This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 5329

for the current year.

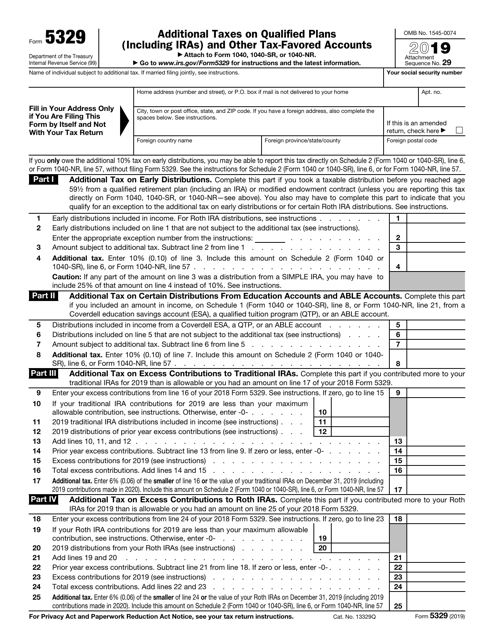

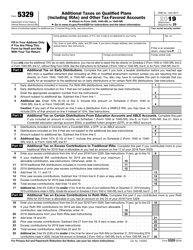

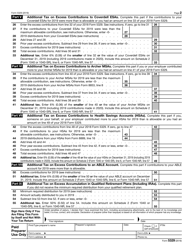

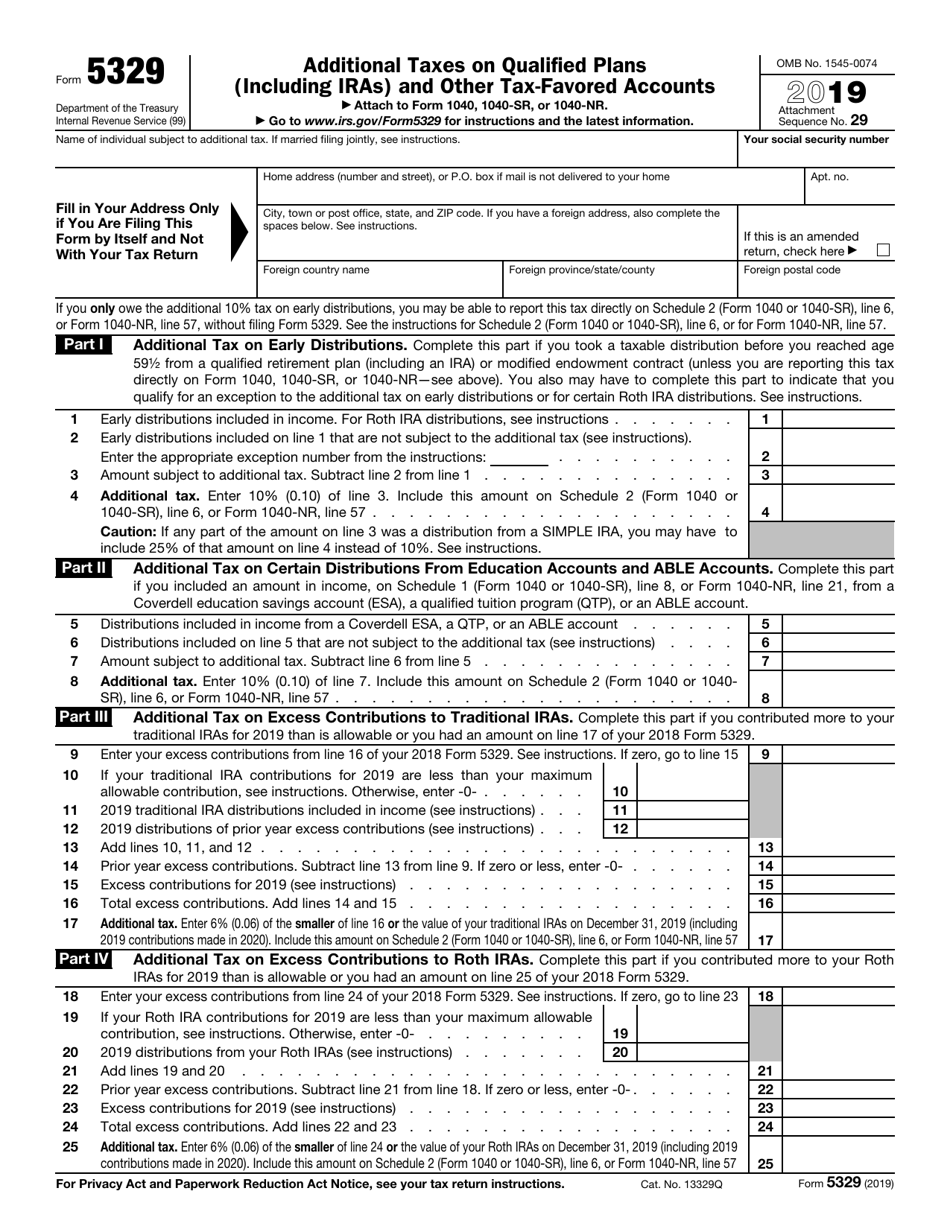

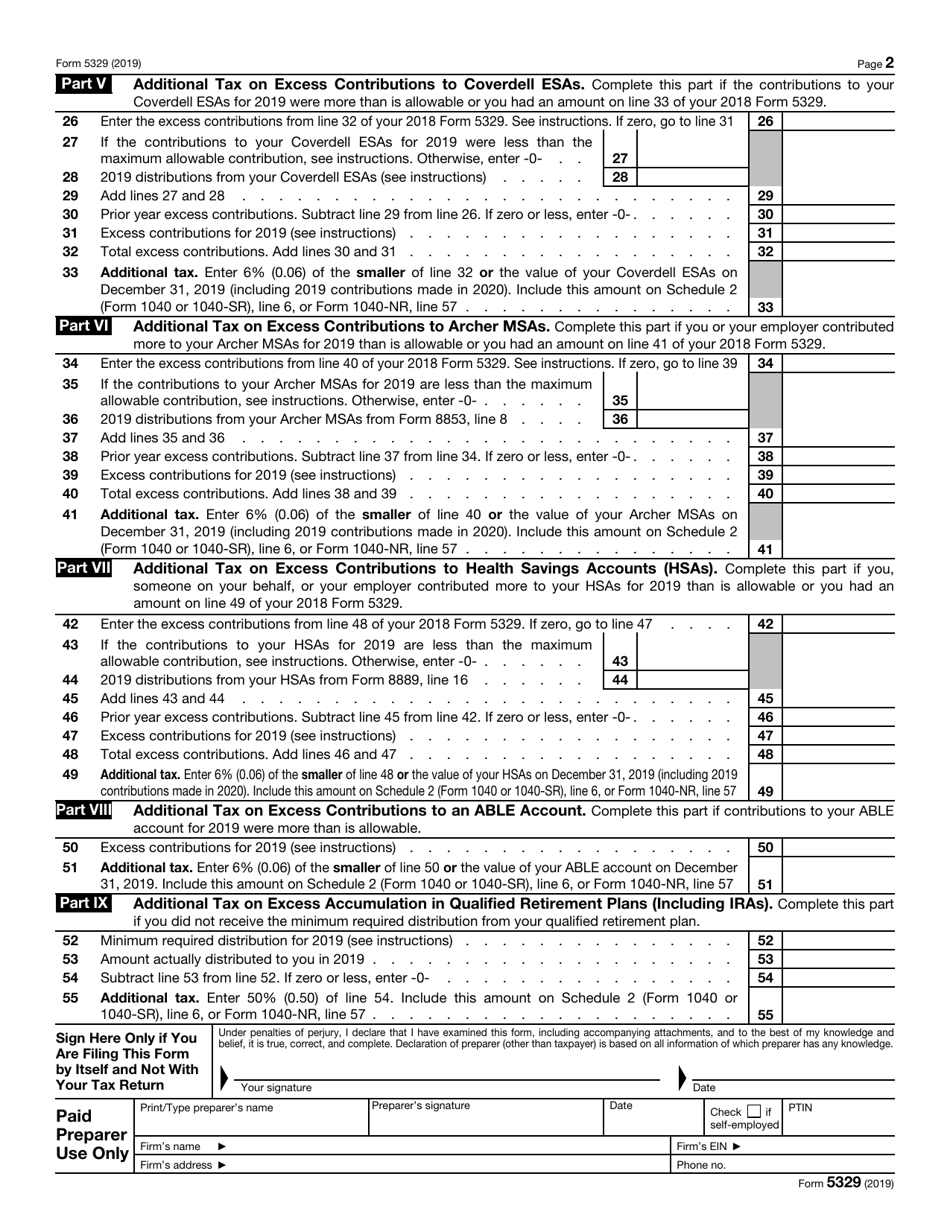

IRS Form 5329 Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts

What Is IRS Form 5329?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 5329?

A: IRS Form 5329 is a form used to report and pay additional taxes on qualified plans, including IRAs, and other tax-favored accounts.

Q: When do I need to file IRS Form 5329?

A: You need to file IRS Form 5329 if you owe additional taxes on your qualified plans or tax-favored accounts.

Q: What are qualified plans?

A: Qualified plans are retirement plans, such as traditional IRAs, 401(k)s, and 403(b)s, that offer tax advantages.

Q: What are tax-favored accounts?

A: Tax-favored accounts include health savings accounts (HSAs), Coverdell education savings accounts (ESAs), and Archer medical savings accounts (MSAs).

Q: What types of additional taxes can be reported on IRS Form 5329?

A: Additional taxes reported on IRS Form 5329 may include early distribution penalties, excess contributions, and failure to take required minimum distributions (RMDs).

Q: How do I calculate the additional taxes on IRS Form 5329?

A: The instructions for IRS Form 5329 provide the calculations and worksheets needed to determine the amount of additional taxes you owe.

Q: Can I e-file IRS Form 5329?

A: No, IRS Form 5329 cannot be filed electronically. It must be mailed to the IRS.

Q: What happens if I don't file IRS Form 5329?

A: If you owe additional taxes on your qualified plans or tax-favored accounts and fail to file IRS Form 5329, you may be subject to penalties and interest on the unpaid taxes.

Q: Can I request an extension to file IRS Form 5329?

A: No, IRS Form 5329 does not have its own extension form. However, if you have a valid reason for not filing on time, you may be able to request an extension for your individual tax return using Form 4868.

Q: Is there a penalty for late filing of IRS Form 5329?

A: Yes, if you do not file IRS Form 5329 by the due date, you may be subject to a late filing penalty. The penalty amount varies depending on the amount of tax owed and the length of the delay.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 5329 through the link below or browse more documents in our library of IRS Forms.