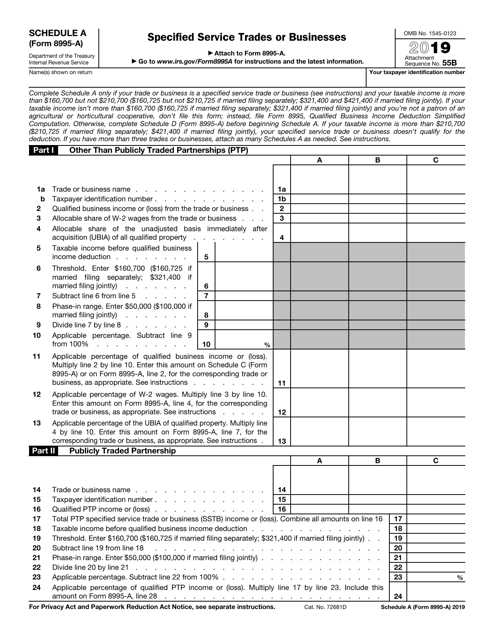

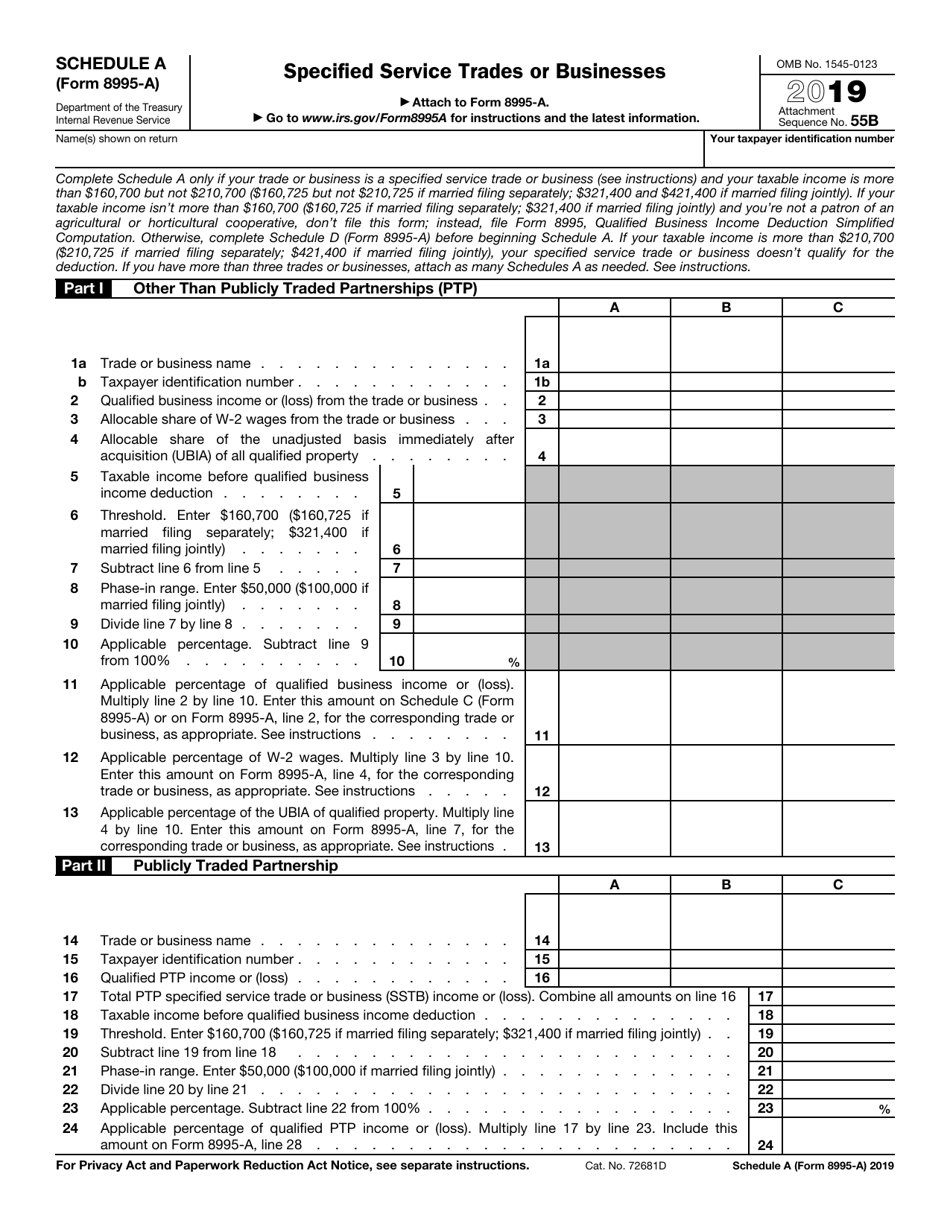

This version of the form is not currently in use and is provided for reference only. Download this version of

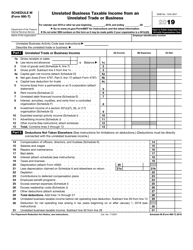

IRS Form 8995-A Schedule A

for the current year.

IRS Form 8995-A Schedule A Specified Service Trades or Businesses

What Is IRS Form 8995-A Schedule A?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 8995-A, Qualified Business Income Deduction. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 8995-A?

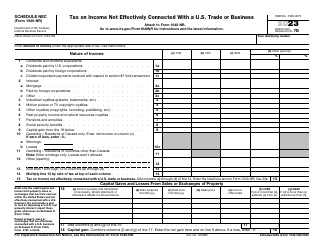

A: IRS Form 8995-A is a schedule that is used to report income and deductions for specified service trades or businesses.

Q: Who needs to file IRS Form 8995-A?

A: Taxpayers who have income from specified service trades or businesses need to file IRS Form 8995-A.

Q: What are specified service trades or businesses?

A: Specified service trades or businesses generally include professions such as law, accounting, healthcare, consulting, and other similar fields.

Q: What information is required on IRS Form 8995-A?

A: IRS Form 8995-A requires information about the taxpayer's income and deductions from specified service trades or businesses.

Q: Can I file IRS Form 8995-A electronically?

A: Yes, you can file IRS Form 8995-A electronically if you are e-filing your tax return.

Form Details:

- A 1-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8995-A Schedule A through the link below or browse more documents in our library of IRS Forms.