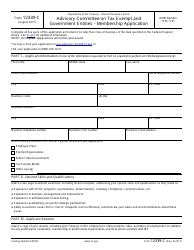

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 8843

for the current year.

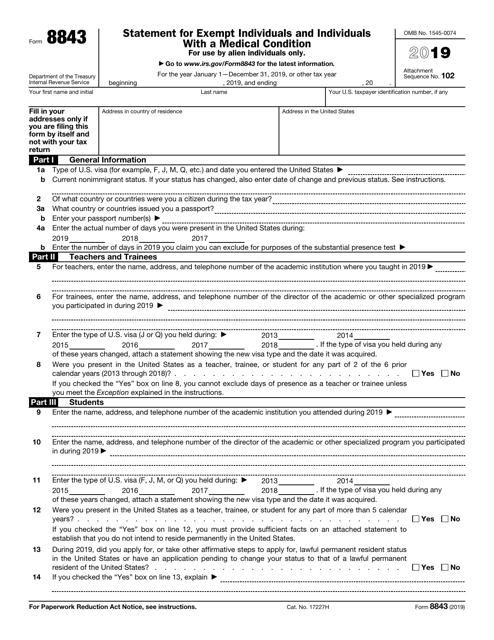

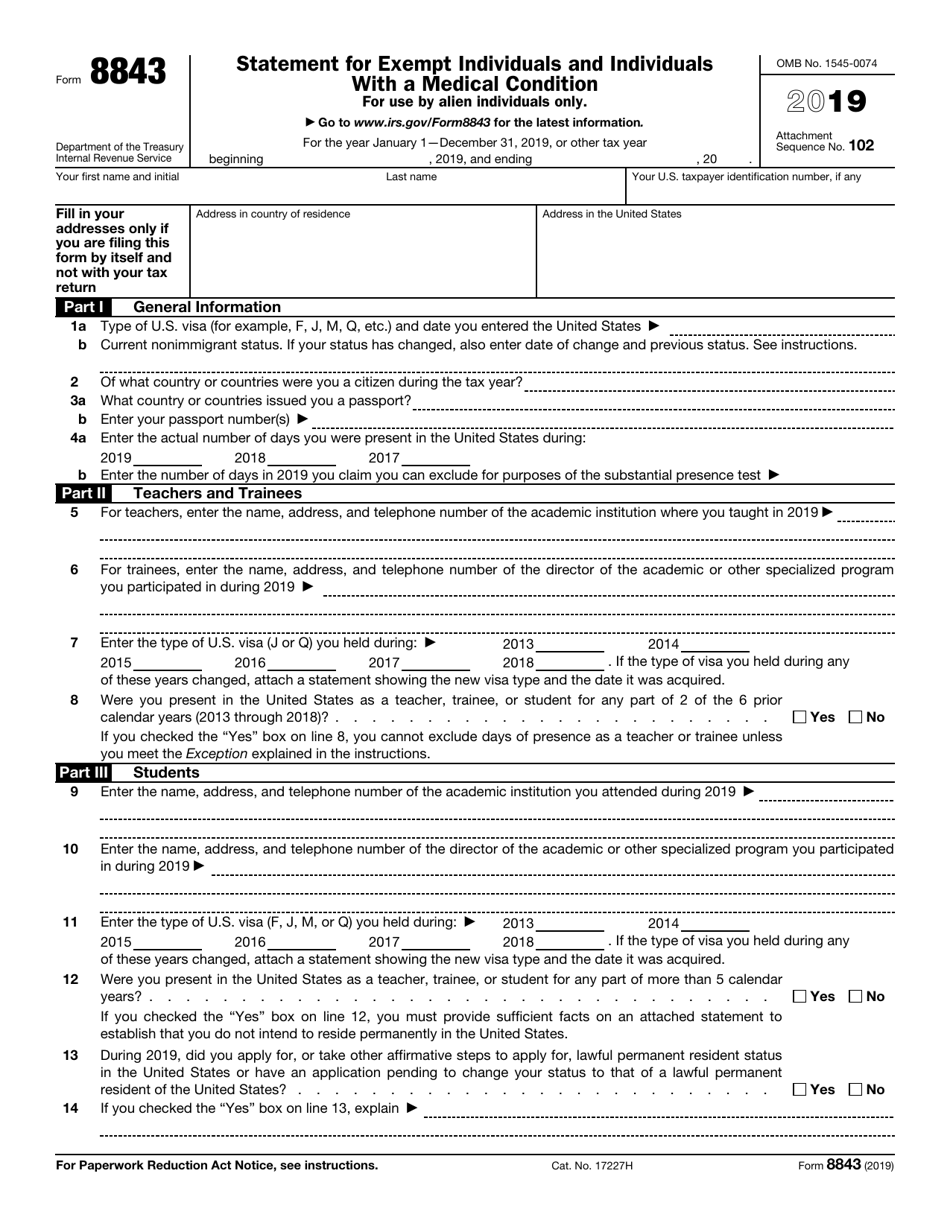

IRS Form 8843 Statement for Exempt Individuals and Individuals With a Medical Condition

What Is Form 8843?

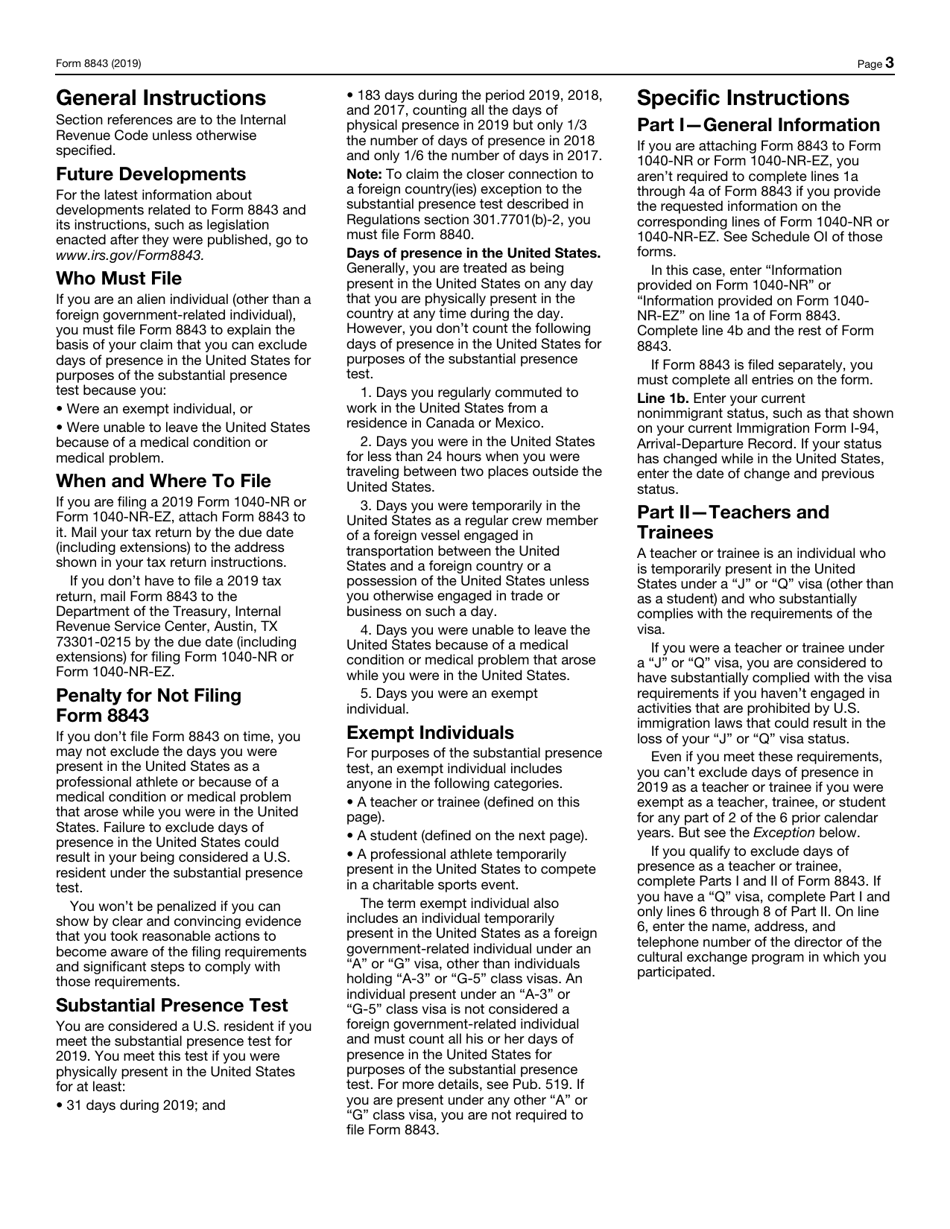

IRS Form 8843, Statement for Exempt Individuals and Individuals with a Medical Condition , is a tax form completed by nonresident aliens present in the U.S. to show the number of days they spent outside of the U.S. and determine their tax responsibility . Prepare this statement if the following conditions apply to you:

- You were present in the U.S.

- You are a nonresident alien .

- You are in the U.S. with an F-1, F-2, J-1, or J-2 visa.

This form was issued by the Internal Revenue Service (IRS) . The latest version of the form was released in 2019 with all previous editions obsolete. You can download a fillable Form 8843 PDF through the link below.

Where to Send Form 8843?

If you need to file Form 1040-NR, U.S. Nonresident Alien Income Tax Return, or Form 1040-NR-EZ, U.S. Income Tax Return for Certain Nonresident Aliens With No Dependents, attach Form 8843 to it and mail it to the address from your tax return instructions.

If you do not need to file a tax return, mail the 8843 Form to the Department of Treasury, Internal Revenue Service Center, Austin, TX 73301-0215 .

How to Fill Out Form 8843?

IRS Form 8843 instructions are as follows:

- Indicate the tax year you are reporting.

- Write down your full name and U.S. taxpayer identification number if you have it.

- If you file the form without a tax return, enter your addresses in the country of residence and in the U.S.

- State your type of visa, the date you entered the U.S., and current nonimmigrant status . Name the countries you were a citizen of during the tax year.

- Record the number of your passport and the number of days you were present in the U.S. during the last three calendar years. Write down the number of days in the reporting year you can exclude for purposes of the substantial presence test.

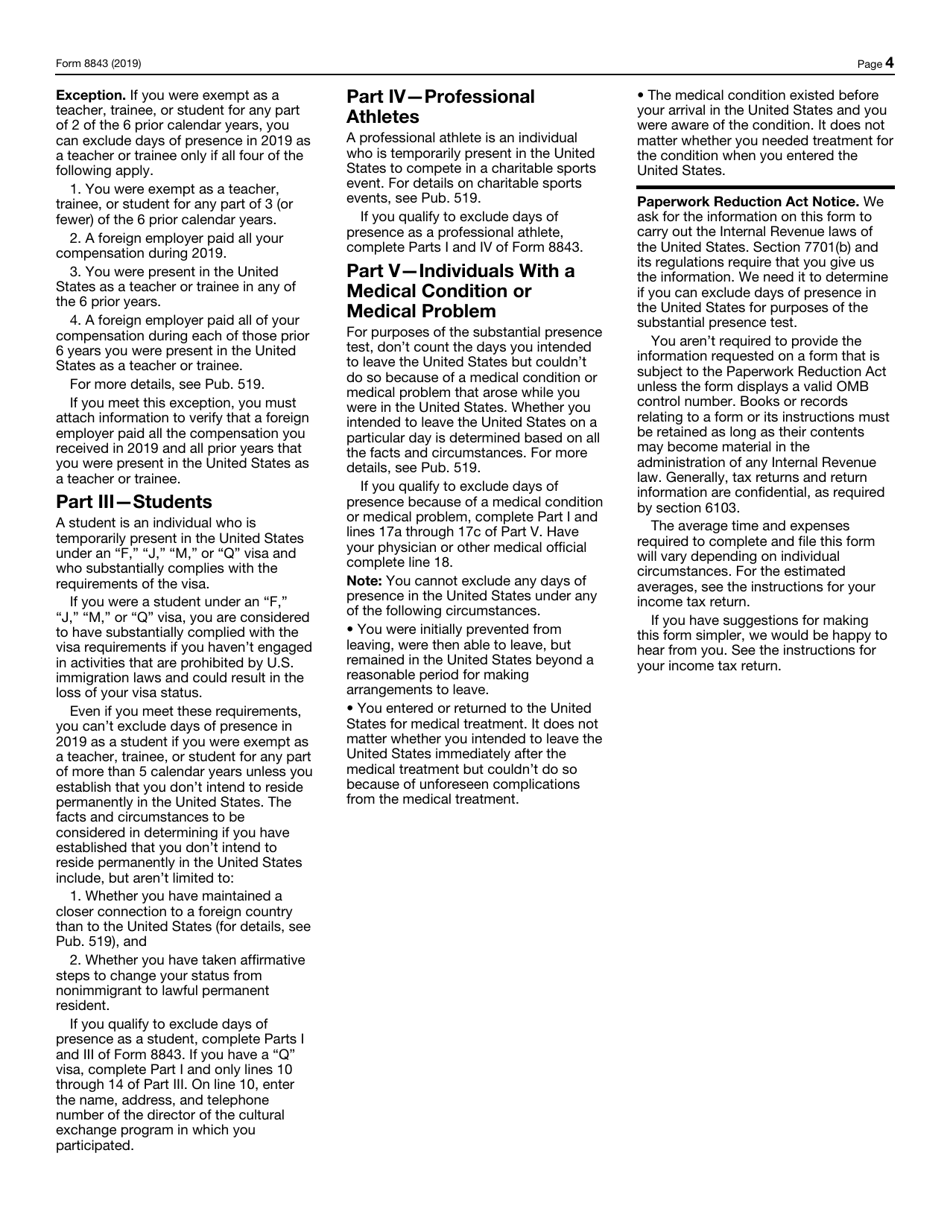

- Part II must be filled out by teachers and trainees. Indicate the name, address, and telephone number of the academic institution where you taught or provide details of the director of the academic program you participated in. Record the type of visa you held during the last six years. State whether you were present in the U.S. as a student, trainee, or teacher in the last six years.

- Part III was designed for students. You need to write down the names and contact information of the academic institution you attended or the director of the academic program you participated in. Record your visa type and state whether you were present in the U.S. for the last five years. If you applied for permanent resident status or have an application pending to change your status, check the appropriate box and explain the circumstances.

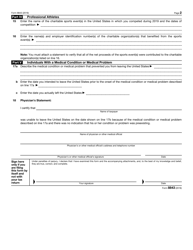

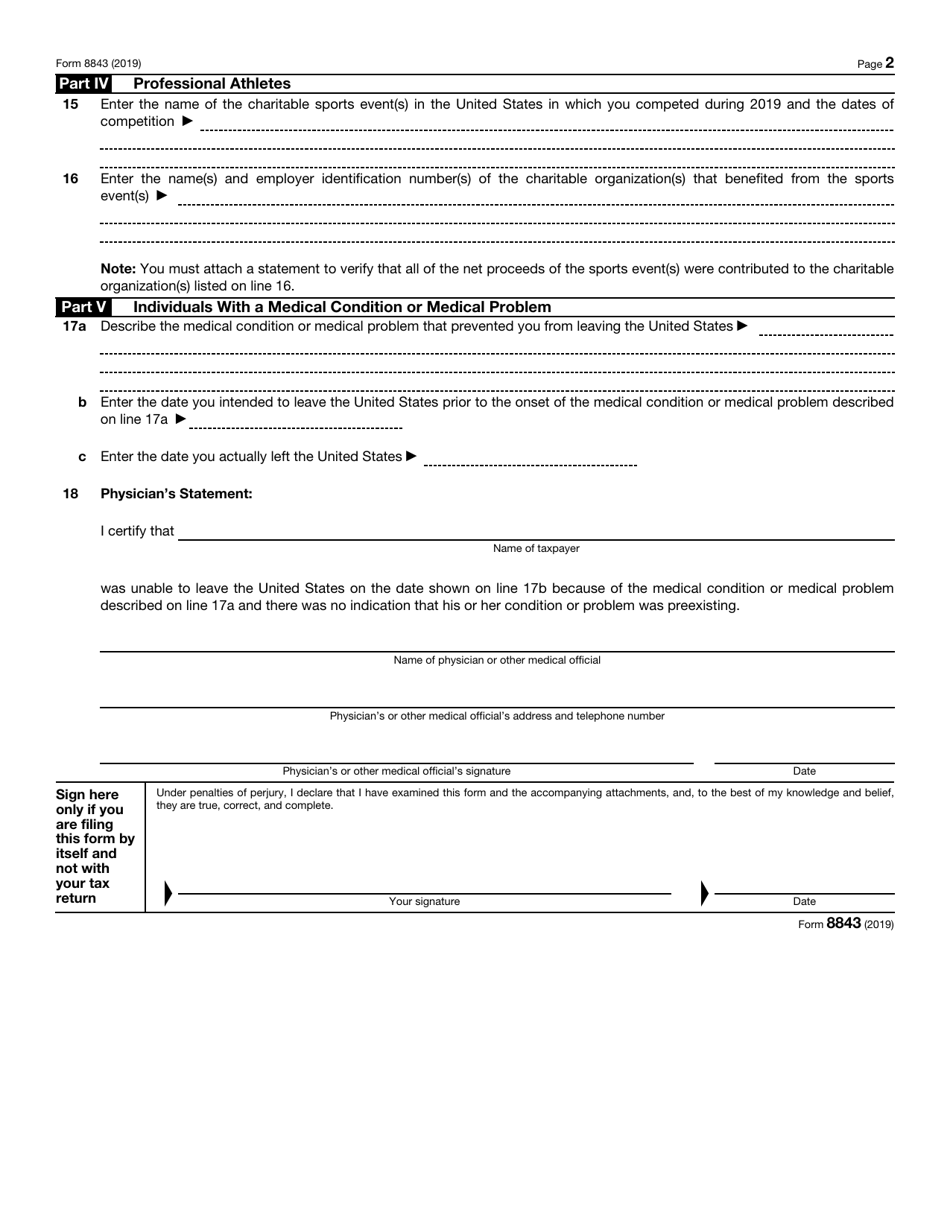

- Part IV is for professional athletes only. Indicate the names of the charitable sports events you have competed in and the dates of these events. Record the name and employer identification number of the charitable organizations that benefited from the listed events. Attach a statement to confirm that all the net proceeds of the events went to the charitable organizations.

- Part V must be filled out by individuals with medical conditions and problems. Describe the illness or injury that prevented you from leaving the U.S., enter the date you intended to leave and the date you actually left. Your physician must certify the information in the form and sign it.

- If you are submitting the statement by itself, sign and date the form certifying the information is true and correct to the best of your knowledge and belief.

When Is Form 8843 Due?

The Form 8843 deadline is June 15, 2020 - whether you need or do not need to submit a tax return. In case you cannot file by the due date , complete IRS Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return, to request an automatic extension of time to file .

If you fail to submit this statement on time, you will not be able to exclude the days you were present in the U.S. A penalty for not filing Form 8843 can be avoided if you present convincing and clear evidence that you took substantial actions to be aware of the filing requirements . Still, if you fail to exclude the days of presence in the U.S., you might be considered a U.S. resident according to the substantial presence test.