This version of the form is not currently in use and is provided for reference only. Download this version of

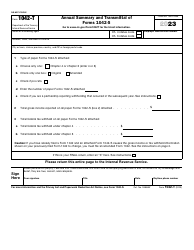

Instructions for IRS Form 1094-B, 1095-B

for the current year.

Instructions for IRS Form 1094-B, 1095-B

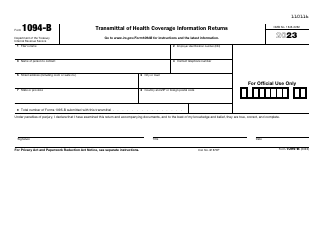

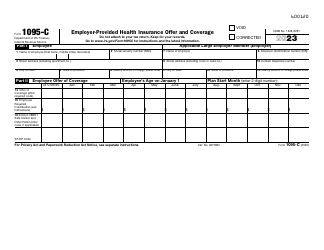

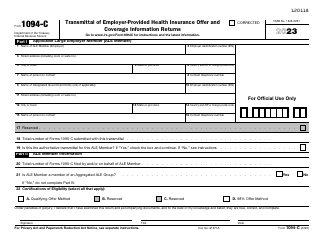

This document contains official instructions for IRS Form 1094-B , and IRS Form 1095-B . Both forms are released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1094-B is available for download through this link. The latest available IRS Form 1095-B can be downloaded through this link.

FAQ

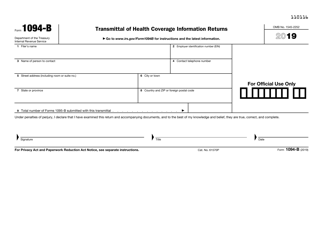

Q: What is IRS Form 1094-B?

A: IRS Form 1094-B is used by insurers, self-insuring employers, and other entities to report information about individuals who are covered by minimum essential coverage.

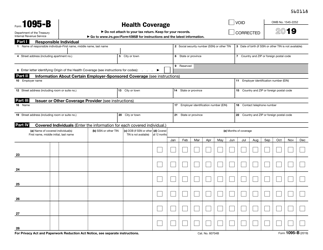

Q: What is IRS Form 1095-B?

A: IRS Form 1095-B is used to report information about individuals who are covered by minimum essential coverage.

Q: Who needs to file Form 1094-B?

A: Insurers, self-insuring employers, and other entities that provide minimum essential coverage to individuals need to file Form 1094-B.

Q: Who needs to file Form 1095-B?

A: Insurers, self-insuring employers, and other entities that provide minimum essential coverage to individuals need to file Form 1095-B.

Q: What information is required on Form 1094-B?

A: Form 1094-B requires information about the entity providing the coverage, the number of individuals covered, and other related details.

Q: What information is required on Form 1095-B?

A: Form 1095-B requires information about each individual covered, including their name, social security number, and the months they were covered.

Q: When is the deadline to file Forms 1094-B and 1095-B?

A: The deadline to file Forms 1094-B and 1095-B is typically on or before February 28th (or March 31st if filing electronically) of the following year.

Q: Do individuals need to attach Form 1095-B to their tax return?

A: No, individuals do not need to attach Form 1095-B to their tax return. They should keep it for their records.

Q: What should I do if I did not receive Form 1095-B?

A: If you did not receive Form 1095-B, contact the entity that should have provided the form to you.

Instruction Details:

- This 7-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.