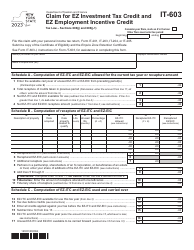

This version of the form is not currently in use and is provided for reference only. Download this version of

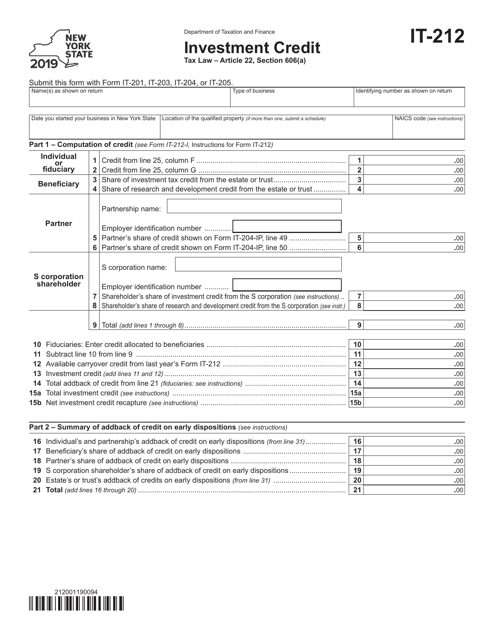

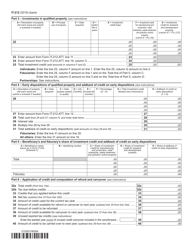

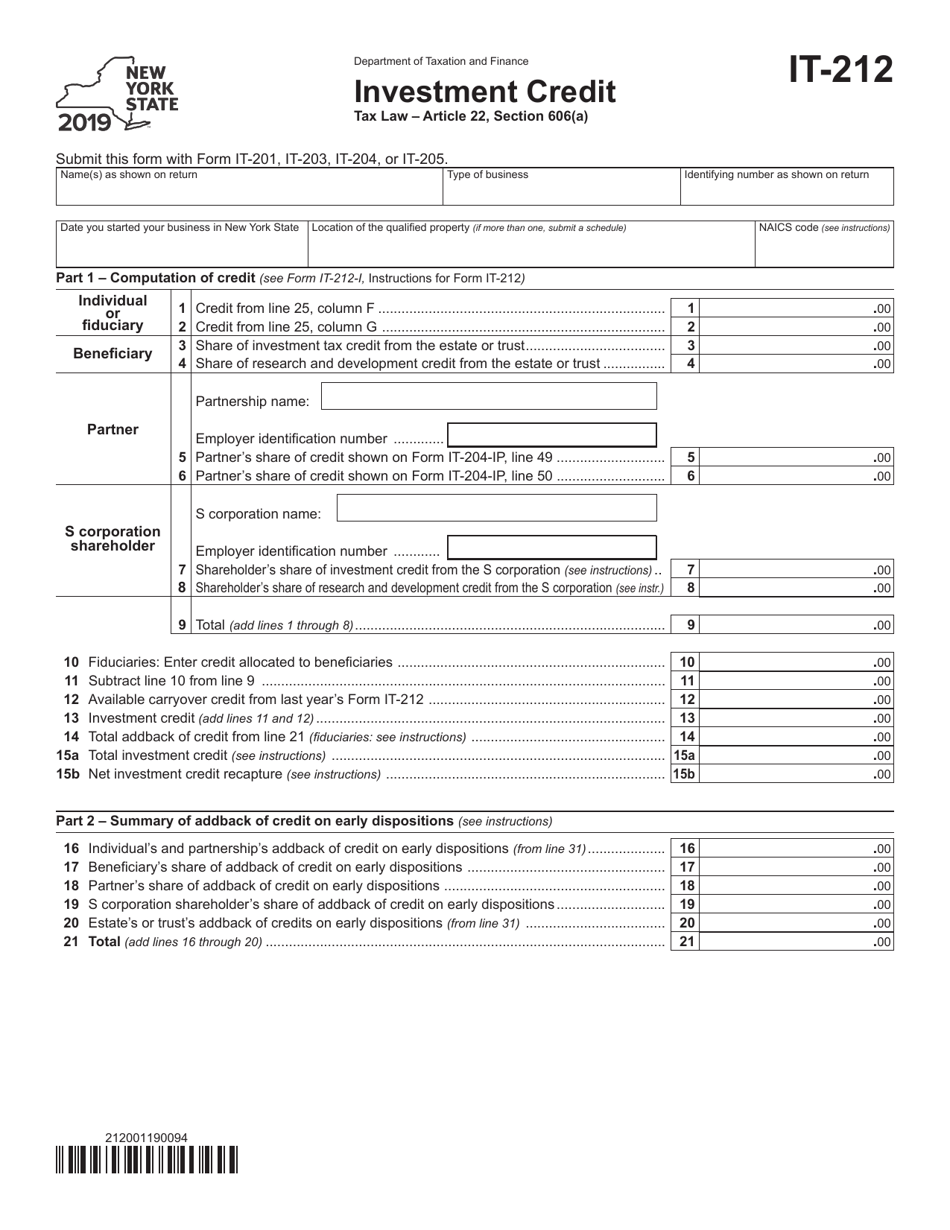

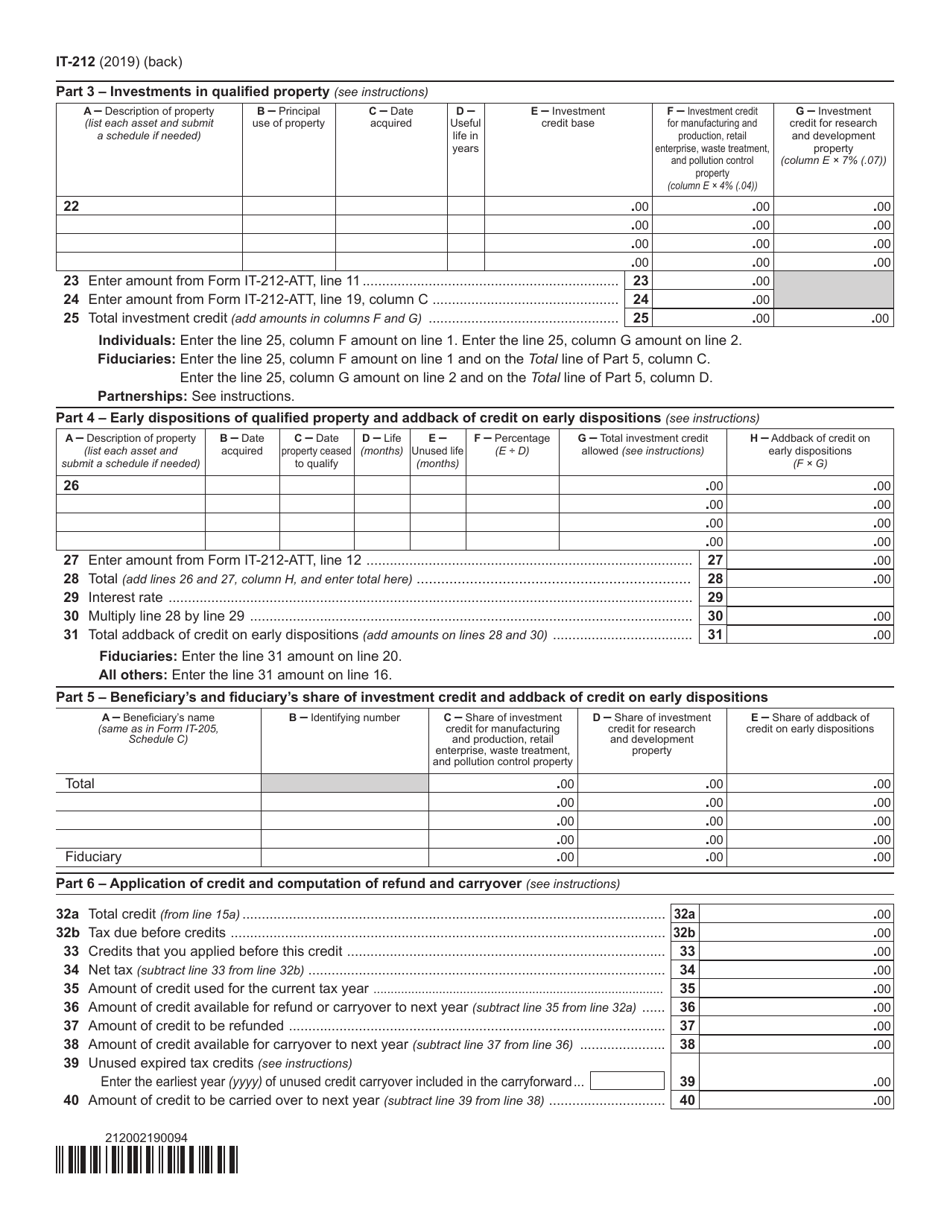

Form IT-212

for the current year.

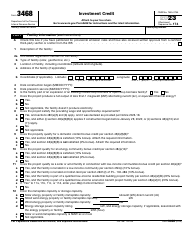

Form IT-212 Investment Credit - New York

What Is Form IT-212?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-212?

A: Form IT-212 is a tax form used in New York to claim the Investment Credit.

Q: Who can use Form IT-212?

A: Individuals and businesses in New York who qualify for the Investment Credit can use Form IT-212.

Q: What is the Investment Credit?

A: The Investment Credit is a tax credit available to taxpayers in New York who make eligible investments in qualified businesses.

Q: What information is required on Form IT-212?

A: Form IT-212 requires information about the taxpayer's investments in qualified businesses, including the investment amount and the business identification number.

Q: When is the deadline to file Form IT-212?

A: The deadline to file Form IT-212 is the same as the deadline for filing your New York State income tax return, which is usually April 15th.

Q: Can I file Form IT-212 electronically?

A: Yes, Form IT-212 can be filed electronically if you are e-filing your New York State income tax return.

Q: Is the Investment Credit refundable?

A: No, the Investment Credit is non-refundable, meaning it can only reduce your tax liability to zero but cannot result in a refund.

Q: Do I need to include supporting documentation with Form IT-212?

A: Yes, you must include documentation to support your claimed investments in qualified businesses, such as investment certificates or statements.

Q: What should I do if I have questions about Form IT-212?

A: If you have questions about Form IT-212 or the Investment Credit, you can contact the New York State Department of Taxation and Finance or consult a tax professional.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-212 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.