This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1094-C, 1095-C

for the current year.

Instructions for IRS Form 1094-C, 1095-C

This document contains official instructions for IRS Form 1094-C , and IRS Form 1095-C . Both forms are released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1094-C is available for download through this link. The latest available IRS Form 1095-C can be downloaded through this link.

FAQ

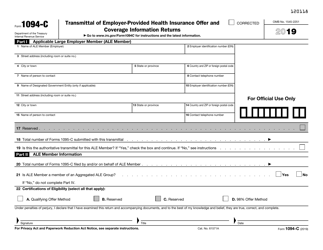

Q: What is IRS Form 1094-C?

A: IRS Form 1094-C is used by applicable large employers to report information about offers of health coverage and enrollment in the coverage for their employees.

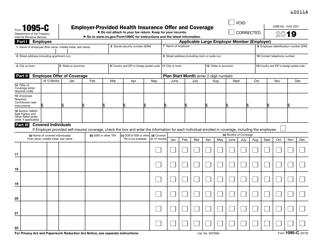

Q: What is IRS Form 1095-C?

A: IRS Form 1095-C is used by employers to provide information to employees about the health coverage offered to them.

Q: Who needs to file IRS Form 1094-C and 1095-C?

A: Applicable large employers with 50 or more full-time equivalent employees are required to file Form 1094-C and Form 1095-C.

Q: What information is reported on IRS Form 1094-C?

A: Form 1094-C requires the employer to provide information about their business and certify whether they offered health coverage to employees and their dependents.

Q: What information is reported on IRS Form 1095-C?

A: Form 1095-C provides employee-specific information about the health coverage offered and any enrollment in the coverage.

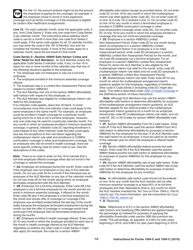

Q: When is the deadline to file IRS Form 1094-C and 1095-C?

A: The deadline to file Form 1094-C and furnish Form 1095-C to employees is typically February 28th or March 31st, depending on whether you file electronically or by mail.

Q: Is there a penalty for not filing IRS Form 1094-C and 1095-C?

A: Yes, there can be penalties for failing to file or furnish the required forms. It's important to comply with the reporting requirements.

Instruction Details:

- This 17-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.