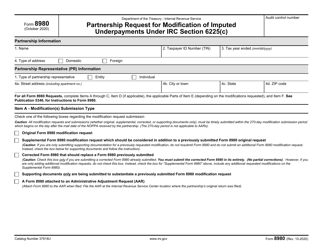

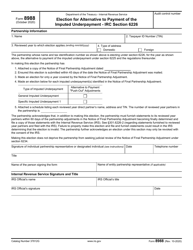

This version of the form is not currently in use and is provided for reference only. Download this version of

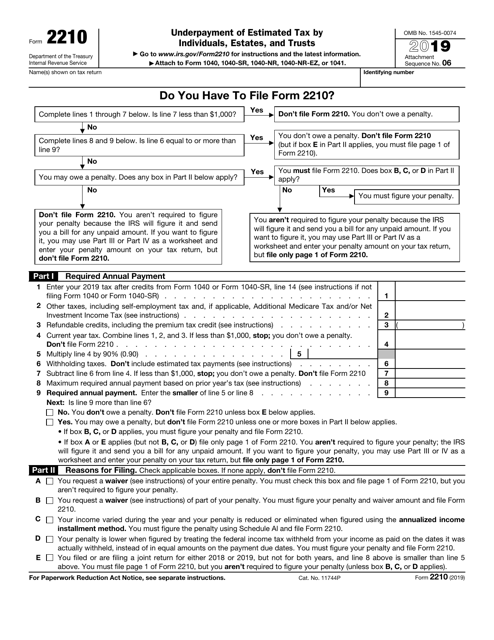

IRS Form 2210

for the current year.

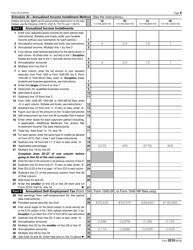

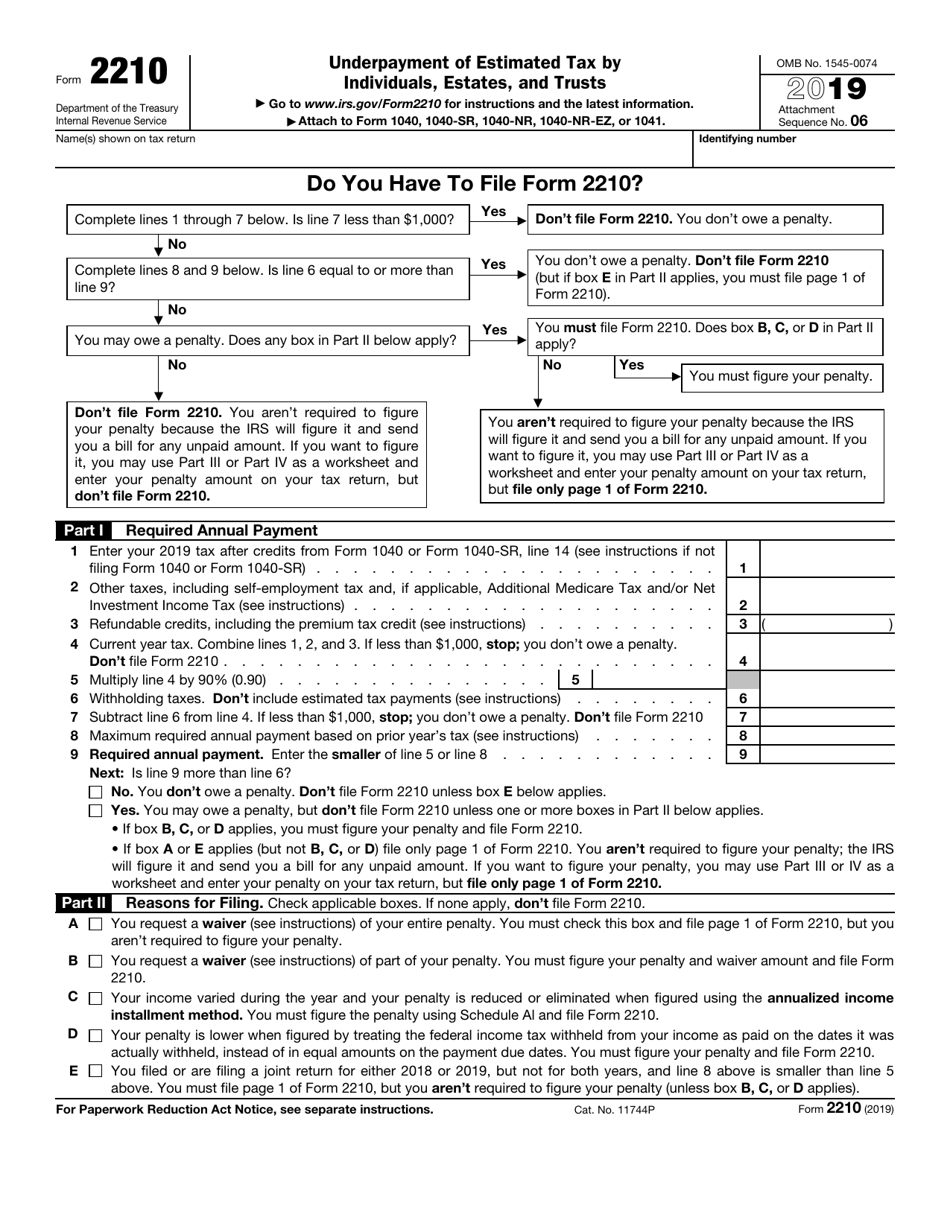

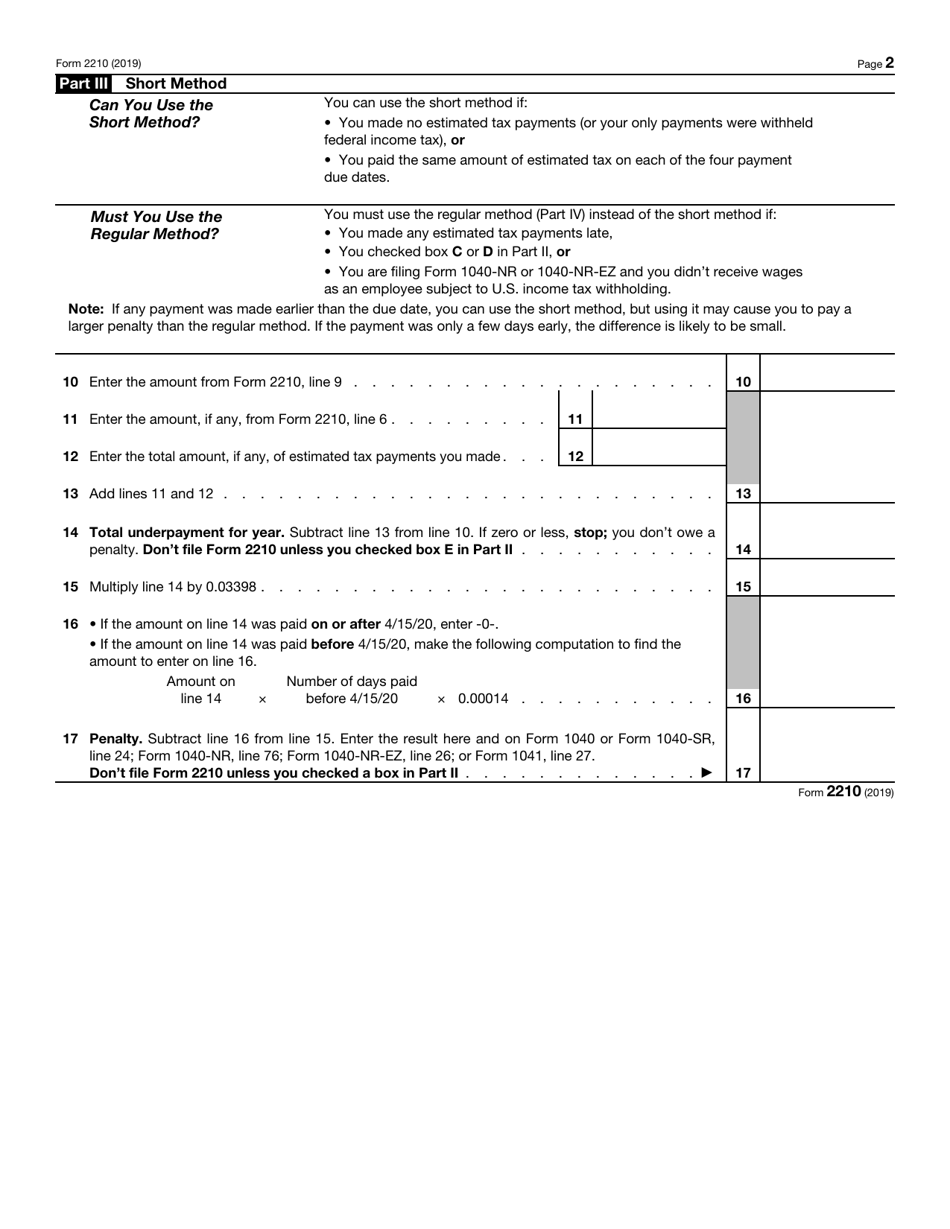

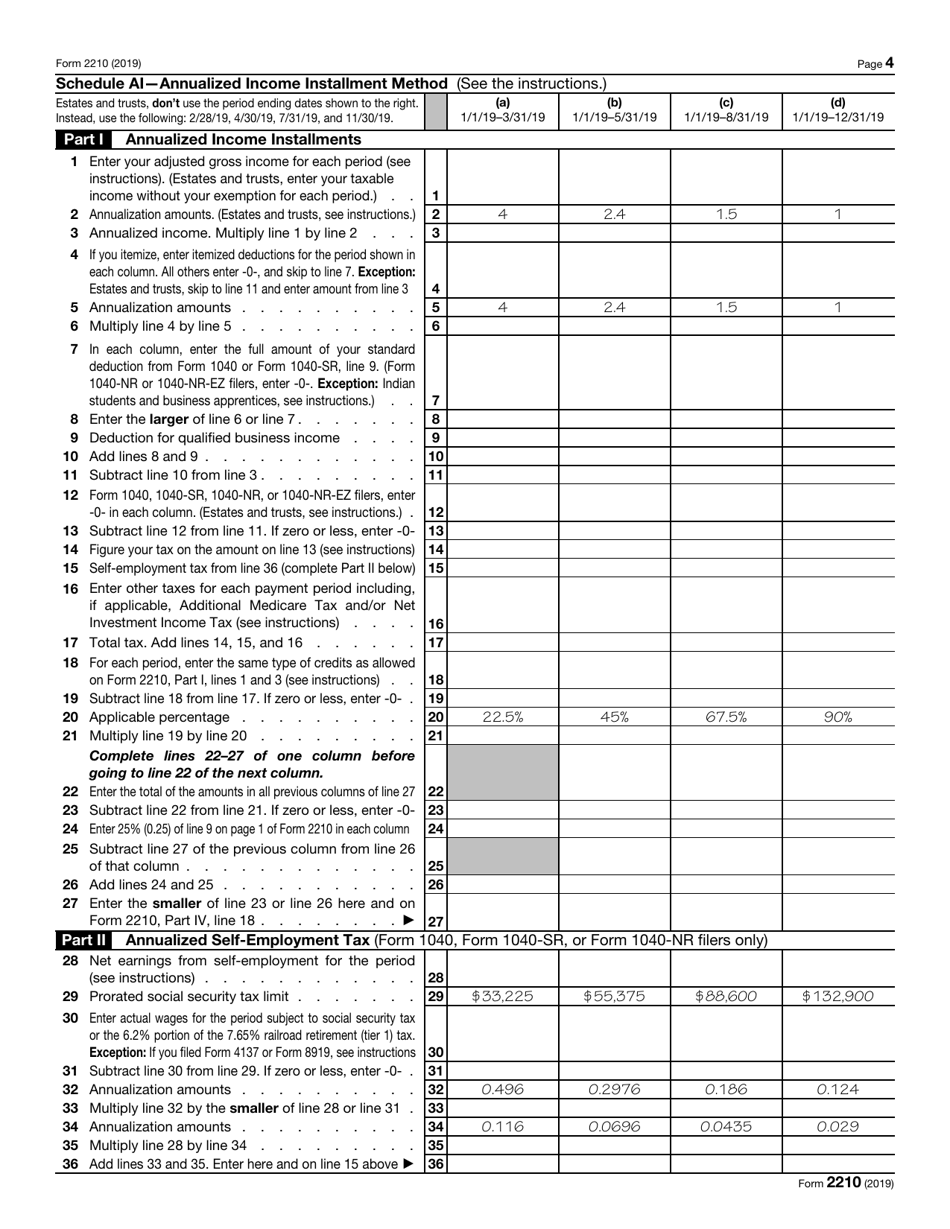

IRS Form 2210 Underpayment of Estimated Tax by Individuals, Estates, and Trusts

What Is IRS Form 2210?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 2210?

A: IRS Form 2210 is a form used to calculate and report any underpayment of estimated tax by individuals, estates, and trusts to the Internal Revenue Service (IRS).

Q: Who needs to file IRS Form 2210?

A: Individuals, estates, and trusts may need to file IRS Form 2210 if they had an underpayment of estimated tax during the tax year.

Q: What is an underpayment of estimated tax?

A: An underpayment of estimated tax occurs when an individual, estate, or trust did not pay enough in estimated tax throughout the year.

Q: Why would someone have an underpayment of estimated tax?

A: There are several reasons why someone might have an underpayment of estimated tax, including not paying enough tax through withholding or not making sufficient estimated tax payments.

Q: When is IRS Form 2210 due?

A: IRS Form 2210 is generally due on the same day as the individual's tax return, which is usually April 15th of the following year. However, there may be exceptions depending on the specific circumstances.

Q: What happens if someone doesn't file IRS Form 2210 when required?

A: If someone is required to file IRS Form 2210 but fails to do so, they may be subject to penalties and interest on the underpayment of estimated tax.

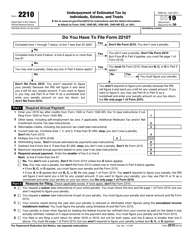

Q: Are there any exceptions or special rules for filing IRS Form 2210?

A: Yes, there are certain exceptions and special rules for filing IRS Form 2210. It's recommended to review the instructions and consult with a tax professional for specific guidance.

Form Details:

- A 4-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 2210 through the link below or browse more documents in our library of IRS Forms.