This version of the form is not currently in use and is provided for reference only. Download this version of

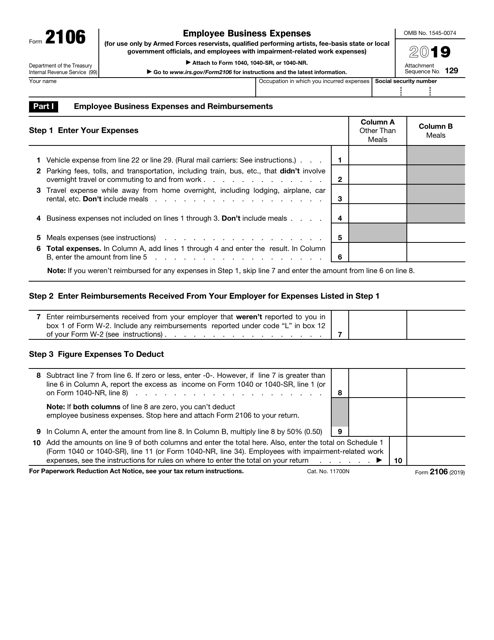

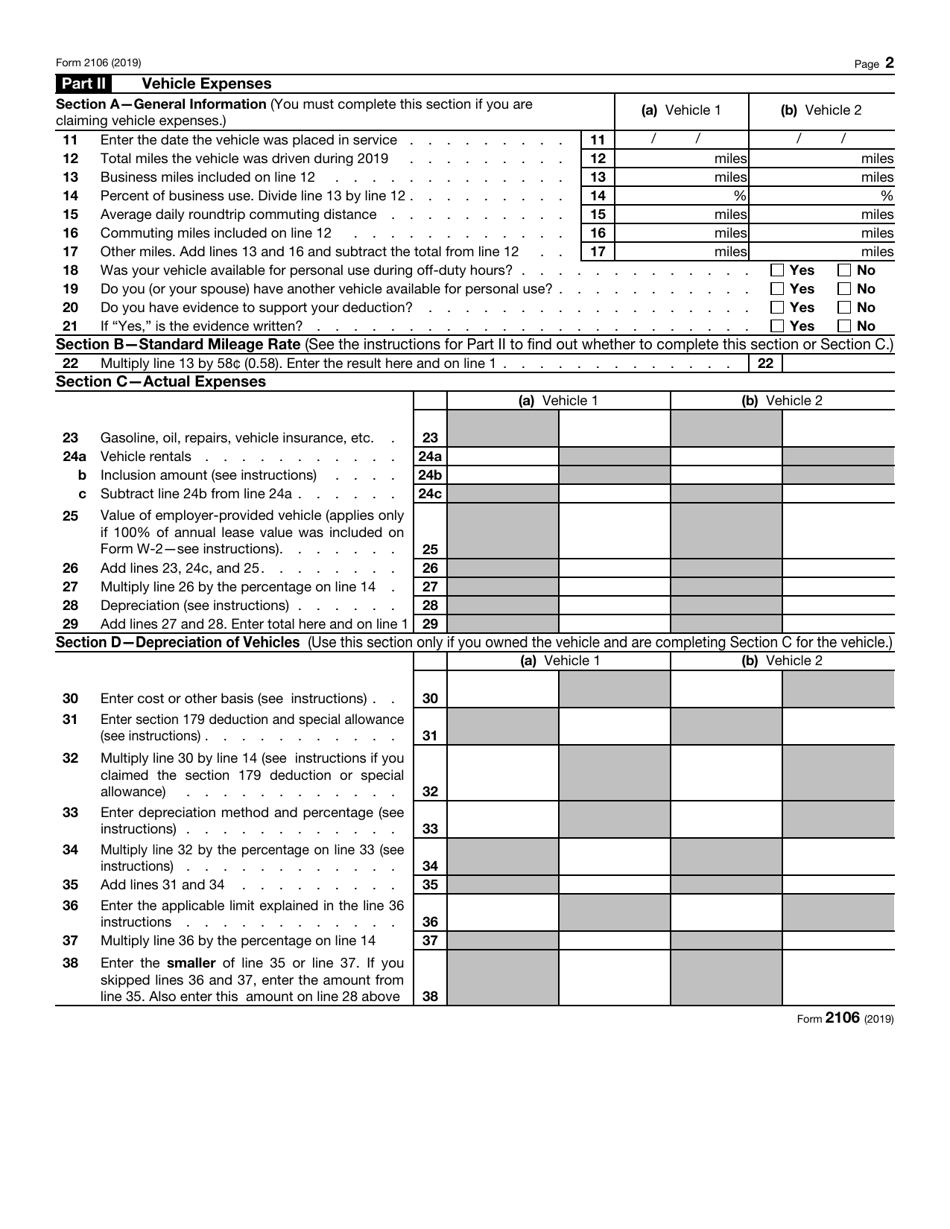

IRS Form 2106

for the current year.

IRS Form 2106 Employee Business Expenses

What Is IRS Form 2106?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 2106?

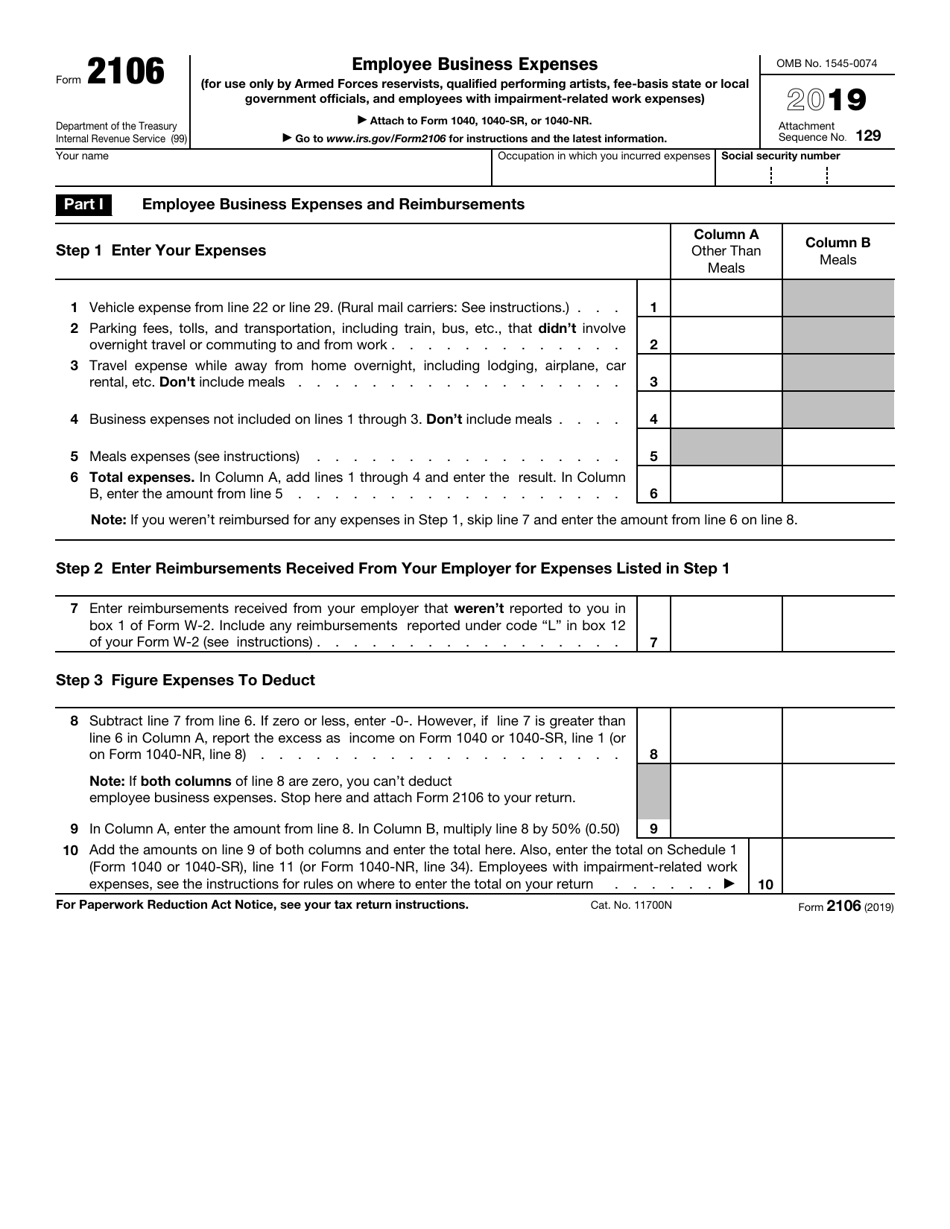

A: IRS Form 2106 is a tax form used to report employee business expenses.

Q: Who should use IRS Form 2106?

A: Employees who have business expenses that are not reimbursed by their employer may use IRS Form 2106.

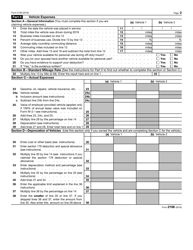

Q: What types of expenses can be reported on IRS Form 2106?

A: Common examples of expenses that can be reported on IRS Form 2106 include vehicle expenses, travel expenses, and home office expenses.

Q: Can I deduct all of my business expenses?

A: You can only deduct business expenses that are considered ordinary and necessary for your job or profession.

Q: Are there any limitations on deducting employee business expenses?

A: Yes, there are certain limitations on deducting employee business expenses. For example, you must itemize deductions on Schedule A of your tax return and the expenses must exceed 2% of your adjusted gross income.

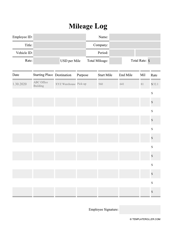

Q: Do I need to keep records of my business expenses?

A: Yes, it is important to keep records of your business expenses to support your deductions in case of an audit.

Q: When is the deadline to file IRS Form 2106?

A: IRS Form 2106 is typically filed with your annual tax return by the April tax deadline.

Q: Can I e-file IRS Form 2106?

A: Yes, you can e-file IRS Form 2106 along with your tax return if you are using tax software or working with a tax professional.

Q: What happens if I make a mistake on IRS Form 2106?

A: If you make a mistake on IRS Form 2106, you may need to file an amended tax return using Form 1040X to correct the error.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 2106 through the link below or browse more documents in our library of IRS Forms.