This version of the form is not currently in use and is provided for reference only. Download this version of

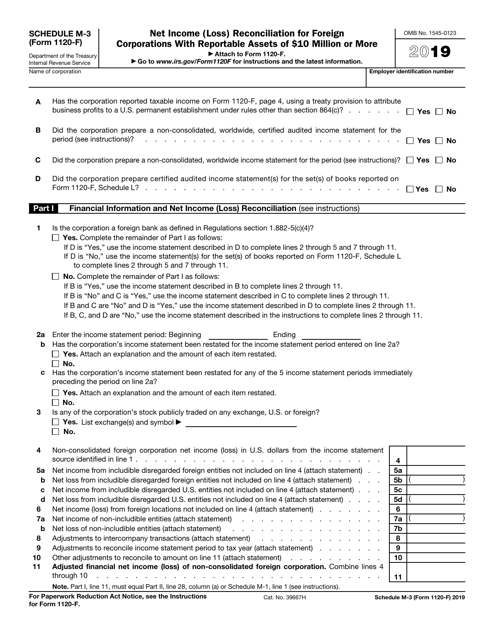

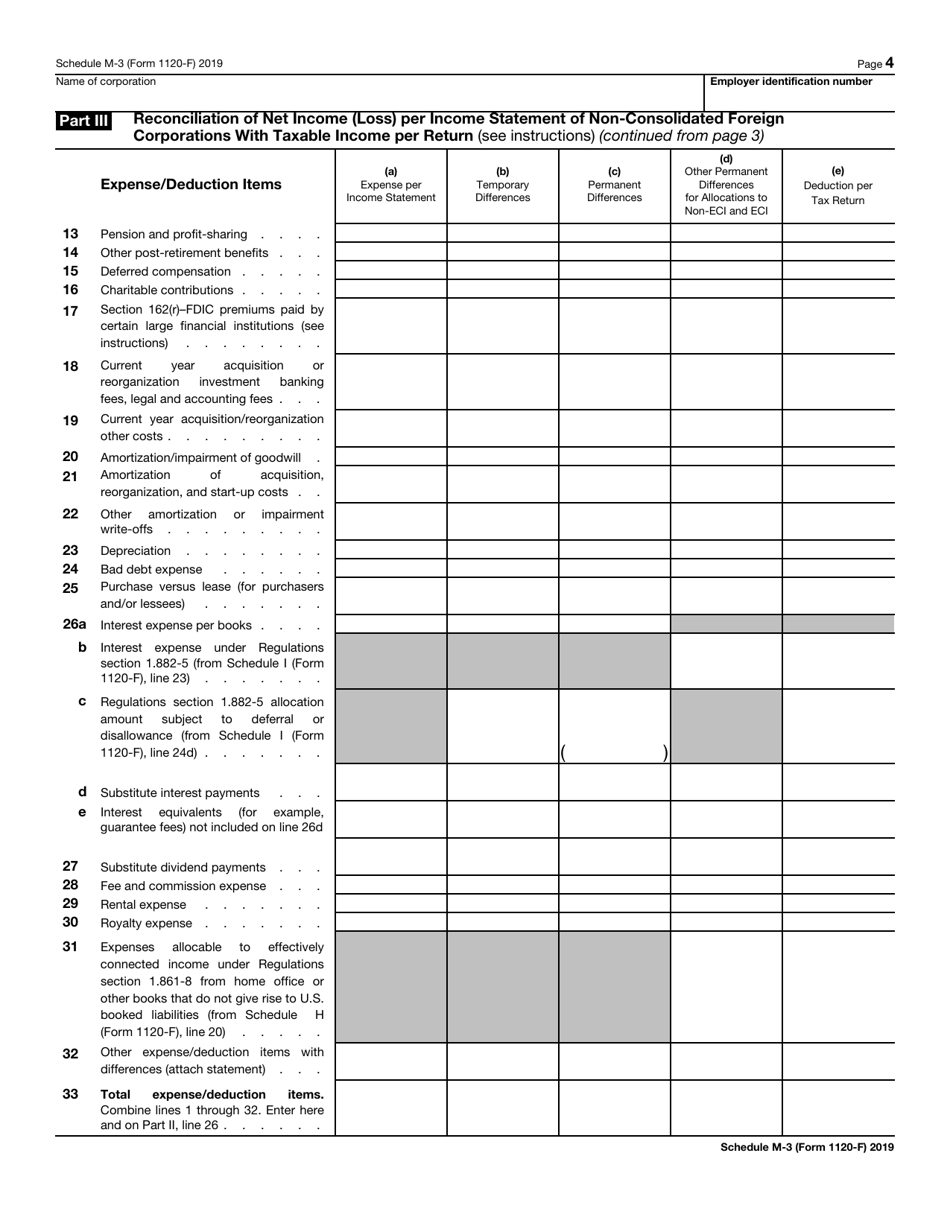

IRS Form 1120-F Schedule M-3

for the current year.

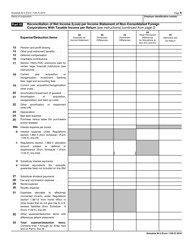

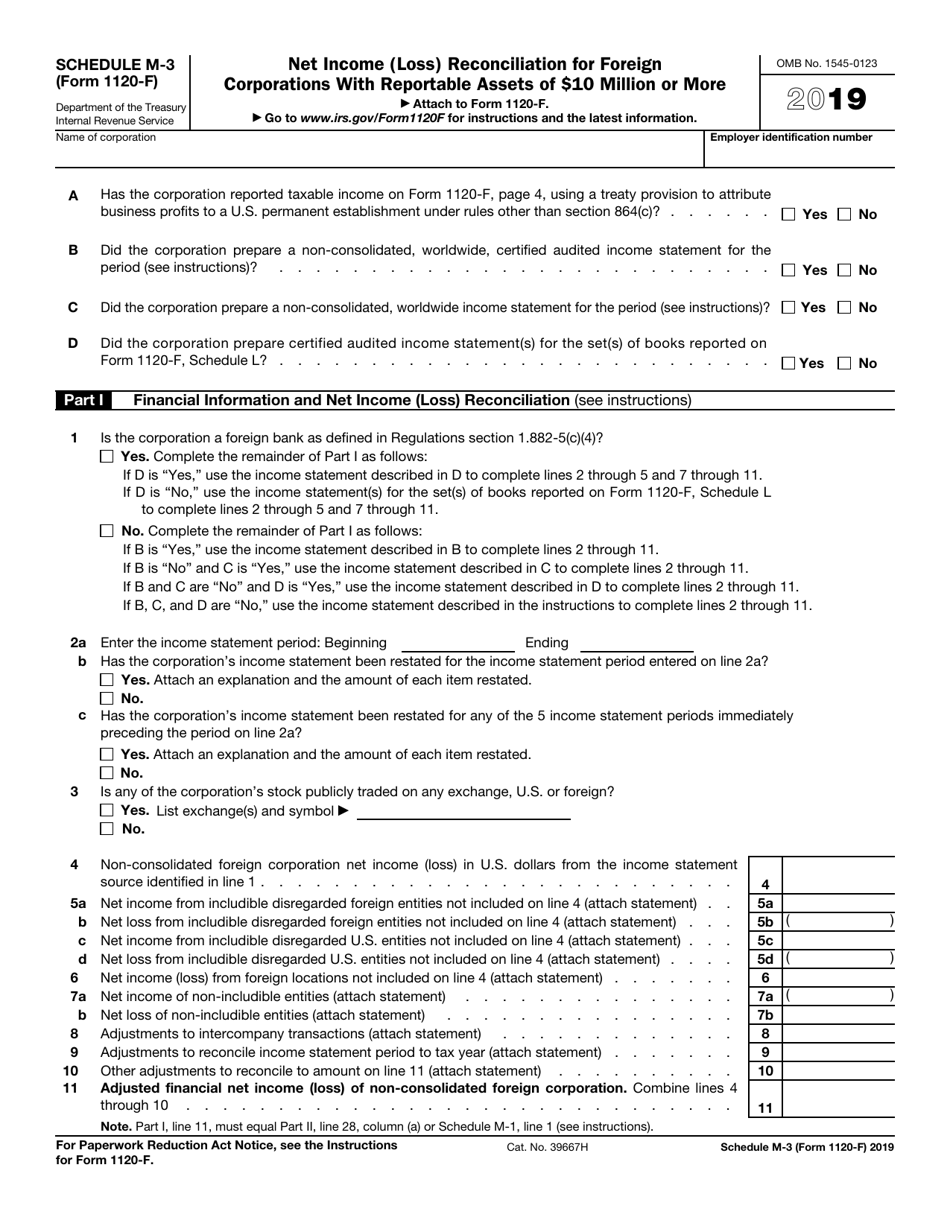

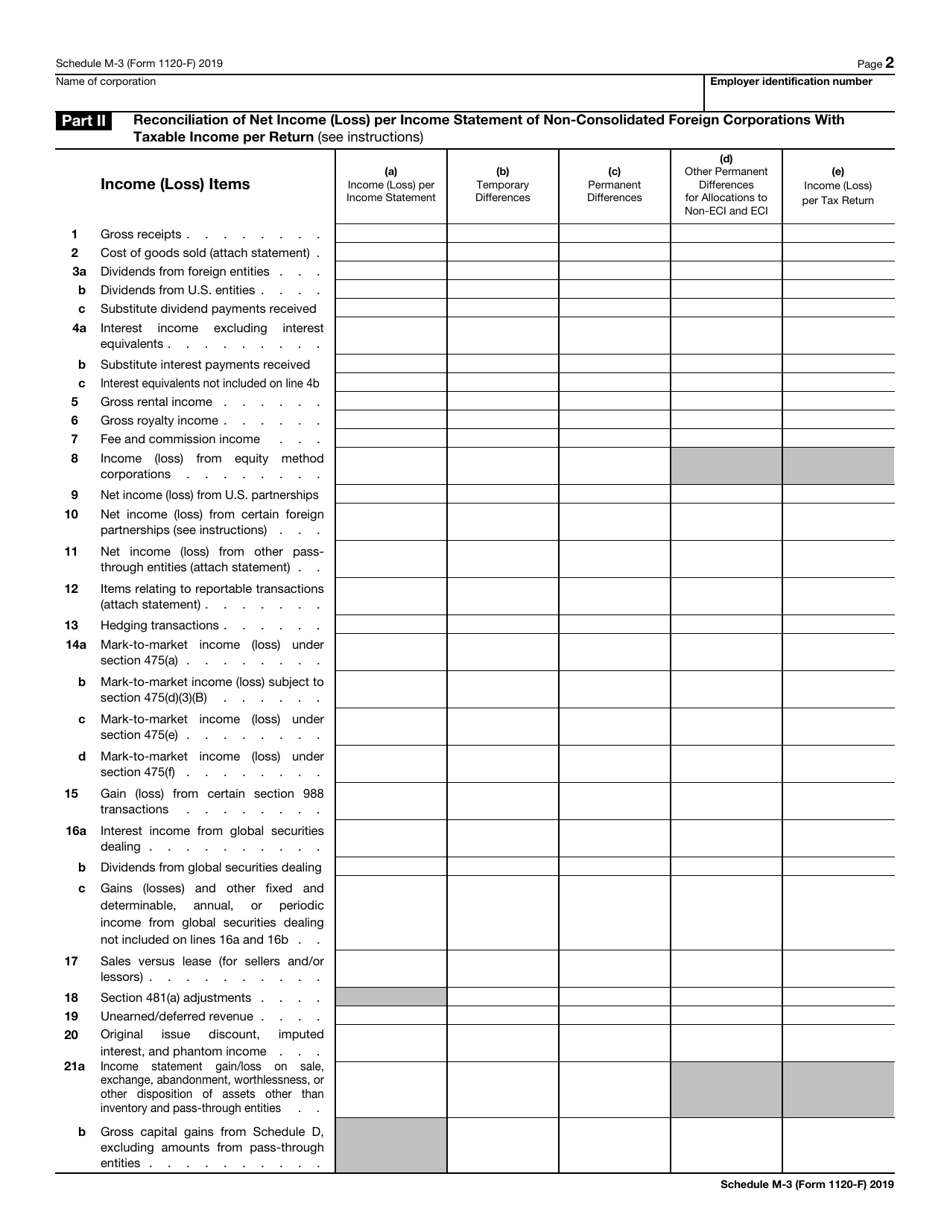

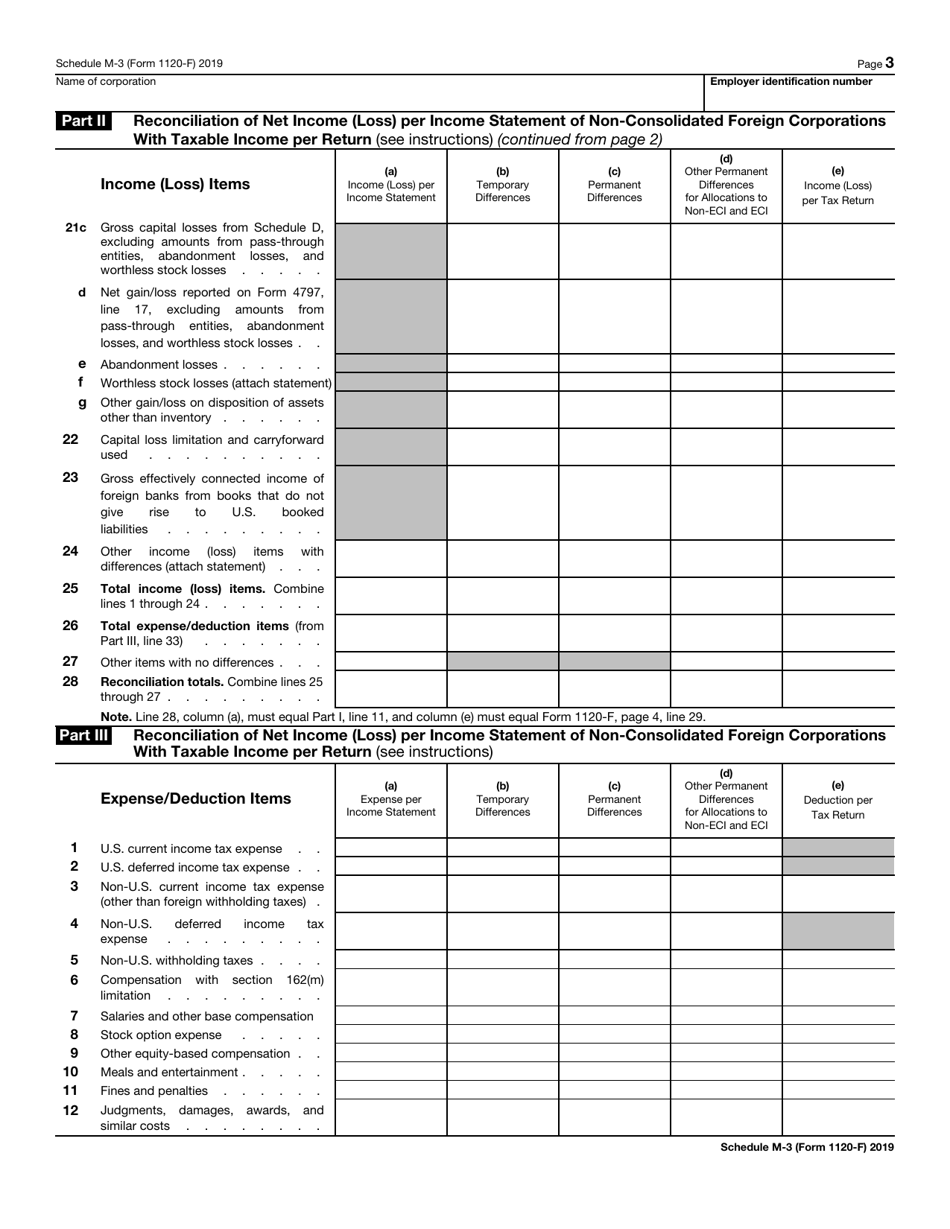

IRS Form 1120-F Schedule M-3 Net Income (Loss) Reconciliation for Foreign Corporations With Reportable Assets of $10 Million or More

What Is IRS Form 1120-F Schedule M-3?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1120-F, U.S. Income Tax Return of a Foreign Corporation. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1120-F Schedule M-3?

A: IRS Form 1120-F Schedule M-3 is a document used by foreign corporations to reconcile their net income (loss) with reportable assets of $10 million or more.

Q: Who is required to file IRS Form 1120-F Schedule M-3?

A: Foreign corporations with reportable assets of $10 million or more are required to file IRS Form 1120-F Schedule M-3.

Q: What does the Schedule M-3 form help with?

A: The Schedule M-3 form helps foreign corporations reconcile their net income (loss) with reportable assets of $10 million or more.

Q: Is the Schedule M-3 form mandatory for all foreign corporations?

A: No, it is only mandatory for foreign corporations with reportable assets of $10 million or more.

Form Details:

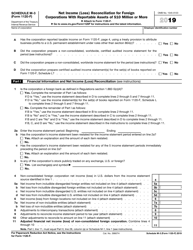

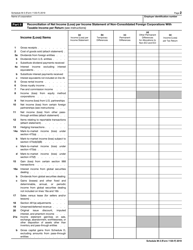

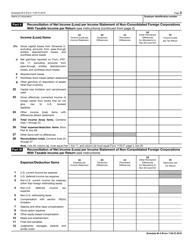

- A 4-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1120-F Schedule M-3 through the link below or browse more documents in our library of IRS Forms.