This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 2441

for the current year.

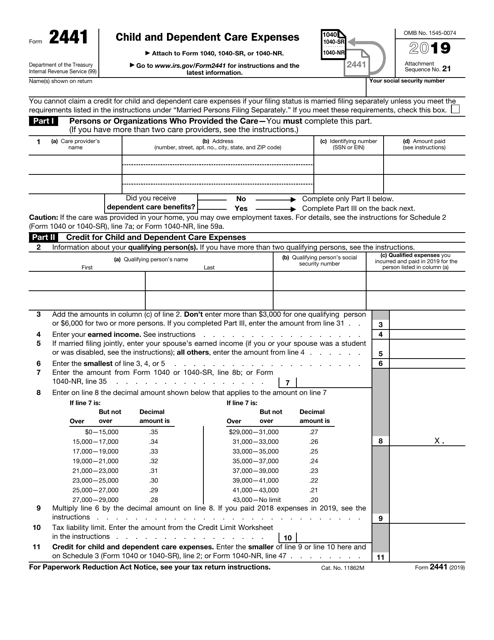

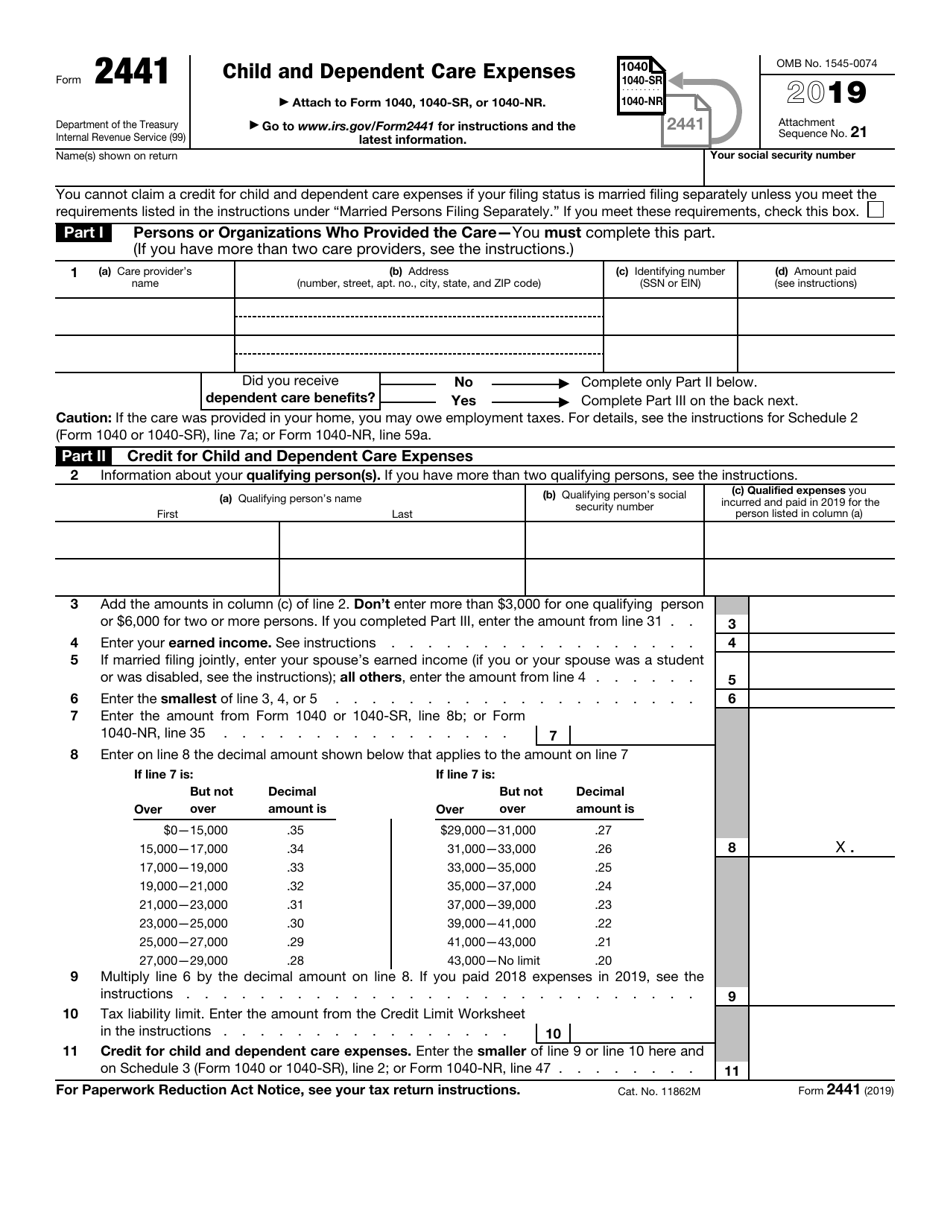

IRS Form 2441 Child and Dependent Care Expenses

What Is Form 2441?

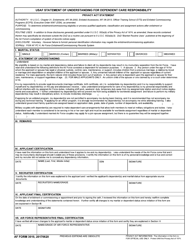

IRS Form 2441, Child and Dependent Care Expenses , is a document completed by taxpayers who have paid care providers to take care of their children and dependents so that they could work or seek employment.

Alternate Name:

- Child and Dependent Care Credit form.

This application lets taxpayers apply for credit for child and dependent care expenses. It must be attached to your tax return - Form 1040, U.S. Individual Income Tax Return, Form 1040-SR, U.S. Tax Return for Seniors, or Form 1040-NR, U.S. Nonresident Alien Income Tax Return.

This form was released by the Internal Revenue Service (IRS) . The latest version of the form was issued in 2019 with all previous editions obsolete. You can download a fillable Form 2441 through the link below.

How to Fill Out IRS Form 2441?

Follow these steps to complete the Child and Dependent Care Credit form:

- Write down your name and social security number (SSN).

- If you lived apart from your spouse during the last 6 months of the report year, your home was the qualifying person's main residence for more than half a year, and you paid more than half the cost of maintaining that residence, you may file separately while being married and are allowed to check the appropriate box.

- State the care provider's name, address, SSN or employer identification number, and the amount of money you paid for the care.

- If you did not receive dependent care benefits, fill out only Part II. Provide information about the qualifying individuals - their names, SSNs, and expenses you paid.

- Add the expenses and record your and your spouse's (if you are married filing jointly) earned income.

- Enter the smallest of the aforestated numbers and the amount from line 8b on Form 1040 or 1040-SR or line 35 on Form 1040-NR.

- Choose the decimal amount that applies to this amount.

- Multiply the smaller number listed by the decimal amount.

- Figure out the limit of your tax liability using the Credit Limit Worksheet.

- Write down the smaller number from the last two lines.

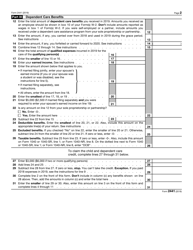

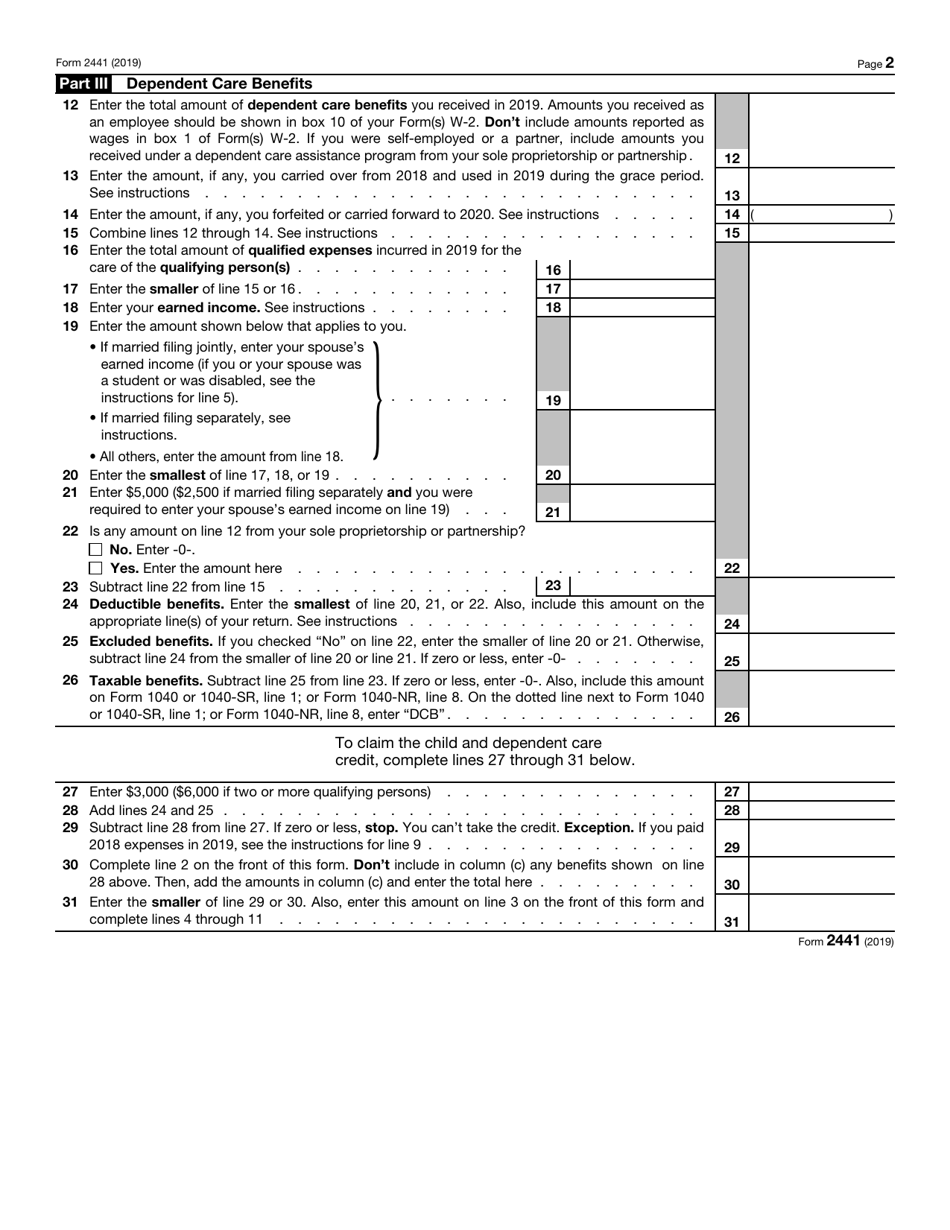

- If you received dependent care benefits, complete Part III also. Start with entering the total amount of these benefits, including those you carried over from the previous tax year and carried forward to the next year.

- Add these amounts and enter the total amount of qualified expenses.

- State the smaller number from the last two lines and yours and your spouse's earned income.

- Write down $5,000 ($2,500 if married filing separately).

- If the amount of dependent care benefits you received during the reporting year comes from your sole proprietorship or partnership, enter the amount again and subtract it from the total amount of benefits.

- Provide the details on the deductible, excluded, and taxable benefits.

- To claim Child and Dependent Care Credit, enter $3,000 ($6,000 for more than one qualifying individual), add the deductible and excluded benefits, subtract them from the $3,000 ($6,000), and enter the smaller number between this amount and the expenses.

If you need more information on this form, you may consult with official instructions for Form 2441, also released by the IRS. You will know more about people who can use this form and fill out the Credit Limit Worksheet to learn how much you owe in taxes.