This version of the form is not currently in use and is provided for reference only. Download this version of

Form T3012A

for the current year.

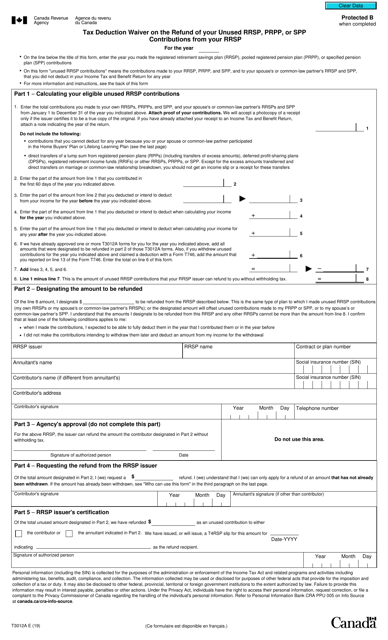

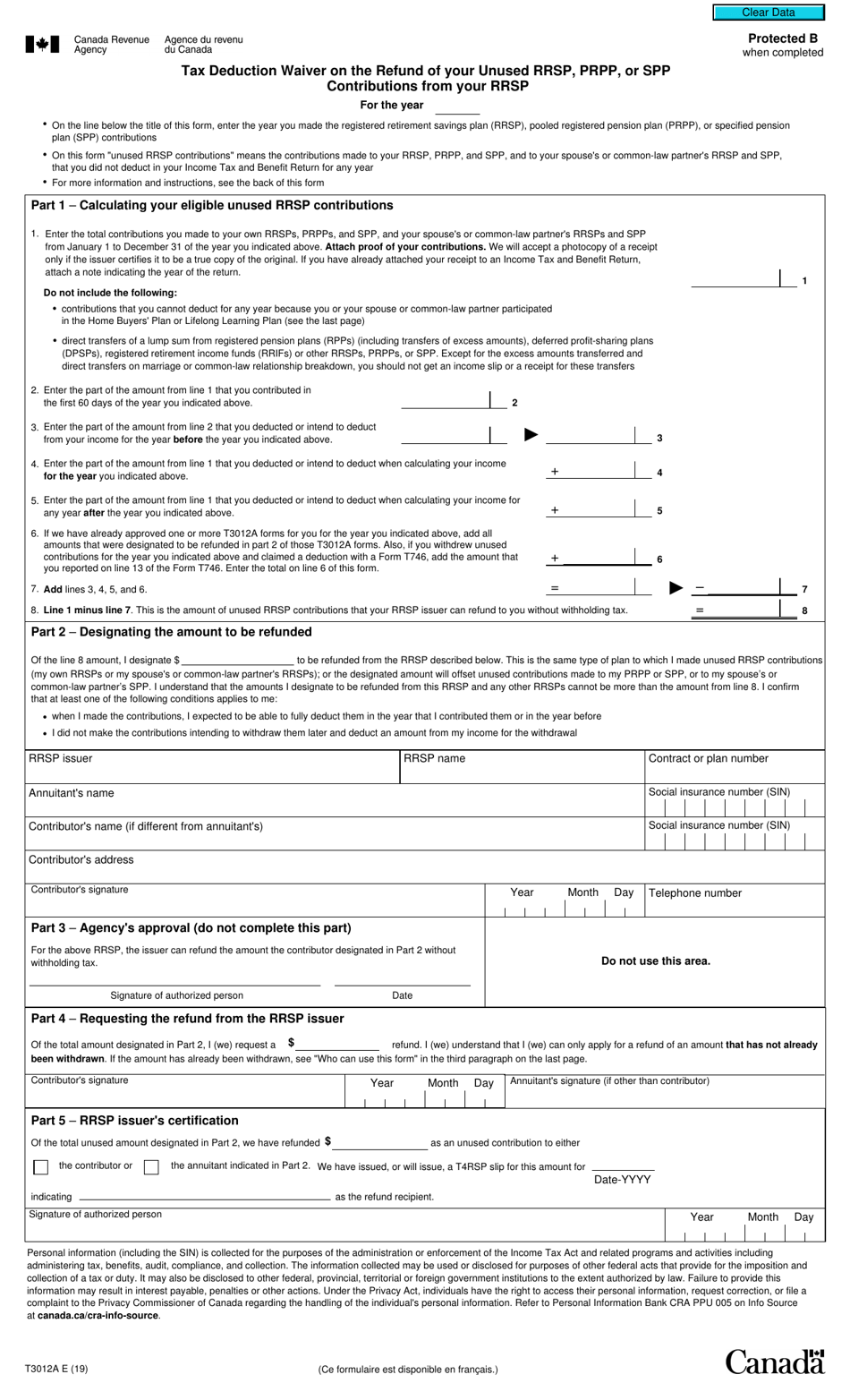

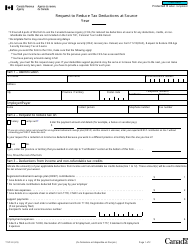

Form T3012A Tax Deduction Waiver on the Refund of Your Unused Rrsp, Prpp, or Spp Contributions From Your Rrsp - Canada

Form T3012A is used in Canada to request a waiver on the taxes owed when withdrawing unused RRSP (Registered Retirement Savings Plan), PRPP (Pooled Registered Pension Plan), or SPP (Specified Pension Plan) contributions from your RRSP. The waiver may be granted if you meet certain criteria outlined by the Canada Revenue Agency.

The individual who contributed to the RRSP, PRPP, or SPP and wants to claim a tax deduction waiver would file Form T3012A in Canada.

FAQ

Q: What is Form T3012A?

A: Form T3012A is a Tax Deduction Waiver on the Refund of your unused RRSP, PRPP, or SPP contributions from your RRSP.

Q: Who needs to fill out Form T3012A?

A: Individuals who want to waive the tax deduction on the refund of their unused RRSP, PRPP, or SPP contributions from their RRSP need to fill out Form T3012A.

Q: What does the T3012A form do?

A: The T3012A form is used to waive the tax deduction on the refund of unused contributions made to your RRSP, PRPP, or SPP.

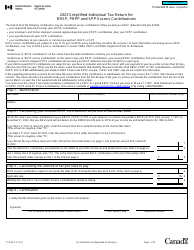

Q: What are RRSP, PRPP, and SPP contributions?

A: RRSP stands for Registered Retirement Savings Plan, PRPP stands for Pooled Registered Pension Plan, and SPP stands for Specified Pension Plan. These are types of retirement savings plans in Canada.

Q: Why would someone want to waive the tax deduction on their RRSP, PRPP, or SPP contributions refund?

A: Someone might want to waive the tax deduction on their RRSP, PRPP, or SPP contributions refund if they do not want to claim a tax deduction on their unused contributions.

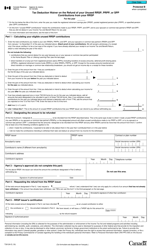

Q: How do I fill out Form T3012A?

A: You need to fill out the required information on Form T3012A, including your personal information, details about your unused contributions and the tax year of the contributions. You can then submit the form to the Canada Revenue Agency (CRA).