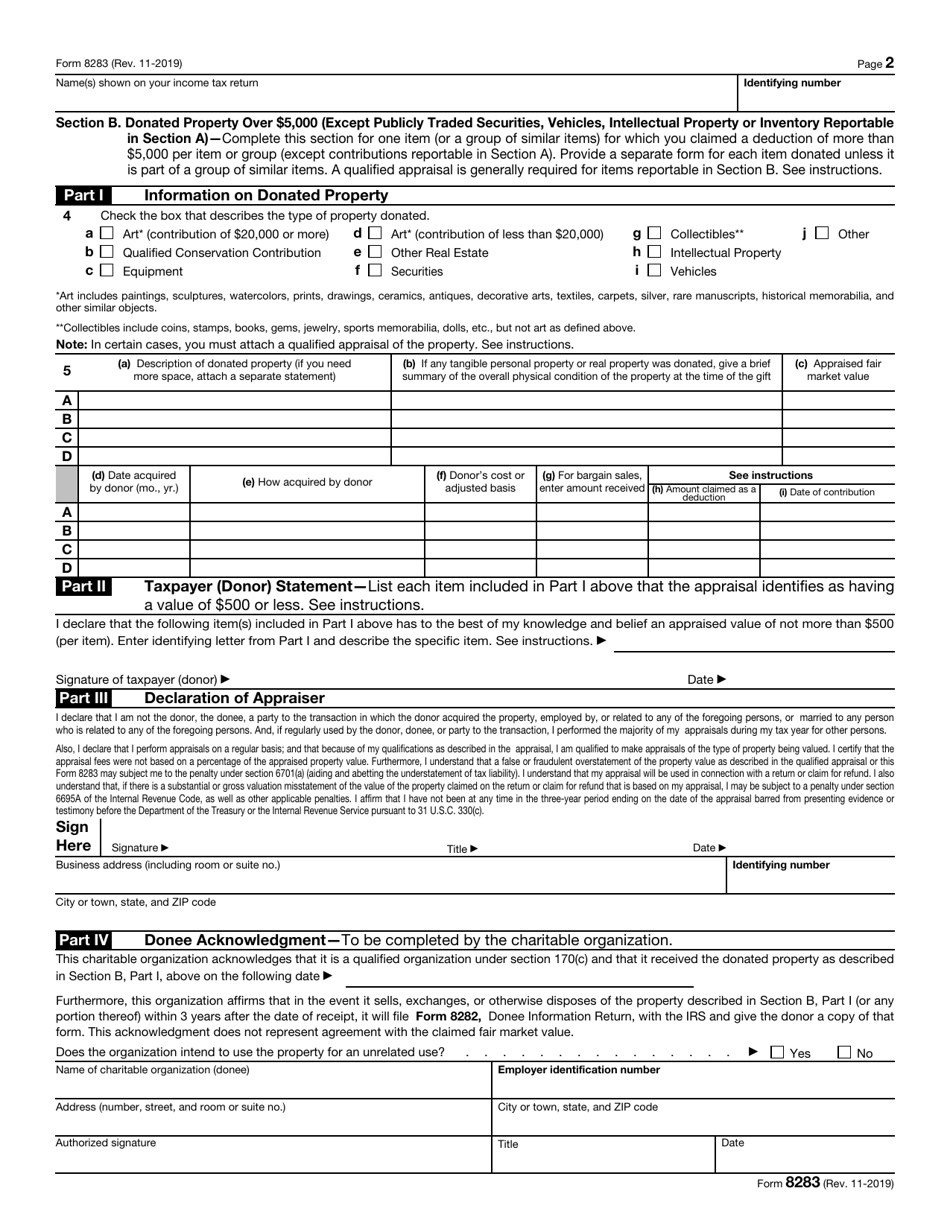

This version of the form is not currently in use and is provided for reference only. Download this version of

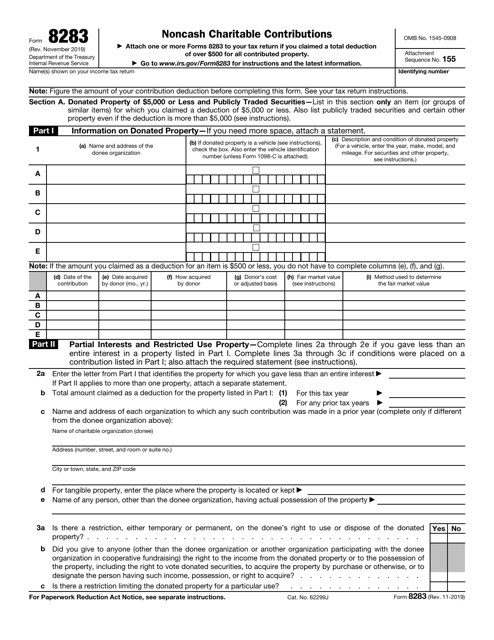

IRS Form 8283

for the current year.

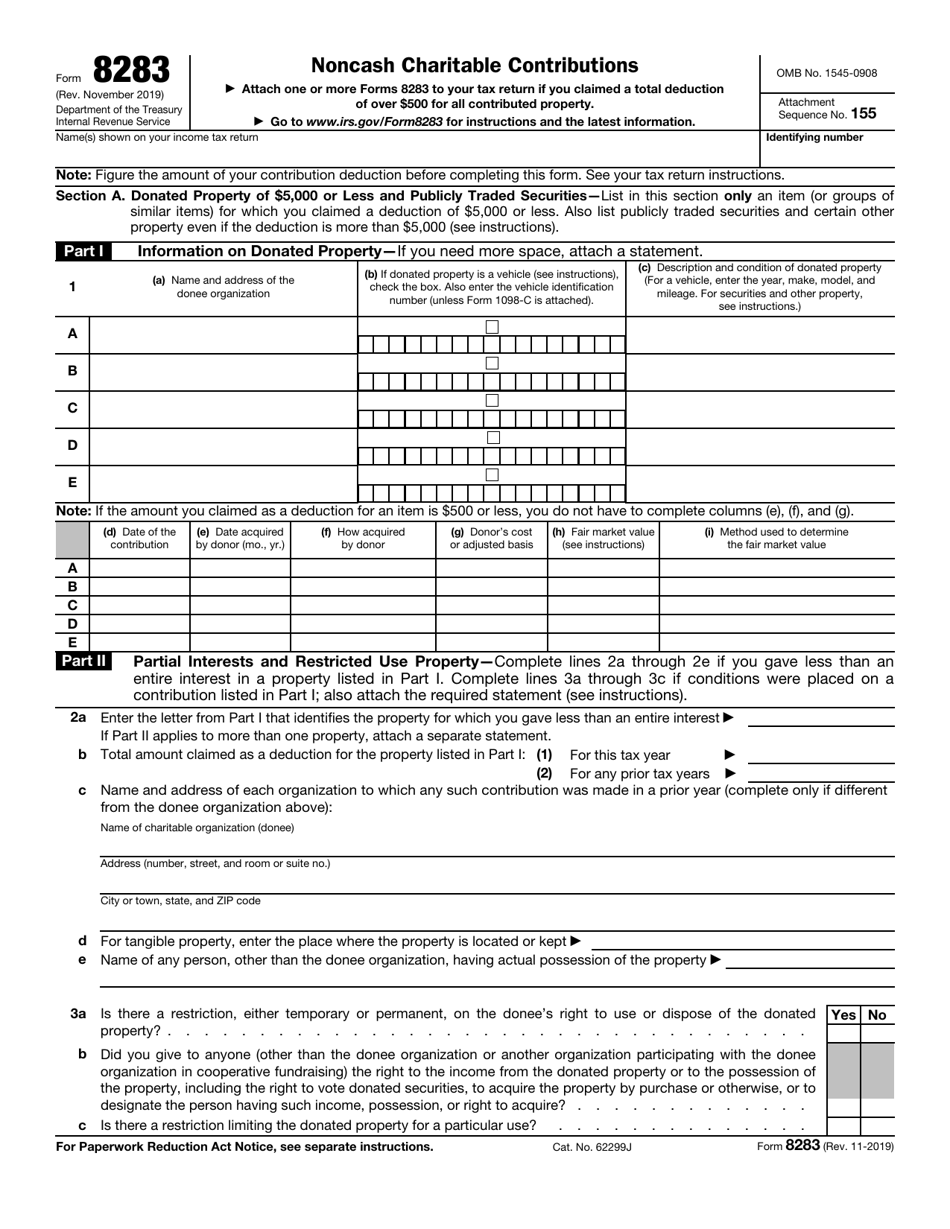

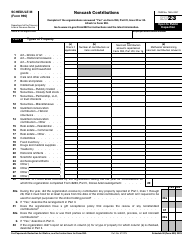

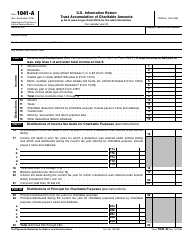

IRS Form 8283 Noncash Charitable Contributions

What Is IRS Form 8283?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on November 1, 2019. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8283?

A: IRS Form 8283 is a form used to report noncash charitable contributions.

Q: Who needs to file IRS Form 8283?

A: Taxpayers who make noncash charitable contributions exceeding $500 in value need to file IRS Form 8283.

Q: What is considered a noncash charitable contribution?

A: Noncash charitable contributions include items like clothing, furniture, and vehicles.

Q: Why do I need to file IRS Form 8283?

A: Filing IRS Form 8283 is necessary to claim a deduction on your taxes for noncash charitable contributions.

Q: When do I need to file IRS Form 8283?

A: IRS Form 8283 should be filed along with your tax return, typically by the April 15th deadline.

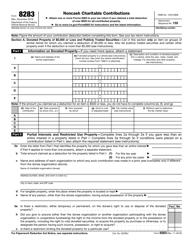

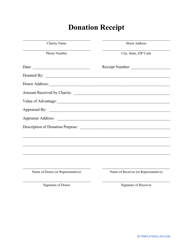

Q: What information do I need to provide on IRS Form 8283?

A: You will need to provide detailed information about the donated property, its fair market value, the name and address of the charitable organization, and more.

Q: Are there any limitations on the deduction for noncash charitable contributions?

A: Yes, there are limitations based on your income and the type of property donated. It's best to consult a tax professional for guidance.

Q: Can I e-file IRS Form 8283?

A: No, IRS Form 8283 cannot be e-filed and must be filed by mail along with your tax return.

Q: What happens if I don't file IRS Form 8283?

A: If you fail to file IRS Form 8283 for eligible noncash charitable contributions, you may not be able to claim the deduction on your taxes.

Form Details:

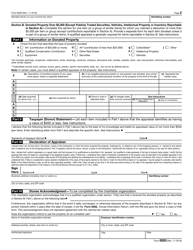

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8283 through the link below or browse more documents in our library of IRS Forms.