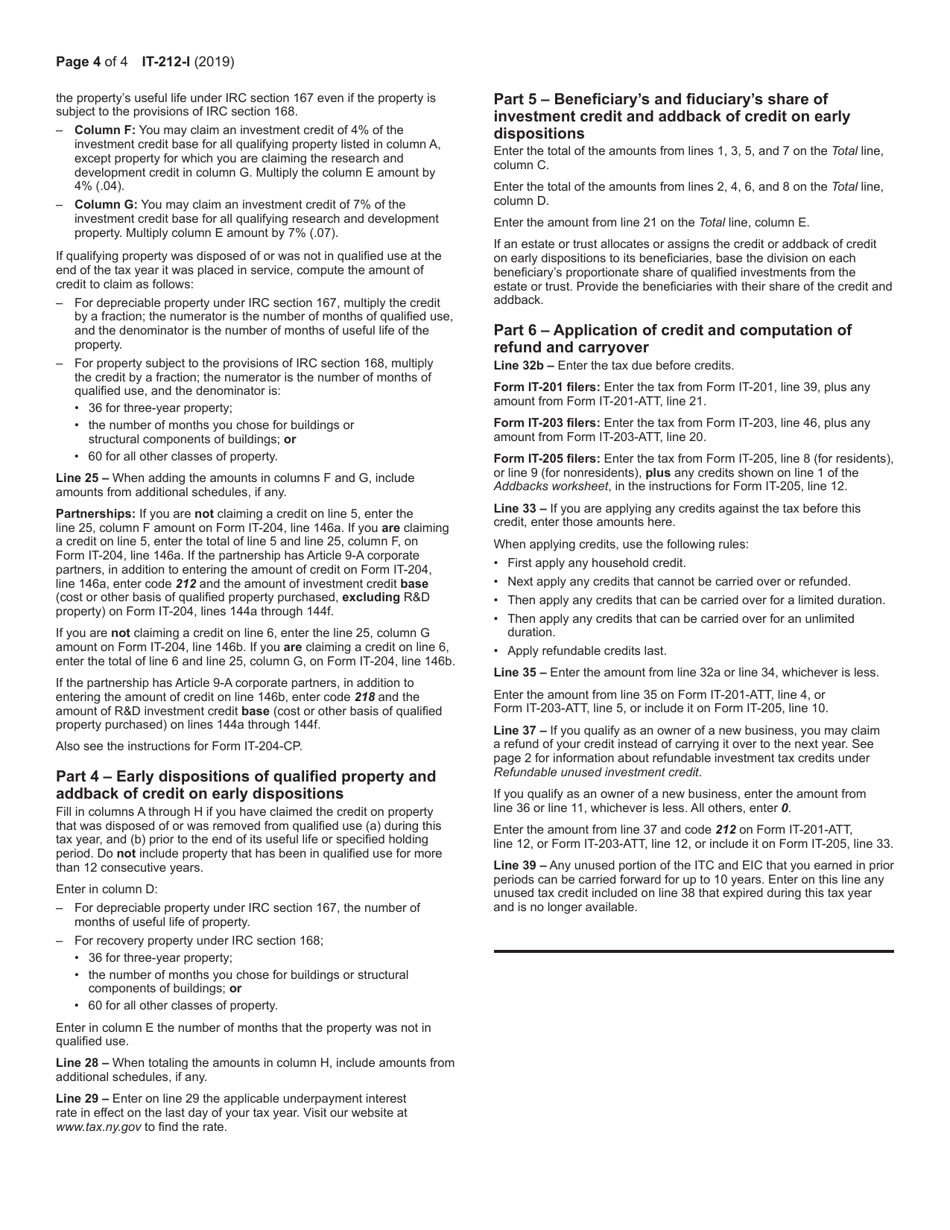

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form IT-212

for the current year.

Instructions for Form IT-212 Investment Credit - New York

This document contains official instructions for Form IT-212 , Investment Credit - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form IT-212 is available for download through this link.

FAQ

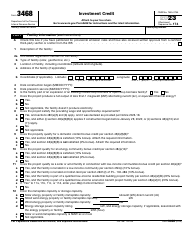

Q: What is Form IT-212?

A: Form IT-212 is a New York state tax form used to claim the Investment Credit.

Q: What is the Investment Credit?

A: The Investment Credit is a tax credit available to individuals and businesses in New York who make qualified investments in certain industries.

Q: Who can claim the Investment Credit?

A: Both individuals and businesses in New York who make qualified investments may be eligible to claim the Investment Credit.

Q: What types of investments are eligible for the credit?

A: Qualified investments may include the purchase of equipment, machinery, or property used in certain industries, such as manufacturing, research and development, and green energy.

Q: How do I fill out Form IT-212?

A: You will need to provide information about your qualified investments, including the amount of the credit you are claiming and supporting documentation.

Q: When is the deadline to file Form IT-212?

A: The deadline to file Form IT-212 is typically the same as your personal or business tax return deadline, which is usually April 15th for individuals.

Q: Are there any limitations or restrictions on claiming the Investment Credit?

A: Yes, there are certain limitations and restrictions, including a maximum credit amount and eligibility requirements based on the type of investment and industry.

Q: Can I claim the Investment Credit if I don't live in New York?

A: No, the Investment Credit is specific to investments made in New York state, so you must be a resident of New York or have a business located in New York to qualify.

Q: What should I do if I have questions or need help with Form IT-212?

A: You can contact the New York State Department of Taxation and Finance directly for assistance with Form IT-212 or consult with a tax professional.

Instruction Details:

- This 4-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.