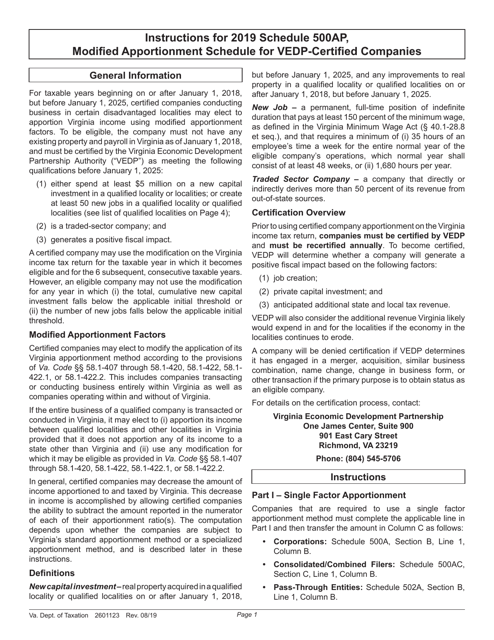

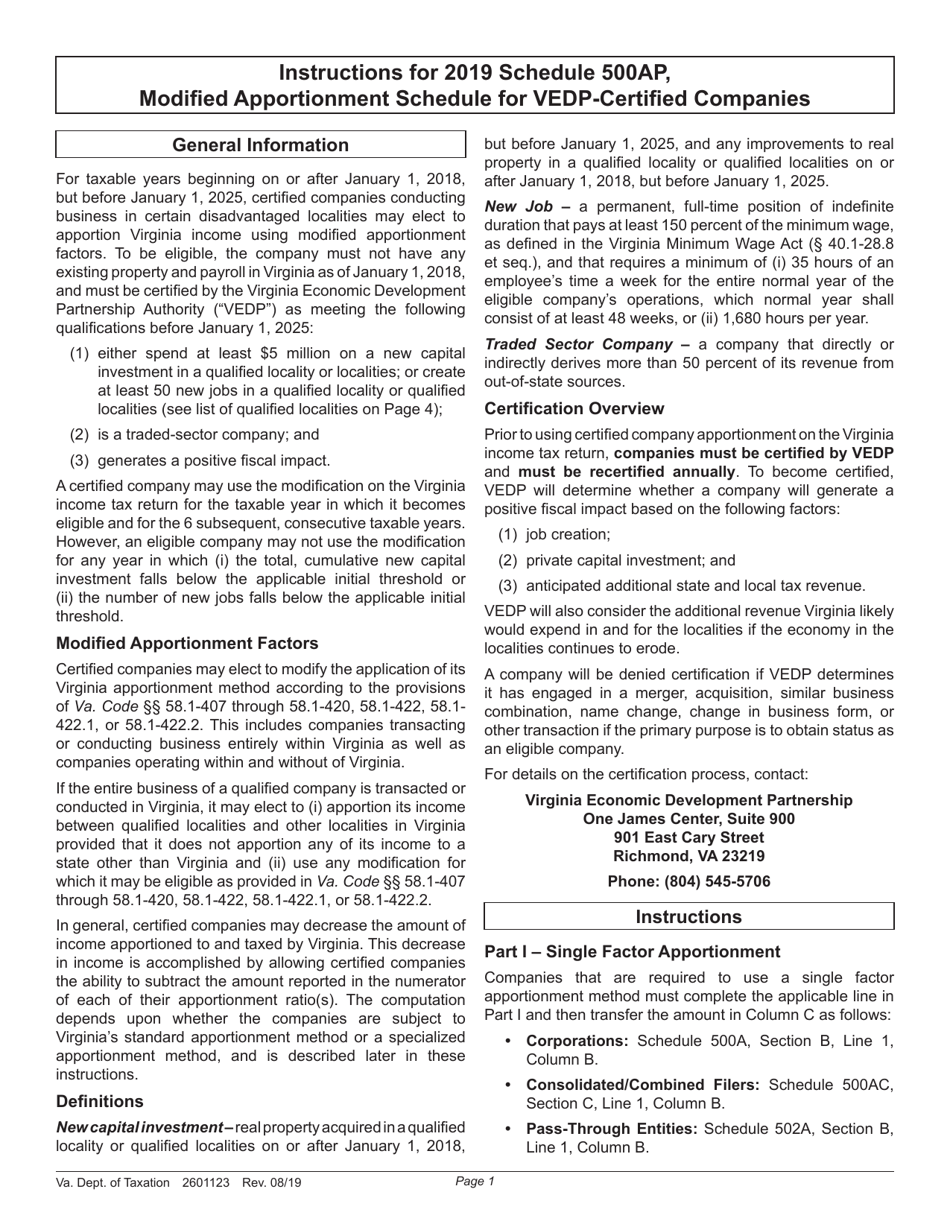

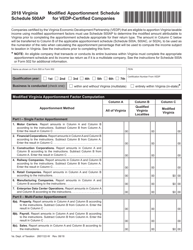

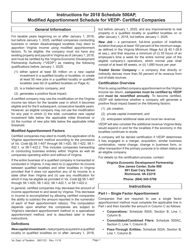

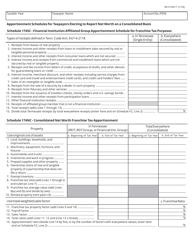

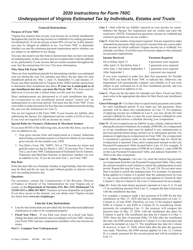

Instructions for Schedule 500AP Modified Apportionment Schedule for Vedp-Certified Companies - Virginia

This document contains official instructions for Schedule 500AP , Modified Apportionment Schedule for Vedp-Certified Companies - a form released and collected by the Virginia Department of Taxation.

FAQ

Q: What is Schedule 500AP?

A: Schedule 500AP is a modified apportionment schedule for Vedp-Certified Companies in Virginia.

Q: Who is eligible to use Schedule 500AP?

A: Vedp-Certified Companies in Virginia are eligible to use Schedule 500AP.

Q: What is the purpose of Schedule 500AP?

A: The purpose of Schedule 500AP is to calculate the apportionment of income for Vedp-Certified Companies in Virginia.

Q: How is Schedule 500AP different from other apportionment schedules?

A: Schedule 500AP is a modified version of the standard apportionment schedule specifically designed for Vedp-Certified Companies.

Q: Are there any special requirements for using Schedule 500AP?

A: Yes, Vedp-Certified Companies must meet certain criteria and provide additional information when using Schedule 500AP.

Q: Is Schedule 500AP mandatory for Vedp-Certified Companies?

A: No, Vedp-Certified Companies have the option to use either Schedule 500AP or the standard apportionment schedule.

Q: What benefits does Schedule 500AP offer to Vedp-Certified Companies?

A: Schedule 500AP offers certain tax incentives and benefits to Vedp-Certified Companies in Virginia.

Q: Can Schedule 500AP be used by companies outside of Virginia?

A: No, Schedule 500AP is specifically designed for Vedp-Certified Companies in Virginia and cannot be used by companies outside of the state.

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Virginia Department of Taxation.