Instructions for FEC Form 3X Report of Receipts and Disbursements for Other Than an Authorized Committee

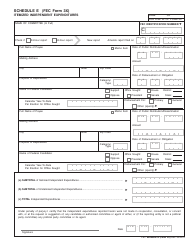

This document contains official instructions for FEC Form 3X , Report of Receipts and Disbursements for Other Than an Authorized Committee - a form released and collected by the Federal Election Commission. An up-to-date fillable FEC Form 3X Schedule E is available for download through this link.

FAQ

Q: What is FEC Form 3X?

A: FEC Form 3X is a report used to disclose the receipts and disbursements of political committees other than authorized committees.

Q: Who needs to file FEC Form 3X?

A: Political committees other than authorized committees need to file FEC Form 3X to disclose their financial activity.

Q: What is the purpose of filing FEC Form 3X?

A: The purpose of filing FEC Form 3X is to provide transparency and accountability in the fundraising and spending activities of political committees.

Q: What information needs to be reported on FEC Form 3X?

A: FEC Form 3X requires the reporting of receipts, disbursements, debts, loans, and contributions received or made by the political committee.

Q: When is FEC Form 3X due?

A: FEC Form 3X is due on a semi-annual basis, with reporting periods ending on June 30th and December 31st.

Q: Are there any filing fees associated with FEC Form 3X?

A: No, there are no filing fees associated with FEC Form 3X.

Q: What happens if a political committee fails to file FEC Form 3X?

A: Failure to file FEC Form 3X can result in penalties and legal consequences, including fines and potential legal action.

Q: Is FEC Form 3X the only form for reporting financial activity?

A: No, FEC Form 3X is specific to political committees other than authorized committees. There are other forms for reporting financial activity by different types of political entities.

Instruction Details:

- This 33-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Federal Election Commission.