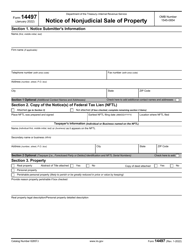

This version of the form is not currently in use and is provided for reference only. Download this version of

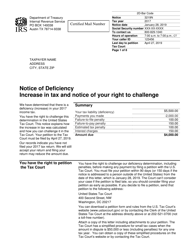

IRS Form 56

for the current year.

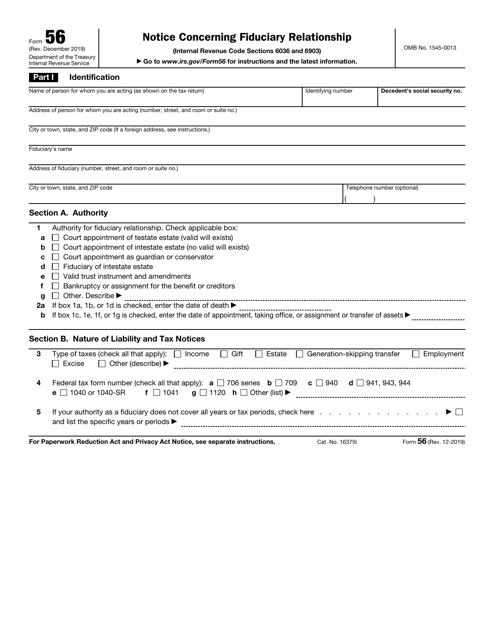

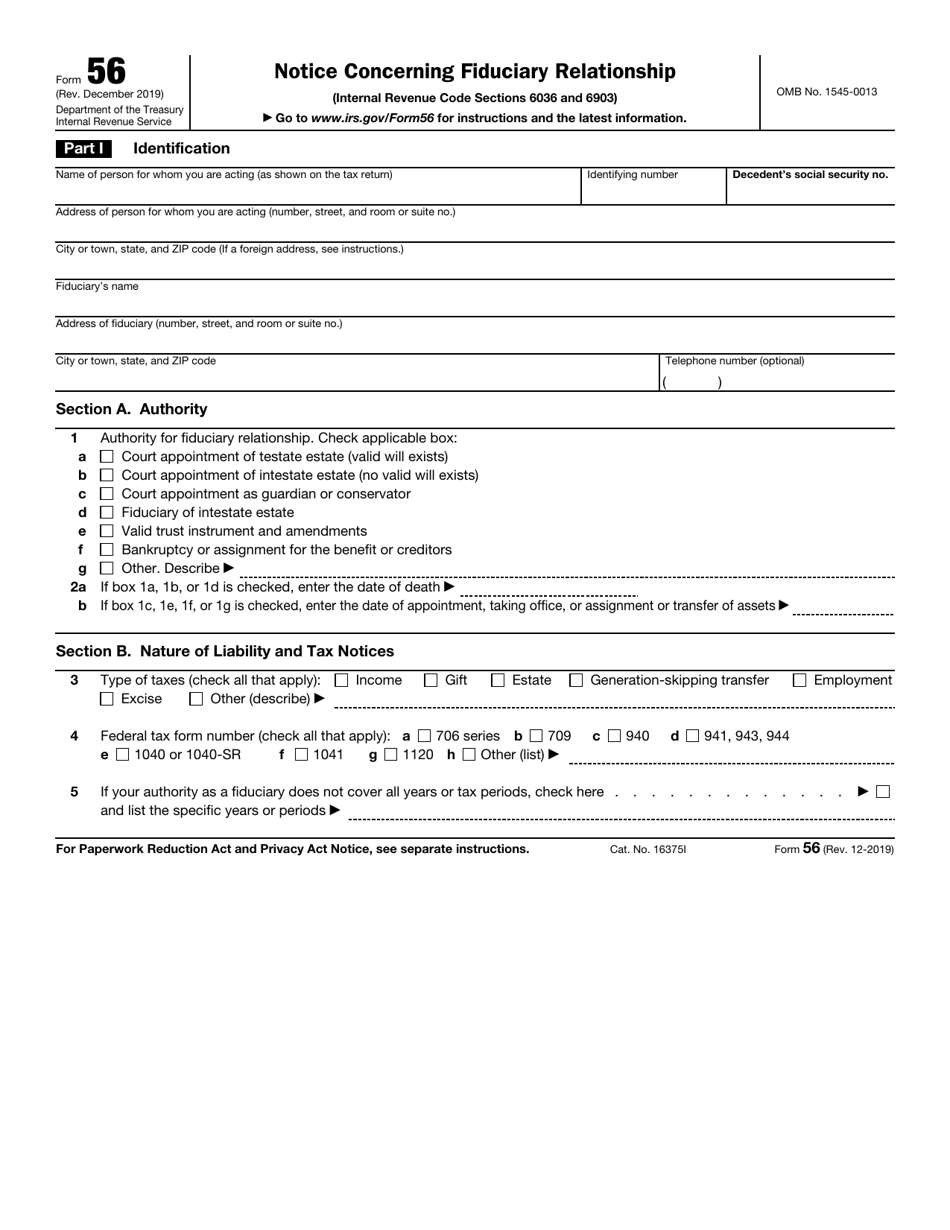

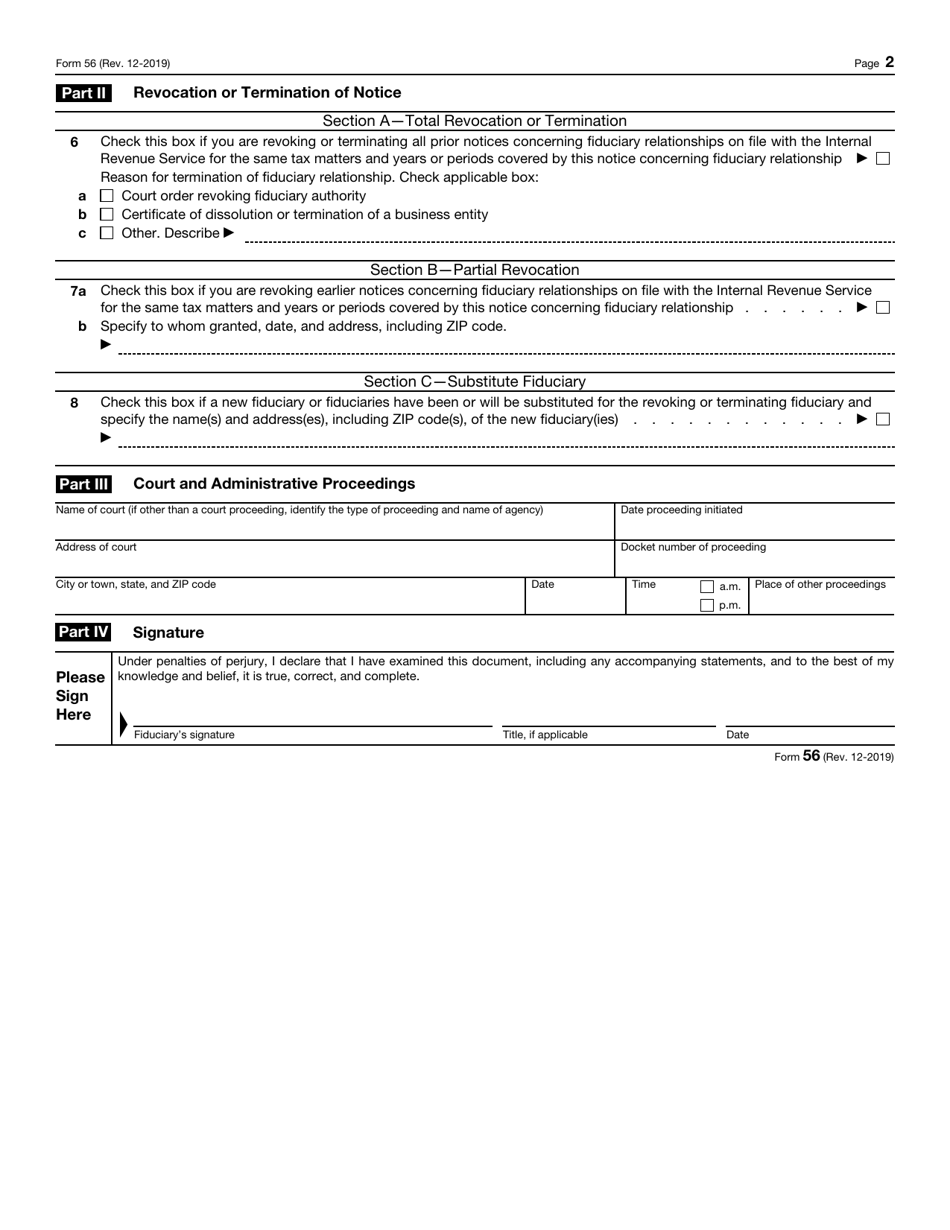

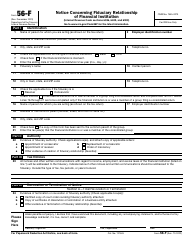

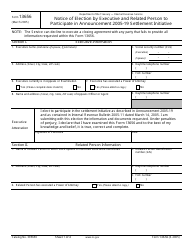

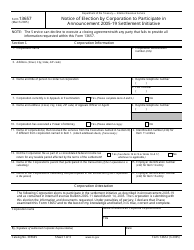

IRS Form 56 Notice Concerning Fiduciary Relationship

What Is IRS Form 56?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on December 1, 2019. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 56?

A: IRS Form 56 is a notice concerning fiduciary relationship.

Q: When is IRS Form 56 used?

A: IRS Form 56 is used when a fiduciary relationship exists, such as when someone is acting on behalf of a deceased person's estate or a trust.

Q: Who should file IRS Form 56?

A: The fiduciary or the person responsible for managing the assets of the estate or trust should file IRS Form 56.

Q: What information is required in IRS Form 56?

A: IRS Form 56 requires information about the fiduciary, the estate or trust, and the beneficiaries.

Q: Why is IRS Form 56 important?

A: IRS Form 56 notifies the IRS about the existence of a fiduciary relationship and helps ensure that the proper taxes are paid.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 56 through the link below or browse more documents in our library of IRS Forms.