This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8283

for the current year.

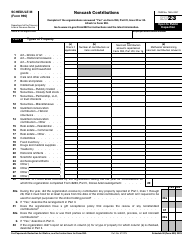

Instructions for IRS Form 8283 Noncash Charitable Contributions

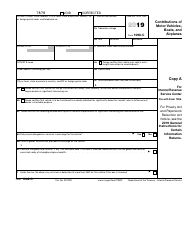

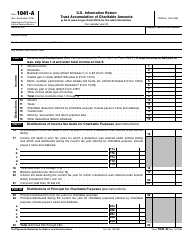

This document contains official instructions for IRS Form 8283 , Noncash Charitable Contributions - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8283 is available for download through this link.

FAQ

Q: What is IRS Form 8283?

A: IRS Form 8283 is a tax form that individuals use to report noncash charitable contributions.

Q: Do I need to fill out Form 8283?

A: You need to fill out Form 8283 if you are making noncash charitable contributions valued at $500 or more.

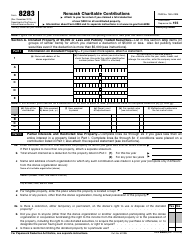

Q: What information is required on Form 8283?

A: Form 8283 requires information about the donated property, its fair market value, and the qualified organization receiving the donation.

Q: When should I file Form 8283?

A: You should file Form 8283 as part of your federal tax return when you claim a deduction for noncash charitable contributions.

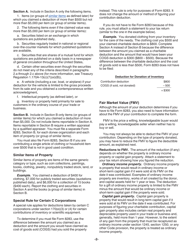

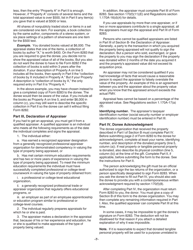

Q: Are there any special rules for certain types of donated property?

A: Yes, there are special rules for certain types of donated property, such as cars, boats, and intellectual property. These rules may require additional forms and documentation.

Q: How long should I keep a copy of Form 8283?

A: You should keep a copy of Form 8283 and any supporting documents for at least 3 years after the date you filed your tax return.

Instruction Details:

- This 8-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.