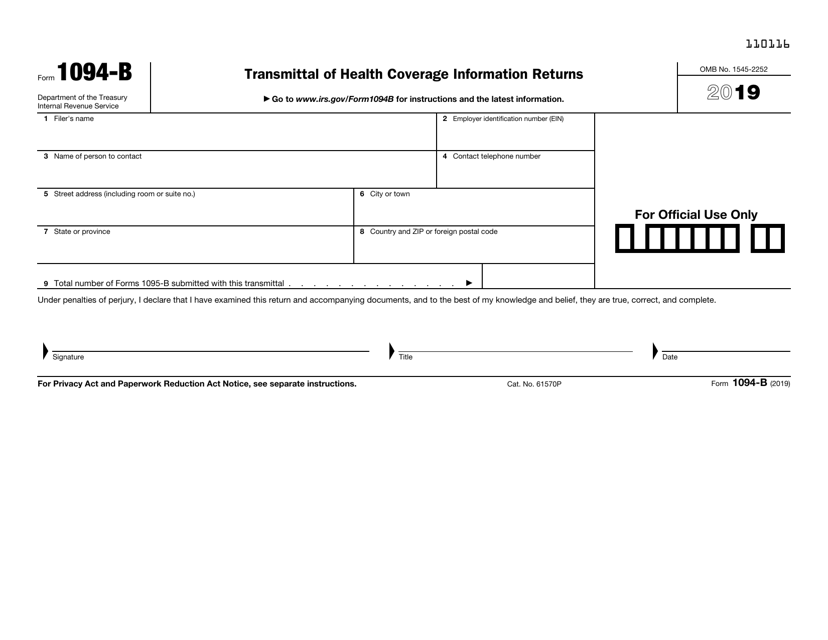

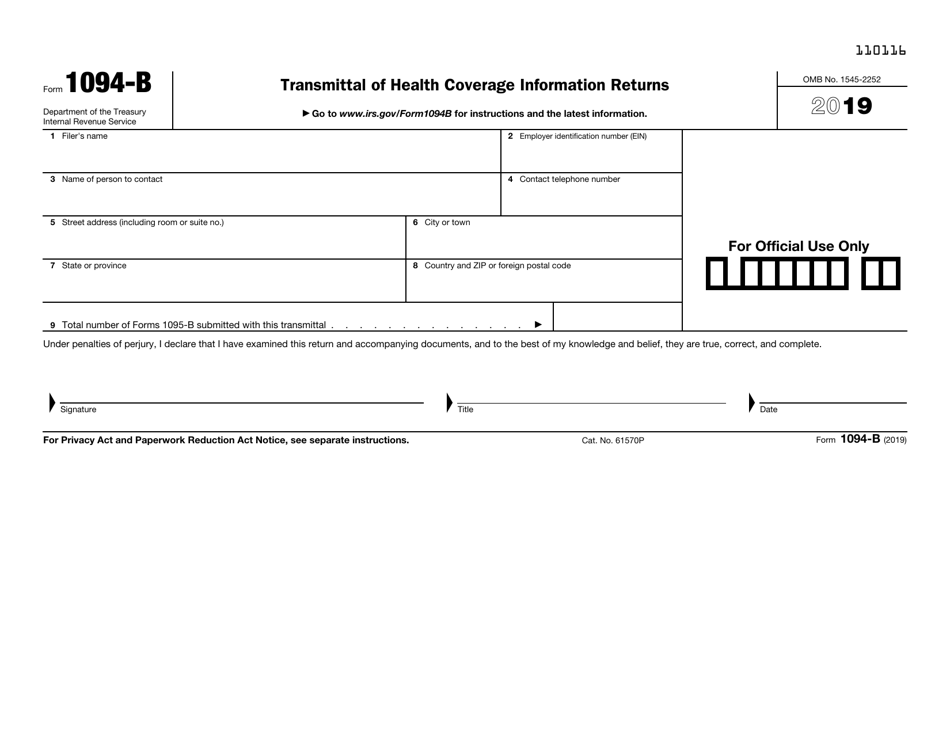

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1094-B

for the current year.

IRS Form 1094-B Transmittal of Health Coverage Information Returns

What Is Form 1094-B?

IRS Form 1094-B, Transmittal of Health Coverage Information Returns , is a document used by insurance providers to send the Internal Revenue Service (IRS) information about individuals whose essential health coverage meets the standards of the Affordable Care Act. Minimum essential coverage generally includes individual market plans, eligible employer-sponsored plans, and government-sponsored programs. This form must be filed with Form 1095-B, Health Coverage, which is sent by the IRS to taxpayers who are eligible to receive minimum essential health coverage.

The latest version of the form was released in 2019 with all previous editions obsolete. A fillable 1094-B Form is available for download below.

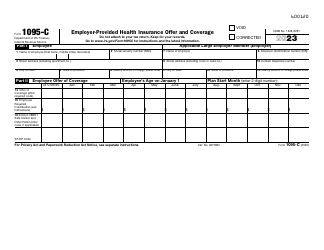

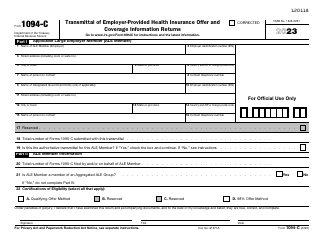

IRS Form 1094-C, Transmittal of Employer-Provided Health Insurance Offer and Coverage Information Returns, is a related cover sheet document used to report to the IRS summary information about the Applicable Large Employer (ALE) and to transmit Form 1095-C, Employer-Provided Health Insurance Offer and Coverage.

What Is the Difference Between Form 1094-B and 1095-B?

IRS Form 1094-B is a form used by the IRS to obtain information about individuals that have health coverage meeting the standards of the Affordable Care Act. It must be filed with Form 1095-B. IRS Form 1094-B (transmittal) is supplementary to Form 1095-B (returns). The 1094-B Form is used as a cover sheet that the insurance provider needs to identify itself, state the number of Forms 1095-B submitted to the IRS, and the name and telephone number of the responsible party for the IRS to contact.

IRS Form 1094-B Instructions

Instructions for Form 1094-B are as follows:

- State the filer's full name.

- Write down the filer's employer identification number (EIN).

- Provide the name and the telephone number of the person to contact - the IRS might need to ask this individual some questions regarding the information on the form.

- Enter the filer's street address.

- Indicate the number of Forms 1095-B submitted along with this document.

- Sign and date the form.

When Is Form 1094-B Due?

Form 1094-B's due date is the last day of February, or the last day of March if you are filing electronically, of the year that follows the calendar year of coverage. This requirement is fulfilled if the form is correctly addressed and mailed on or before the due date. If the due date falls on a Saturday, Sunday, or legal holiday, file the form on the following business day. There is a $270 penalty for each form if you fail to submit the correct information.

Where to Mail Form 1094-B?

The mailing address for the form depends on the location of the business or the legal residence:

- Department of the Treasury Internal Revenue Service Center Austin, TX 73301 - for Alabama, Arizona, Arkansas, Connecticut, Delaware, Florida, Georgia, Kentucky, Louisiana, Maine, Massachusetts, Mississippi, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, Texas, Vermont, Virginia, West Virginia, and foreign countries;

- Department of the Treasury Internal Revenue Service Center PO Box 219256 Kansas City, MO 64121-9256 - for Alaska, California, Colorado, District of Columbia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Maryland, Michigan, Minnesota, Missouri, Montana, Nebraska, Nevada, North Dakota, Oklahoma, Oregon, South Carolina, South Dakota, Tennessee, Utah, Washington, Wisconsin, Wyoming.