This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2 Schedule 7

for the current year.

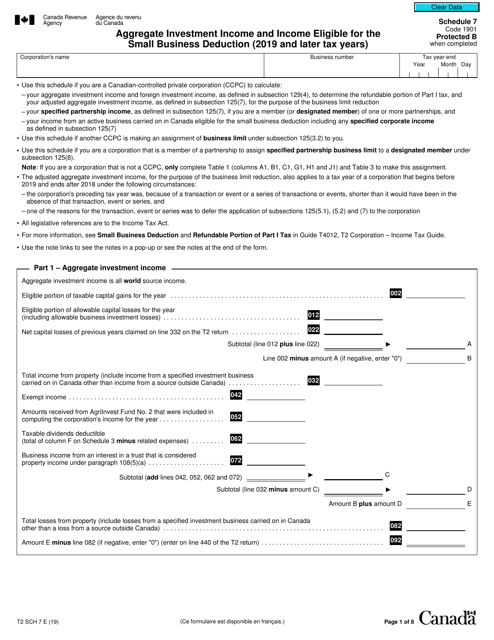

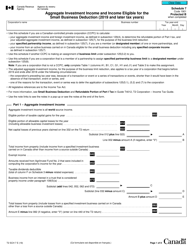

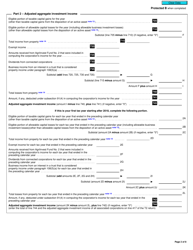

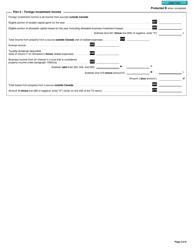

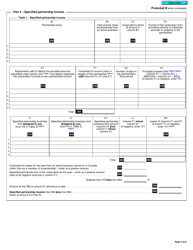

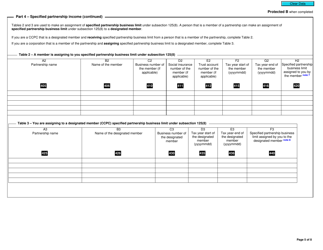

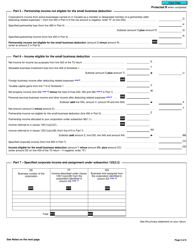

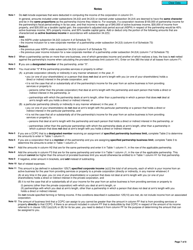

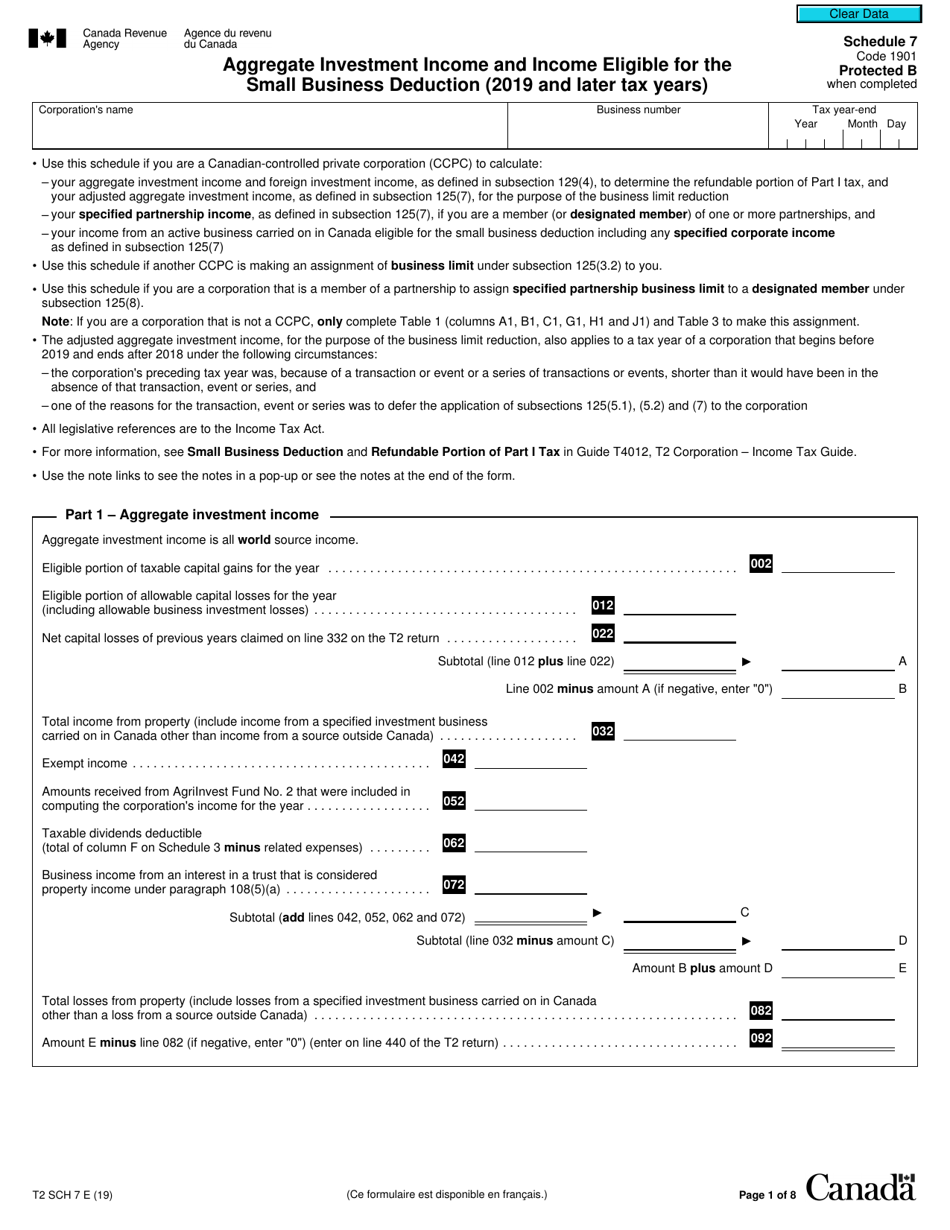

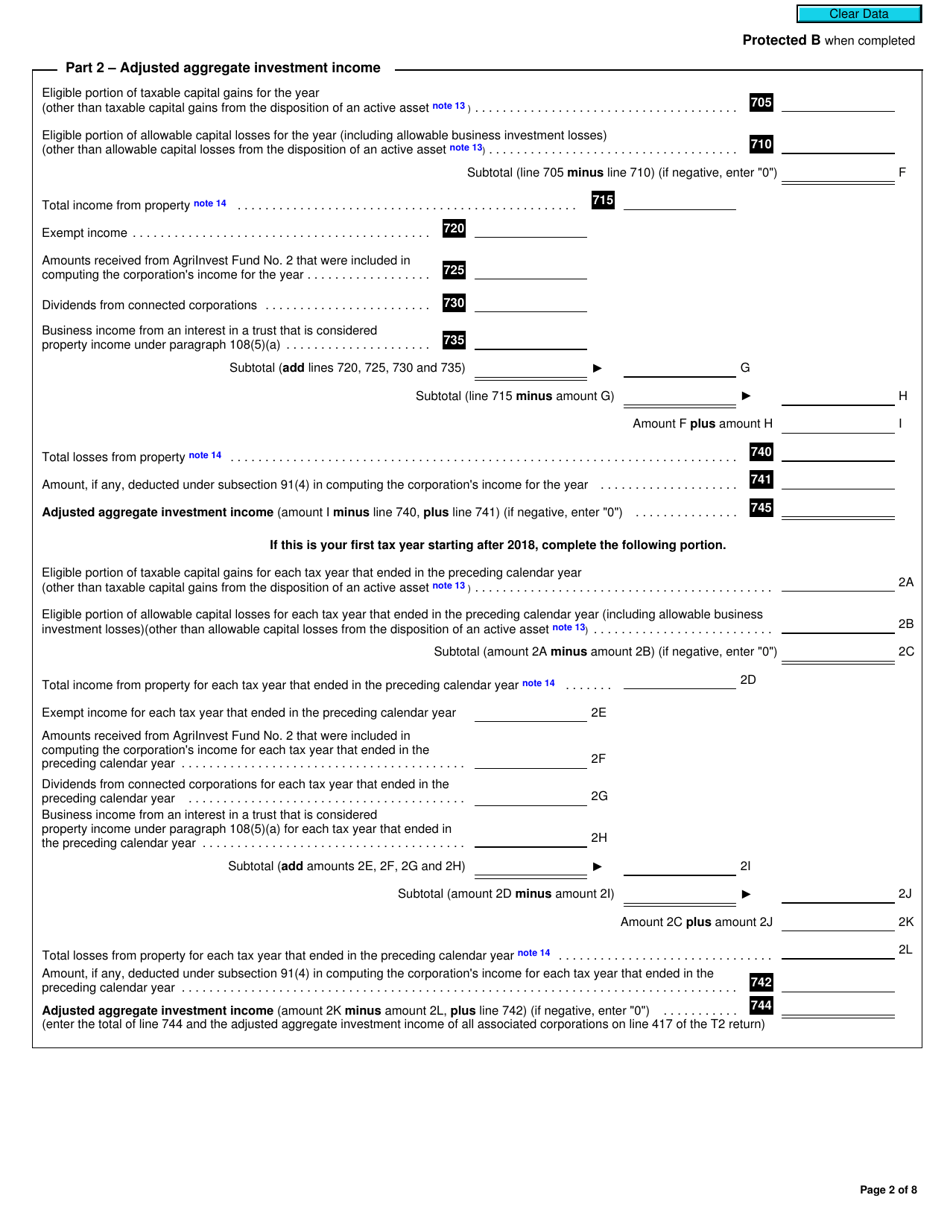

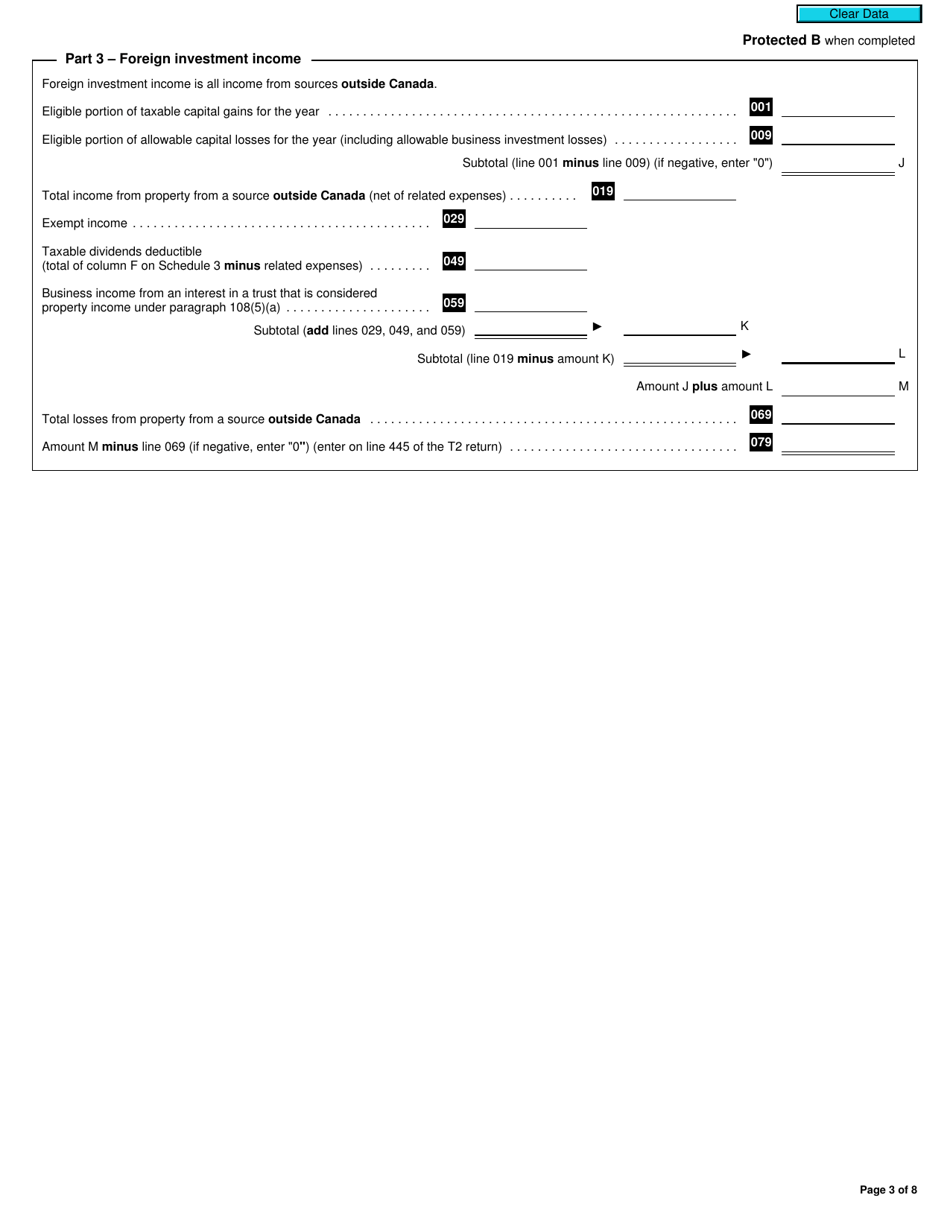

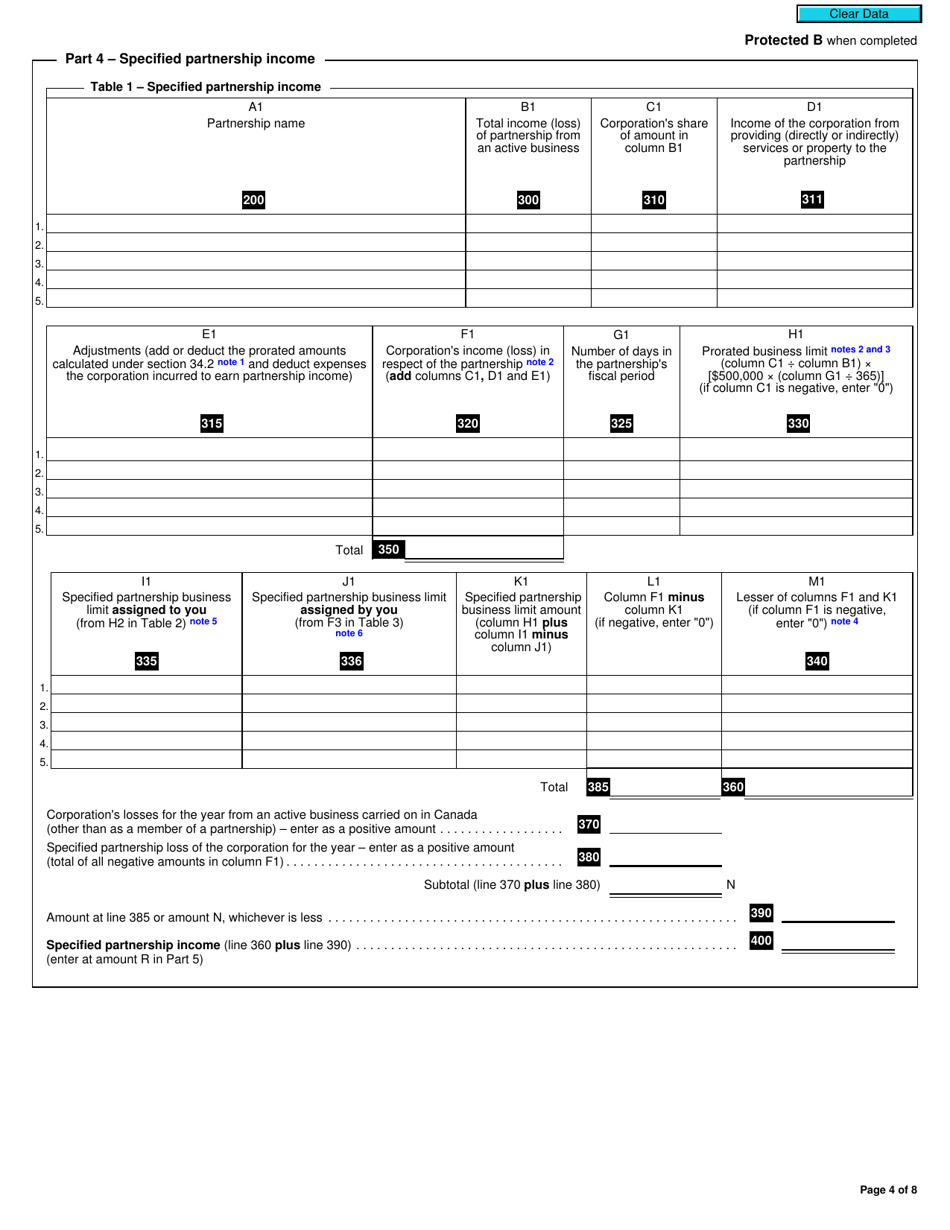

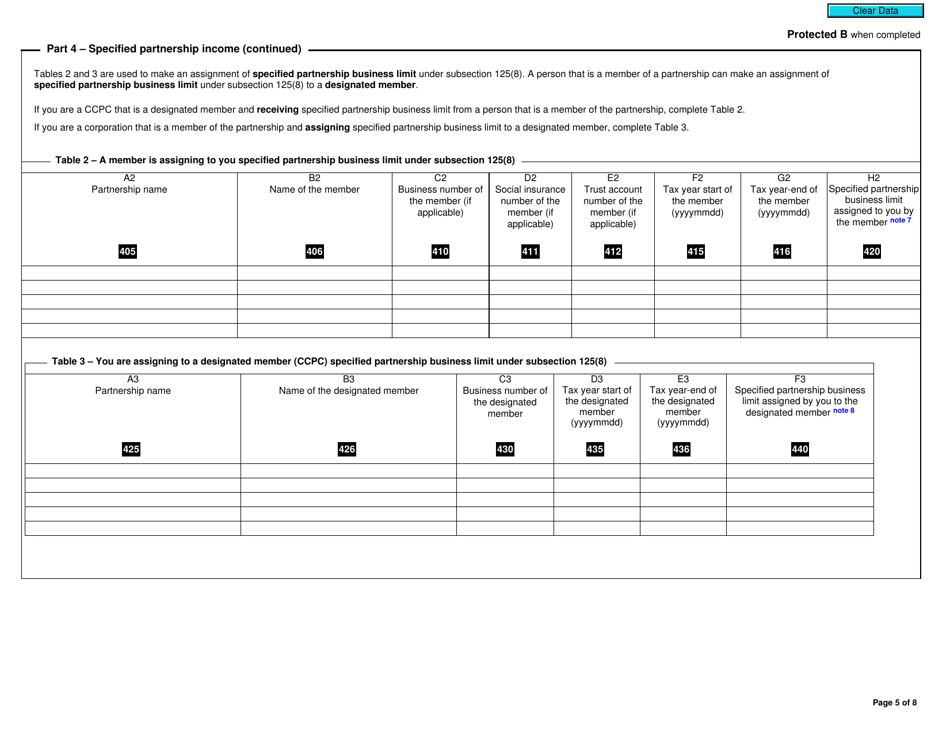

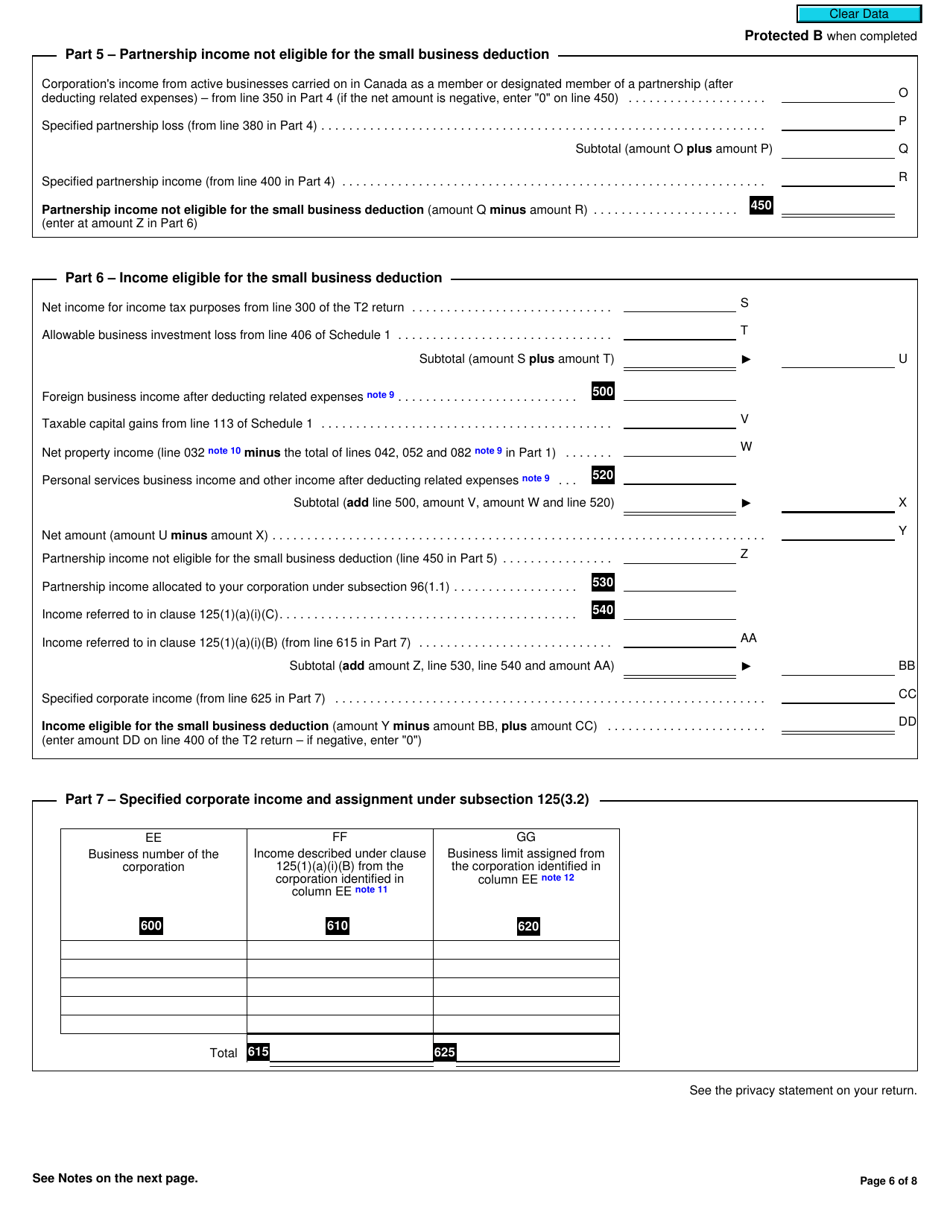

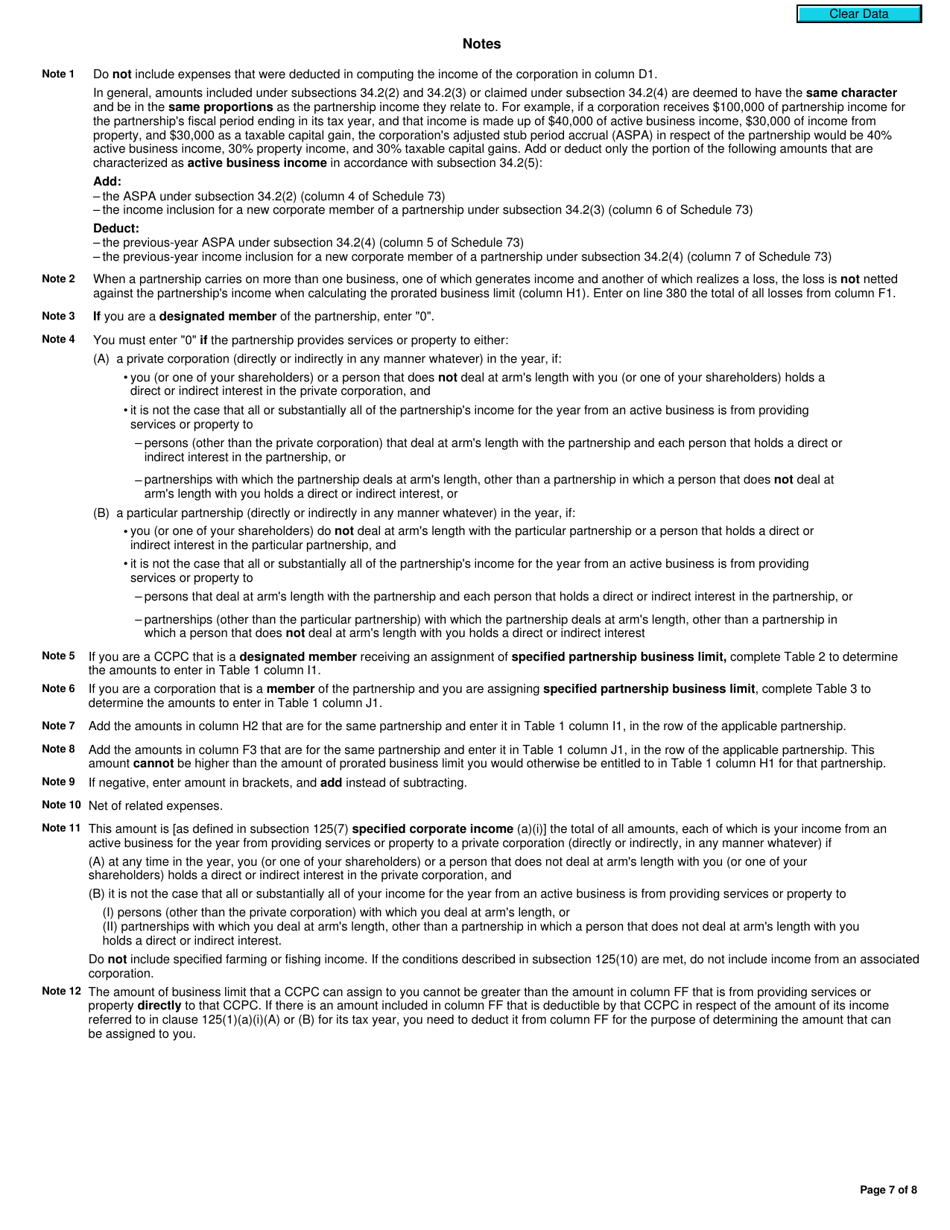

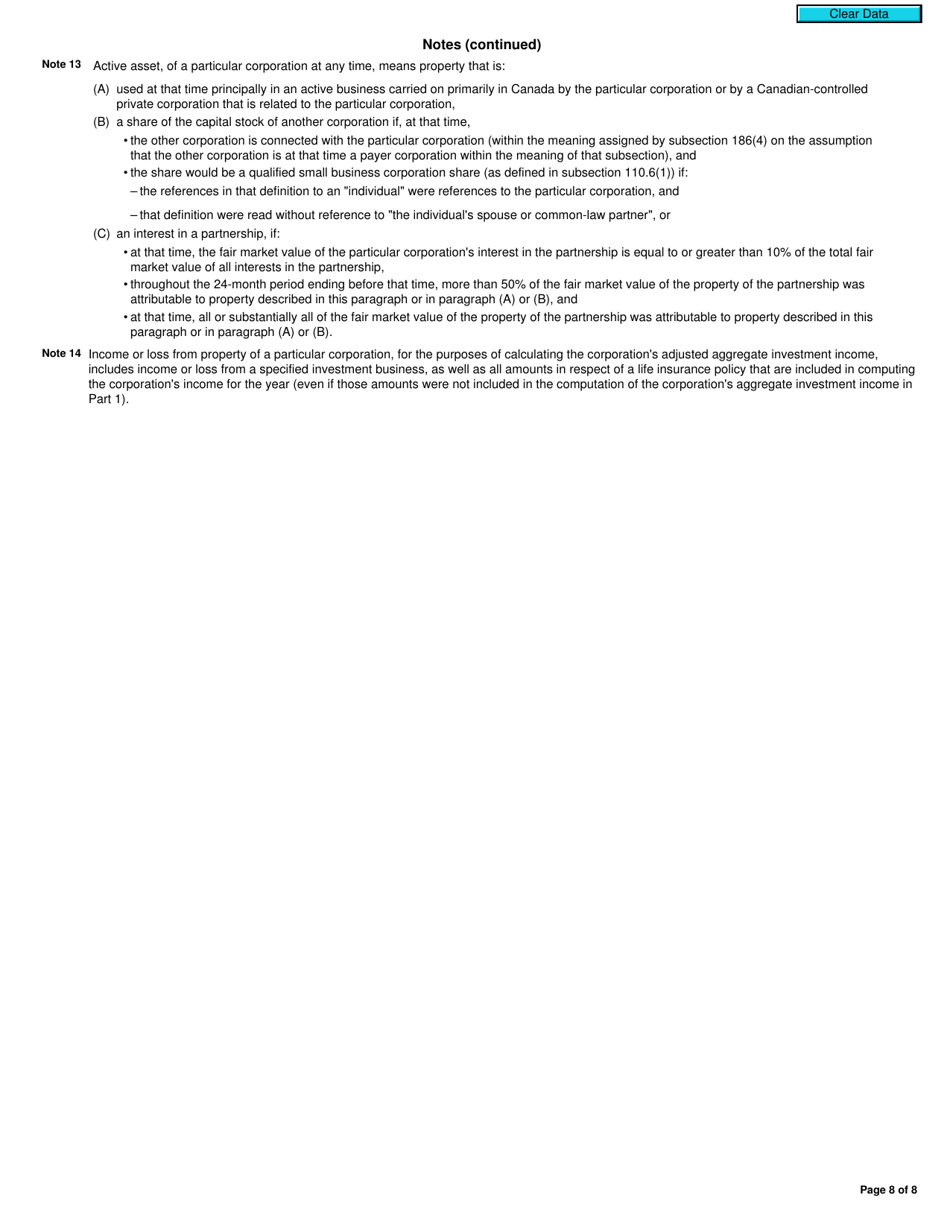

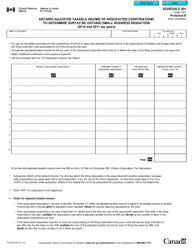

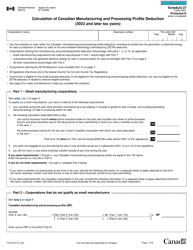

Form T2 Schedule 7 Aggregate Investment Income and Income Eligible for the Small Business Deduction (2019 and Later Tax Years) - Canada

Form T2 Schedule 7 is used in Canada to report aggregate investment income and income eligible for the small business deduction for tax years 2019 and later. It helps businesses calculate their tax liabilities and determine their eligibility for certain deductions.

The Form T2 Schedule 7 for Canada's tax years starting in 2019 and onwards is filed by corporations that need to calculate their aggregate investment income and income eligible for the small business deduction.

FAQ

Q: What is T2 Schedule 7?

A: T2 Schedule 7 is a form used in Canada for reporting aggregate investment income and income eligible for the small business deduction.

Q: What is aggregate investment income?

A: Aggregate investment income includes dividends, interest, rental income, and certain capital gains.

Q: What is income eligible for the small business deduction?

A: Income eligible for the small business deduction is the active business income earned by a Canadian-controlled private corporation.

Q: When should T2 Schedule 7 be filed?

A: T2 Schedule 7 should be filed with the corporate income tax return.

Q: Are there different versions of T2 Schedule 7 for different tax years?

A: Yes, T2 Schedule 7 is specific to 2019 and later tax years.

Q: Who needs to file T2 Schedule 7?

A: Canadian corporations that have aggregate investment income or income eligible for the small business deduction need to file T2 Schedule 7.