This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1040 (1040-SR) Schedule H

for the current year.

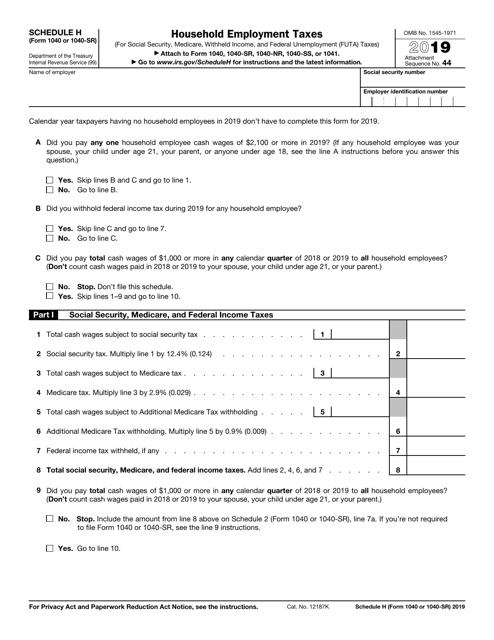

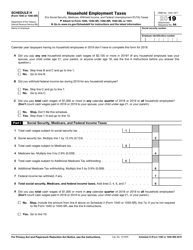

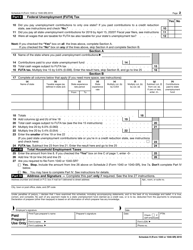

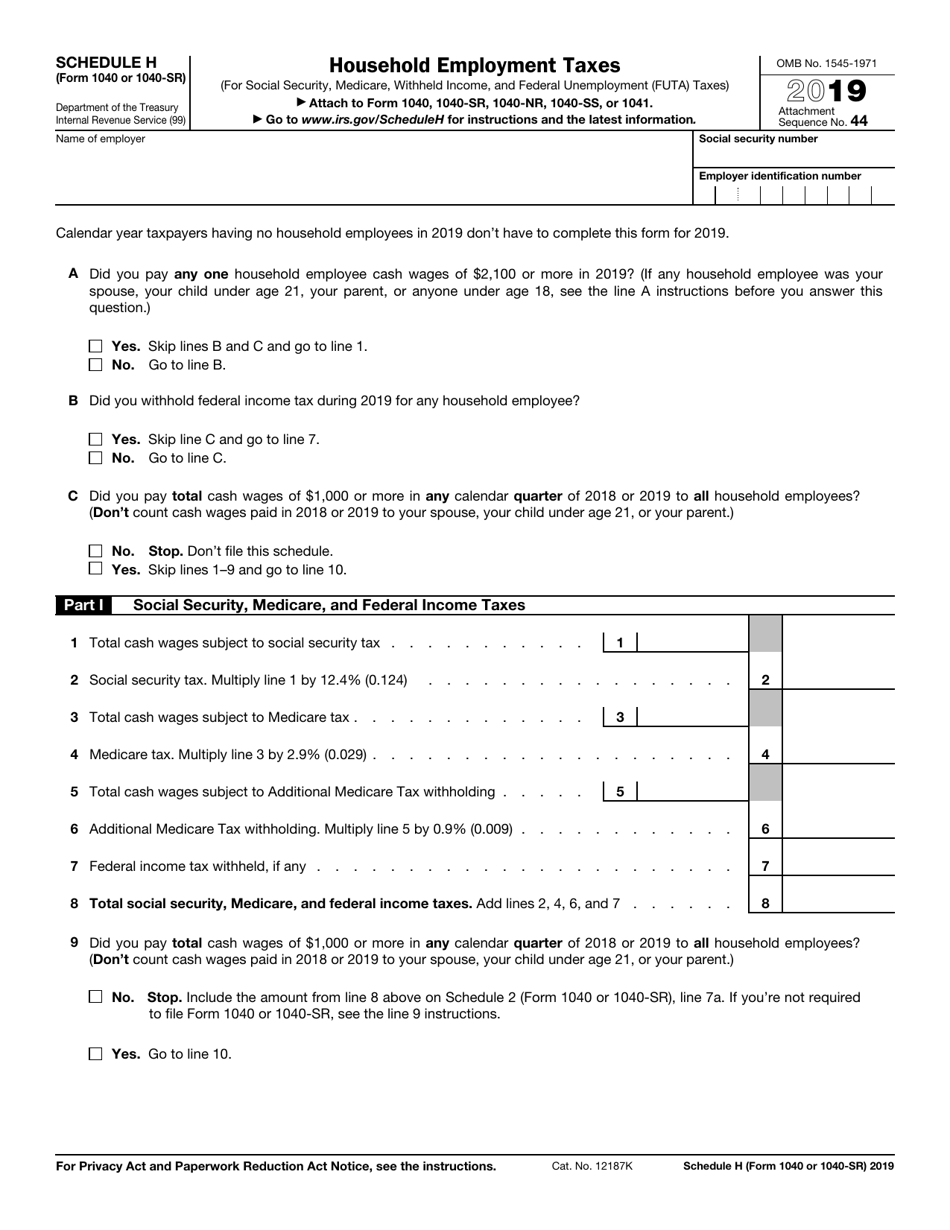

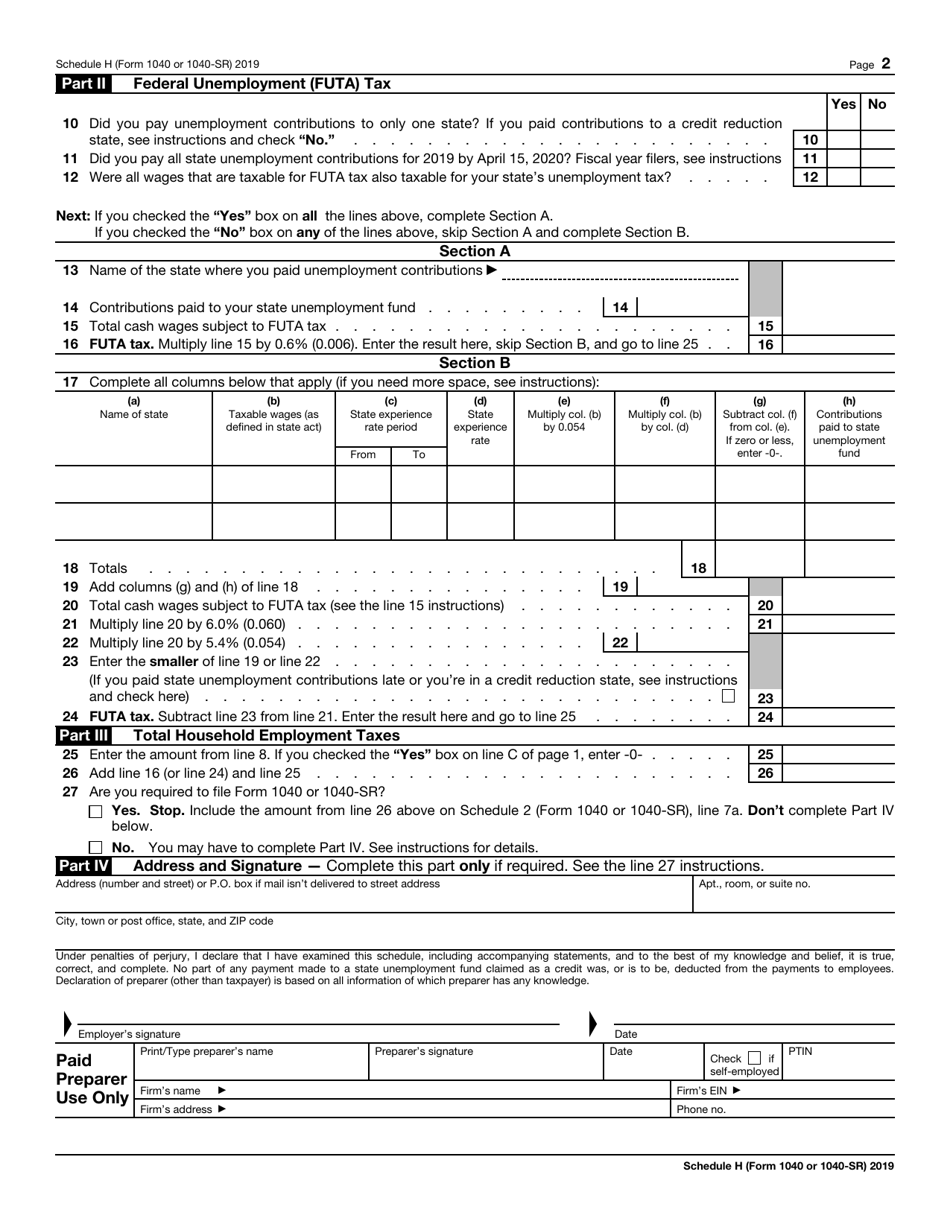

IRS Form 1040 (1040-SR) Schedule H Household Employment Taxes

What Is IRS Form 1040 (1040-SR) Schedule H?

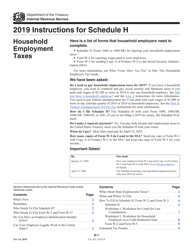

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1040, and IRS Form 1040-SR. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1040?

A: IRS Form 1040 is the standard individual income tax return form for U.S. taxpayers.

Q: What is IRS Form 1040-SR?

A: IRS Form 1040-SR is a simplified version of Form 1040 designed specifically for taxpayers who are 65 years of age or older.

Q: What is Schedule H?

A: Schedule H is an additional form that is used to report household employment taxes.

Q: What are household employment taxes?

A: Household employment taxes are the taxes that employers must pay for employees, such as nannies, housekeepers, and other domestic workers.

Q: Who is required to file Schedule H?

A: You may be required to file Schedule H if you have paid household employees a certain amount of wages during the tax year.

Q: What information is required on Schedule H?

A: Schedule H requires you to provide information about the wages you paid to household employees, calculate the taxes owed, and report any tax credits or exemptions.

Q: When is Schedule H due?

A: Schedule H is generally due on the same day as your individual income tax return (Form 1040 or 1040-SR), which is usually April 15th.

Q: What happens if I don't file Schedule H?

A: Failure to file Schedule H when required may result in penalties and interest charges.

Q: Can I e-file Schedule H?

A: Yes, you can e-file Schedule H along with your individual income tax return.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1040 (1040-SR) Schedule H through the link below or browse more documents in our library of IRS Forms.