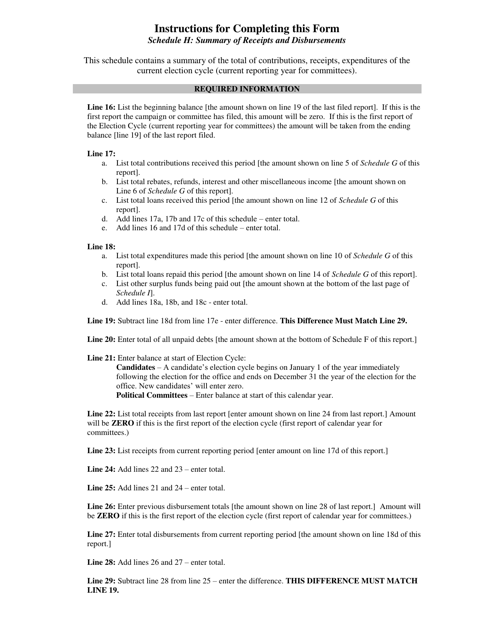

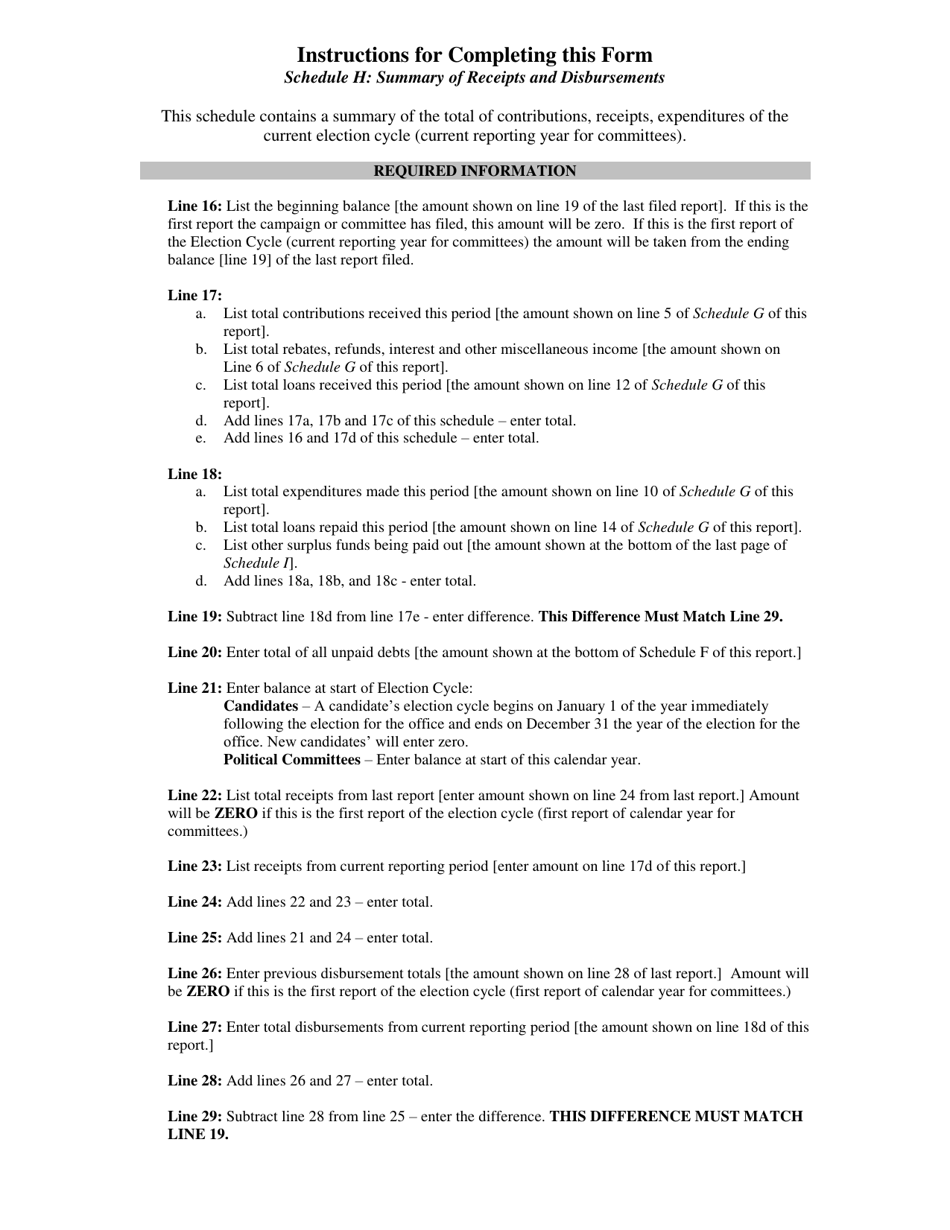

Instructions for Schedule H Summary of Receipts and Disbursements - Virginia

This document contains official instructions for Schedule H , Summary of Receipts and Disbursements - a form released and collected by the Virginia Department of Elections.

FAQ

Q: What is Schedule H?

A: Schedule H is a form that summarizes the receipts and disbursements of an organization.

Q: Who needs to fill out Schedule H?

A: Nonprofit organizations in Virginia that are required to file Form 990 or Form 990-EZ with the IRS need to fill out Schedule H.

Q: What information is required on Schedule H?

A: Schedule H requires information about the organization's total receipts, total disbursements, and any additional details about significant transactions.

Q: When is Schedule H due?

A: Schedule H is due with the organization's annual filing of Form 990 or Form 990-EZ.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Virginia Department of Elections.