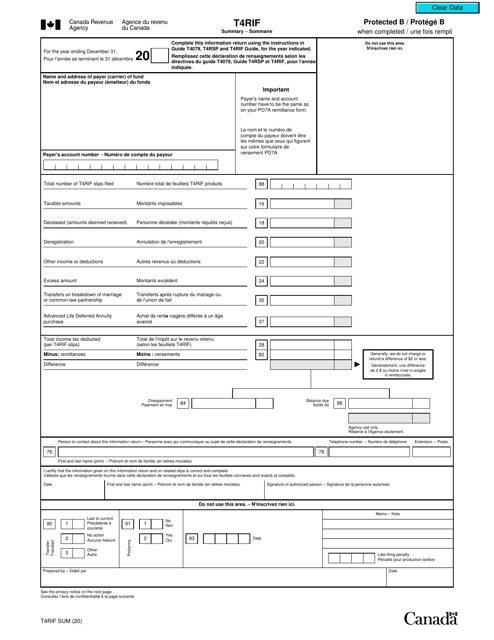

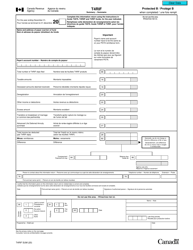

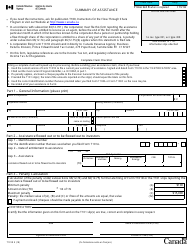

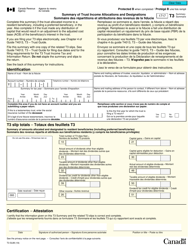

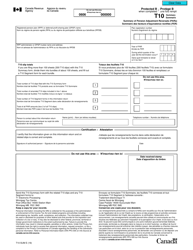

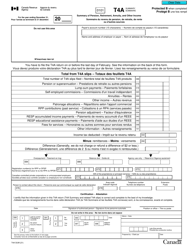

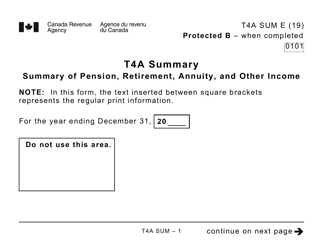

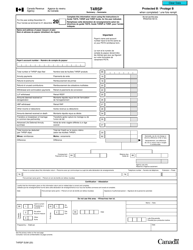

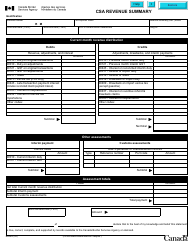

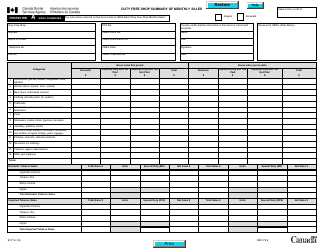

Form T4RIFSUM Summary - Canada (English / French)

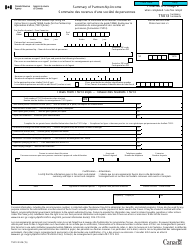

Form T4RIFSUM Summary - Canada (English/French) is used to summarize the details of withdrawals made from a Registered Retirement Income Fund (RRIF) in a given tax year. It provides a summary of income earned from the RRIF, tax withheld, and other relevant information that needs to be reported on your Canadian income tax return.

The Form T4RIFSUM Summary in Canada is filed by the payer (employer or financial institution) who makes payments from a Registered Retirement Income Fund (RRIF).

Form T4RIFSUM Summary - Canada (English/French) - Frequently Asked Questions (FAQ)

Q: What is a T4RIFSUM form?

A: T4RIFSUM is a summary of the amounts reported on T4RIF slips in Canada.

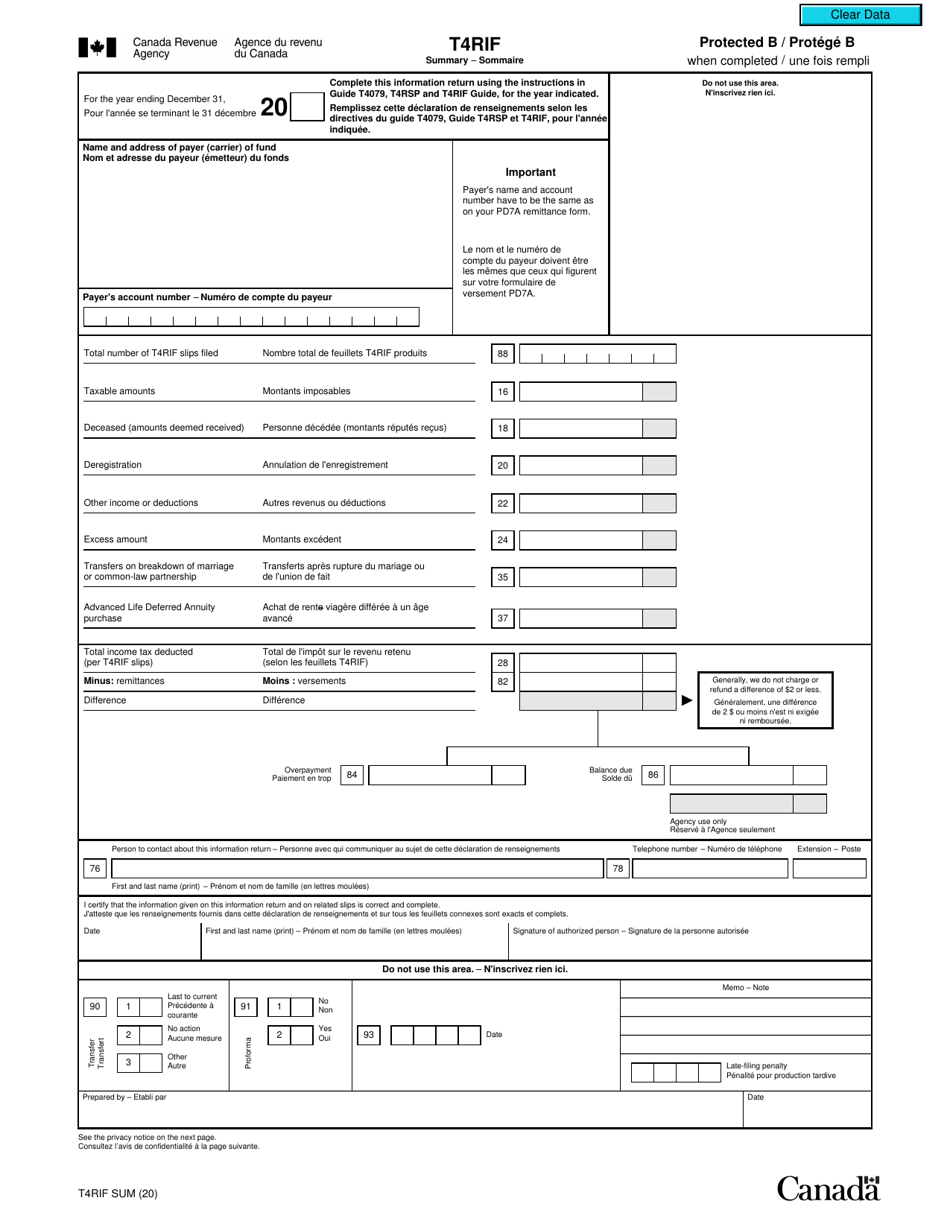

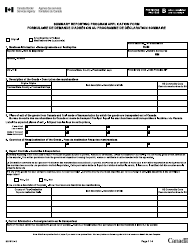

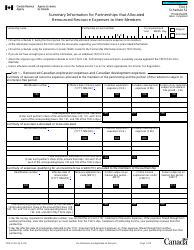

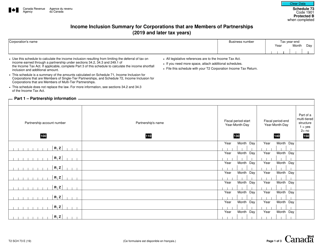

Q: Who needs to complete a T4RIFSUM form?

A: Financial institutions that file T4RIF slips for their clients need to complete this form.

Q: What information is included in a T4RIFSUM form?

A: The form includes information on the total amounts of income, tax withheld, and other deductions reported on T4RIF slips.

Q: When is the deadline to submit a T4RIFSUM form?

A: The deadline to submit the form to the CRA is the last day of February following the calendar year for which the slips were issued.

Q: Do I need to include a copy of T4RIF slips with the T4RIFSUM form?

A: No, you don't need to include copies of the T4RIF slips. The CRA receives the slips directly from the financial institutions.