This version of the form is not currently in use and is provided for reference only. Download this version of

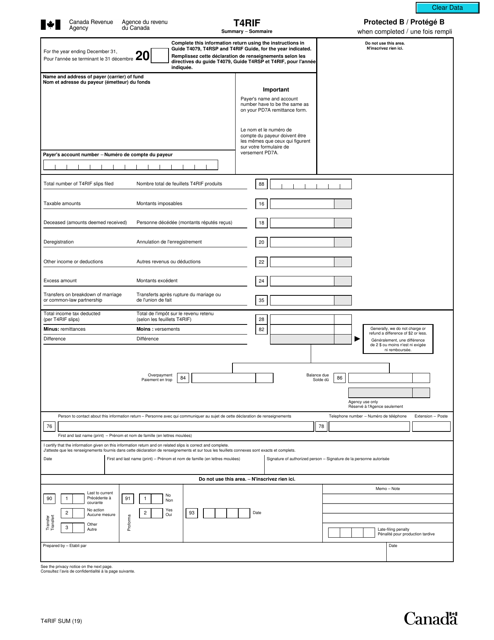

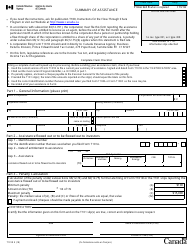

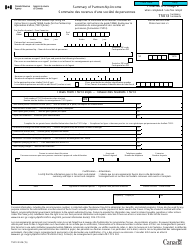

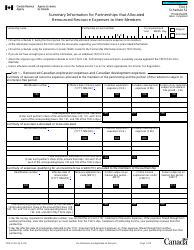

Form T4RIFSUM

for the current year.

Form T4RIFSUM Summary - Canada (English / French)

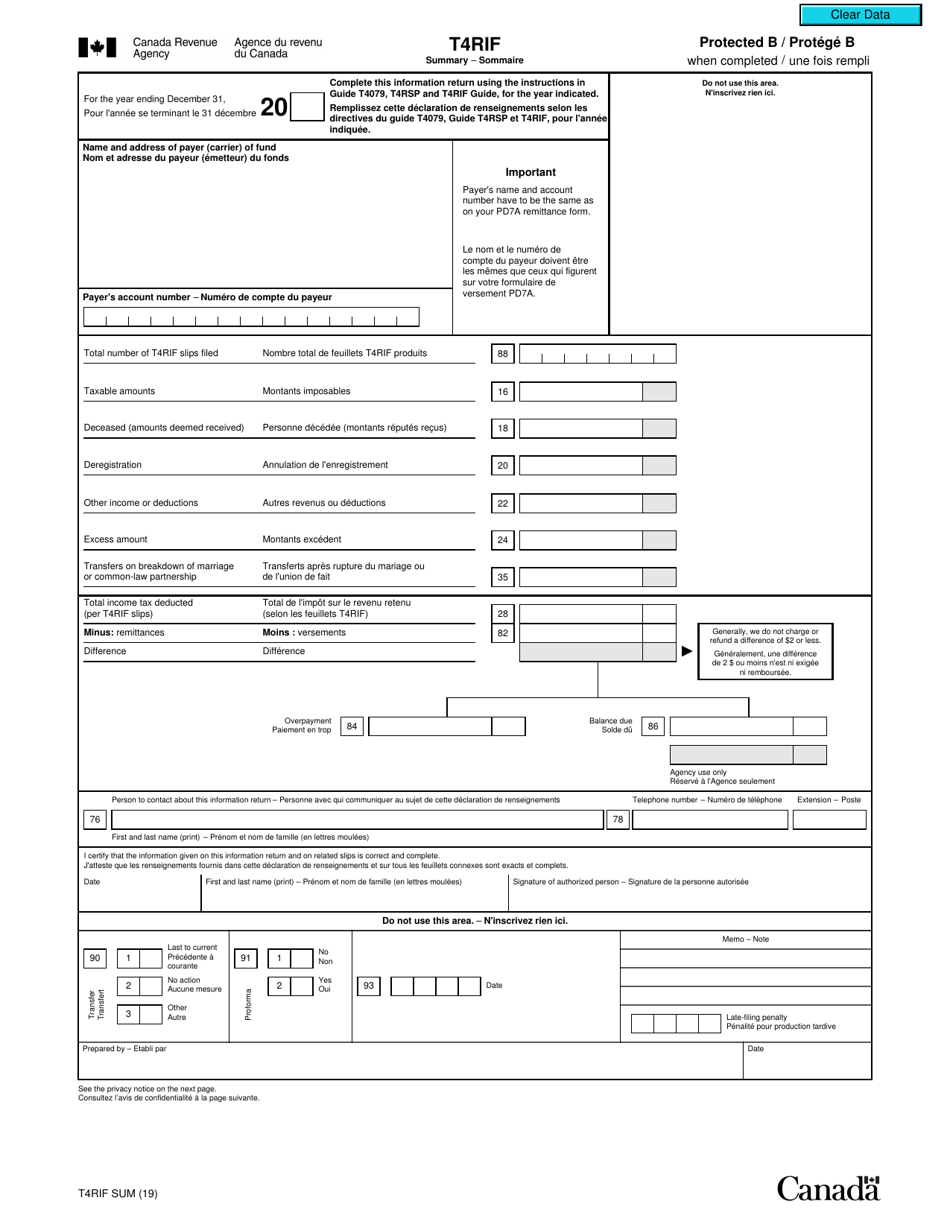

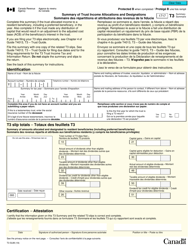

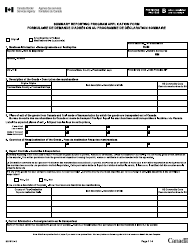

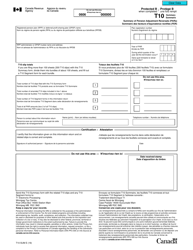

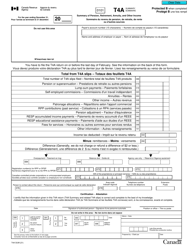

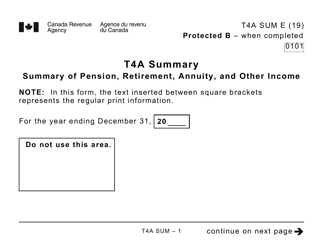

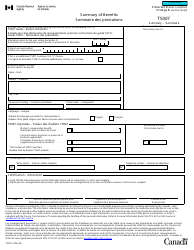

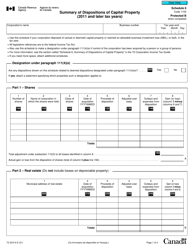

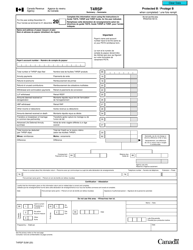

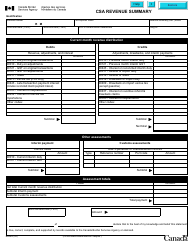

Form T4RIFSUM Summary (Canada, English/French) is used to summarize the total taxable amount of money withdrawn from a Registered Retirement Income Fund (RRIF) in a tax year. It provides a summary of the amounts reported on individual T4RIF slips.

The taxpayer files the Form T4RIFSUM summary in Canada.

FAQ

Q: What is Form T4RIFSUM?

A: Form T4RIFSUM is a summary of your total income, tax deductions, and tax withheld for withdrawals from a Registered Retirement Income Fund (RRIF) in Canada.

Q: Who needs to fill out Form T4RIFSUM?

A: Individuals who received income from a RRIF in Canada need to fill out Form T4RIFSUM.

Q: What information is required to fill out Form T4RIFSUM?

A: You will need to provide your personal information, including your name, address, and social insurance number, as well as details about your RRIF income and tax withheld.

Q: When is Form T4RIFSUM due?

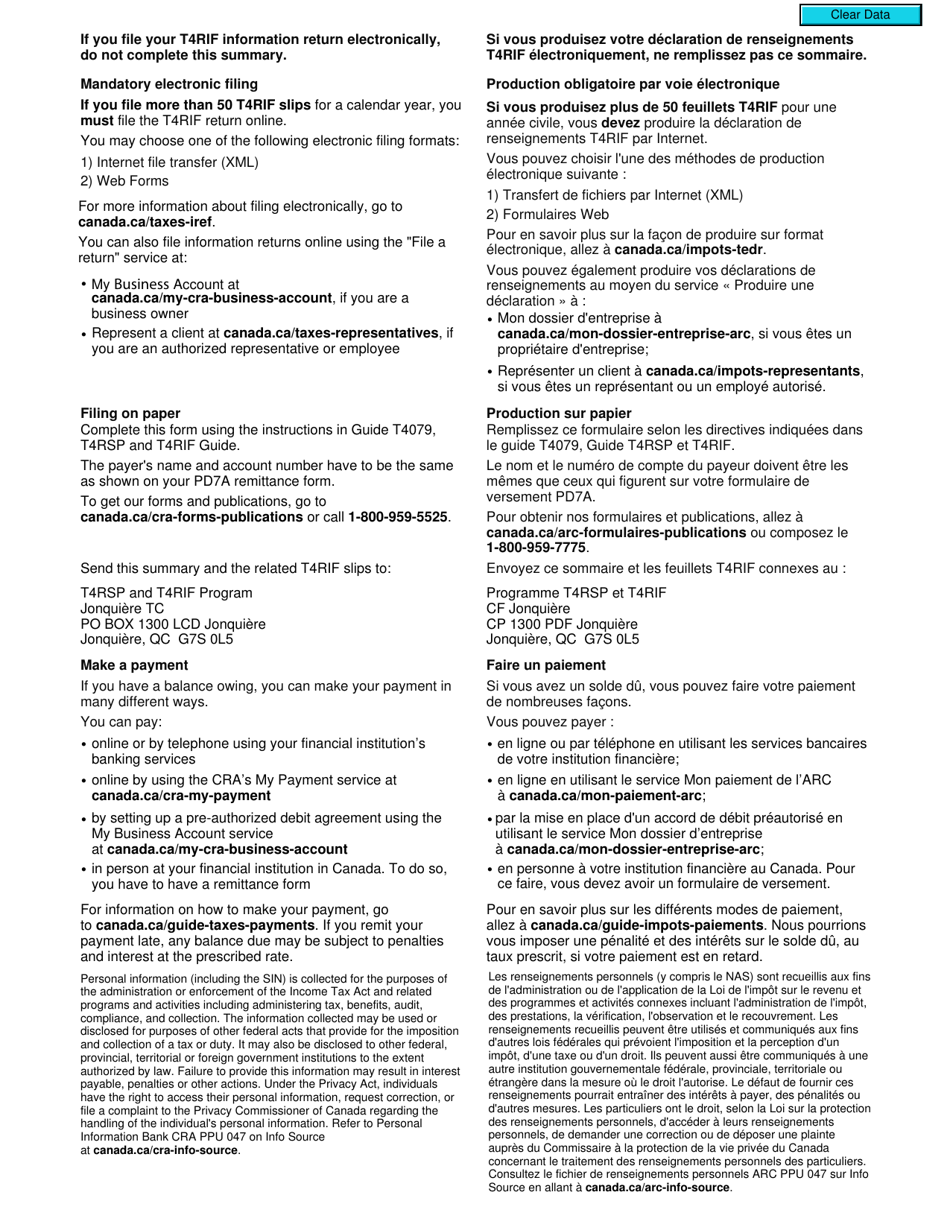

A: Form T4RIFSUM is due by the end of February following the year in which you received the RRIF income.

Q: Do I need to submit Form T4RIFSUM if I didn't receive any income from a RRIF?

A: No, you do not need to file Form T4RIFSUM if you did not receive any income from a RRIF in Canada.

Q: What should I do if I made a mistake on Form T4RIFSUM?

A: If you made a mistake on Form T4RIFSUM, you should contact the CRA to request a correction or submit an amended form.

Q: Is there a penalty for not filing Form T4RIFSUM?

A: Yes, there may be penalties for not filing Form T4RIFSUM, so it is important to submit it on time and accurately.

Q: Can I file Form T4RIFSUM in French?

A: Yes, Form T4RIFSUM is available in both English and French versions.