This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 2106

for the current year.

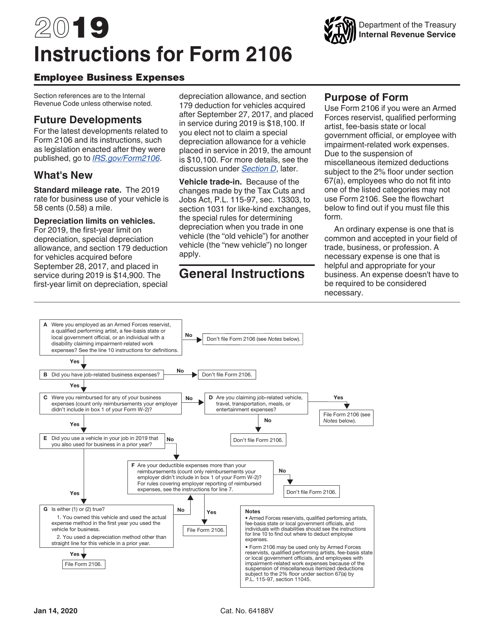

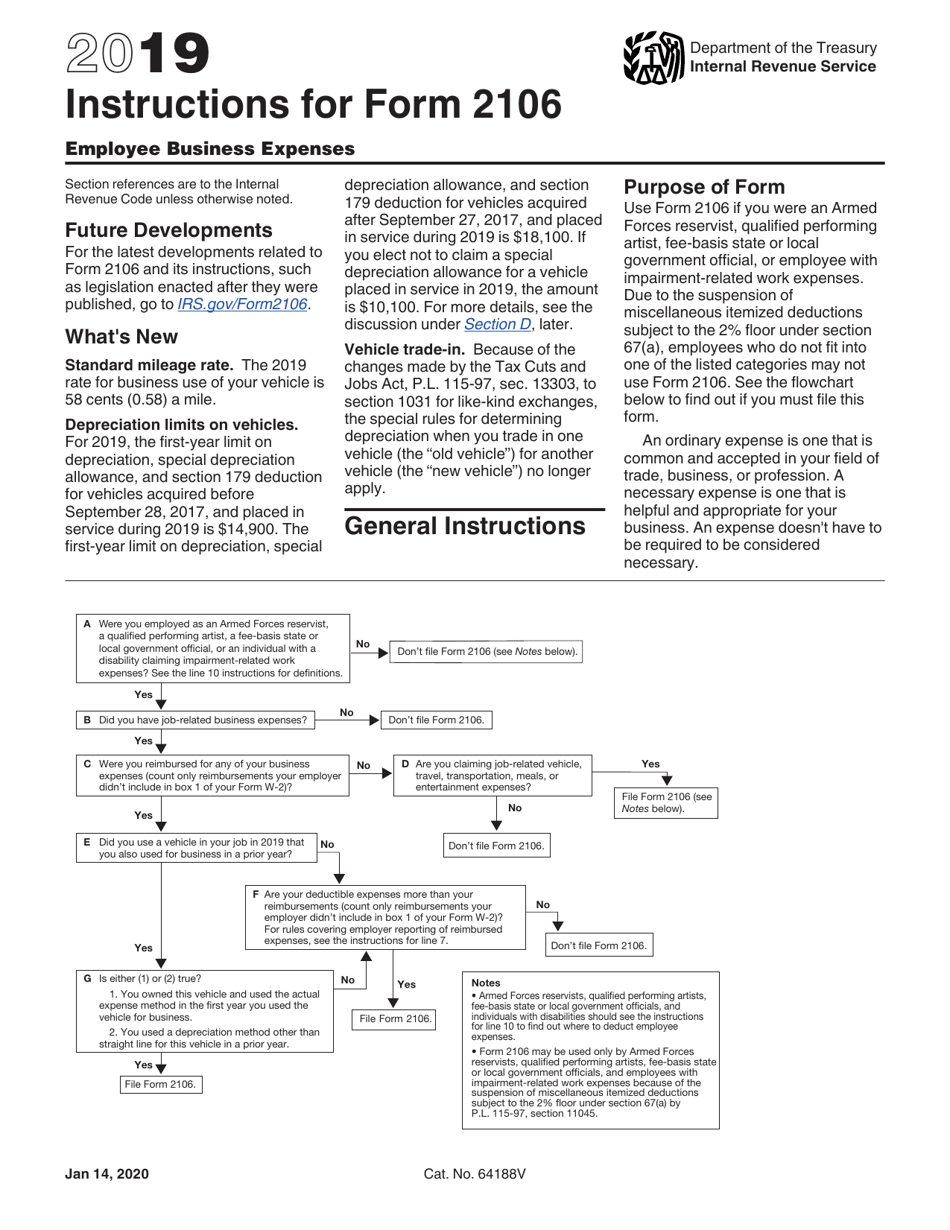

Instructions for IRS Form 2106 Employee Business Expenses

This document contains official instructions for IRS Form 2106 , Employee Business Expenses - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 2106 is available for download through this link.

FAQ

Q: What is IRS Form 2106?

A: IRS Form 2106 is used to report employee business expenses.

Q: Who should use IRS Form 2106?

A: Employees who have unreimbursed business expenses can use Form 2106.

Q: What kind of expenses can be reported on Form 2106?

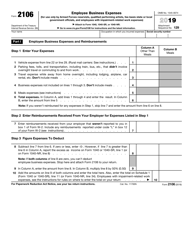

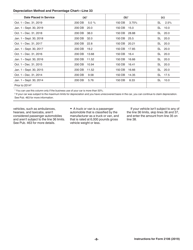

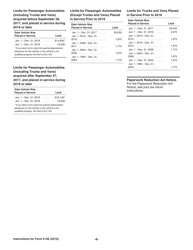

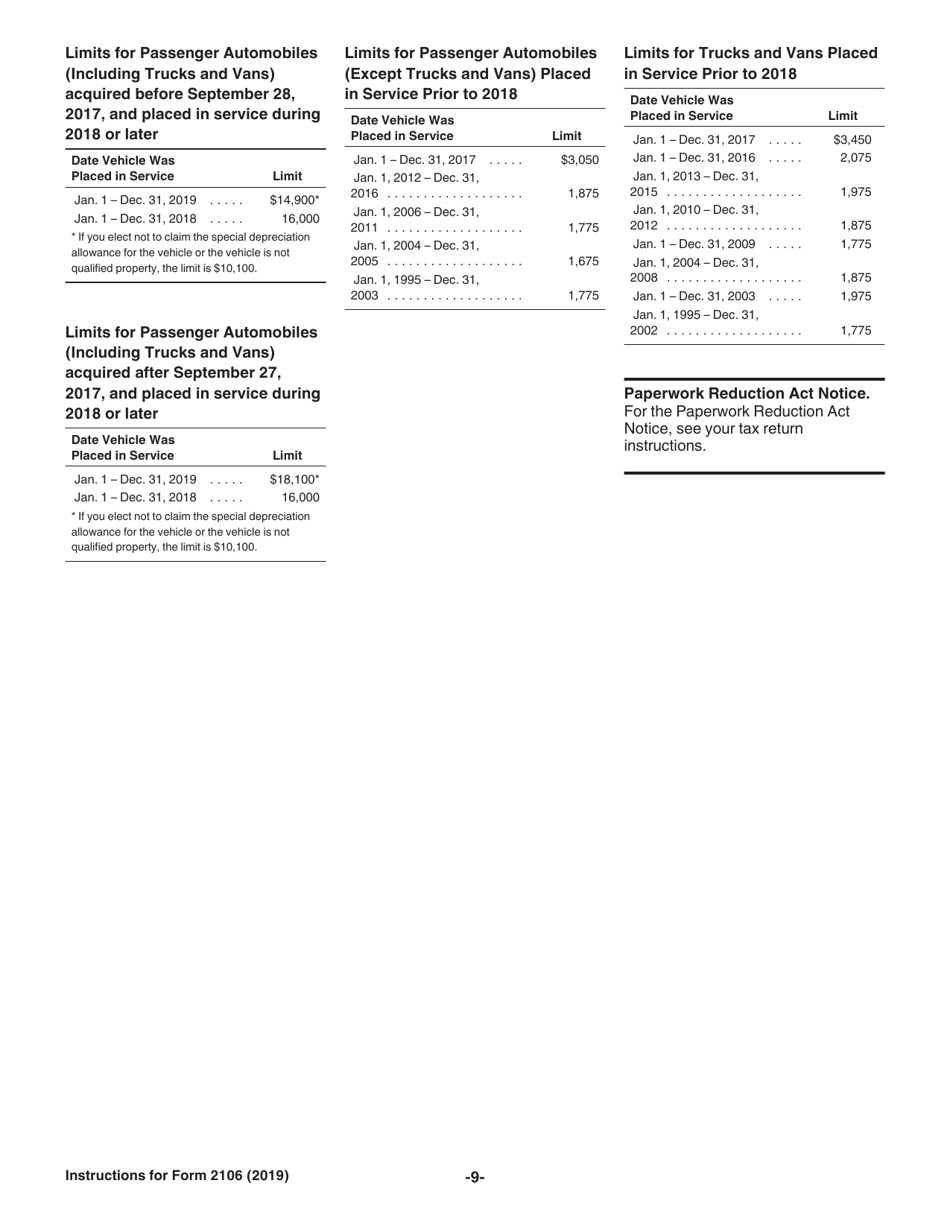

A: You can report expenses such as travel, meals, entertainment, and vehicle expenses on Form 2106.

Q: Do I need to attach receipts to Form 2106?

A: No, you don't need to attach receipts to Form 2106, but you should keep them for your records.

Q: Can I deduct all of my business expenses on Form 2106?

A: No, there are certain limitations and rules for deducting employee business expenses. You should consult the IRS guidelines or a tax professional for more information.

Q: When is the deadline to file Form 2106?

A: Form 2106 must be filed with your individual tax return by the April filing deadline, unless you request an extension.

Q: Can I e-file Form 2106?

A: Yes, you can e-file Form 2106 along with your tax return.

Q: What happens if I make a mistake on Form 2106?

A: If you make a mistake on Form 2106, you can file an amended return (Form 1040X) to correct it.

Instruction Details:

- This 9-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.