This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC626

for the current year.

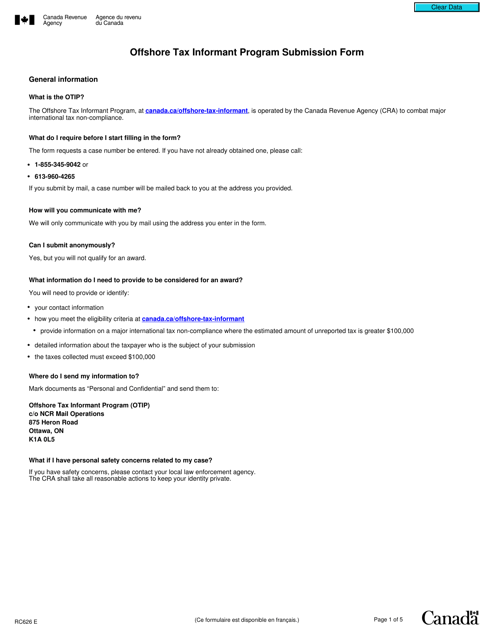

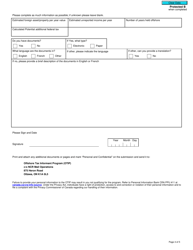

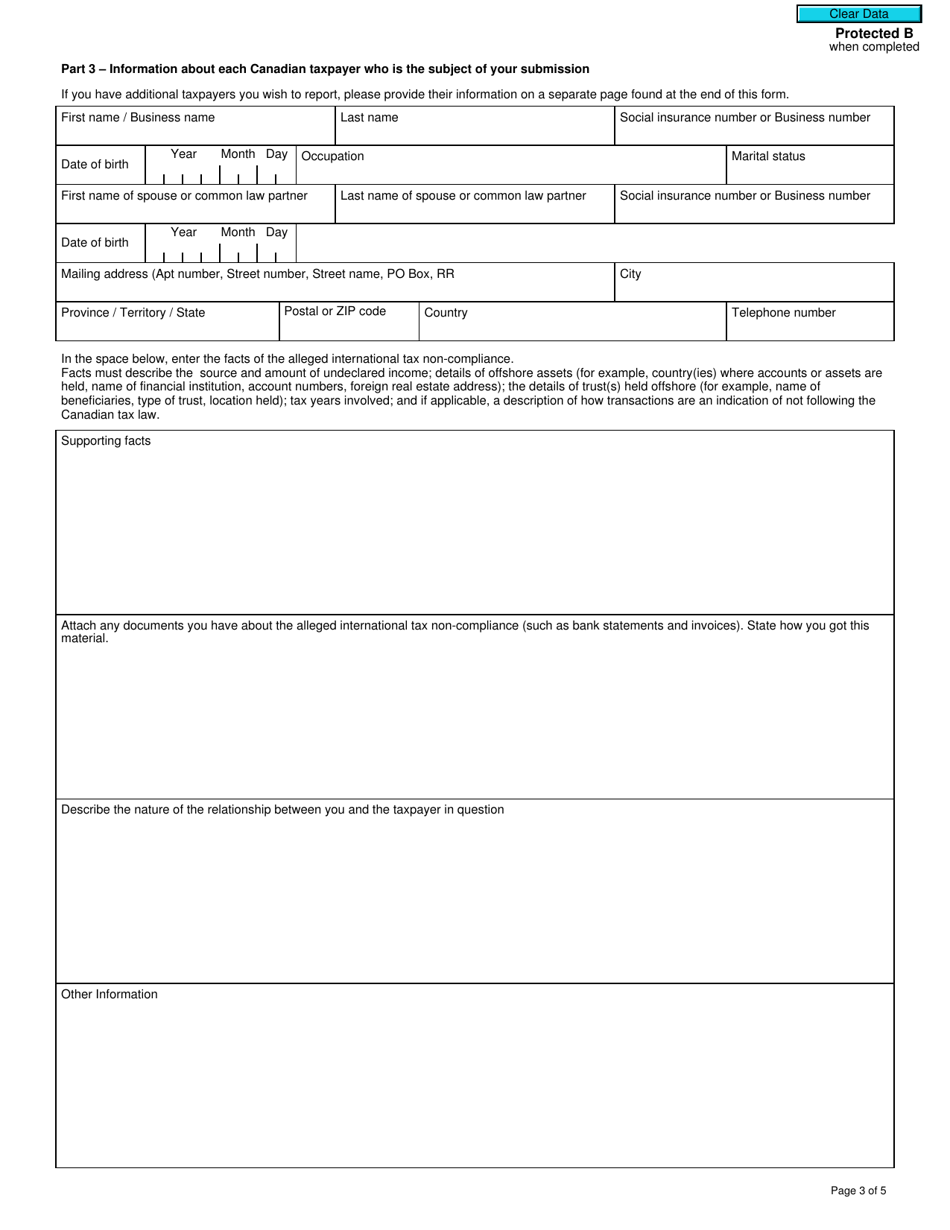

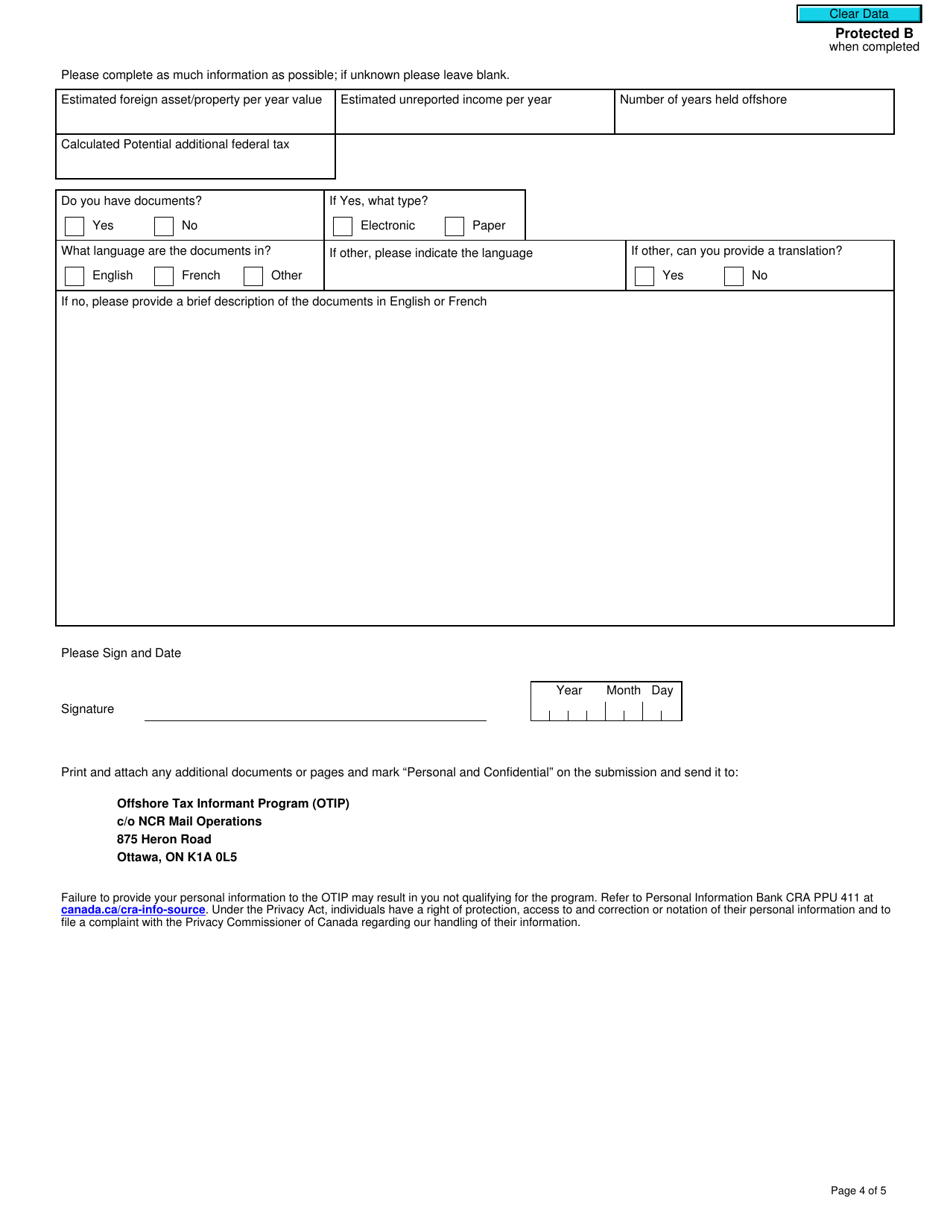

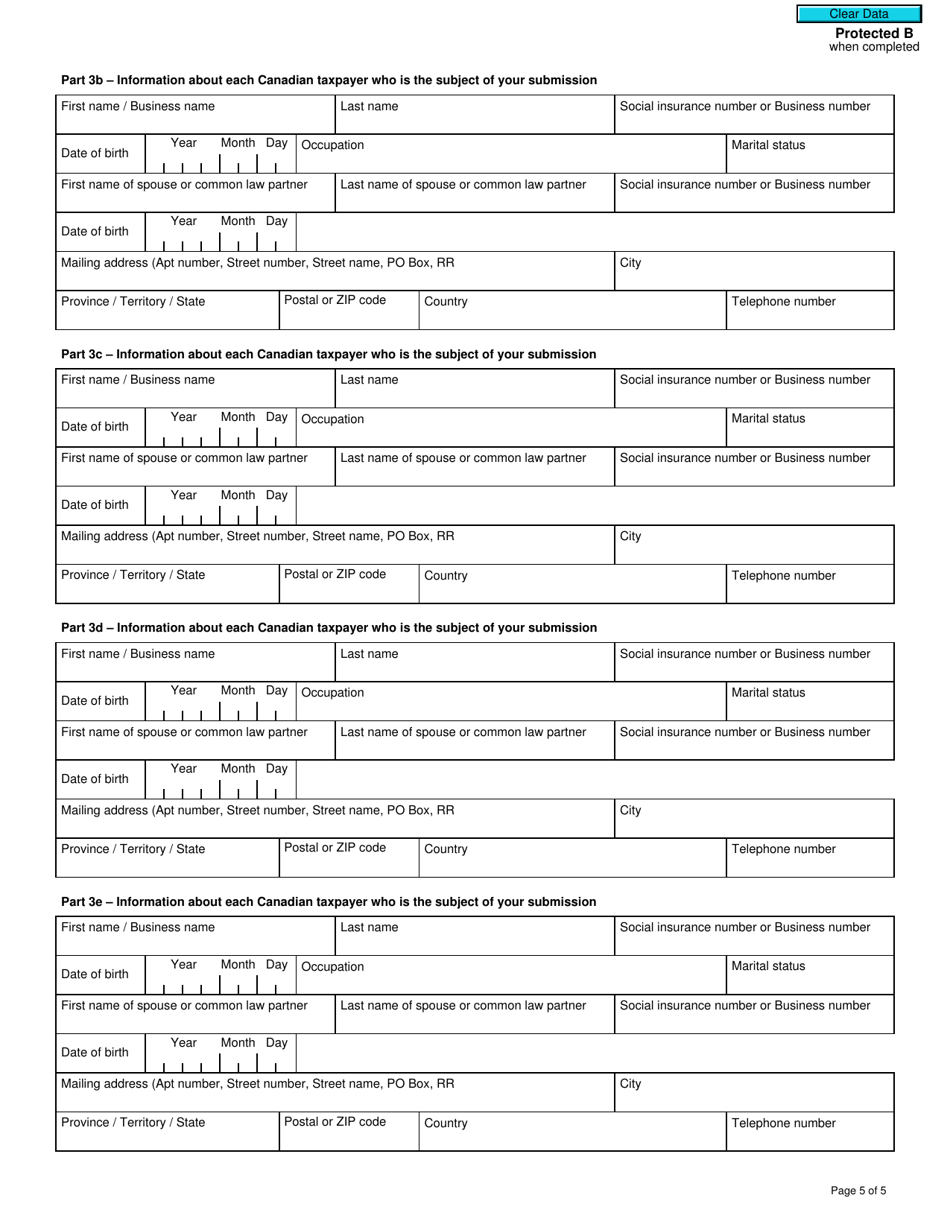

Form RC626 Offshore Tax Informant Program Submission Form - Canada

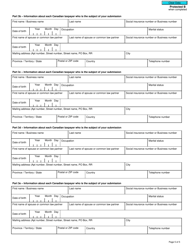

Form RC626, the Offshore Tax Informant Program Submission Form, is used in Canada to report potential tax evasion or non-compliance by individuals or businesses that have offshore assets or income. The form allows individuals to provide information to the Canada Revenue Agency (CRA) about possible tax offenses concerning offshore activities.

The Form RC626 Offshore Tax Informant Program Submission Form in Canada is filed by individuals who have information about offshore tax non-compliance.

FAQ

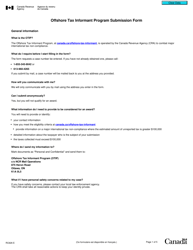

Q: What is the Form RC626 Offshore Tax Informant Program Submission Form?

A: The Form RC626 Offshore Tax Informant Program Submission Form is a document used in Canada to report information on potential tax evasion related to offshore activities.

Q: Who can submit the Form RC626?

A: Anyone who has information about potential tax evasion related to offshore activities can submit the Form RC626.

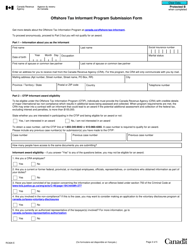

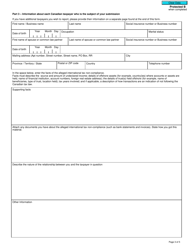

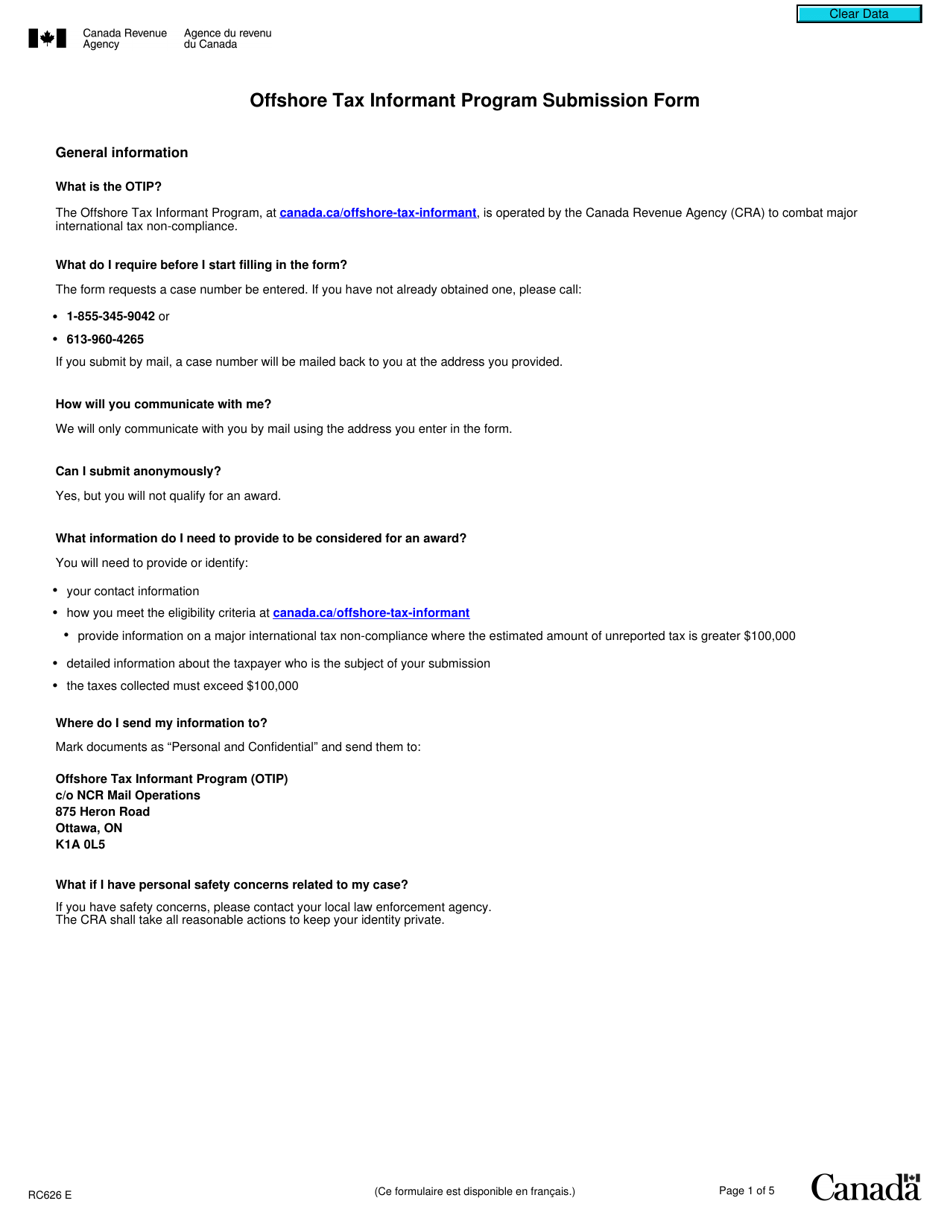

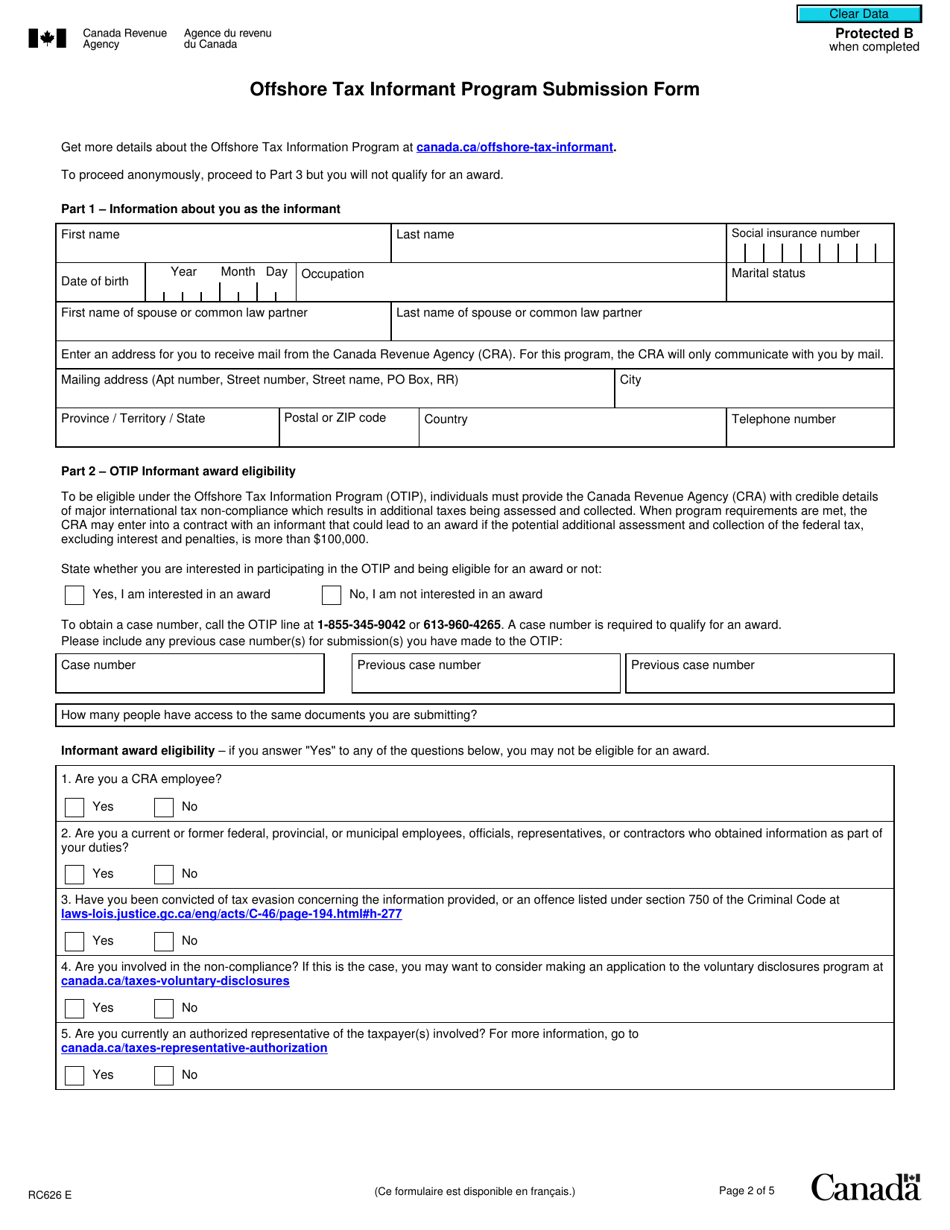

Q: What information should be included in the Form RC626?

A: The Form RC626 requires information about the individual or entity involved in the suspected tax evasion, as well as any supporting details and relevant documents.

Q: Is there a deadline for submitting the Form RC626?

A: There is no specific deadline for submitting the Form RC626, but it is recommended to submit the form as soon as possible after obtaining the relevant information.

Q: Are there any rewards for submitting information using the Form RC626?

A: Yes, the Canada Revenue Agency (CRA) offers rewards to informants for providing credible and useful information that leads to the assessment and collection of taxes owing.

Q: Is the identity of the informant kept confidential?

A: Yes, the identity of the informant is kept confidential by the Canada Revenue Agency (CRA), unless required by law to disclose it.