This version of the form is not currently in use and is provided for reference only. Download this version of

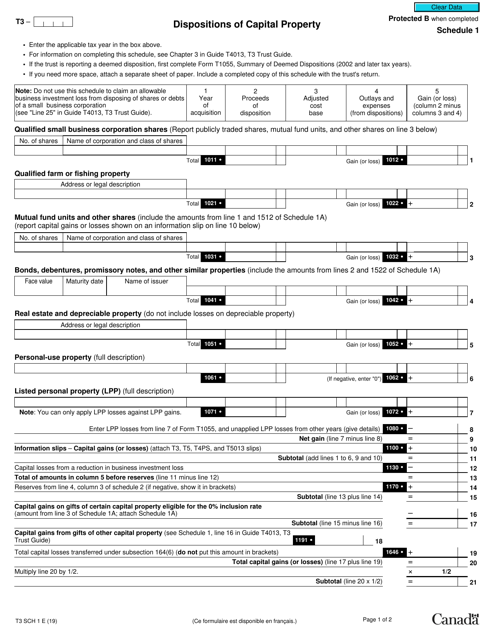

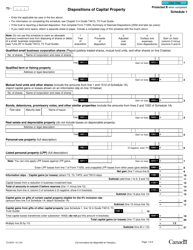

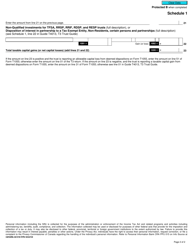

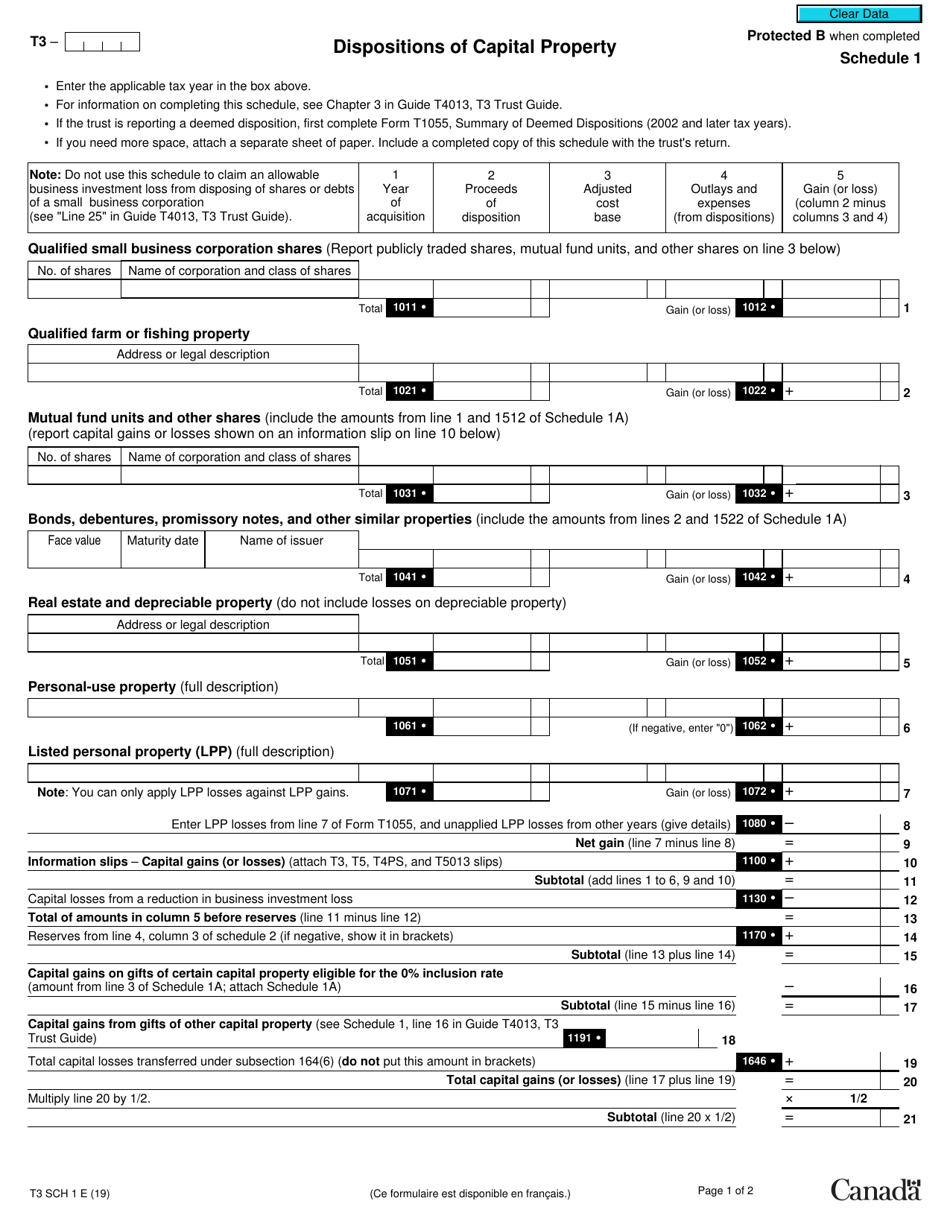

Form T3 Schedule 1

for the current year.

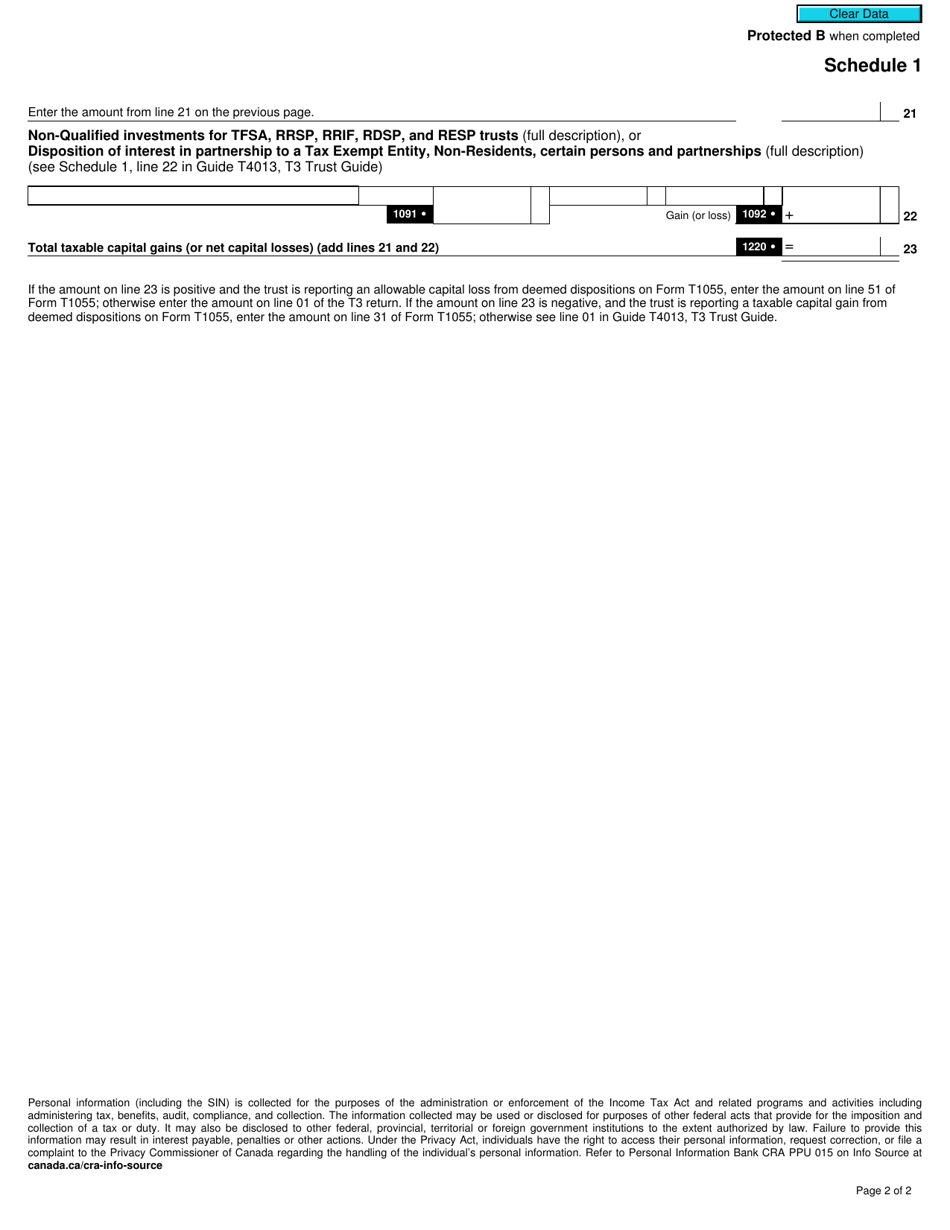

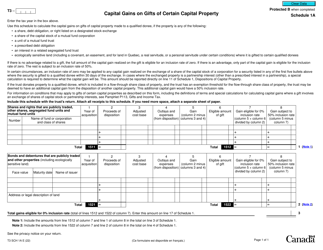

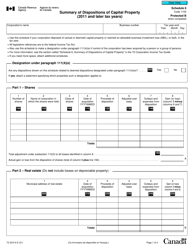

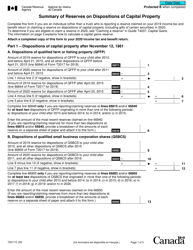

Form T3 Schedule 1 Dispositions of Capital Property - Canada

Form T3 Schedule 1 Dispositions of Capital Property is used in Canada for reporting the sale or disposition of capital property by a trust.

The Form T3 Schedule 1 Dispositions of Capital Property in Canada is typically filed by estates or trusts that have disposed of capital property during the tax year.

FAQ

Q: What is Form T3 Schedule 1?

A: Form T3 Schedule 1 is a tax form used in Canada to report dispositions of capital property.

Q: What is the purpose of Form T3 Schedule 1?

A: The purpose of Form T3 Schedule 1 is to report any transactions involving the sale or transfer of capital property.

Q: Who needs to file Form T3 Schedule 1?

A: Individuals or entities in Canada who have disposed of capital property during the tax year typically need to file Form T3 Schedule 1.

Q: What information is required on Form T3 Schedule 1?

A: Form T3 Schedule 1 requires information such as the description of the property, the date of disposition, the proceeds of disposition, and the cost amount.

Q: When is Form T3 Schedule 1 due?

A: Form T3 Schedule 1 is generally due by the same deadline as your personal income tax return, which is April 30 of the following year.