This version of the form is not currently in use and is provided for reference only. Download this version of

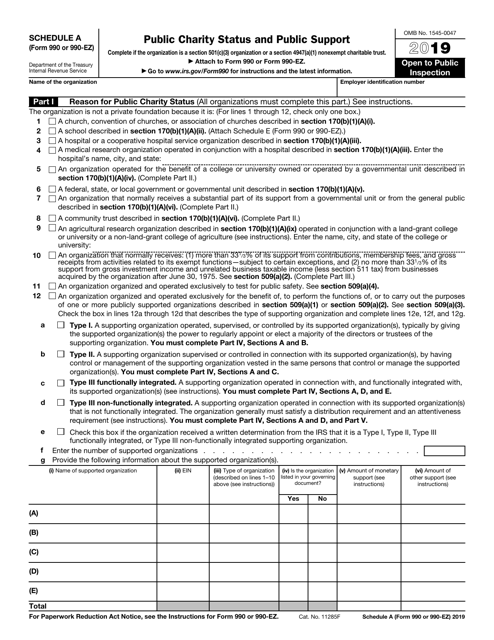

IRS Form 990 (990-EZ) Schedule A

for the current year.

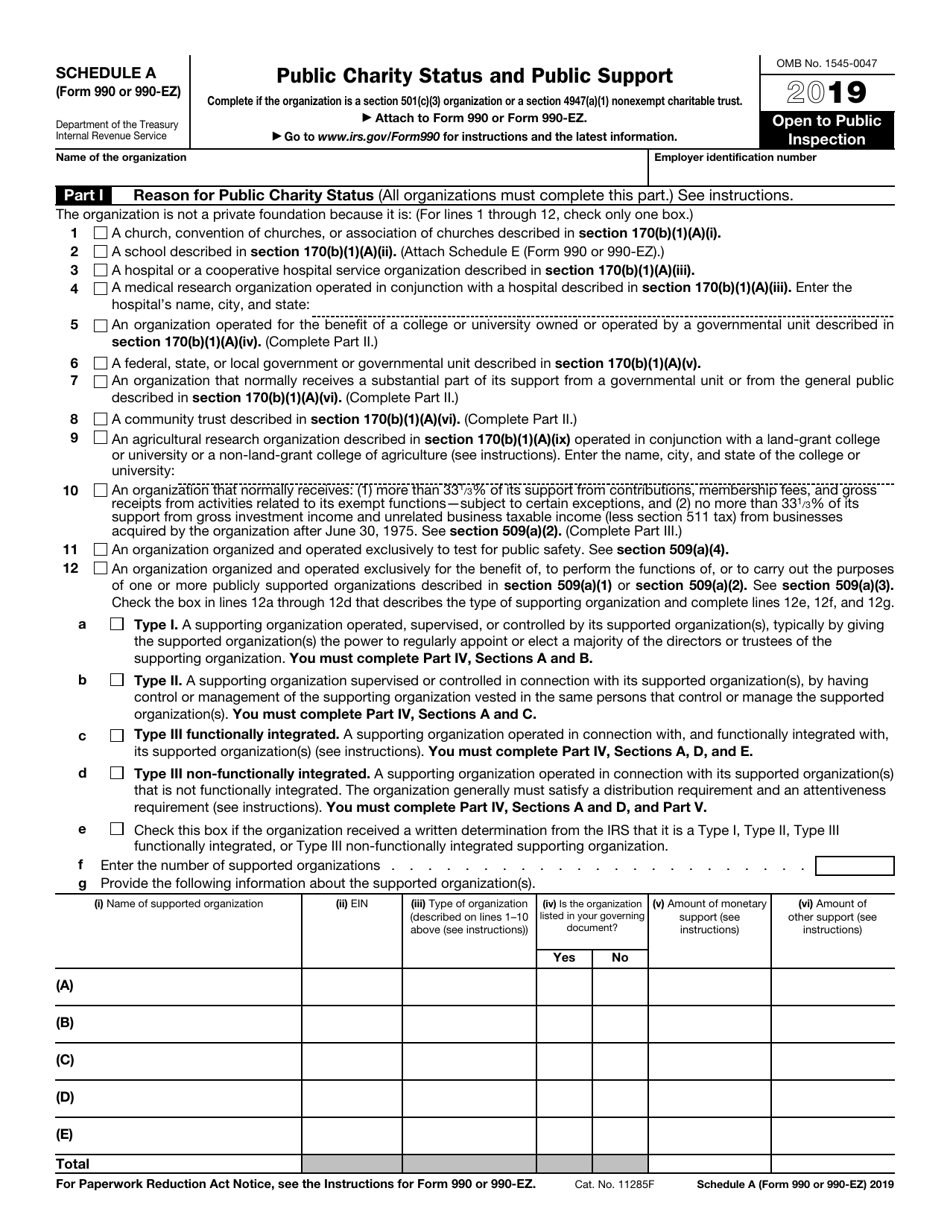

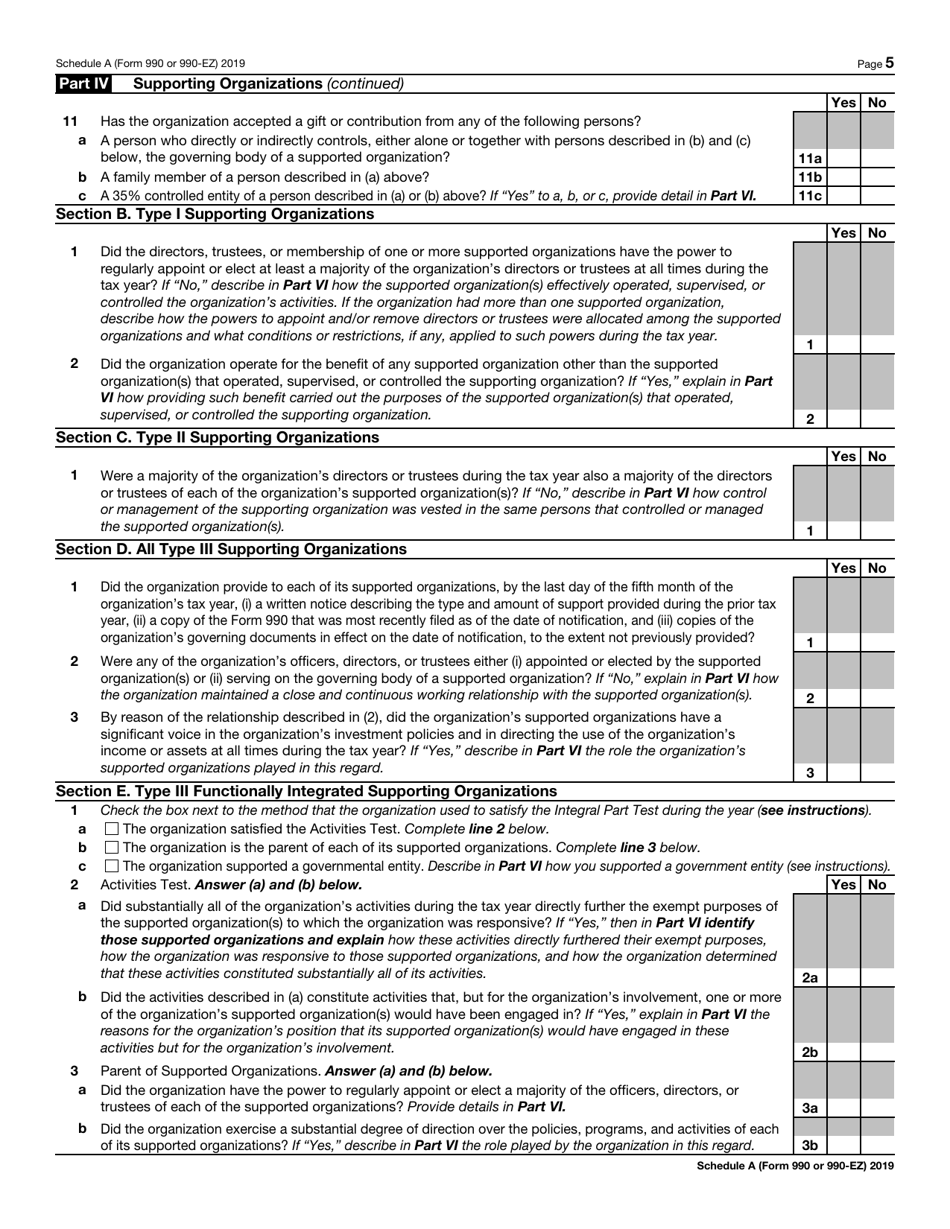

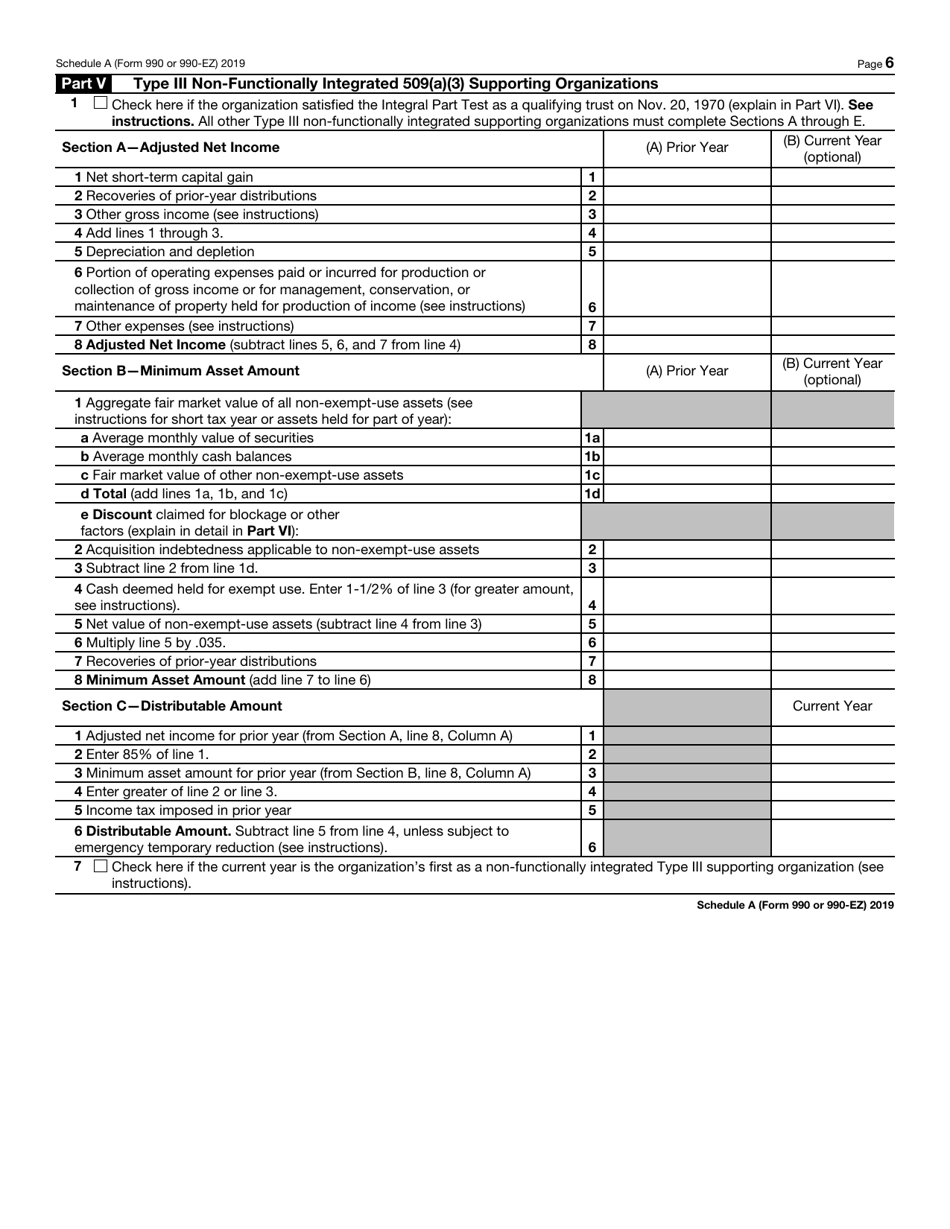

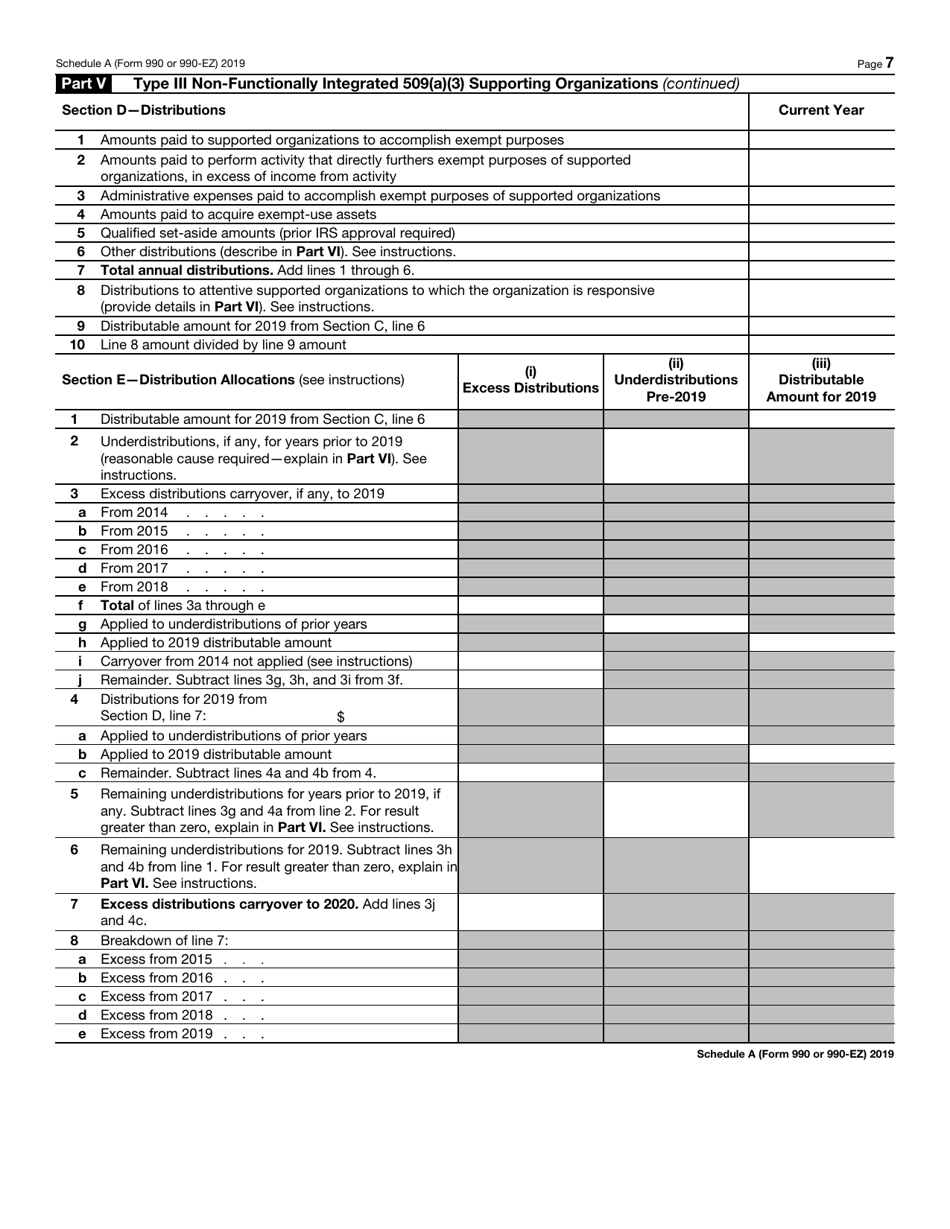

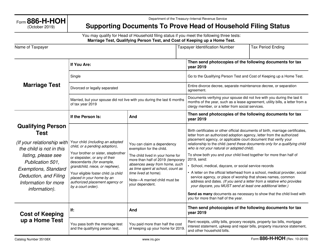

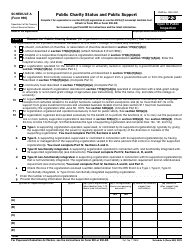

IRS Form 990 (990-EZ) Schedule A Public Charity Status and Public Support

What Is IRS Form 990 (990-EZ) Schedule A?

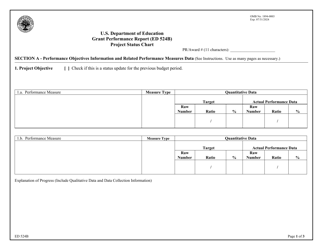

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 990, and IRS Form 990-EZ. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 990?

A: IRS Form 990 is a tax form used by tax-exempt organizations to report financial information to the Internal Revenue Service (IRS).

Q: What is IRS Form 990-EZ?

A: IRS Form 990-EZ is a simplified version of Form 990, which is available to certain tax-exempt organizations with less than $200,000 in gross receipts and less than $500,000 in total assets.

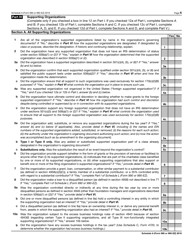

Q: What is Schedule A on IRS Form 990?

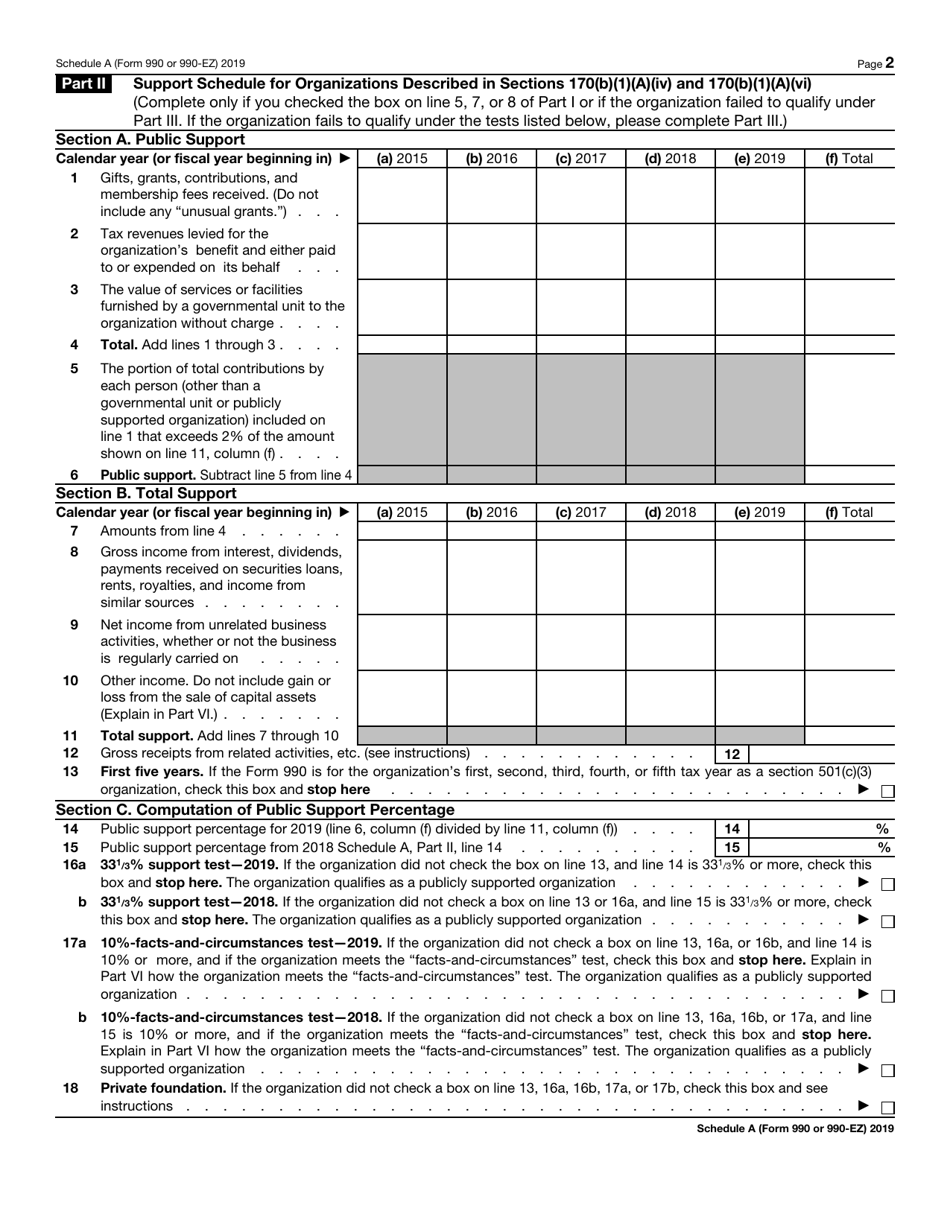

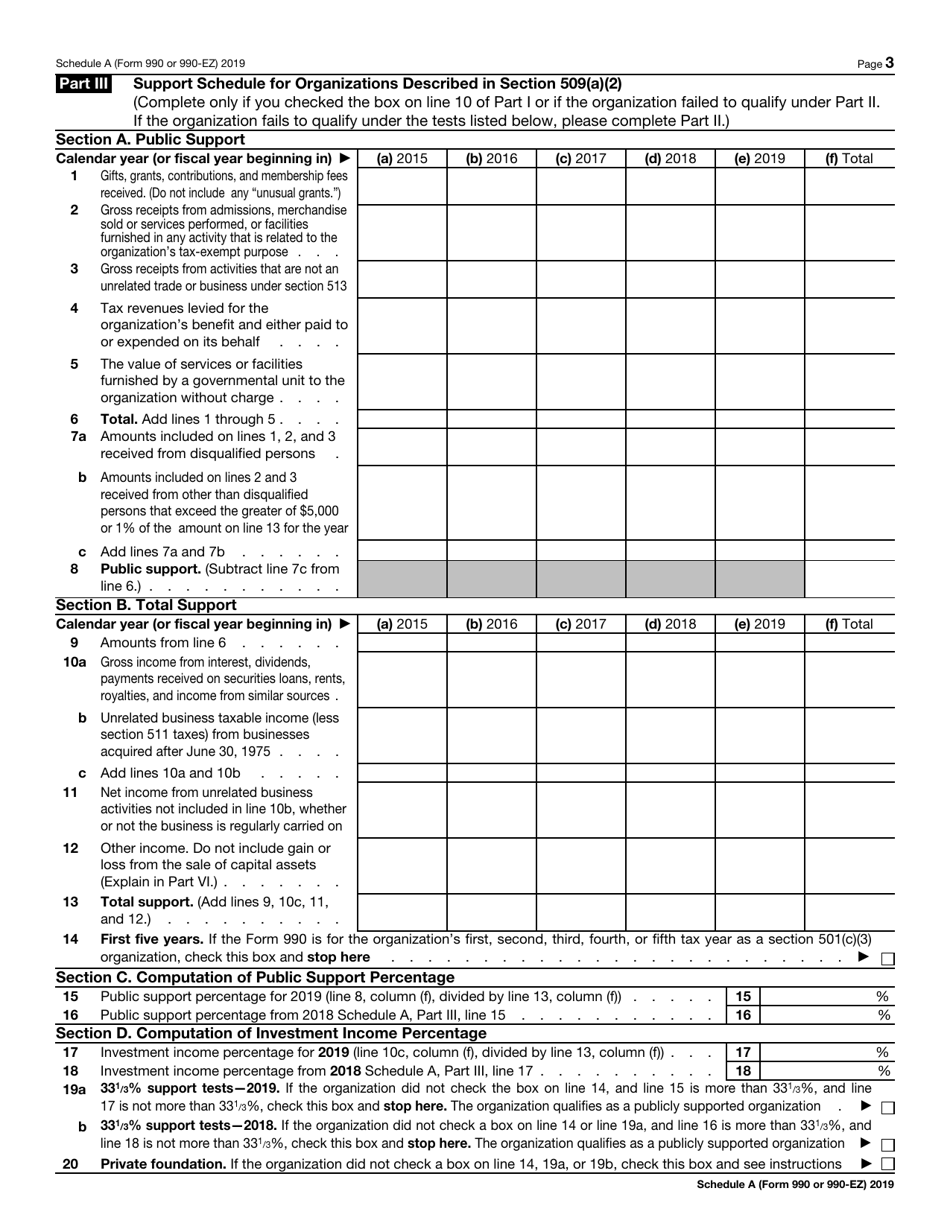

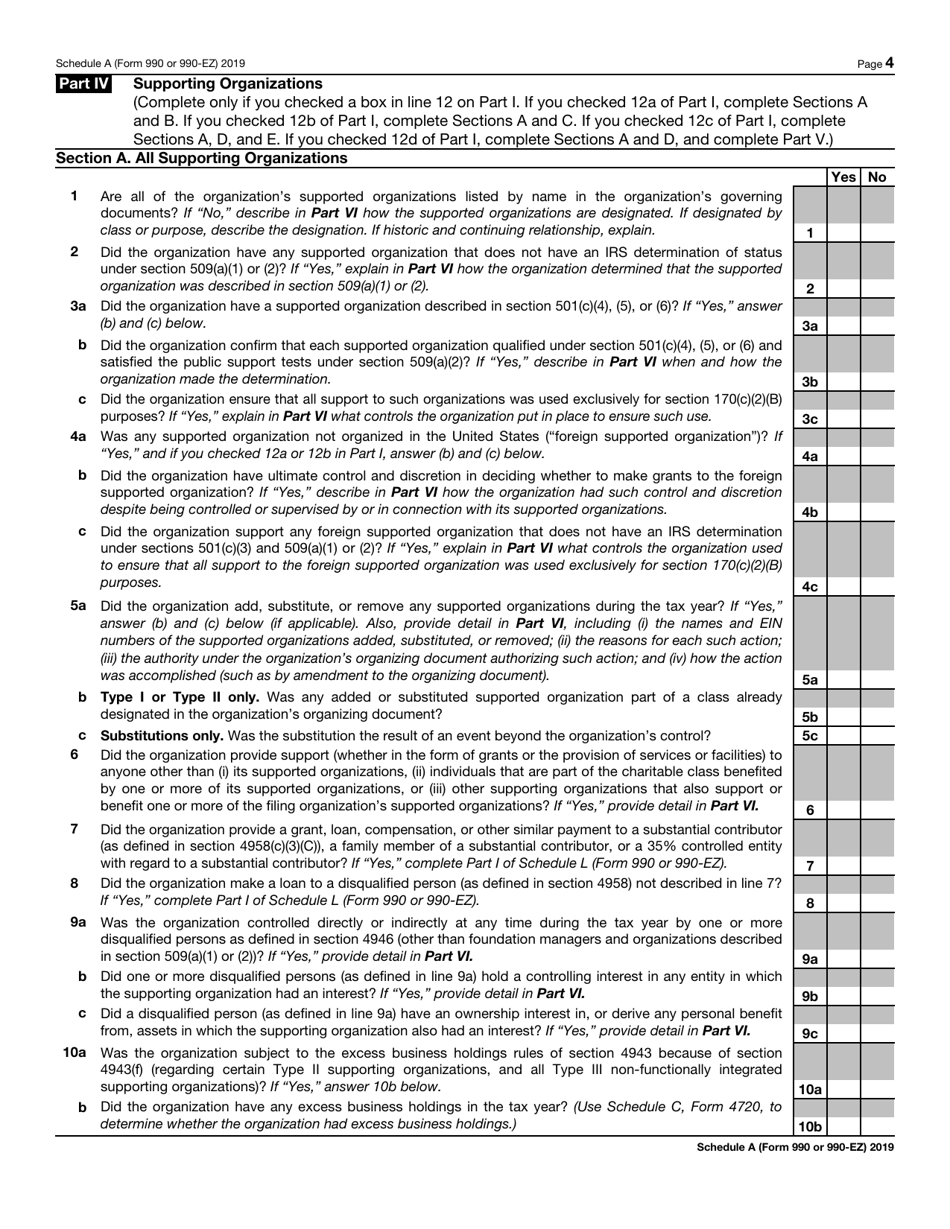

A: Schedule A is a section of IRS Form 990 (or 990-EZ) used to report public charity status and public support for tax-exempt organizations.

Q: What is public charity status?

A: Public charity status is a designation given to tax-exempt organizations that receive a substantial amount of funding from the general public or a broad range of sources.

Q: What is public support?

A: Public support refers to the sources of funding that a tax-exempt organization receives from the general public or a broad range of sources, as opposed to receiving funds from a limited number of individuals or organizations.

Q: Why is Schedule A important?

A: Schedule A is important because it provides crucial information about a tax-exempt organization's public charity status and public support, which can affect its tax-exempt status and eligibility for certain benefits and grants.

Q: Who needs to file Schedule A?

A: Tax-exempt organizations that are required to file IRS Form 990 or 990-EZ need to complete Schedule A if they claim public charity status and want to report their public support.

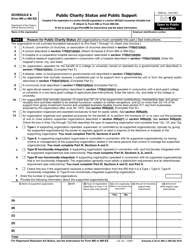

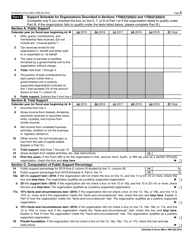

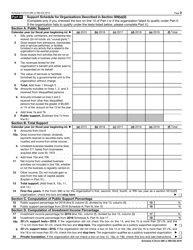

Q: What information is required on Schedule A?

A: Schedule A requires tax-exempt organizations to provide details about their public charity status, sources of public support, and financial information related to their public support.

Form Details:

- A 8-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 990 (990-EZ) Schedule A through the link below or browse more documents in our library of IRS Forms.