This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 990, 990-EZ Schedule A

for the current year.

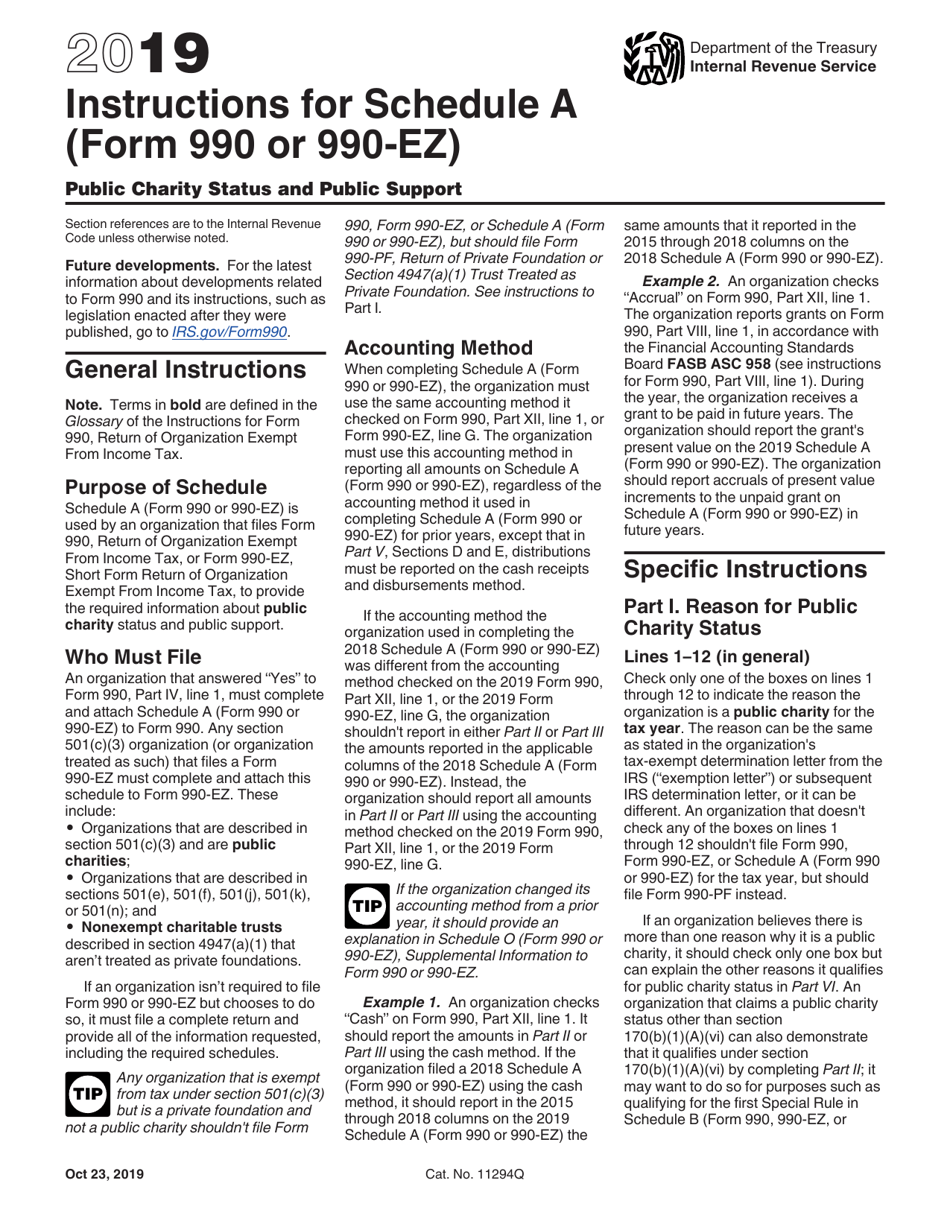

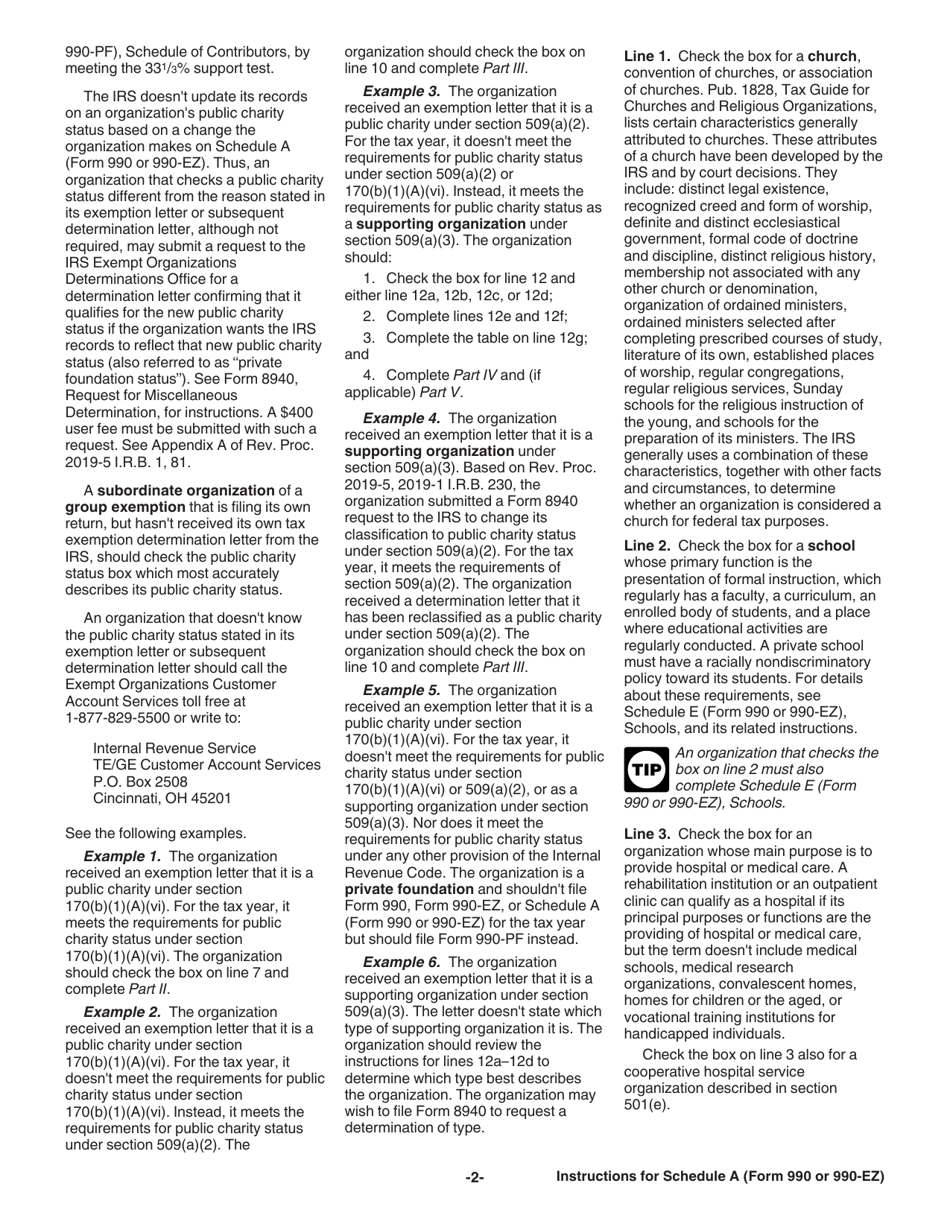

Instructions for IRS Form 990, 990-EZ Schedule A Public Charity Status and Public Support

This document contains official instructions for IRS Form 990 Schedule A and IRS Form 990-EZ Schedule A . Both forms are released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 990 (990-EZ) Schedule A is available for download through this link.

FAQ

Q: What is IRS Form 990?

A: IRS Form 990 is a tax form used by tax-exempt organizations to provide specific information about their activities and finances to the Internal Revenue Service (IRS).

Q: What is IRS Form 990-EZ?

A: IRS Form 990-EZ is a simplified version of Form 990 and is used by smaller tax-exempt organizations to report their financial information.

Q: What is Schedule A?

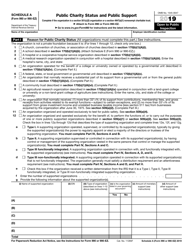

A: Schedule A is an attachment to Form 990 or 990-EZ that public charities use to provide information about their public charity status and public support.

Q: What is public charity status?

A: Public charity status is a designation given to certain tax-exempt organizations that receive a substantial amount of their support from the general public or governmental units.

Q: What is public support?

A: Public support refers to the types of financial contributions that a tax-exempt organization receives from the public, such as donations, grants, and membership fees.

Q: Why is Schedule A important?

A: Schedule A is important because it helps the IRS determine if a tax-exempt organization qualifies for public charity status and whether it has sufficient public support.

Q: What information is required in Schedule A?

A: Schedule A requires information about the organization's income and expenses, public support percentage, and types of public support received.

Instruction Details:

- This 19-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.