This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1120-F Schedule M-3

for the current year.

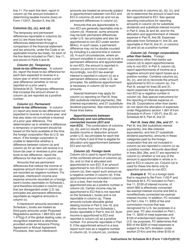

Instructions for IRS Form 1120-F Schedule M-3 Net Income (Loss) Reconciliation for Foreign Corporations With Reportable Assets of $10 Million or More

This document contains official instructions for IRS Form 1120-F Schedule M-3, Reportable Assets of $10 Million or More - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1120-F Schedule M-3 is available for download through this link.

FAQ

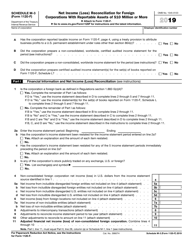

Q: What is IRS Form 1120-F Schedule M-3?

A: IRS Form 1120-F Schedule M-3 is a tax form used by foreign corporations to reconcile their net income (loss) with their reportable assets.

Q: Who needs to use IRS Form 1120-F Schedule M-3?

A: Foreign corporations with reportable assets of $10 million or more need to use IRS Form 1120-F Schedule M-3.

Q: What is the purpose of IRS Form 1120-F Schedule M-3?

A: The purpose of IRS Form 1120-F Schedule M-3 is to provide a detailed reconciliation of a foreign corporation's net income (loss) with its reportable assets.

Q: Are there any penalties for not filing IRS Form 1120-F Schedule M-3?

A: Yes, there may be penalties for not filing IRS Form 1120-F Schedule M-3 or for filing it incorrectly. It is important to comply with all tax filing requirements.

Q: What information is required to complete IRS Form 1120-F Schedule M-3?

A: To complete IRS Form 1120-F Schedule M-3, you will need information about the foreign corporation's net income (loss) and reportable assets.

Q: Can I seek professional help to complete IRS Form 1120-F Schedule M-3?

A: Yes, it is recommended to seek professional help, such as a tax advisor or accountant, to ensure accuracy and compliance when completing IRS Form 1120-F Schedule M-3.

Q: When is the deadline for filing IRS Form 1120-F Schedule M-3?

A: The deadline for filing IRS Form 1120-F Schedule M-3 is typically the same as the deadline for filing the foreign corporation's annual tax return, which is generally March 15th.

Q: Are there any exceptions to filing IRS Form 1120-F Schedule M-3?

A: Yes, there are certain exceptions to filing IRS Form 1120-F Schedule M-3. It is best to consult with a tax professional or review the IRS instructions for specific exceptions and requirements.

Q: What should I do if I have more questions about IRS Form 1120-F Schedule M-3?

A: If you have more questions about IRS Form 1120-F Schedule M-3, it is recommended to consult with a tax professional or contact the Internal Revenue Service (IRS) for assistance.

Instruction Details:

- This 27-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.