This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1095-C

for the current year.

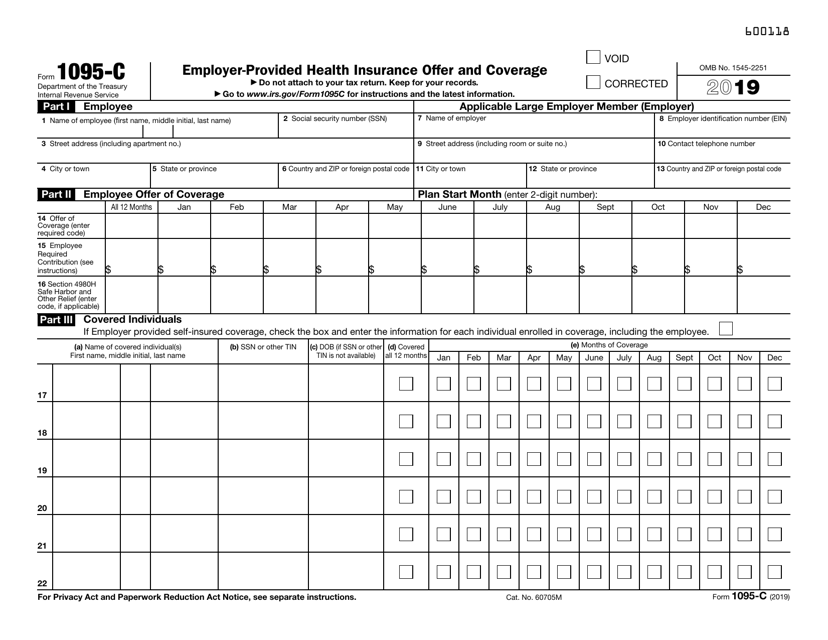

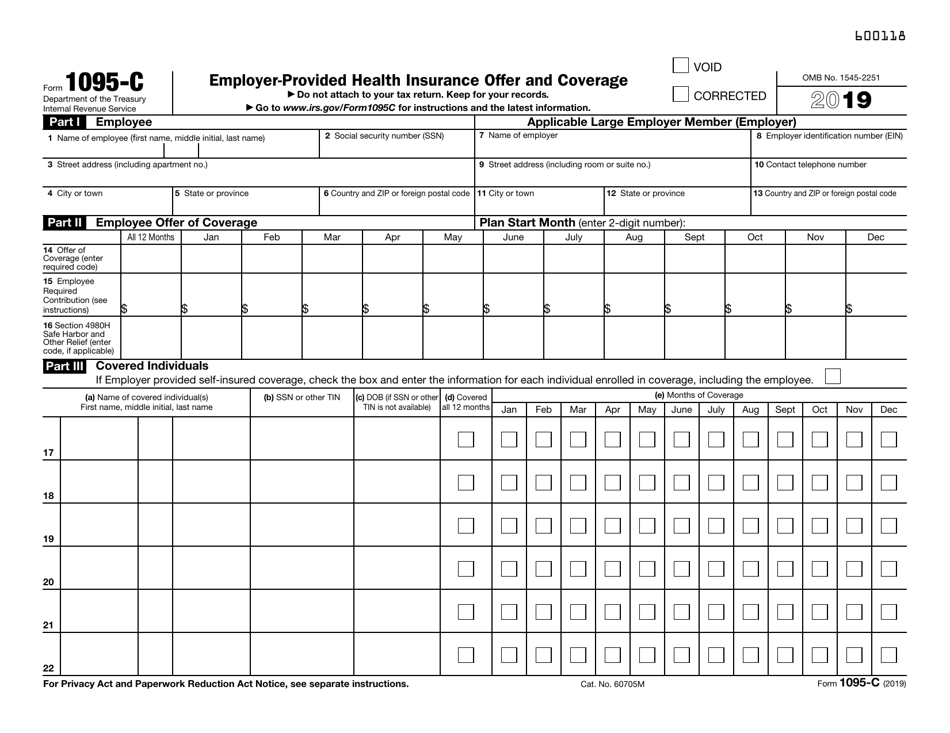

IRS Form 1095-C Employer-Provided Health Insurance Offer and Coverage

What Is Form 1095-C?

IRS Form 1095-C, Employer-Provided Health Insurance Offer and Coverage , is a document filed by employers with 50 or more full-time employees to inform the employees about health coverage and their current and prospective enrollment in insurance plans required under sections 6055 and 6056 of the Internal Revenue Code. This form is sent by the employer, not by the Internal Revenue Service (IRS) , and it complements other health insurance disclosures - Form 1095-A and Form 1095-B.

Alternate Name:

- Employer-Provided Health Insurance Tax Form

The latest version of the form was released in 2019 with all previous editions obsolete. A fillable Form 1095-C is available for download below.

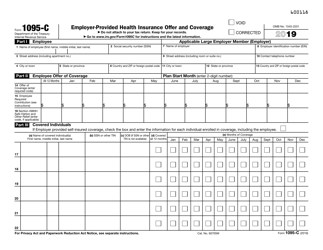

The due day for Form 1095-C is the last day of February if you file it on paper and the last day of March if you file it electronically the year that follows the calendar year of coverage. There is a penalty of $270 for each return if you fail to provide an accurate information return.

What Is Form 1095-C Used For?

The 1095-C tax return is sent to any employee of an Applicable Large Employers (ALE) member who qualifies as a full-time employee for at least one month of the calendar year. It is the ALE member's responsibility to report that information for every employee and to the IRS. Additionally, this form is used to determine the employees eligible for the premium tax credit.

What Is the Difference Between 1095-B and 1095-C?

Sometimes people who are covered by insurance from an employer receive a copy of a related form, which is very similar to 1095-C Form - 1095-B, Health Coverage. It contains substantially the same information, but it is generated by small self-funded groups or employers who use the Small Business Health Options Program (SHOP). It is possible that some taxpayers receive both tax forms, depending on how employers' coverage is set up.

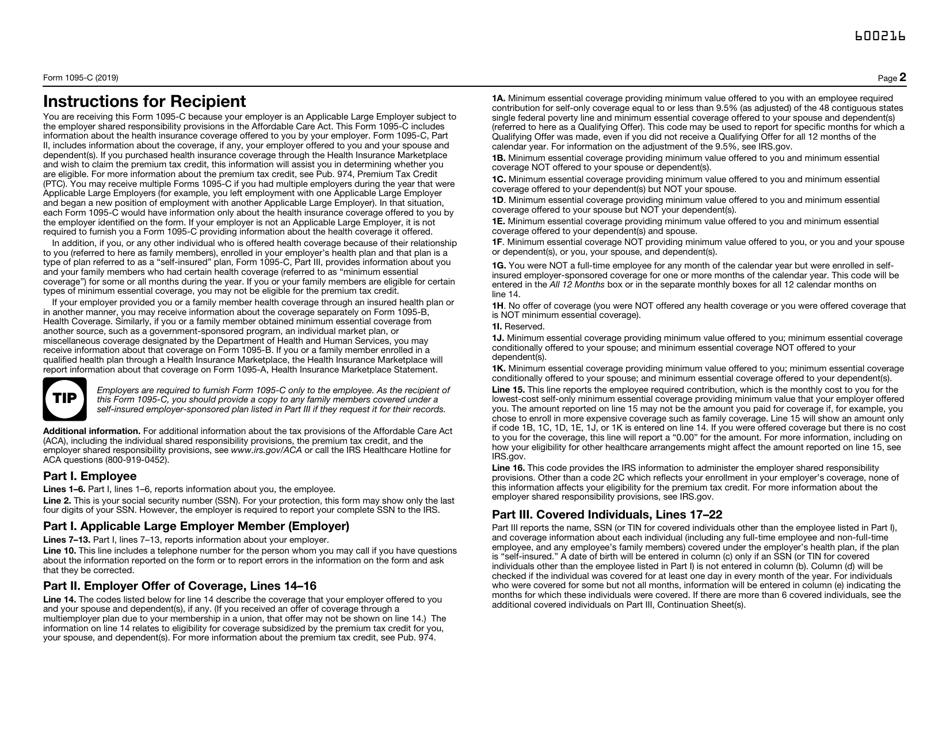

IRS Form 1095-C Instructions

Check out the official IRS-issued instructions for Form 1095-C for more tips and information.

Mail completed forms to the Department of the Treasury Internal Revenue Service Center in Austin, Texas (if you live in Alabama, Arizona, Arkansas, Connecticut, Delaware, Florida, Georgia, Kentucky, Louisiana, Maine, Massachusetts, Mississippi, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, Texas, Vermont, Virginia, West Virginia, and foreign countries) or to the Department of the Treasury Internal Revenue Service Center in Kansas City, Missouri (if you live in Alaska, California, Colorado, District of Columbia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Maryland, Michigan, Minnesota, Missouri, Montana, Nebraska, Nevada, North Dakota, Oklahoma, Oregon, South Carolina, South Dakota, Tennessee, Utah, Washington, Wisconsin, or Wyoming).

If you must send 250 forms or more, you have to file electronically.

How to Fill Out Form 1095-C?

- Part I - Employee. An employee means an individual who works as an employee under the common-law standard that outlines the employer-employee relationship. Provide the employee's full name, the social security number, and the complete address.

- Part I - Applicable Large Employer Member (Employer). This is a single employer, or a group of employers, that employed at least 50 full-time employees on business days throughout the calendar year to which the IRS 1095-C Form relates. Enter the employer's name, the employer identification number (EIN), the street address, and the telephone number.

- Part II - Employee Offer of Coverage. Use the box «Plan Start Month» to enter the two-digit number to state the calendar month during which the plan year begins for the employee who is offered coverage. Consult with the Instructions for the form to find the applicable codes for the Offer of Coverage and the section 4980H Safe Harbor and Other Relief (if applicable). State the amount of the employee required contribution.

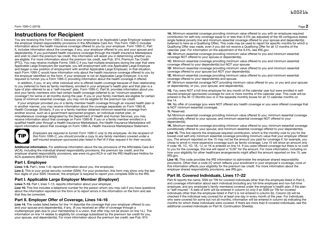

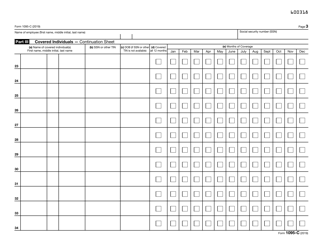

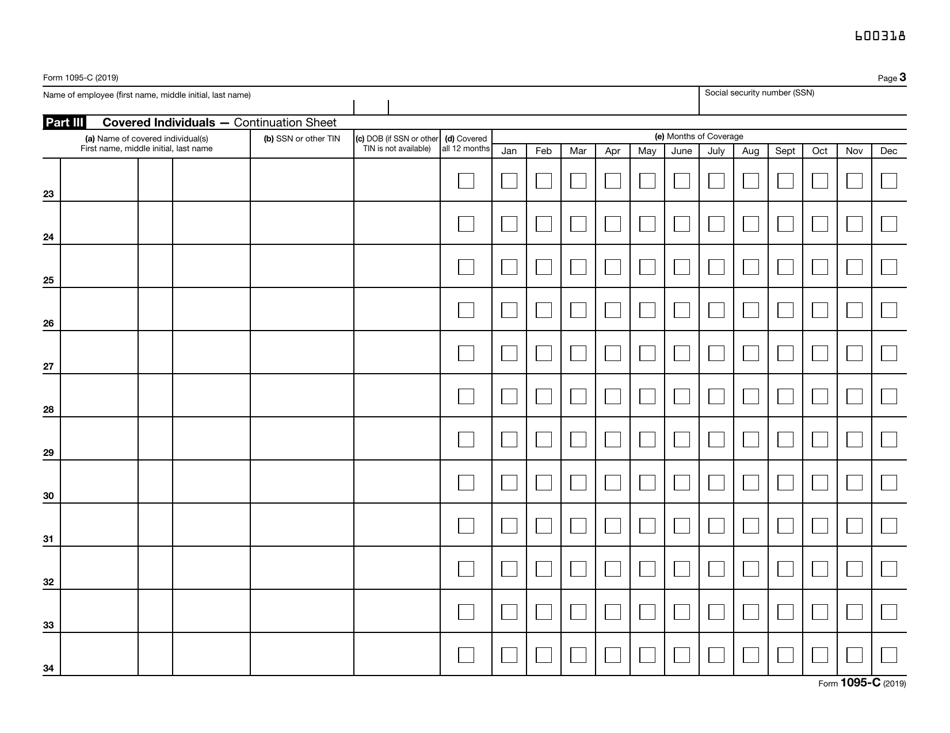

- Part III - Covered Individuals. Columns a, b, c, d, and e must be completed for every individual enrolled in the health insurance coverage, including the employee identified in Part I of the form. State each individual's full name, the social security number or the date of birth, and indicate the months in which the individual was covered.

IRS 1095-C Related Forms:

- IRS Form 1095-A, Health Insurance Marketplace Statement, is a related document used to inform the IRS about the individuals covered by a qualified health plan through the Health Insurance Marketplace. The health marketplace tax form is necessary to allow people to coordinate the credit on their returns with advance credit payments, to help them to claim the premium tax credit, and to complete a correct tax return.

- IRS Form 1095-B, Health Coverage, is a related form used to provide certain information to the IRS and the taxpayers about people who have minimum essential coverage and therefore cannot have liability for the individual shared responsibility payment - a fine required under the Affordable Care Act that the individuals and their families who do not possess health insurance must pay jointly. Minimum essential coverage includes individual market plans, plans sponsored by eligible employers, and programs sponsored by the government.