This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 4868

for the current year.

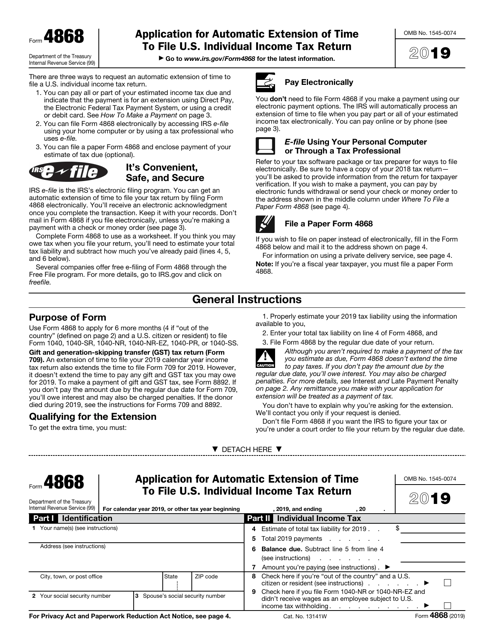

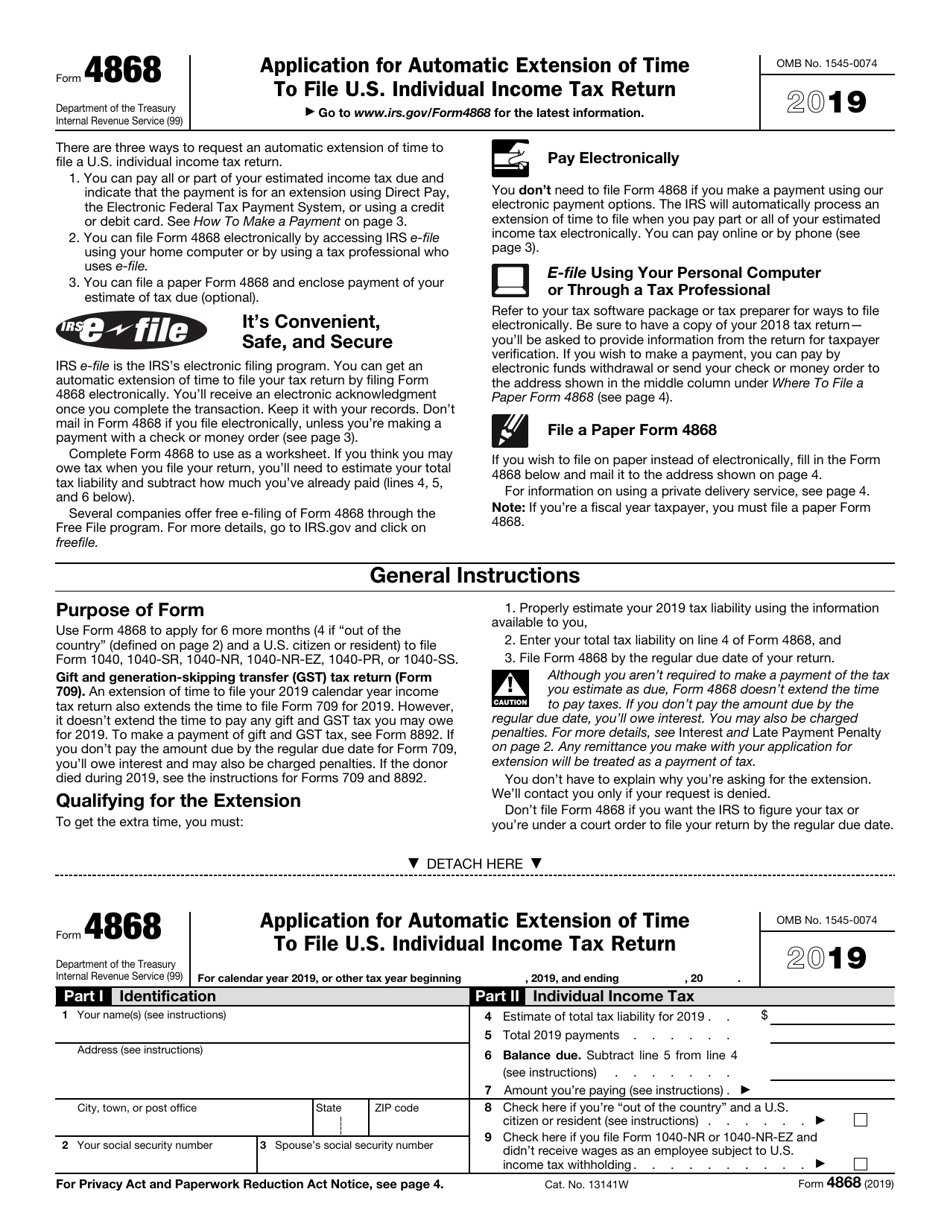

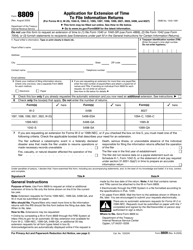

IRS Form 4868 Application for Automatic Extension of Time to File U.S. Individual Income Tax Return

IRS Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return , is a form that needs to be filled out to request an automatic extension to submit income tax return forms. The issuing department of the document, the Internal Revenue Service (IRS) , and it is revised every year. The latest version of the form was released in 2019 . Download a fillable version of IRS Form 4868 by clicking the link below.

Alternate Name:

- IRS Extension Form.

What Is Form 4868 Used For?

The main purpose of the IRS Extension Form is to apply for a six-month extension to file your individual tax return form. You can request an extension to submit the following documents:

- IRS Form 1040, U.S. Individual Income Tax Return.

- IRS Form 1040-NR, U.S. Nonresident Alien Income Tax Return.

- IRS Form 1040-NR-EZ, U.S. Income Tax Return for Certain Nonresident Aliens With No Dependents.

- IRS Form 1040-PR, Self-Employment Tax Return (Spanish).

- IRS Form 1040-SS, U.S. Self-Employment Tax Return (Including the Additional Child Tax Credit for Bona Fide Residents of Puerto Rico).

The time extension to file an individual income tax return granted via this form automatically gives you permission for an extension to file IRS Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return. Note, that permission to file the forms after the due date does not allow you to pay taxes later. You must pay them on time; otherwise, you may be charged penalties.

When Is Form 4868 Due?

File the IRS 4868 Form by the regular date of your tax return. In most cases, the due date for Form 4868 is April 17 if you live in Massachusetts or Maine and April 15 for many other states. It is advised that filers check with the state tax agency for the state in which they reside to not miss any important deadlines. Taxpayers who use fiscal year must submit this form before the original fiscal year return deadline. If you are a United States citizen or resident and are out of the country by the due date of the return, you can submit the return or the extension form by June 17. Besides, if you did not receive any income subject to the United States income tax withholdings, the due date for submitting your tax return and Form 4868 is June 17.

IRS Form 4868 Instructions

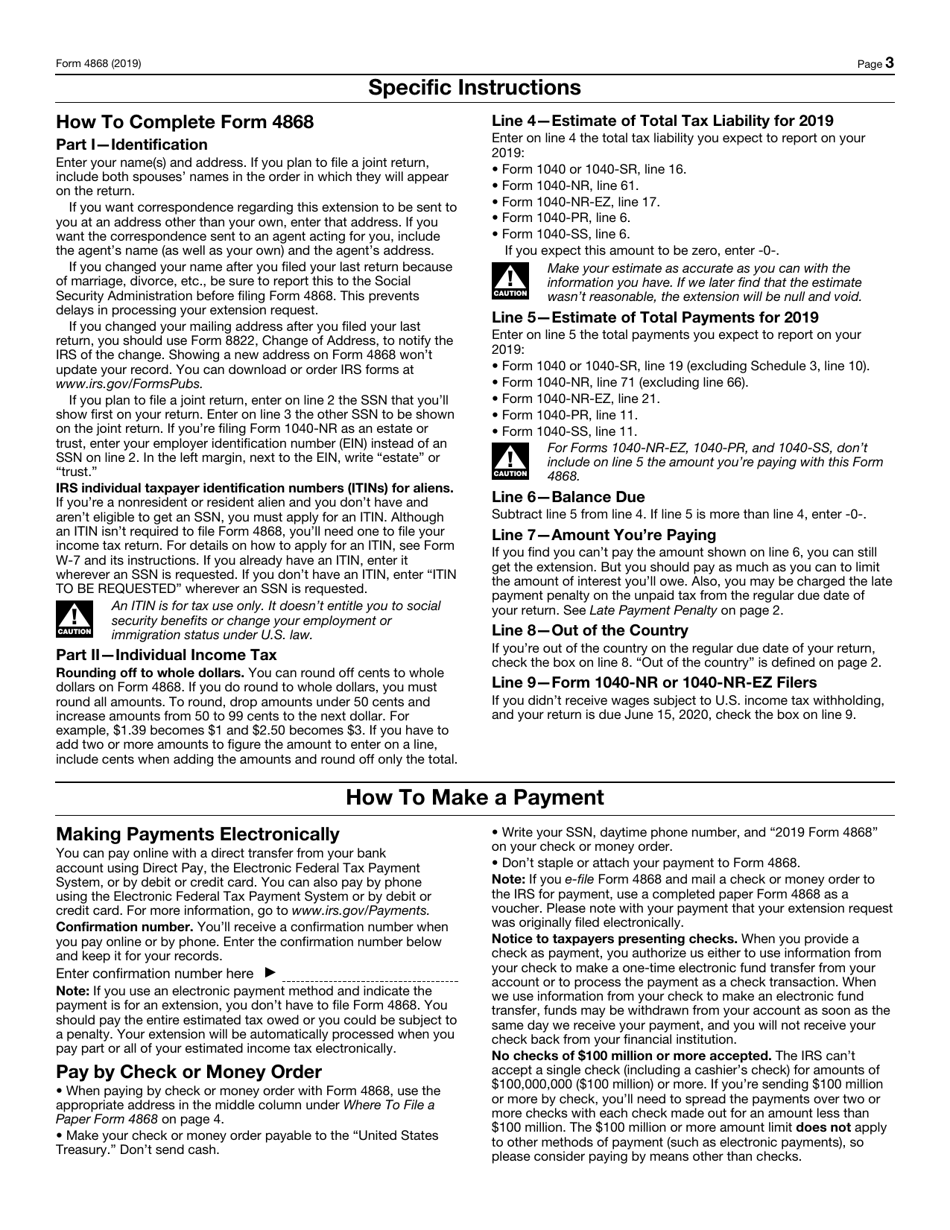

Use the following instructions for IRS Form 4868 to fill out and submit the document correctly:

- Part I. Identification. Provide your name, address, and Social Security number (SSN). If you file a joint return, enter the names and SSNs of both spouses in the order they will appear on the return form. Indicate the address at which you want the IRS to send you correspondence regarding this extension (it can be either yours or your agent's address).

- Part II. Individual Income Tax. You can round off cents to whole dollars on this form.

- Line 4. Estimate of Total Tax Liability for 2019. Enter the total tax liability you are expected to report on your tax return. If the amount is zero, enter -0-.

- Line 5. Estimate of Total Payments for 2019. Indicate the total payment you will report on your tax return form.

- Line 6. Balance Due. Subtract Line 5 from Line 4 and enter the result. If the amount in line 5 is bigger than in Line 4 - indicate -0-.

- Line 7. Amount You're Paying. Even if you cannot pay the amount indicated in Line 6 in full, you still can get the extension. But, in this case, you need to pay as much as you can to reduce the amount of penalty you will owe.

- Line 8 and 9. Self-explanatory.

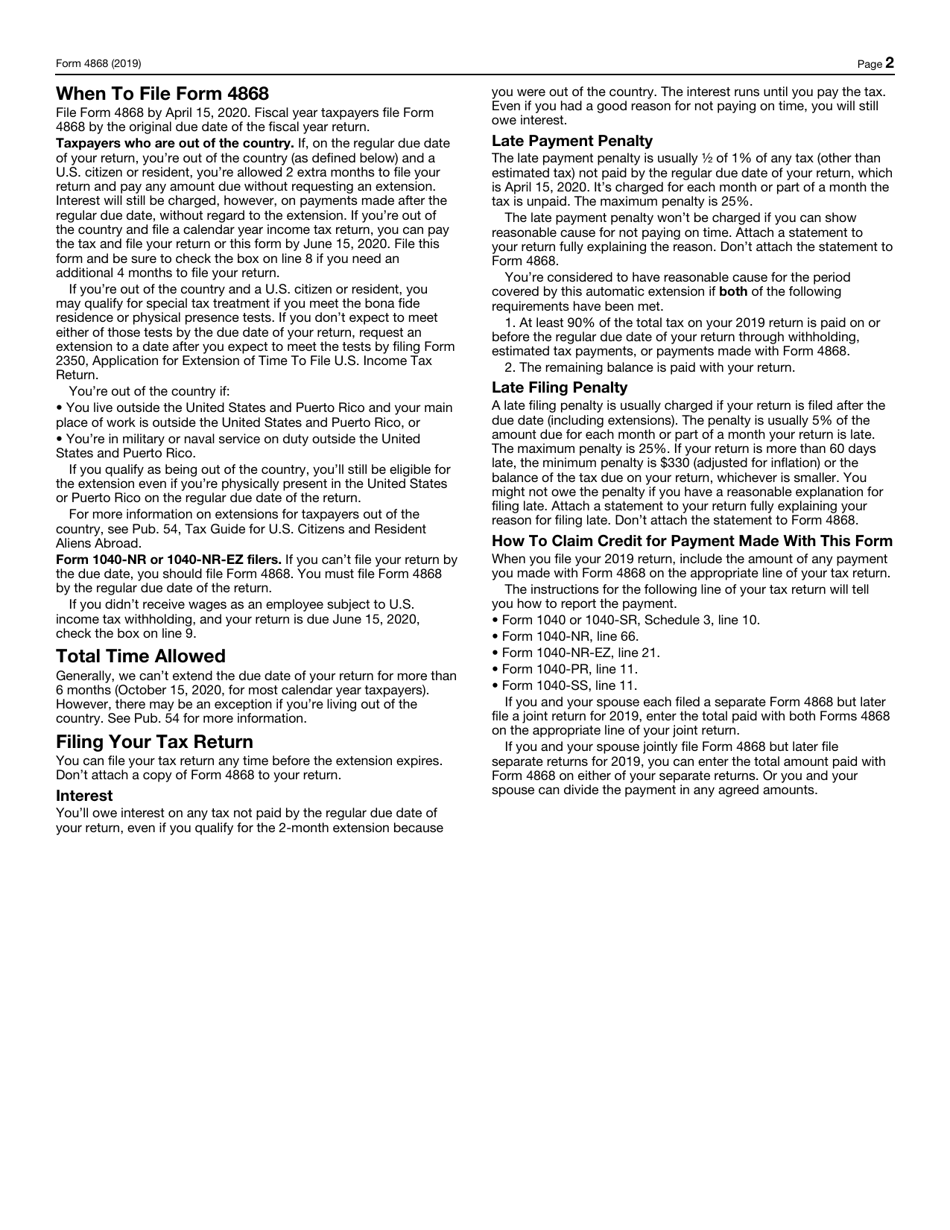

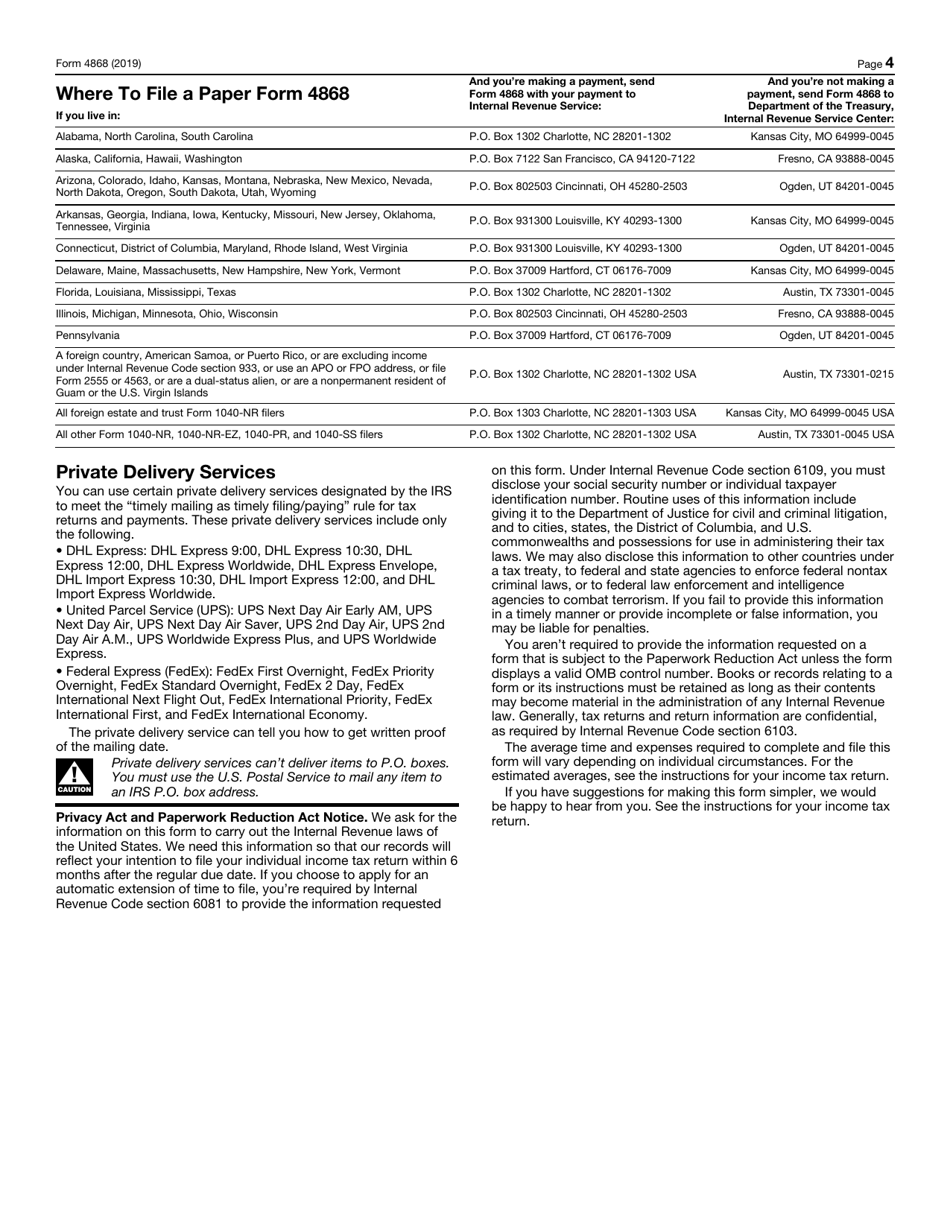

You can submit an electronic or paper version of the form. The addresses for mailing the paper versions are provided in the IRS-issued instructions attached to IRS 4868 Form.

Where to File Form 4868 Electronically?

File IRS Form 4868 electronically via the IRS e-file: IRS electronic filing program. Use your personal computer for this purpose. You can submit the form electronically in two ways:

- By using the IRS Free File program. The list of companies offering free e-filing of IRS 4868 Form is provided on the IRS website; and

- With the help of a tax software package.

In any case, make sure you have your tax return for 2019. You will need to provide the information indicated in the return for verification. After you complete the transaction, you will receive an electronic acknowledgment.