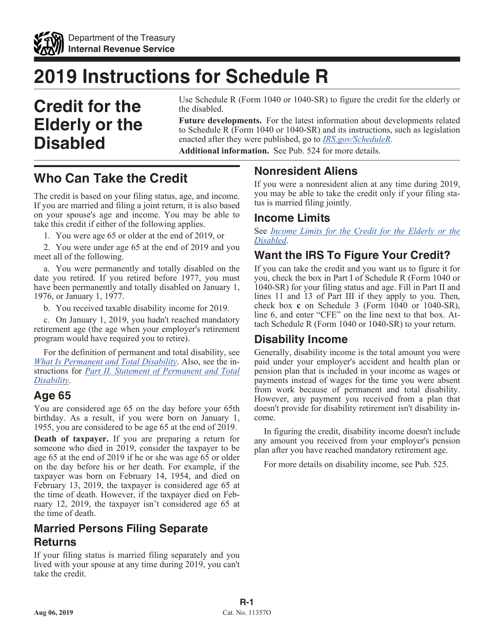

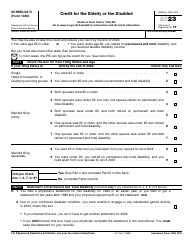

Instructions for IRS Form 1040, 1040-SR Credit for the Elderly or the Disabled

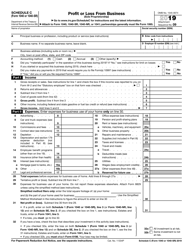

This document contains official instructions for IRS Form 1040 , and IRS Form 1040-SR . Both forms are released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1040 (1040-SR) Schedule C is available for download through this link.

FAQ

Q: What is IRS Form 1040?

A: IRS Form 1040 is the standard individual income tax return form used by U.S. residents to file their annual income taxes.

Q: What is IRS Form 1040-SR?

A: IRS Form 1040-SR is a simplified version of Form 1040 designed for individuals who are 65 years or older.

Q: What is the Credit for the Elderly or the Disabled?

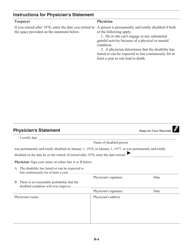

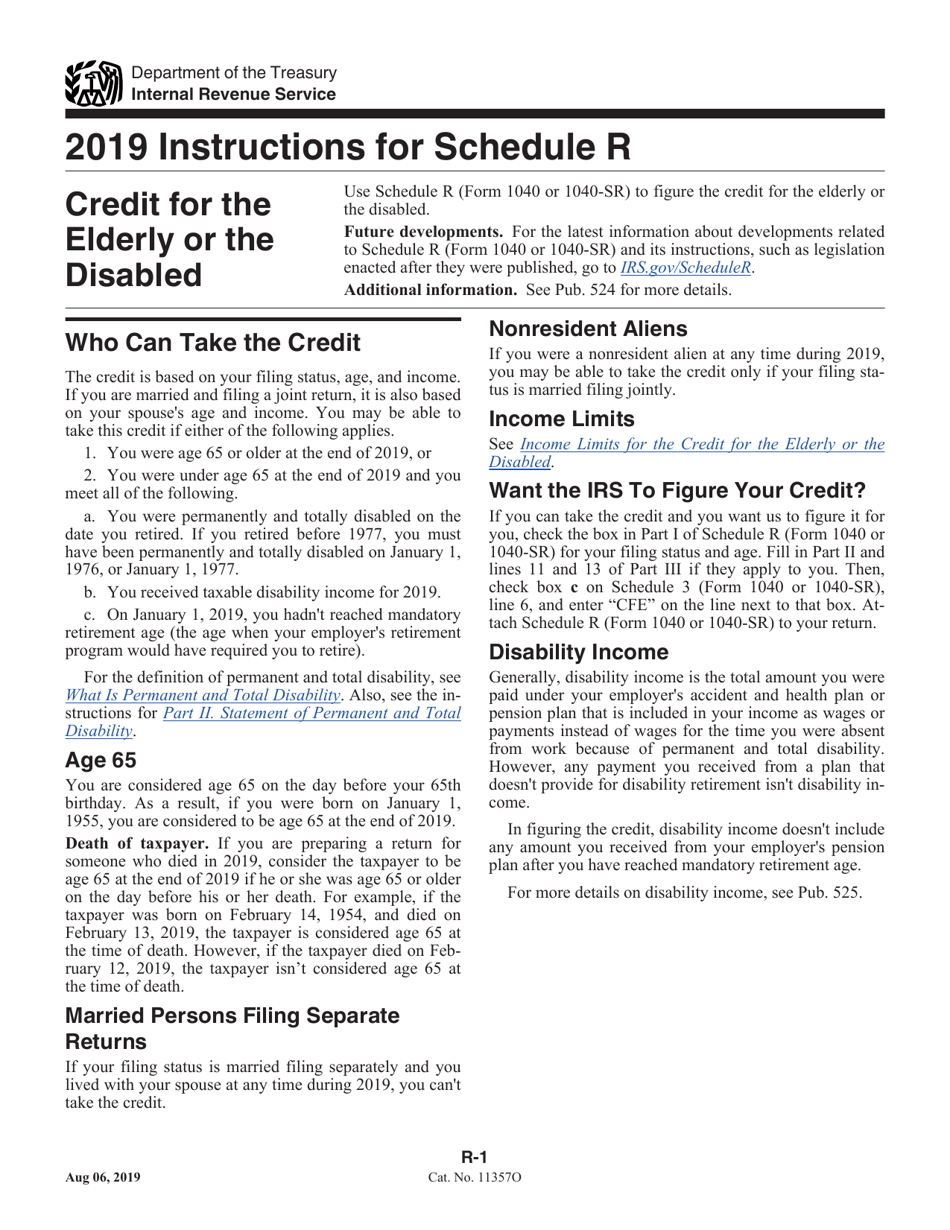

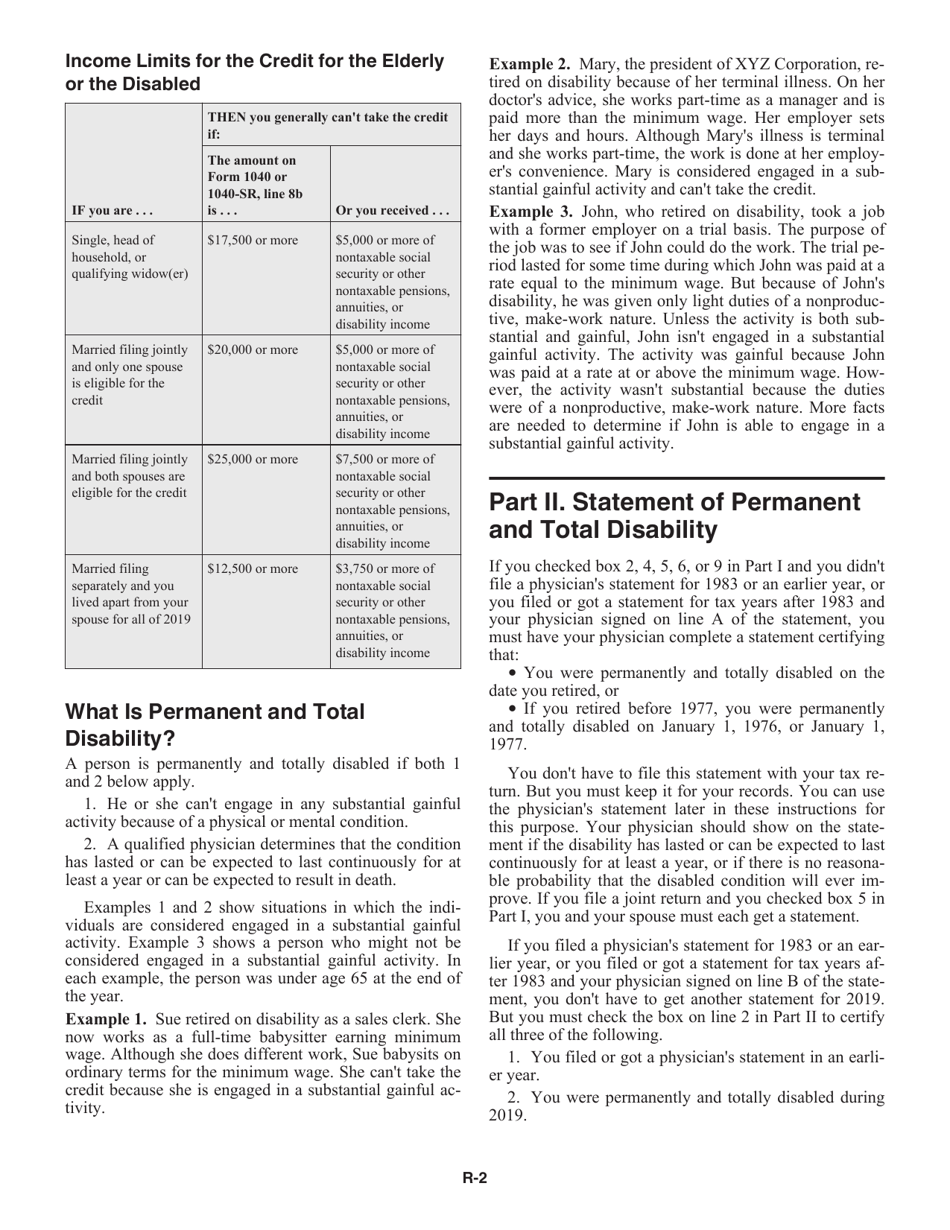

A: The Credit for the Elderly or the Disabled is a tax credit that can be claimed by eligible individuals who are either 65 years or older, or under 65 and retired on permanent and total disability.

Q: Who is eligible for the Credit for the Elderly or the Disabled?

A: To be eligible for the Credit for the Elderly or the Disabled, you must meet specific age or disability criteria and have a certain level of taxable income.

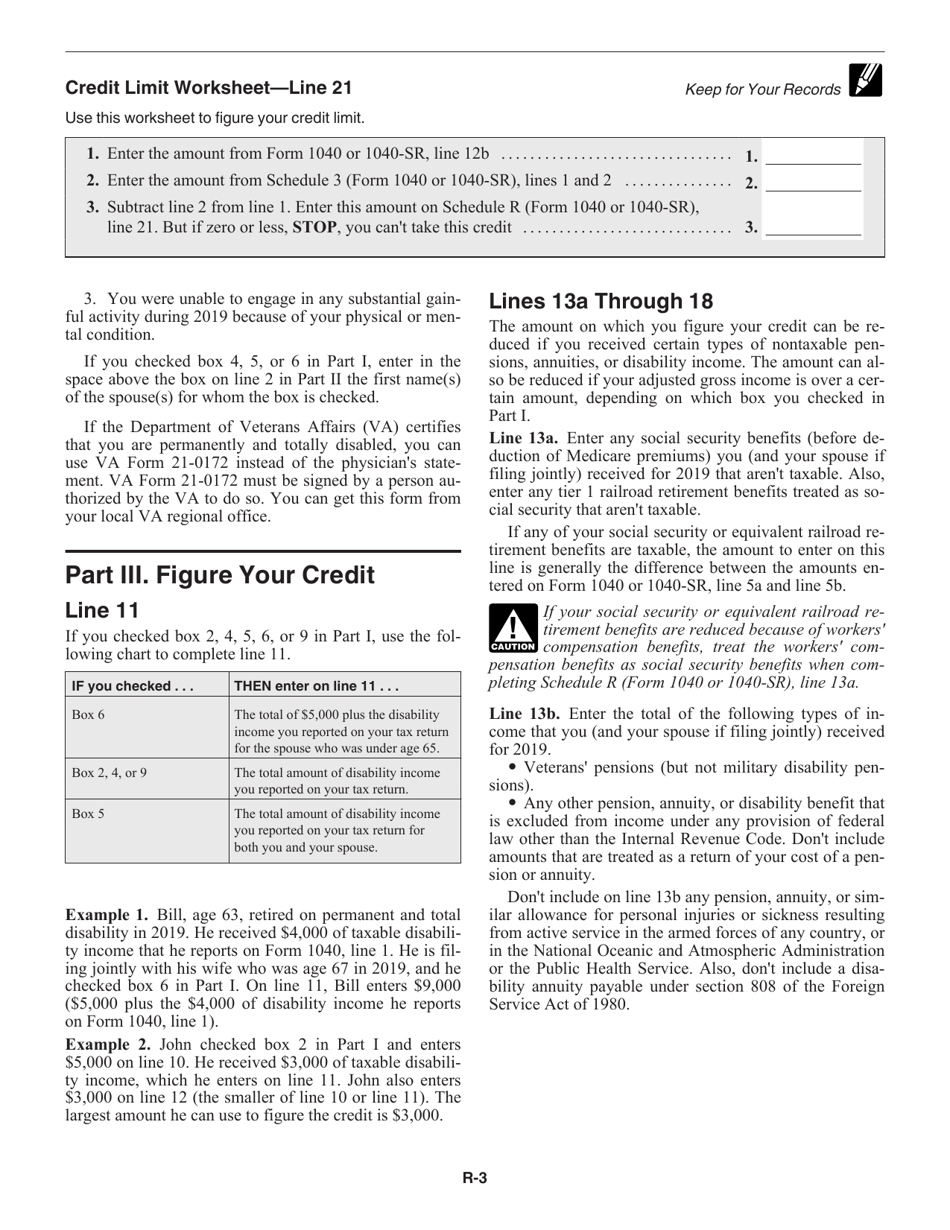

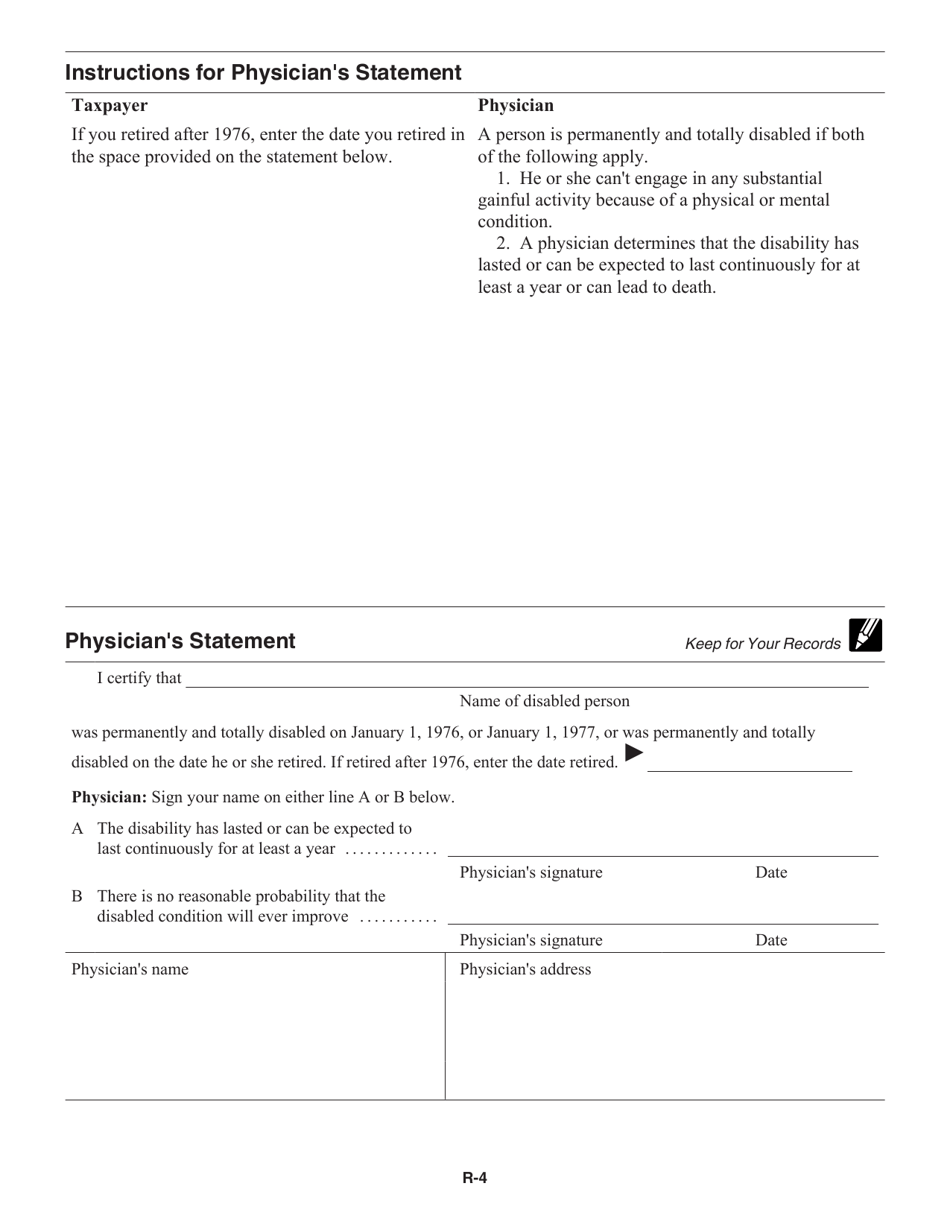

Q: How do I claim the Credit for the Elderly or the Disabled?

A: To claim the Credit for the Elderly or the Disabled, you need to complete either Form 1040 or Form 1040-SR and include the necessary information and documentation.

Instruction Details:

- This 4-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.